- Chinese Leaders Are Gathering for Policy Talks. How the ‘Third Plenum’ Just Might Lift Stocks. (barrons)

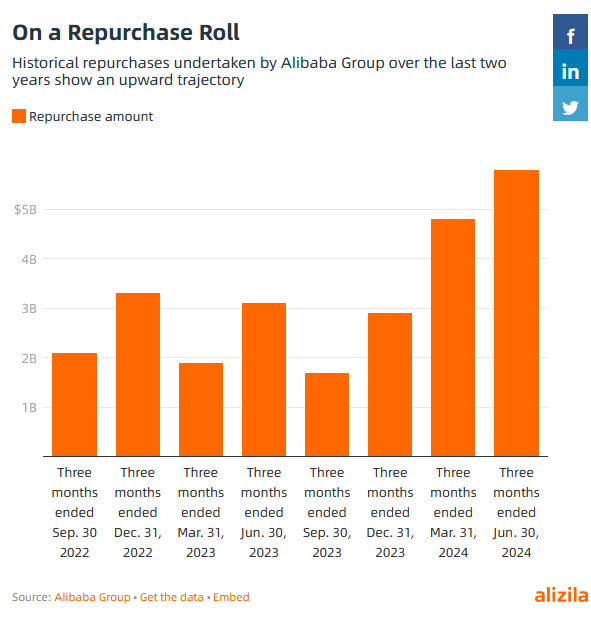

- Alibaba Share Repurchase Program Reaches New Heights During June Quarter (alizila)

- IOC Leverages Alibaba Cloud’s Energy Expert to Optimize Power Consumption at Paris 2024 Venues (alizila)

- President Xi Jinping is presiding over a conclave to draft a new economic program. The stakes are high, but expectations for big changes are modest. (nytimes)

- China’s Economic Growth Comes in Worse Than Expected, Adding Pressure on Xi (bloomberg)

- Amazon Hits Prime Time for Earnings Expansion (wsj)

- What if the A.I. Boosters Are Wrong? (nytimes)

- I.’s Insatiable Appetite for Energy (nytimes)

- How Value Investors Can Benefit From the UK Rebound (bloomberg)

- 4 charts show why Wall Street’s most bullish strategist expects the stock market to triple by 2030 (businessinsider)

- Why small caps have the ‘most compelling investment case’ right now (marketwatch)

- Small-cap stocks get some revenge after Big Tech rally pauses. How long can they keep it up? (marketwatch)

- Fed-favored PCE price gauge set to show easing inflation and raise likelihood of rate cut (marketwatch)

- Evictions Surge in Major Cities in the American Sunbelt (wsj)

- Goldman Strategists Say Big Tech’s AI Splurge Worries Investors (bloomberg)

- Drivers are no longer simply accepting the fact that they have to pay more for car insurance. (wsj)

- Open questions | Stephen Roach on how Beijing can right its economy and the US’ China ‘blunder’ (scmp)

- Explainer | China’s third plenum: the 5 burning questions heating up debate – and our take (scmp)

- China’s economy falters, raises pressure for more stimulus (reuters)

- 4 Major CN Banks Lower Interest Rates for Buying 1st Home in Guangzhou: Report (aastocks)

Be in the know. 20 key reads for Monday…