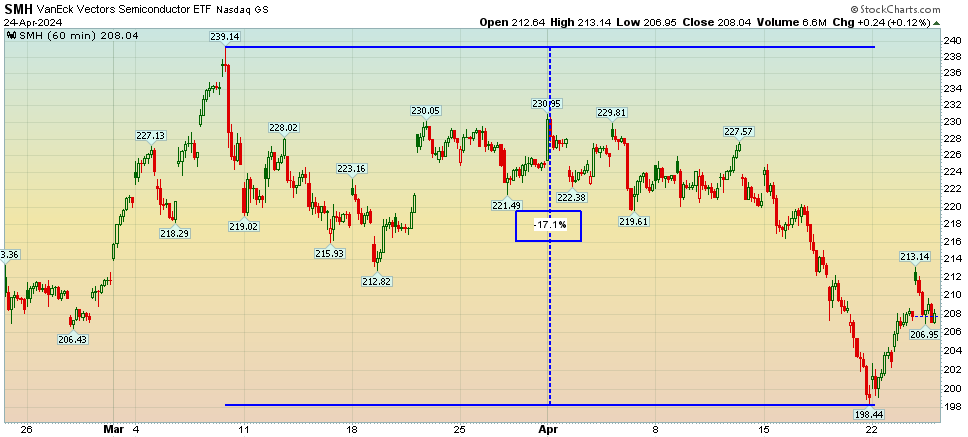

As I stated in recent weeks’ podcast|videocast(s), we continue to maintain 100% of our tactical semiconductors short/hedge and added a “long bonds” TLT call spread (out of our derivative bucket). The combined positions have EV (expected max value) of between 5x-8.45x.

When we zoomed out weeks ago, it was our view that the semiconductor sector had gotten a bit ahead of itself – in the short term. When everyone starts chasing the same “shiny objects” pain is bound to come. It’s has:

Here’s what we said about hedging on March 5th on Fox Business’ The Claman Countdown:

We went into further detail on our hedges/shorts on Yahoo! Finance on March 26:

So Where Does That Leave Us Now?

I think there’s a little more work to do to the downside in the next couple of weeks – either to retest the lows after a bounce or maybe take them out just to flush some of the timid – before resuming higher. Without question, some indicators are overdone and some companies are ready to buy NOW, but patience for a couple of weeks will likely be rewarded to put new money to work for the long term.

I discussed in detail on Monday – with David Lin – what we expect for markets, the Fed, our favorite sectors and more. This got a tremendous amount of positive feedback on David’s channel:

During a shorter interview – with Liz Neo on CNA Singapore on Tuesday – I was more surgical and packed a ton into just six minutes. Between these two interviews, our near term playbook is set:

Citi Never Sleeps

Last week we covered Citi’s Earnings both in the article and on the podcast|videocast. This morning, Mike Mayo (of Wells Fargo) was out with the same thesis we’ve been talking about for months (average basis ~$43). We expect more good things to come over the next couple of years – and so does Mike:

Boeing and Bank of America

We will touch on their earnings in tonight’s podcast|videocast.

Now onto the shorter term view for the General Market:

The CNN “Fear and Greed” rose from 34 last week to 41 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

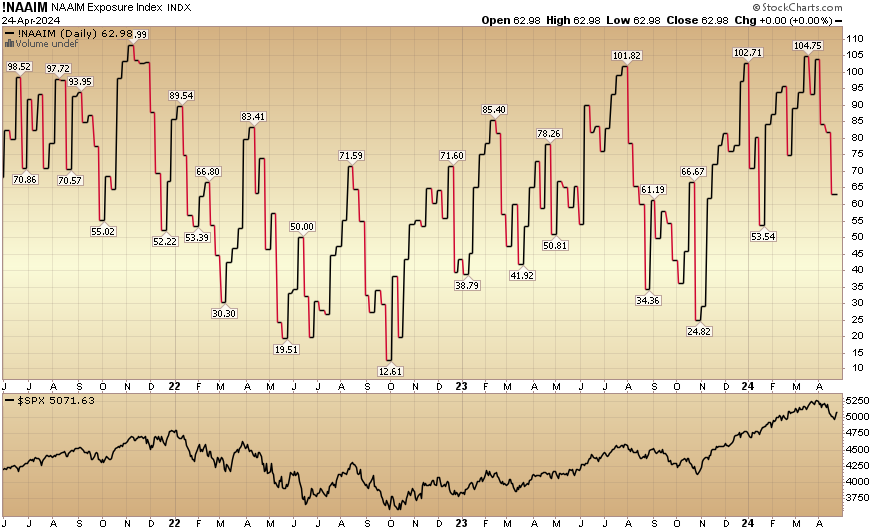

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped down to 62.98% this week from 81.92% equity exposure last week.

Our podcast|videocast will be out later today. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

Congratulations to all of the new clients that came in so far this year. We are now re-opened to smaller accounts $1M+ again as of last Thursday and will remain open until the end of this week (for Q2). To see if you qualify and to take advantage of this opening click here. Larger accounts $5-10M+ can access bespoke service at their preference here.

*Opinion, Not Advice. See Terms

Not a solicitation.