On Wednesday I joined the great Stuart Varney on Fox Business to discuss Nvidia and Small caps. Thanks to Stuart and Christian Dagger for having me on:

Watch in HD Directly on Fox Business

On Friday I joined David Lin on his show “The David Lin Report.” Invariably I get 2-4 calls after doing any one of his shows because he has such a large and engaged audience. Based on the feedback, I believe we gave his audience value beyond anything that have recently heard – as we gave them a way to think about the new administration that few have spoken about:

During earnings season I try to cover 1-2 stocks that we have discussed in our podcast|videocast and/or hold in client portfolios/personally/beneficially.

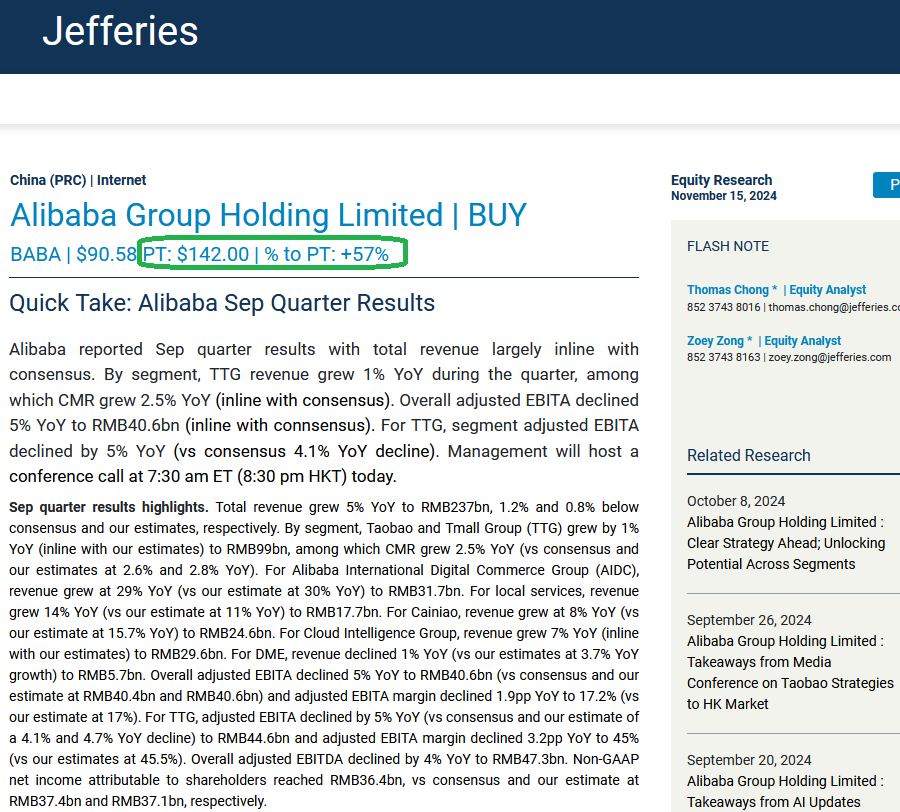

This week, the two earnings results/names we are going to cover are Advance Auto Parts and Alibaba. The common theme with these two are that their respective consumers are at/near troughs in consumer sentiment/confidence and at major inflection points.

For example, if you believe the US consumer is going to stay at these levels of depression permanently, you should sell your Advance Auto Parts stock:

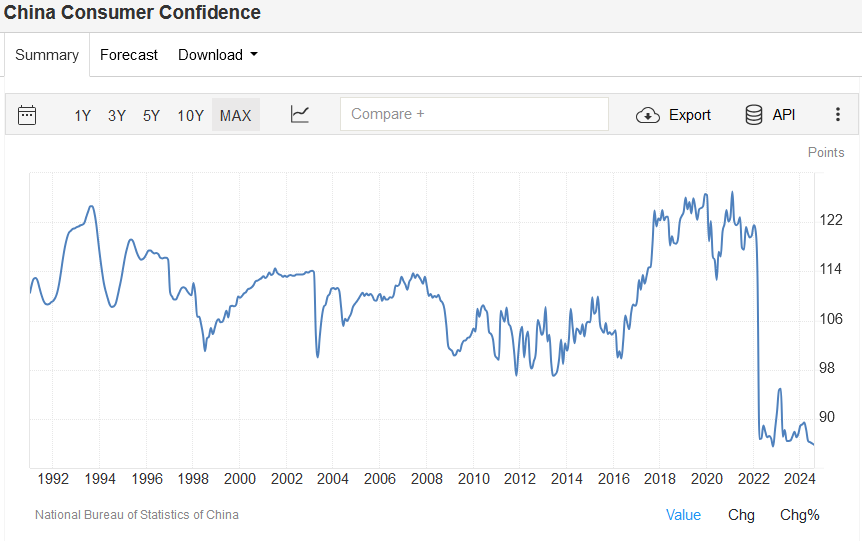

Similarly, if you believe the Chinese Consumer will remain depressed and never recover, you should sell your Alibaba stock:

I have made my career in the mean reversion game and it has served me extremely well over the years. One of my edges is recognizing extremes and betting on recoveries (whether companies, sectors or countries). We are expressly in the “time arbitrage” business and attract partners/investors who can weather the short term noise in exchange for long-term bounties. We live to tell the story because we employ little to no leverage. We run a concentrated high-conviction portfolio in which some theses play out much faster than we anticipated and some take longer, but on balance aim to realize fully valued exits within 36 months (coming off despondent overshot low prices).

