First Move, Wrong Move?

Well, just when I thought I was done with the article of the week, Chair Powell hosted the Fed Presser and made things interesting! I’ve been doing this for a while and have come out several times after Fed meetings saying, “the first move is often the wrong move.” I think it may apply once again, but could take a few days to play out.

This afternoon felt like either a fund blew up or the margin clerks were taking a bunch of dumb over-leveraged money out to the woodshed to put them out of their misery. We used the opportunity to top up positions across the board – end of day and after-hours. That is not to say we got the last tick – as I’m sure we will see some retail selling in the morning as well – but in the selective spots we bought, the margin of safety is so large, that the downside is limited. I live for days like this.

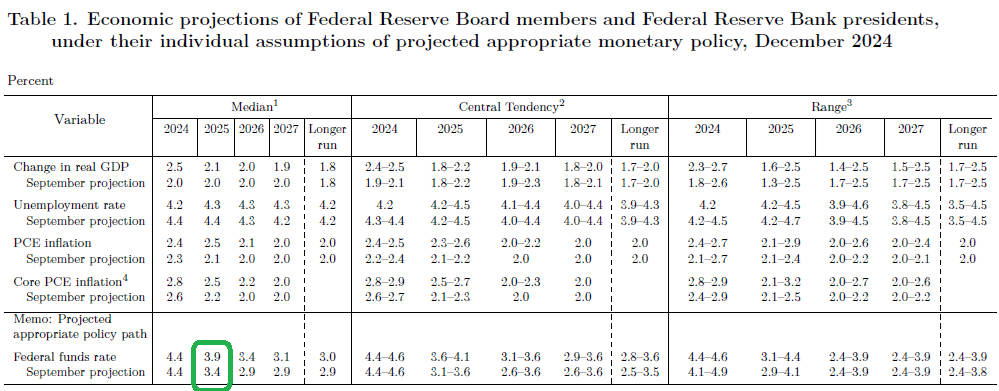

I do not think this is a December 2018 “auto-pilot” moment -as we have been saying on the podcast not to expect more than 1-2 cuts in 2025. Today the Fed confirmed it with their dot plot and SEP. If you’re wondering what drove the markets crazy, it was this little green circle:

They effectively took 2 cuts off the table for 2025. The neutral rate is estimated at ~3.5% (level at which Fed is neither restrictive or accomodative). This implies the Fed will remain somewhat restrictive in 2025, but does not guarantee it. It was not surprising to us, but apparently it was to those who are levered long in MOMO stocks and shiny objects.

