- Country Garden sees home sales jump as Beijing’s rescue package gives developers a boost (scmp)

- Bond Traders Pile Into Fresh Bets on Faster Pace of Fed Cuts (bloomberg)

- Investing in China ‘desirable’ despite risks, says hedge fund giant Ray Dalio (scmp)

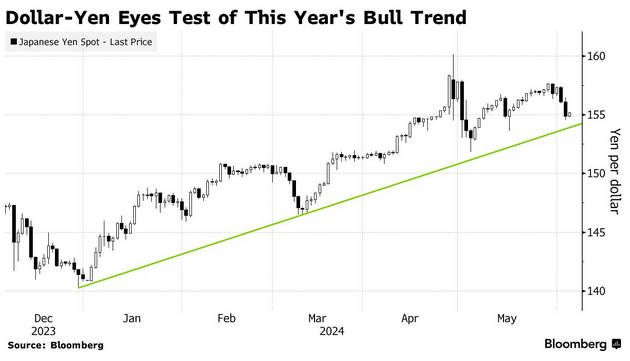

- Hedge Funds Flip Flop on Yen Option Trade as BOJ ‘Spooks’ Market (bloomberg)

- ‘We want to build everybody’s AI chips’: Intel CEO talks of regaining market share (cnbc)

- Here’s what happened in 9 major bubbles in the last 100 years — and what’s going on now (marketwatch)

- Bank of Canada seen cutting rates (marketwatch)

- Traders expect a hawkish cut from the ECB. What it means for markets. (marketwatch)

- Intel, Apollo strike $11 billion deal over chip-manufacturing plant in Ireland (marketwatch)

- Citi Says ECB’s Interest Rate Path Hands European Stocks an Edge (bloomberg)

- These popular stock-market trades are unwinding as Fed bets shift. Here’s what happens next. (marketwatch)

- Margin Debt Is Rising. It’s a Sign Some Investors Are Amping Up Risk. (barrons)

- Americans Have More Investment Income Than Ever (wsj)

- The number of US homes for sale is slowly returning to normal: An ‘incredible trend,’ economists say (nypost)

- The Great Concert Ticket Bust (businessinsider)

- US dollar to weaken, but Fed rate cuts are required, say strategists (streetinsider)

Be in the know. 16 key reads for Wednesday…