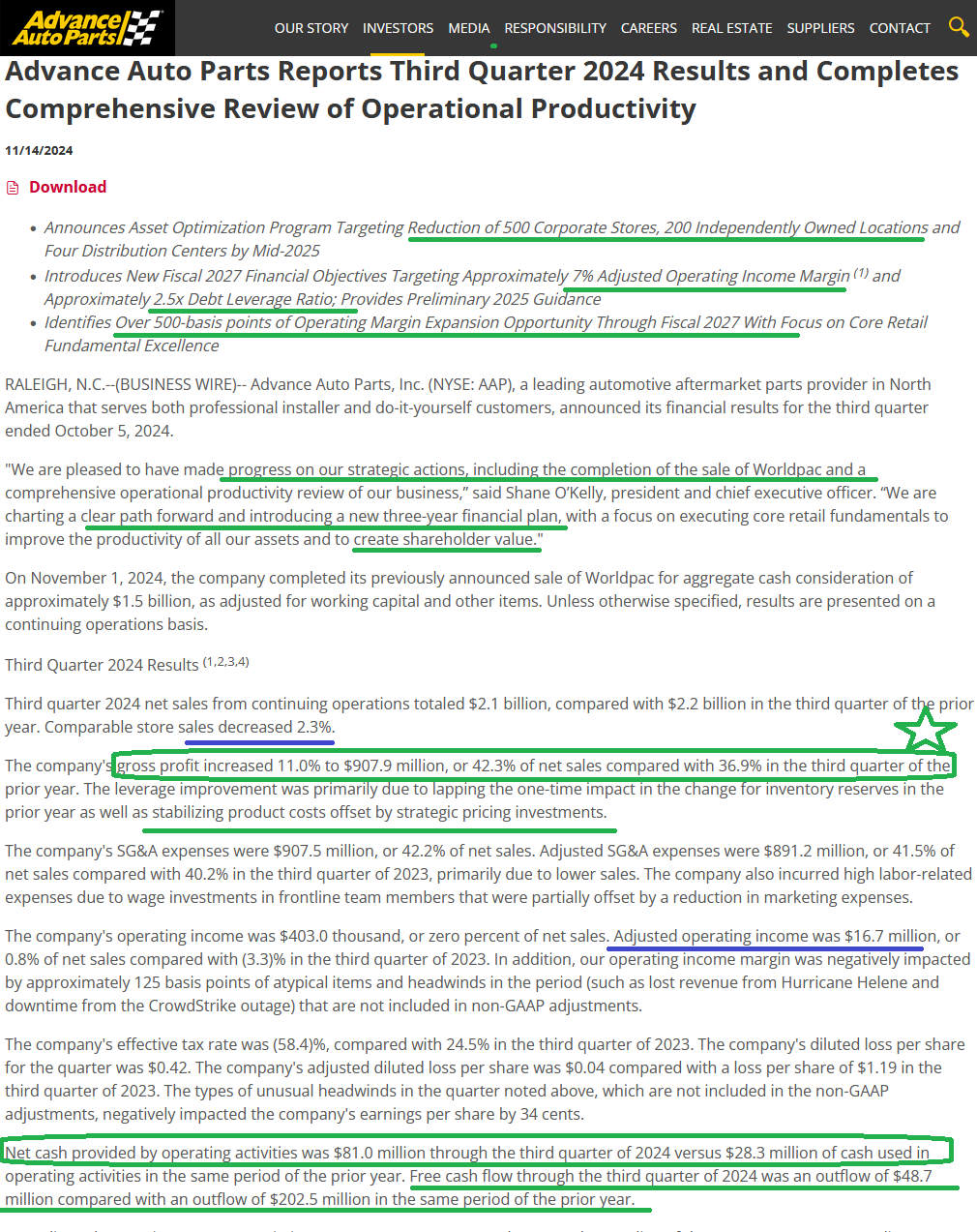

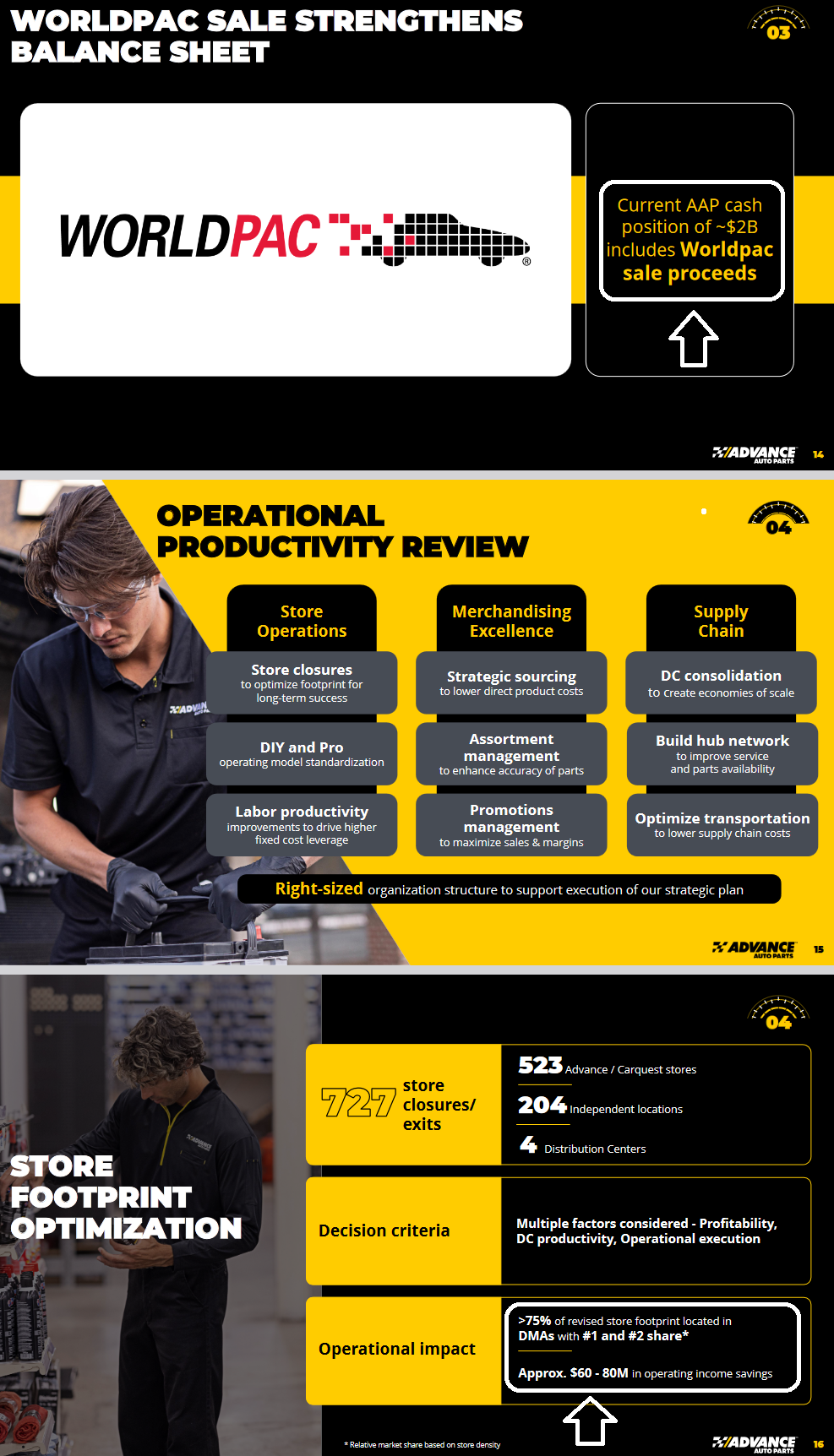

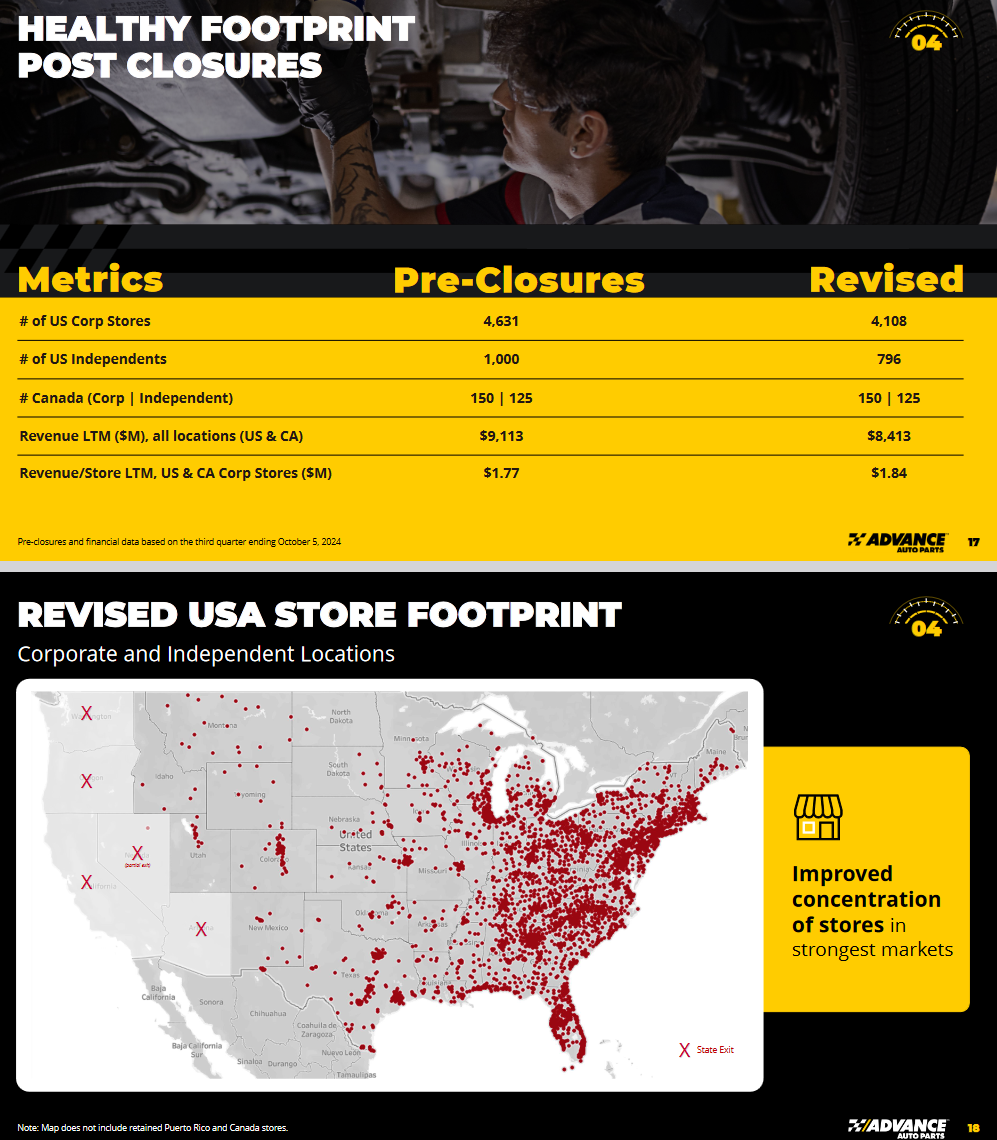

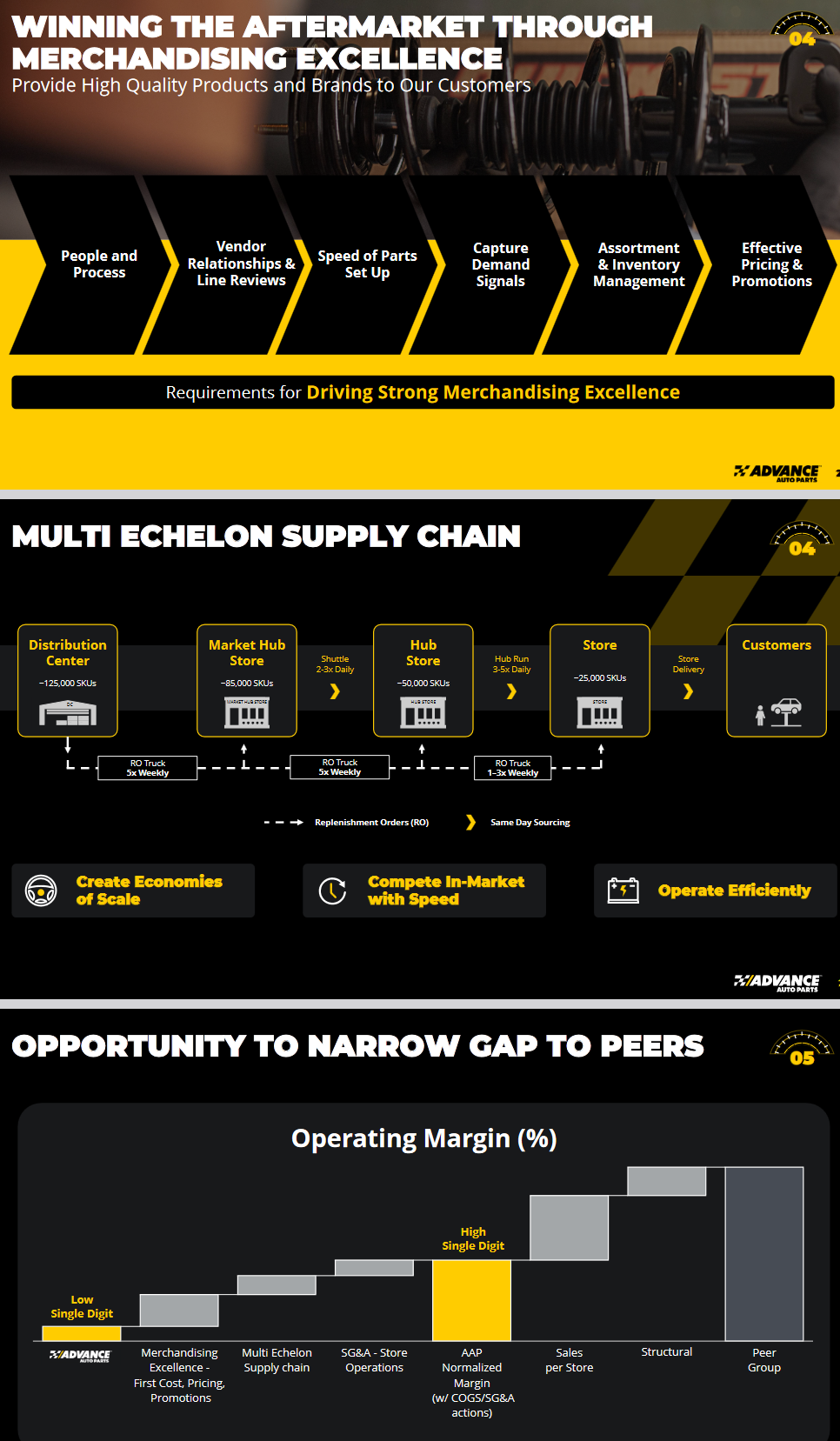

Advance Auto Parts reported earnings last week. The headlines were “Advance Auto Parts shutters 700 Store to Shore Up Finances.” What it should have read is, “New Management – with proven track record of success – fixes years of bad decisions by previous management in ‘shrink to grow strategy’ while maintaining healthy balance sheet through non-core asset sales.”

