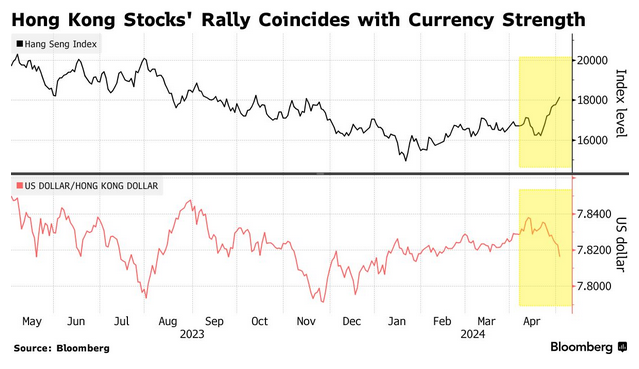

- Hong Kong Stocks March Into Bull Market as Global Money Returns (bloomberg)

- New stimulus is coming as Politburo pledges to cut housing inventory: analysts (scmp)

- MGM Stock Rises as Wall Street Praises Earnings. There’s ‘Momentum in Macau.’ (barrons)

- Third Point made ‘substantial investment’ in Alphabet as shares fell on Google’s Gemini fiasco (marketwatch)

- Fed Chair Projects Optimism Despite Stubborn Inflation (wsj)

- BorgWarner raises full-year 2024 adjusted profit outlook (reuters)

- Intel Bets $28 Billion Comeback on High-Tech US Chip Designs (bloomberg)

- Unforgiving Investors Want Bumper Earnings After Record Rally (bloomberg)

- Japan Likely Spent About $23 Billion in Latest Yen Intervention (bloomberg)

- Powell Keeps Rate Cuts on Table But Leaves Timing Less Certain (bloomberg)

- Odd Lots: Duolingo CEO on the Power of AI Learning (bloomberg)

- Apple’s Earnings Come With a Low Bar and Big Buyback Hopes (bloomberg)

- Number of Chinese Tourists Traveling Overseas Jumps (bloomberg)

- Hybrid Cars Are Surging in Popularity Over EVs. Here’s the Real Reason They’re So Popular. (barrons)

- The Reign of Portland, Maine, as the Top U.S. Luxury Hot Spot Continues for Third-Straight Quarter (barrons)

- Opinion: Mario Gabelli reveals his market-beating secrets and offers some favorite stock picks (marketwatch)

- The Fed Will Be Stuck On Hold Until Something Gives (barrons)

- Albemarle Beats Earnings Estimates. Investors Hope for a Commodity Trough. (barrons)

- Why ‘sell in May and go away’ could be a bit premature for stocks, according to one chart (marketwatch)

- Fed Says Inflation Progress Has Stalled and Extends Wait-and-See Rate Stance (wsj)

- Amazon Gets More Fuel for AI Race (wsj)

- Bored Ape Yacht Club NFTs sold for millions in 2021—prices have dropped 90% since then (cnbc)

- Goldman Sachs still sees two rate cuts this year after Powell speech (streetinsider)

- Berkshire after Buffett: the risk ‘genius’ pulling the insurance strings (ft)

- There are ‘very favorable signs’ inflation will come down, says Wharton’s Jeremy Siegel (cnbc)

Be in the know. 25 key reads for Thursday…