- Intel stock jumps on plan to turn foundry business into subsidiary and allow for outside funding (cnbc)

- Intel to Make Custom AI Chip for Amazon (bloomberg)

- Big names like David Tepper and ‘Big Short’ investor Michael Burry are quietly upping their bets on the Chinese economy (cnbc)

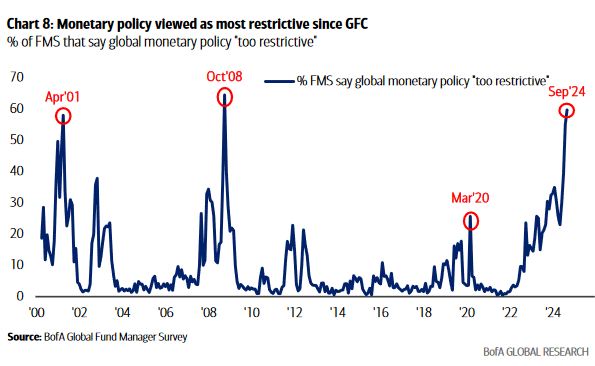

- Fed to cut rates by a quarter point with a soft landing expected, according to CNBC Fed Survey (cnbc)

- China seeks a homegrown alternative to Nvidia — these are some of the companies to watch (cnbc)

- Markets Hinge on Powell Emulating Greenspan’s Soft Landing (bloomberg)

- A Fed interest-rate cut could make small-cap stocks a good investment now (marketwatch)

- Intel, Aiming to Reverse Slump, Unveils New Contracts and Cost Cuts (nytimes)

- Opinion: Why Intel’s latest move for its foundry business is so significant (marketwatch)

- U.S. Officials Jet to Beijing Amid Flood of Cheap Chinese Exports (wsj)

- Amazon Tells Workers to Return to Office Five Days a Week (wsj)

- Boeing, union negotiators to meet as striking workers dig in (reuters)

- This is the only Fed that eased while inflation surged all the way to its peak, says Jim Paulsen (cnbc)

- Intel’s Turnaround Is Working. Buy the Dip. (barrons)

- Intel made 3 big announcements since solvency concerns: Thomas Hayes (foxbusiness)

Be in the know. 15 key reads for Tuesday…