- Third Plenum Promises to Fix “Insufficient Demand”, Week in Review (chinalastnight)

- Third Plenum Communique: CN to Implement Measures to Prevent & Resolve Risks in Property, Local Debts, Small/ Medium Financial Institutions, Others (aastocks)

- Why the Fed Should Cut Rates Now—Not Wait Until September (wsj)

- Big Tech shares lose lustre as US market rocked by violent rotation (ft)

- Why Income Seekers Should Consider Buying High Yield Dividend Stocks Now (barrons)

- American Express Profit Rises 39% as Affluent Consumers Keep Spending (barrons)

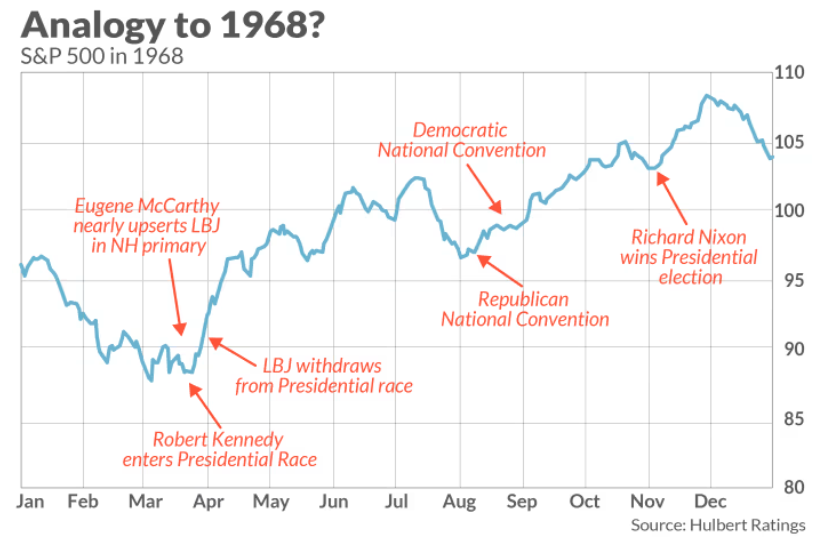

- Here’s how stocks performed the last time a president ended a re-election bid — in 1968 (marketwatch)

- This bearish strategist says there is a bubble in artificial-intelligence stocks, and it could be about to burst (marketwatch)

- Small-cap stocks are perking up. Here’s how to pick winners. (marketwatch)

- Citi advises investors to ‘election proof’ their portfolios — here’s how (marketwatch)

- Ford to Invest $3 Billion in Canada to Boost F-Series Pickup Production (wsj)

- Homeowners Couldn’t Build Pools Fast Enough During Covid. The Tide Might Be Turning. (wsj)

- Get Ready to Pay More for Less-Reliable Electricity (wsj)

- Amazon Prime Day 2024 breaks record, bumps US online sales to $14.2B (nypost)

- Why Is the Oil Industry Booming? (nytimes)

- More Gas Cars and Trucks, Fewer E.V.s as Automakers Change Plans (nytimes)

- China’s Leaders Offer High Hopes, but Few Details for Road to Recovery (nytimes)

- Millionaires Outpriced by Billionaires Flock to Florida’s Fort Lauderdale (bloomberg)

- High-tariff push roils Shein, Temu operations in South Africa, EU, other markets (scmp)

- BABA Demands Each Biz to Have ‘Sense of Operation’ & Further Clarify Focus of Inputs – Report (aastocks)