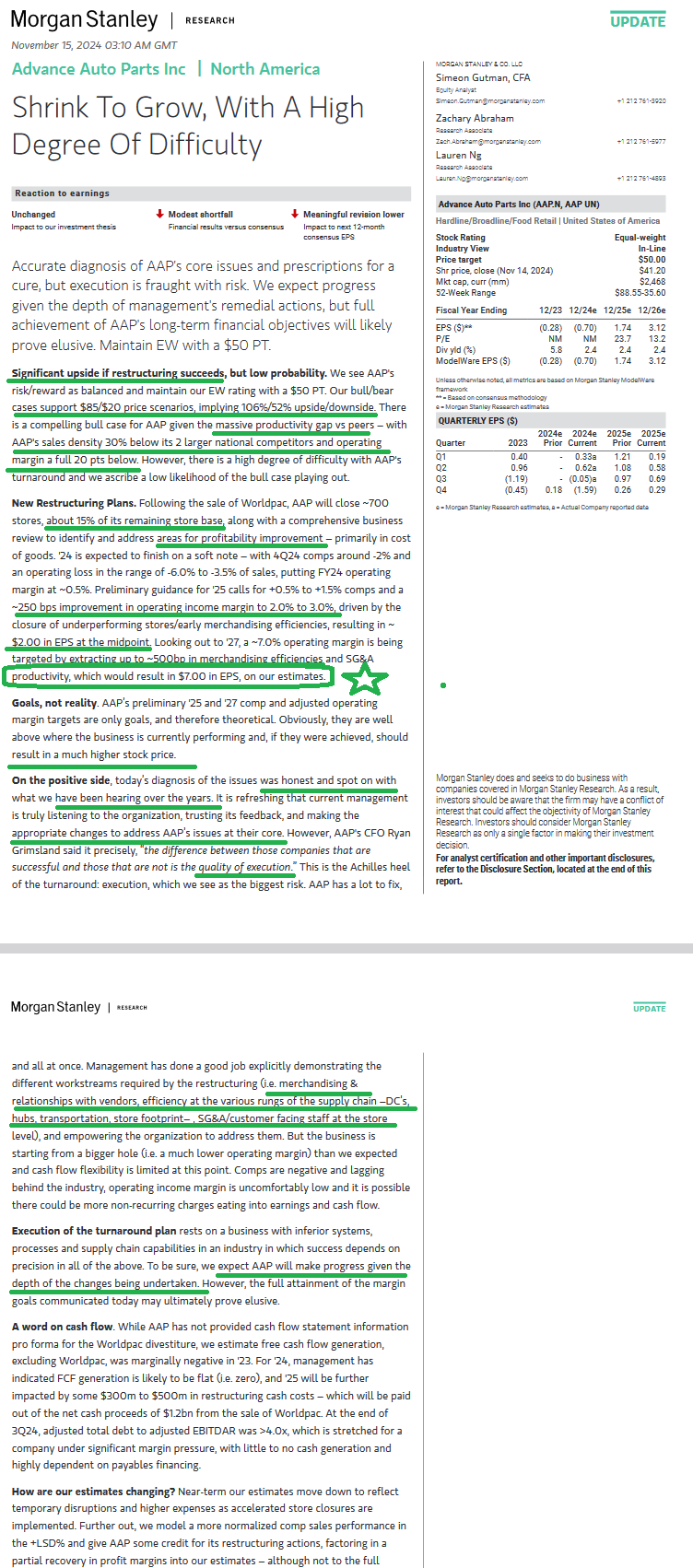

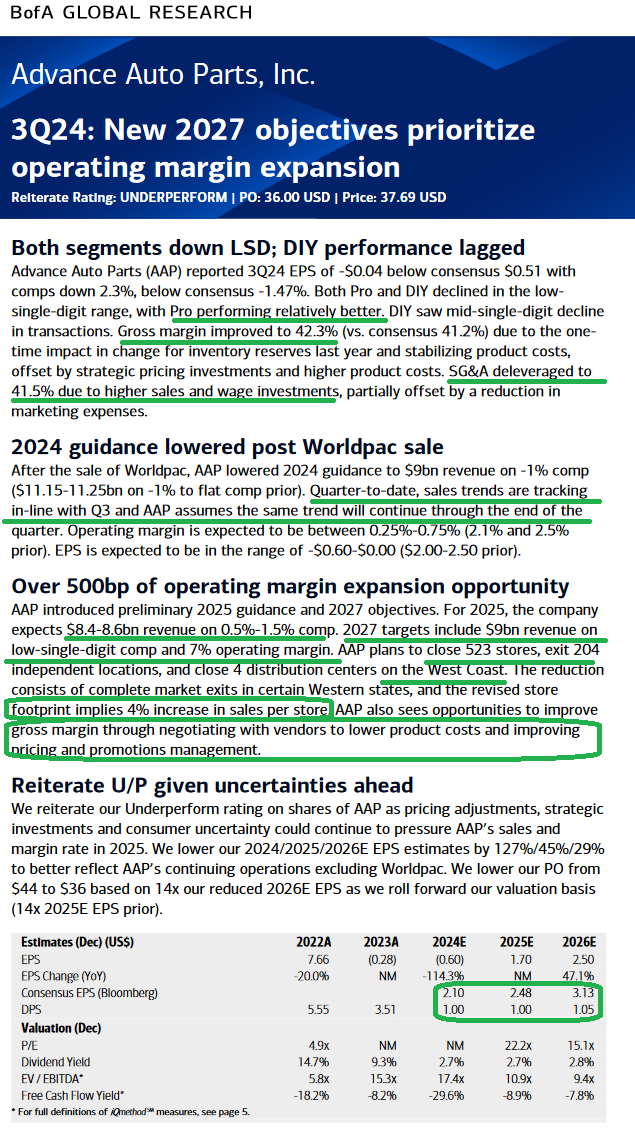

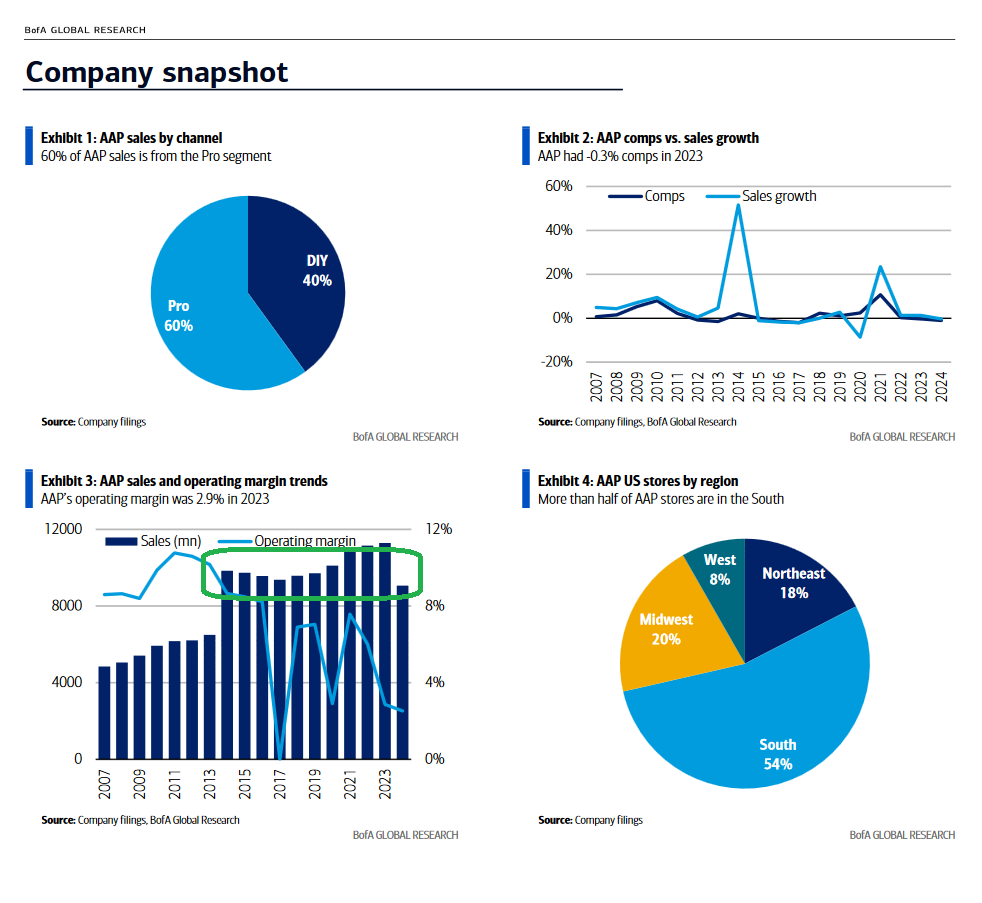

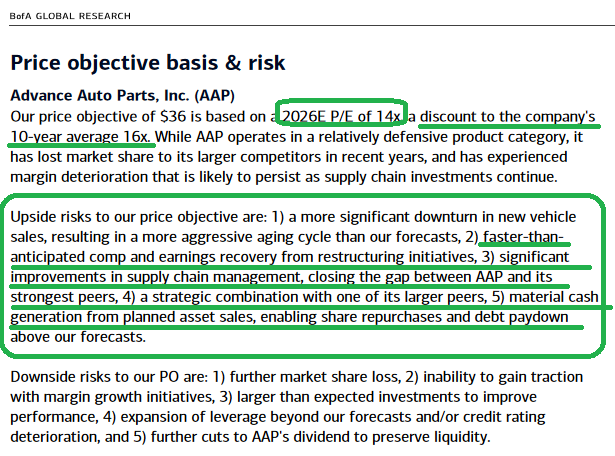

What is fascinating to me is that despite the “negative” headlines, even the sell-side – who usually run for the hills from “turnarounds” – were constructive with their outlooks. Morgan Stanley had a base-case $50 PT with $85 “bull case.” Bank of America was more pessimistic (well below 2026 consensus EPS of $3.13 and MS estimates of $3.12).

Bank of America was more pessimistic coming in well below consensus expectations for 2026. These estimates will be taken up as management executes.

