- Germany’s Economy Is Stuck. But Stocks Are Looking Cheap. (barrons)

- Gym attendance falls flat as Ozempic is blamed for causing people to vomit during workouts (nypost)

- Intel and OpenAI Gauge Chip Demand, and Other Tech News Today (barrons)

- Royal Caribbean Hikes Guidance on Surging Cruise Demand. The Stock’s Rally Can Resume. (barrons)

- Stocks can get more expensive, says strategist. Don’t get in front of FOMO for now. (marketwatch)

- What’s Holding Back Auto Stocks? It Could Be Dividends. (barrons)

- Nvidia Stock Surges. Earnings Answered 3 Key Questions. (barrons)

- Fed Minutes Show Embrace of Inflation Progress but No Hurry to Cut Rates (nytimes)

- The S&P 500 could hit 5,400 by year-end, says Ed Yardeni (cnbc)

- NVDA Adds Record $250BN In Market Cap Overnight: Two Goldman Sachs Or A Whole Netflix (zerohedge)

- Nvidia Declares AI a ‘Whole New Industry’—and Investors Agree (wsj)

- It’s Been 30 Years Since Food Ate Up This Much of Your Income (wsj)

- Killing Time During a Layover? These Golf Courses Near Airports Should Help (wsj)

- Rolls-Royce shares jump 10% after 2023 profits more than double (cnbc)

- Chinese tourists are driving Asia-Pacific’s travel boom — flight bookings to hit pre-pandemic levels (cnbc)

- UBS says hot, demand-driven inflation is positive for stocks, raises its S&P 500 target to a Wall Street high (businessinsider)

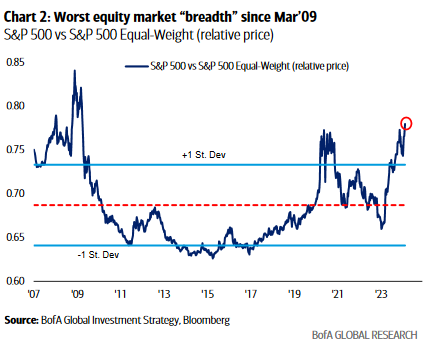

- These 3 charts show that today’s stock market is nowhere near the bubble extremes of 1999 (businessinsider)

Be in the know. 17 key reads for Thursday…