- Alibaba’s Hong Kong primary listing can be magnet for China’s 210 million investors (scmp)

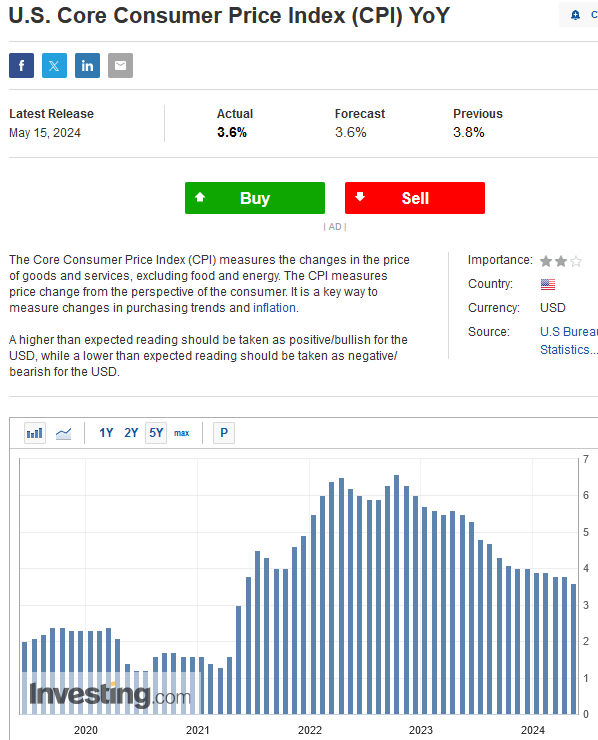

- Softer US Inflation, Retail Data Offer Fed Some Leeway (bloomberg)

- China Considers Government Buying of Unsold Homes to Save Property Market (bloomberg)

- Alibaba, Tencent beat forecasts with strong results, a harbinger of China’s improving corporate earnings as economic growth takes root (scmp)

- Fiscal Bazooka: China Considers Buying Millions Of Homes To Save Property Market (zerohedge)

- JPMorgan’s Jamie Dimon Calls For ‘Full Engagement’ With China (bloomberg)

- Google’s I/O Event Kicks Off With Promise of More AI (barrons)

- The Super Rich Are Eating Out, but Families Aren’t. Restaurants Are Starving. (marketwatch)

- Is it worth it to own Treasurys right now? These 5 charts might hold the answer. (marketwatch)

- Amazon Gets New Cloud-Computing Boss as AI Battle Shakes Up Its Top Profit Engine (wsj)

- He Quit Wall Street to Coach Ivy League Tennis—and Built a Columbia Powerhouse (wsj)

- How China Rose to Lead the World in Cars and Solar Panels (nytimes)

- Why Is Car Insurance So Expensive? (nytimes)

- Cramer: Ford and GM are winners after Biden raises tariffs on Chinese imports (cnbc)

- The S&P 500 just flashed a bullish signal that suggests the stock market will hit record highs this summer (businessinsider)

- AI Is Electrifying These Power Producers’ Shares (wsj)

- NYCB’s loan sale to JPM praised as ‘important first step’ in turnaround (marketwatch)

- Traders Ramp Up Bets in Options Market on Large ECB Rate Cuts (bloomberg)

- PBOC Rolls Over Policy Loan With Growth, Currency on Mind (bloomberg)

- Dollar hits one-month low against euro before US data, falls vs yen (streetinsider)

- OpenAI co-founder and chief scientist Ilya Sutskever departs (ft)

- Brazilian government ousts Petrobras chief after dispute over dividends (ft)

Be in the know. 22 key reads for Wednesday…