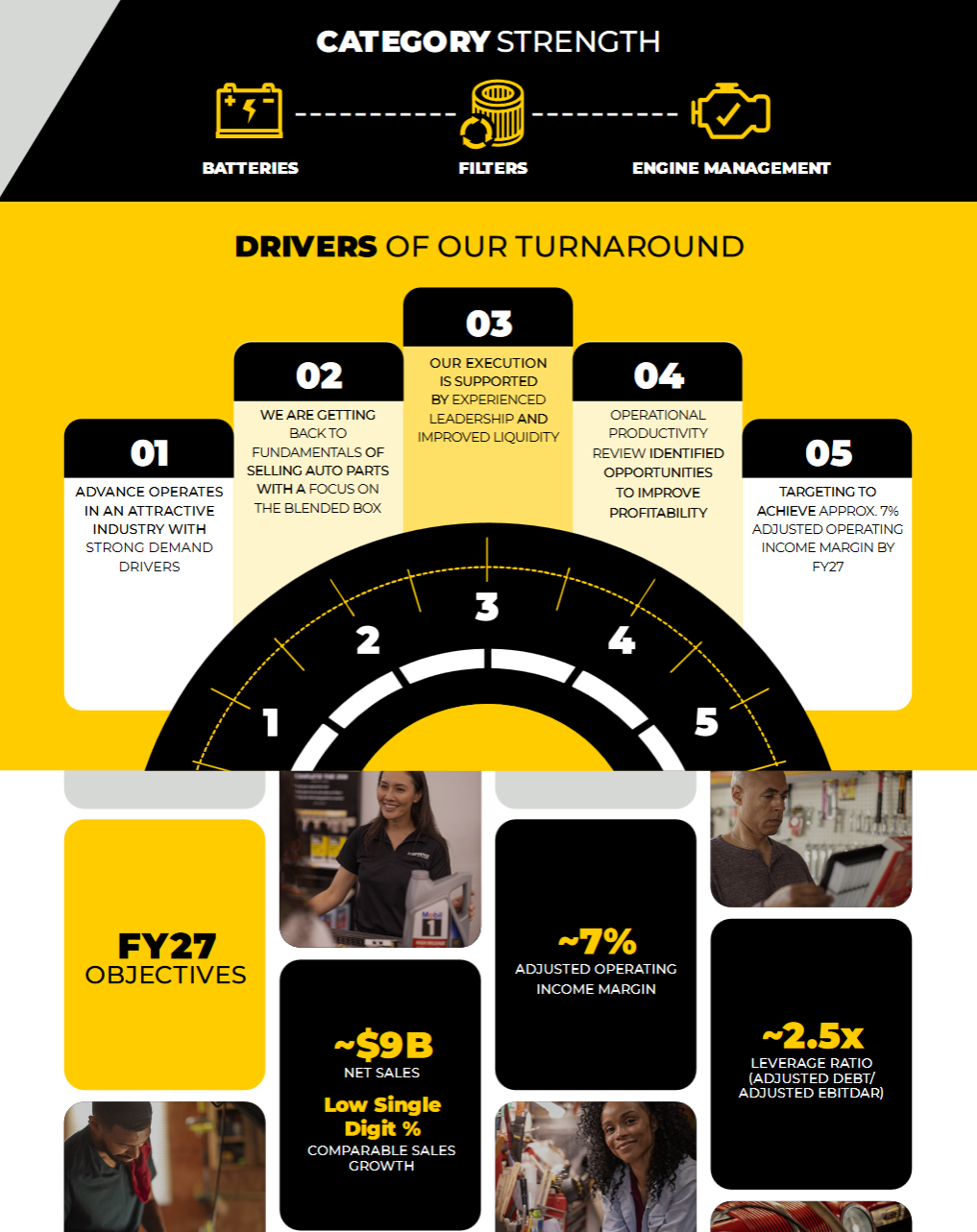

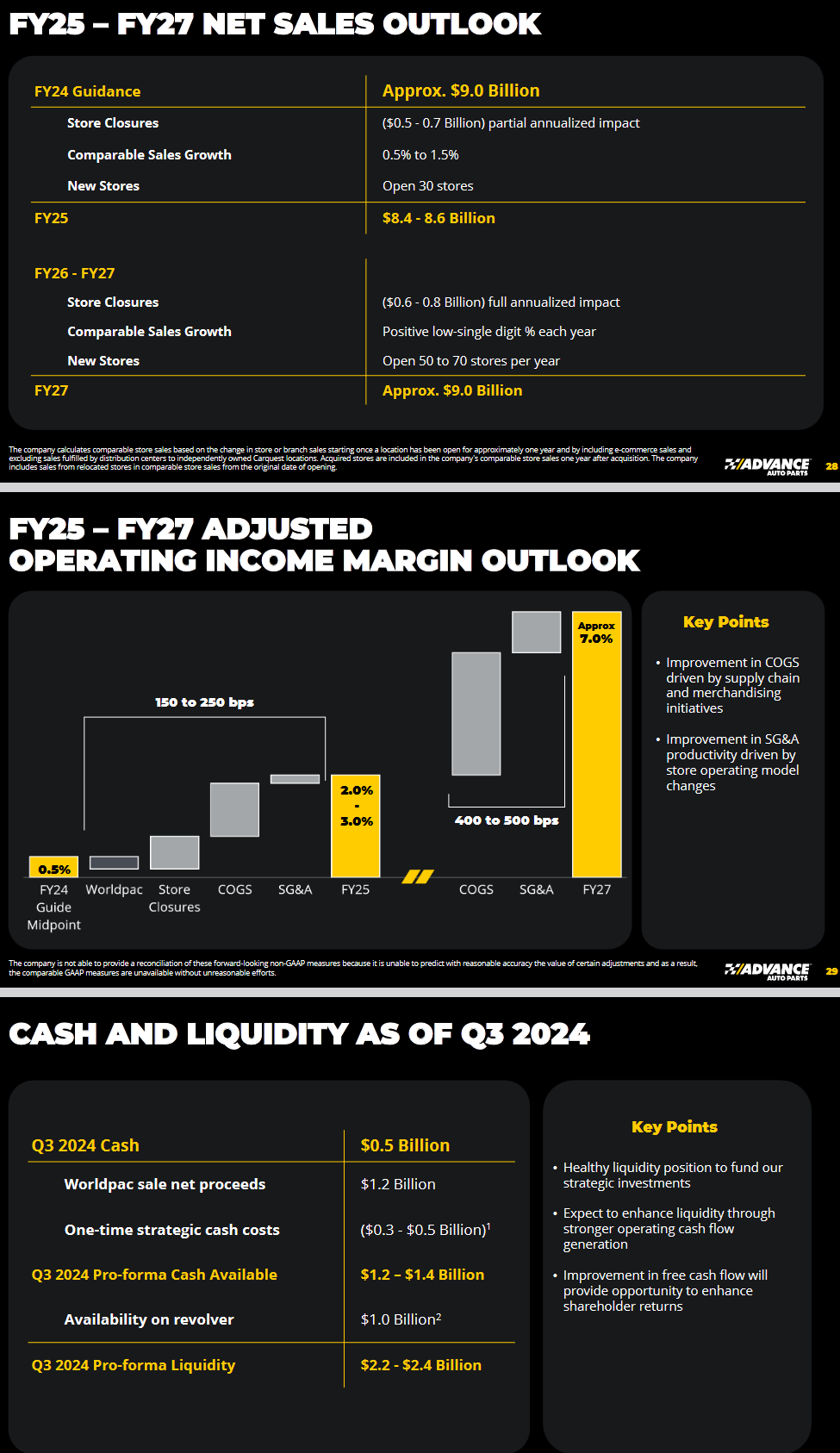

Management was more sanguine than the sell-side analysts and laid out a clear path to recovery over the next two years:

Despite this plan, analysts have consensus estimates for 2027 at $3.13 per share EPS.

Despite this plan, analysts have consensus estimates for 2027 at $3.13 per share EPS.

$9B at a 7% operating margin yields $630M of Operating Income.

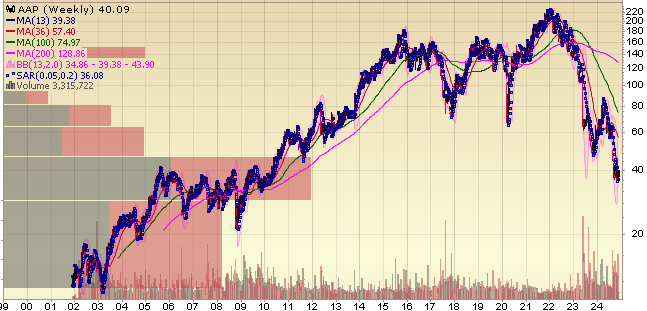

The last 4 times they had operating income in the $600Ms were 2018 ($617M), 2019 ($679M), 2022 ($670M). In those respective years – when the share count was as much as 10.5% higher than higher than today – the business earned $5.75, $6.87 and $7.70 per share in EPS. The stock reached highs of $186.1, $182.6 and $244.50 in each of those years. With a share count reduction of ~10% since those peaks, the EPS will increase off a similar operating income in 2027. The key will be what multiple is applied?  We entered this position with the expectation of a double over three years. As we are now seeing new CEO Shane O’Kelly execute on the plan he laid out at inception (deleverage the balance sheet with $1.5B sale of WorldPac), close unprofitable stores (10%), consolidate supply chain, etc our expectations have moved UP – while the “sell-side” analysts have moved down. It will not be an easy or sure path, but with solvency risk off the table (following the sale of WorldPac) and a sensible “shrink to grow strategy” – coupled with demand tailwinds, this could be another major “Turnaround Tom” special in coming years.

We entered this position with the expectation of a double over three years. As we are now seeing new CEO Shane O’Kelly execute on the plan he laid out at inception (deleverage the balance sheet with $1.5B sale of WorldPac), close unprofitable stores (10%), consolidate supply chain, etc our expectations have moved UP – while the “sell-side” analysts have moved down. It will not be an easy or sure path, but with solvency risk off the table (following the sale of WorldPac) and a sensible “shrink to grow strategy” – coupled with demand tailwinds, this could be another major “Turnaround Tom” special in coming years.

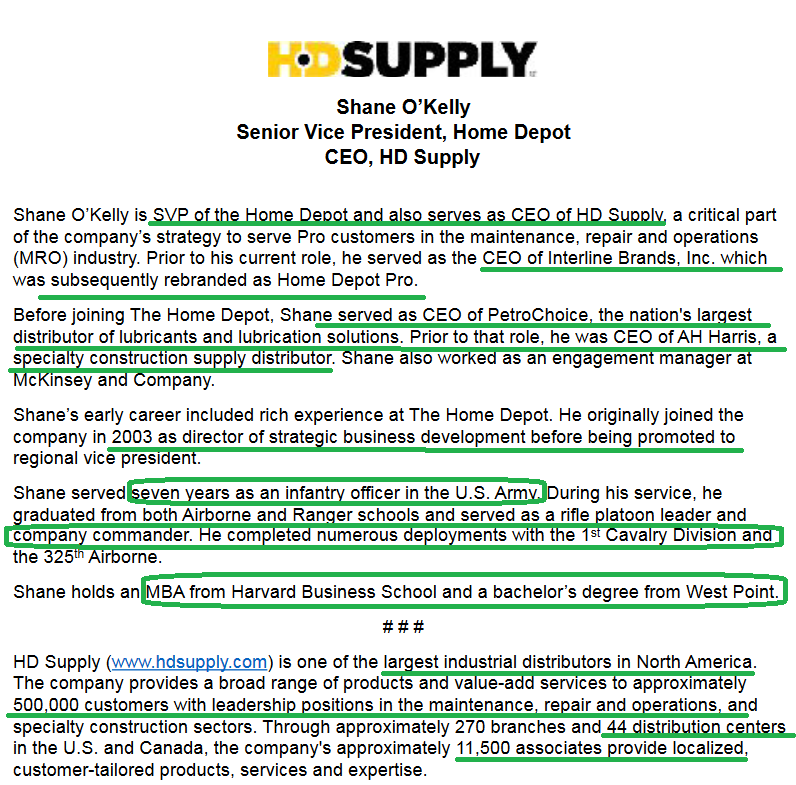

I looked up one of the analysts who wrote a very pessimistic report after earnings (not above). He just graduated (undergrad) in 2022 and his linkedin picture looks like a high-school yearbook photo! A 23 year old kid is trying to tell us what proven Shane O’Kelly – who ran $7B HD Supply for Home Depot – is doing wrong! I’ll bet on Shane every day of the week:

This is the natural sentiment of sell-side analysts when you are closer to lows. The same uber-pessimists become the final “upgraders” at the next top several years out – when their despondency turns to euphoria at the exact wrong time.

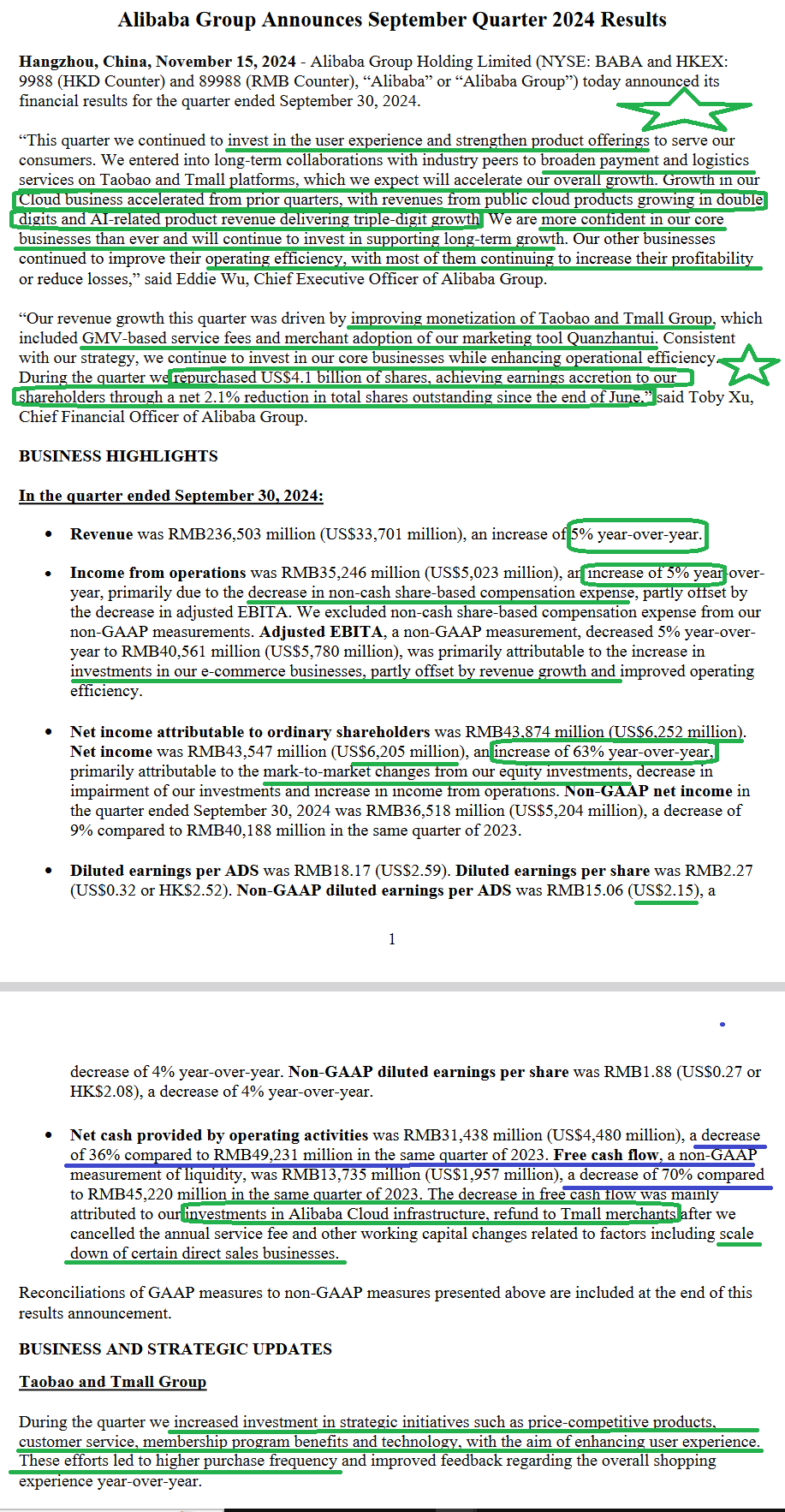

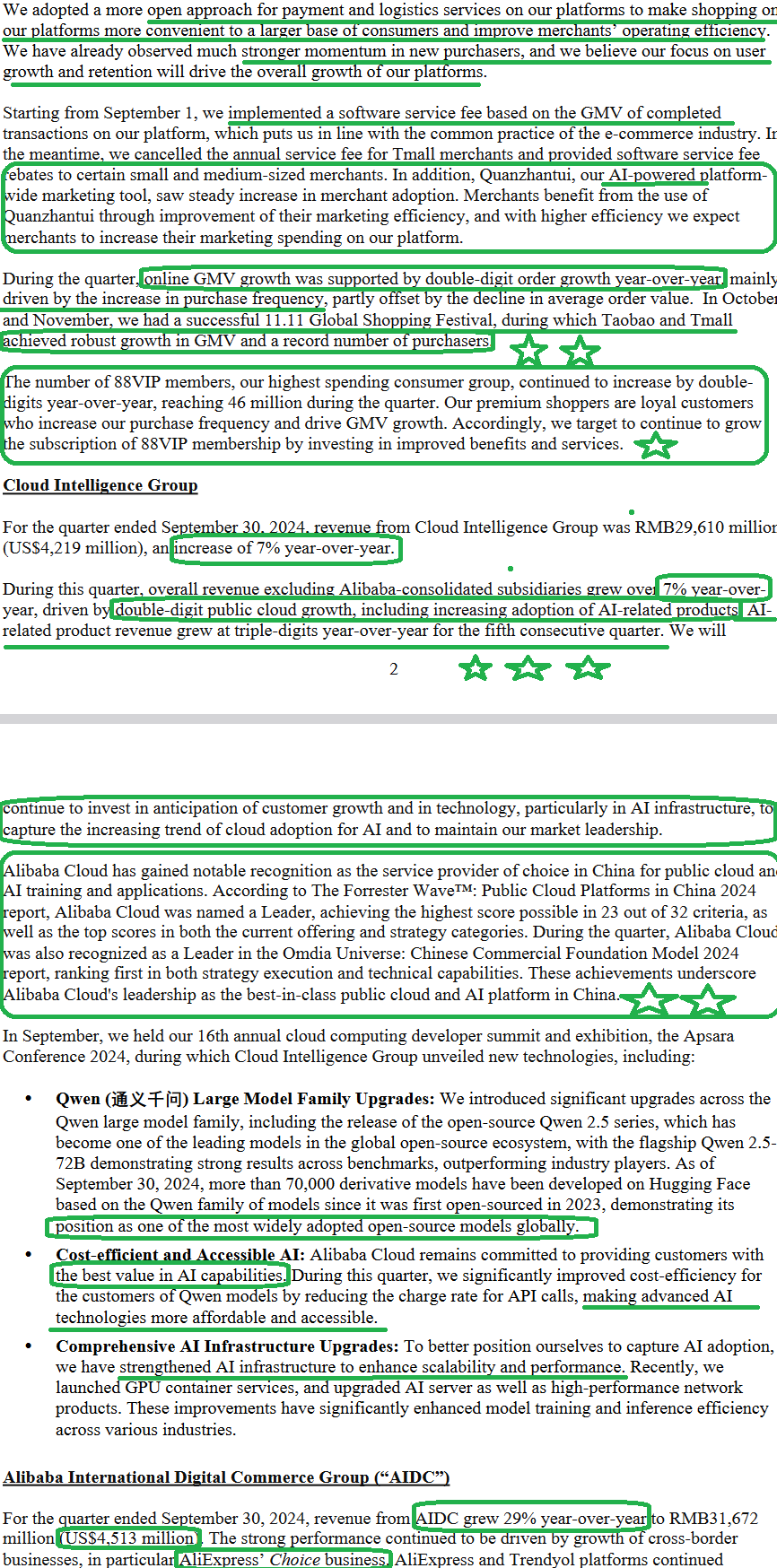

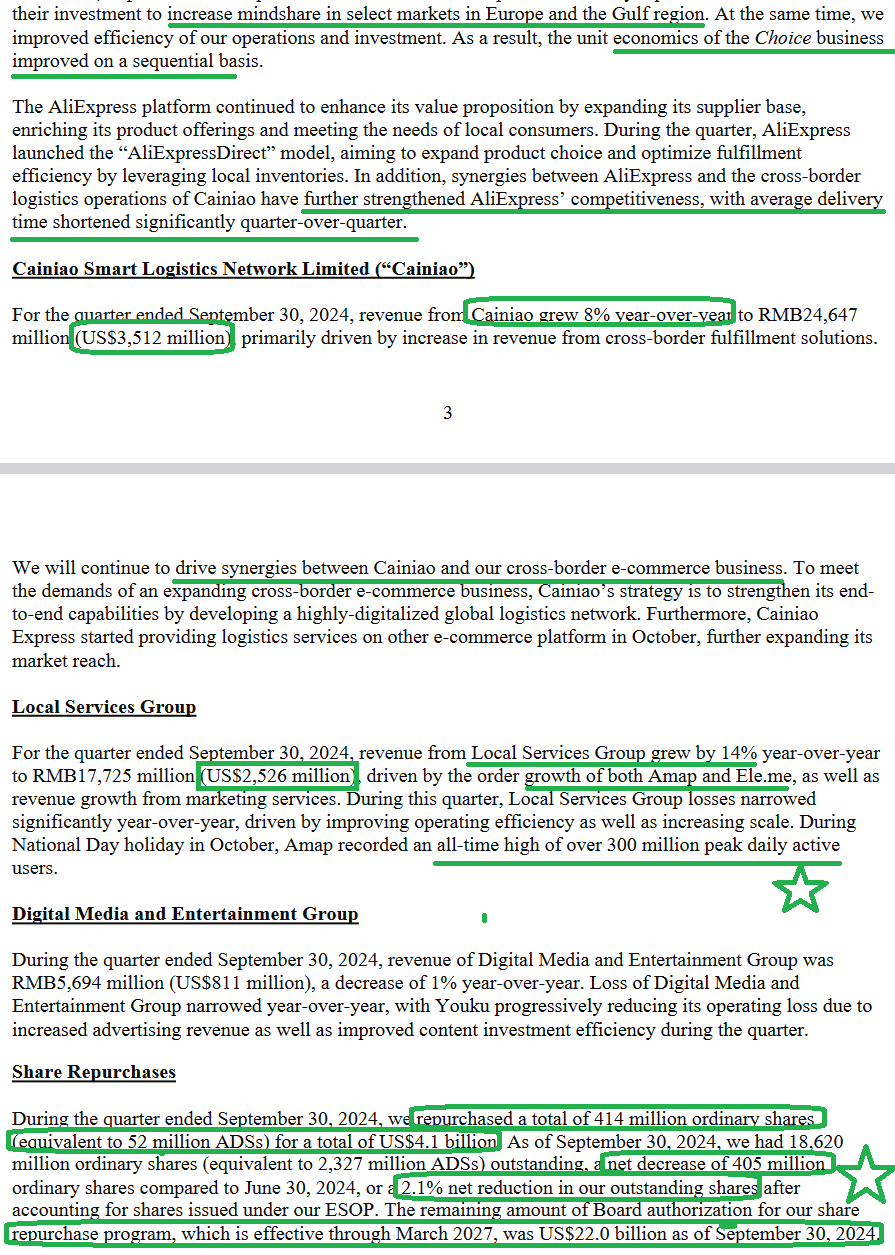

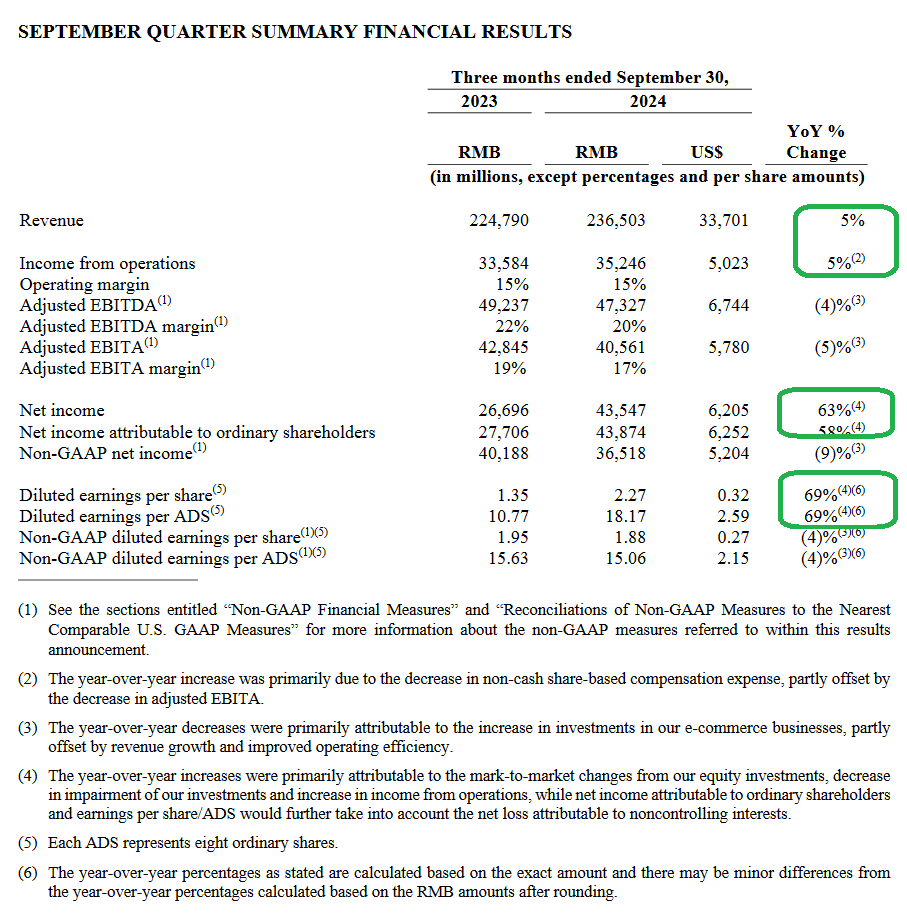

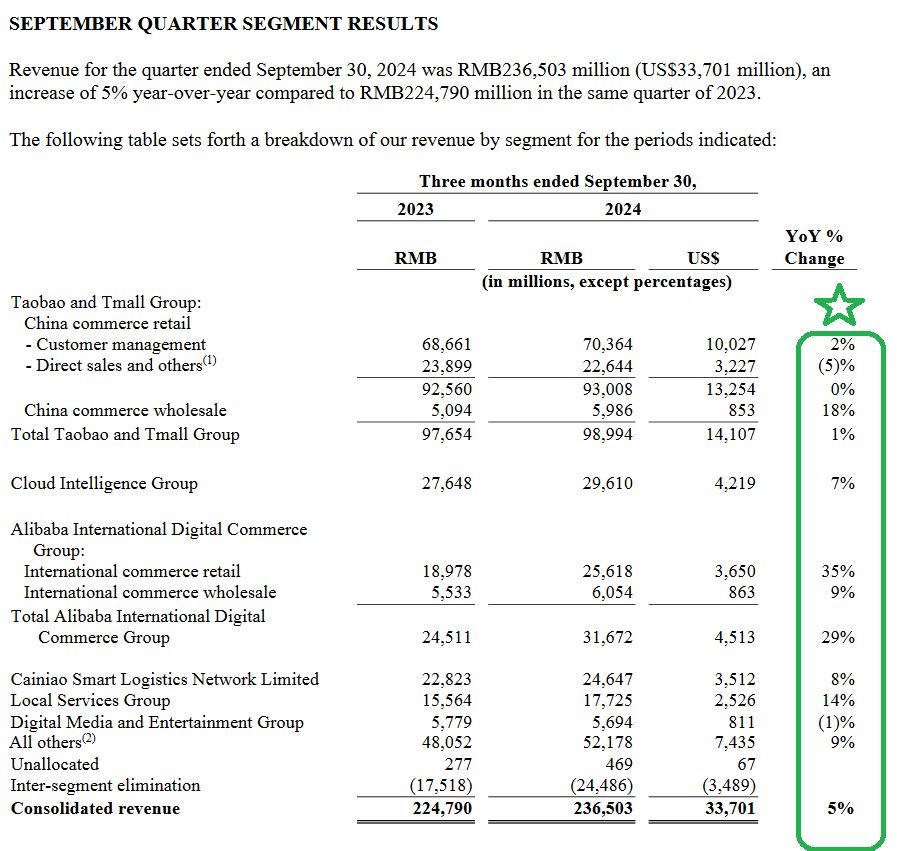

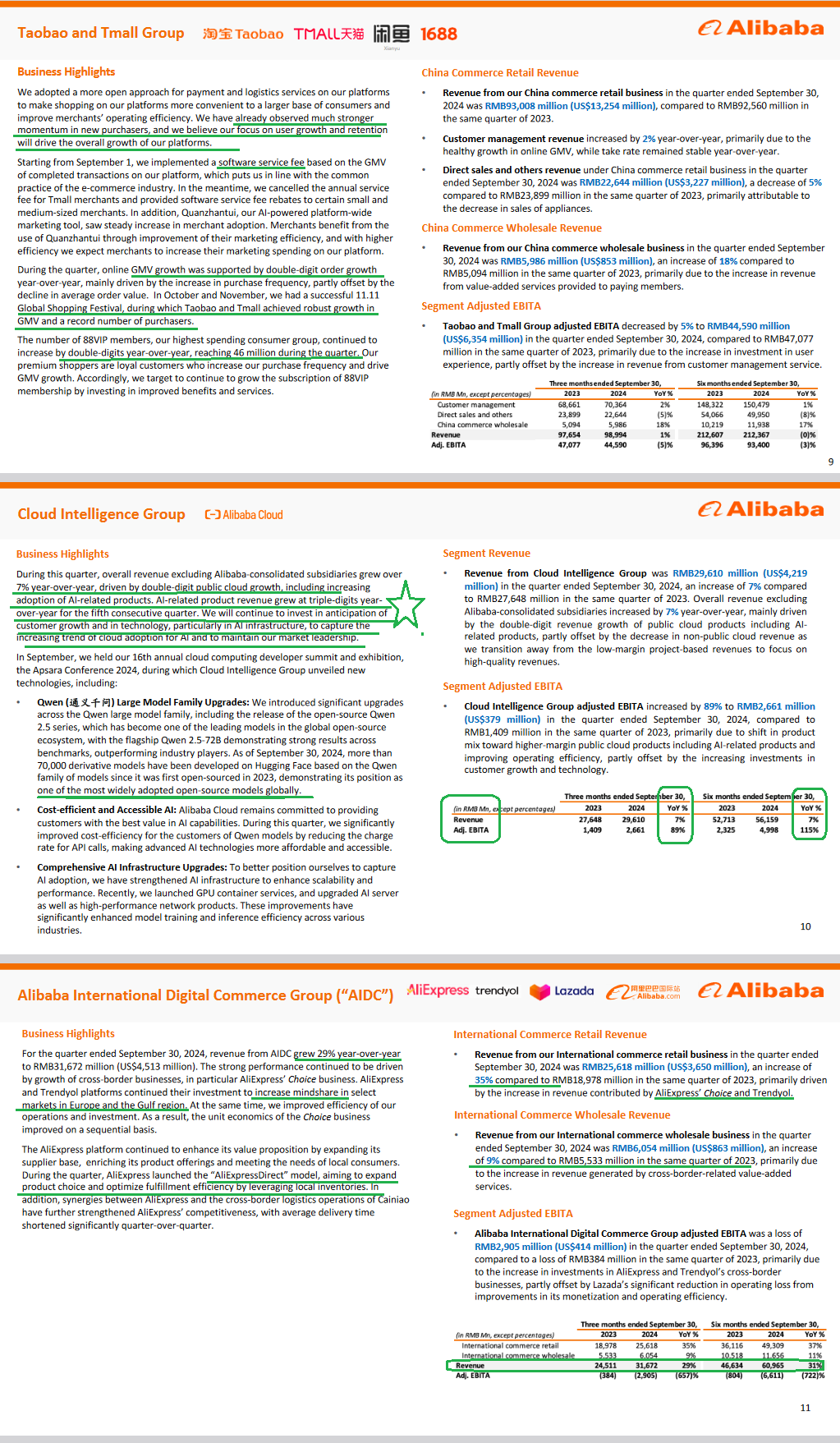

Alibaba

A friendly reminder: we’ve been to this movie before! It has a happy ending, you just need to stay through the intermission. The stock market is designed to transfer wealth from the impatient to the patient. Which are you, the transferer or the transferee?

General Market

General Market

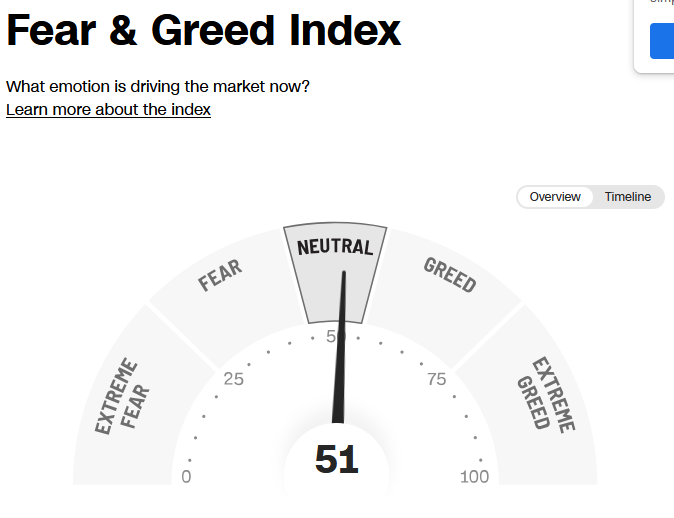

The CNN “Fear and Greed” dropped from 68 last week to 51 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

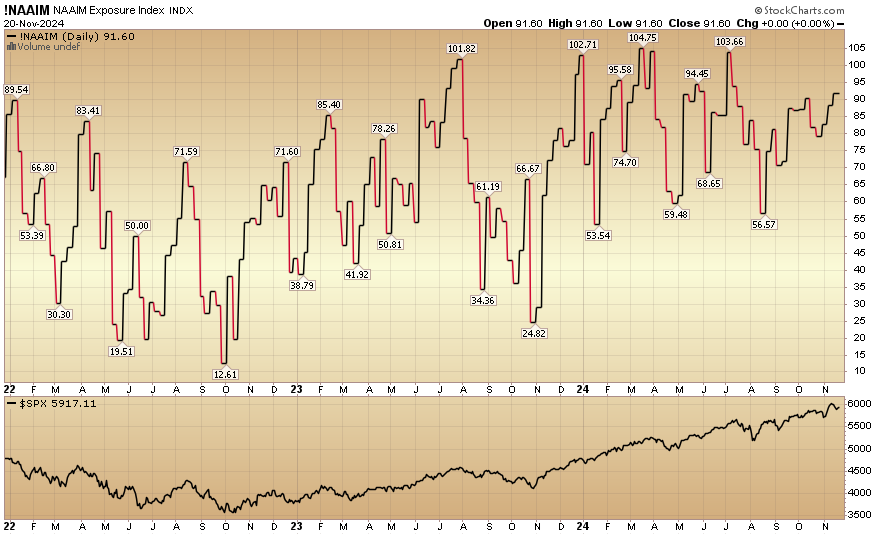

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) rose to 91.60% this week from 88.31% equity exposure last week.

Our podcast|videocast will be out tonight. We have a lot of great data to cover this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

*Opinion, Not Advice. See Terms