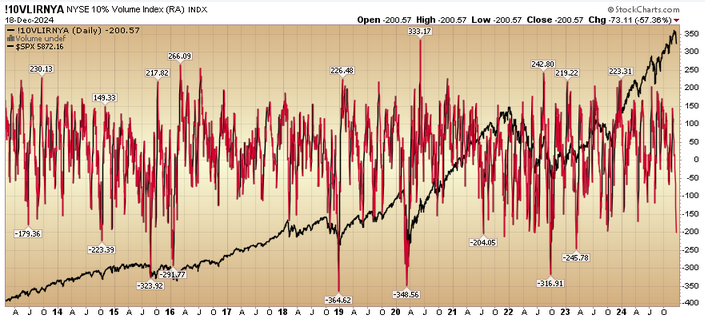

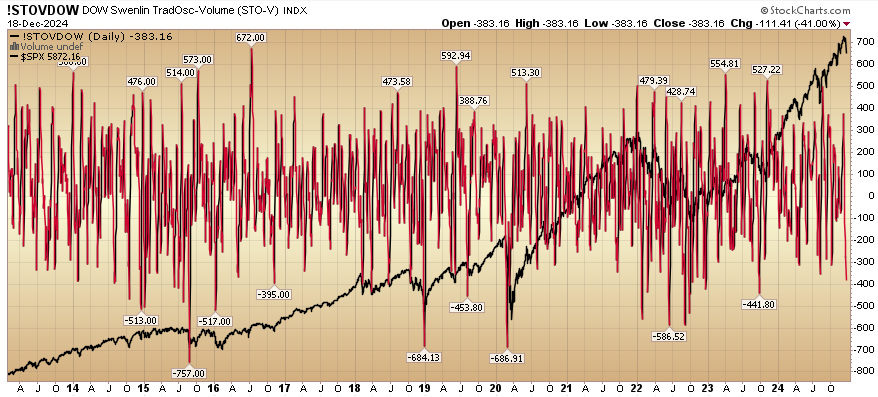

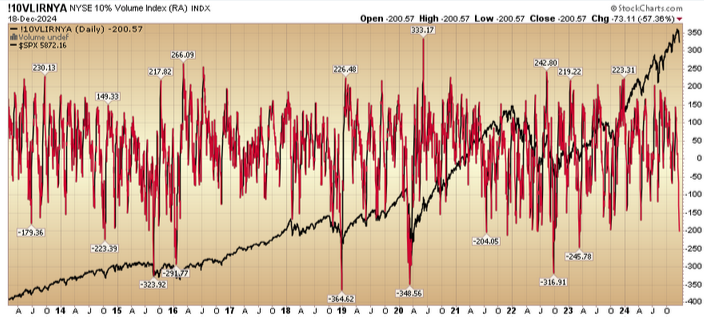

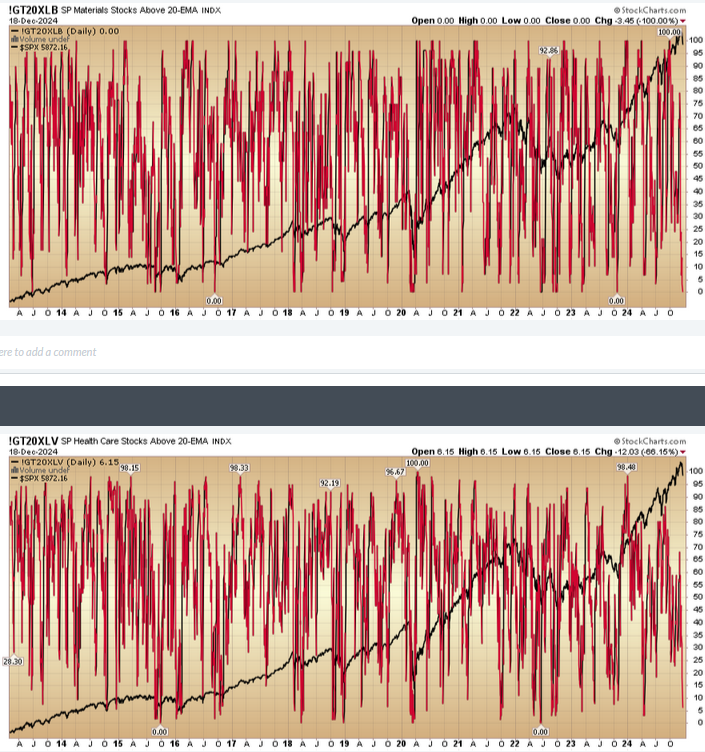

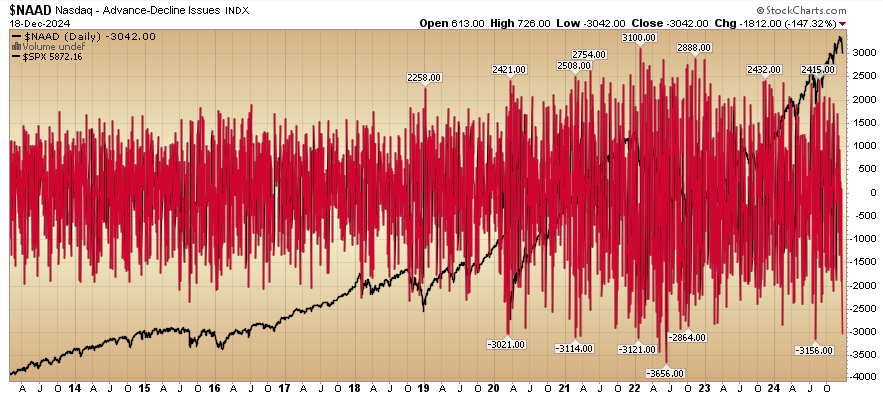

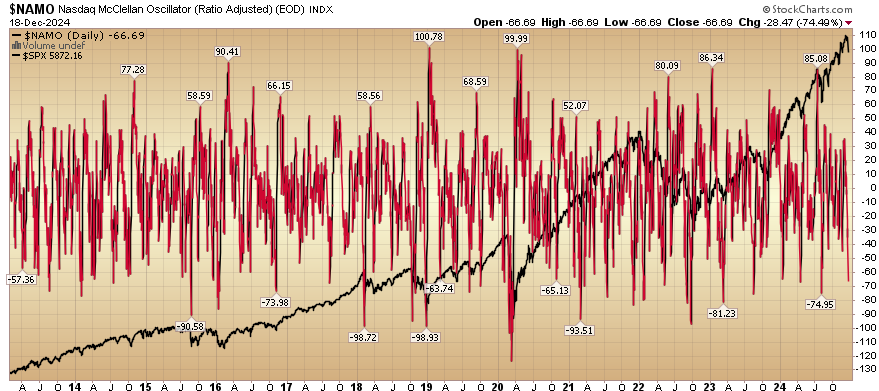

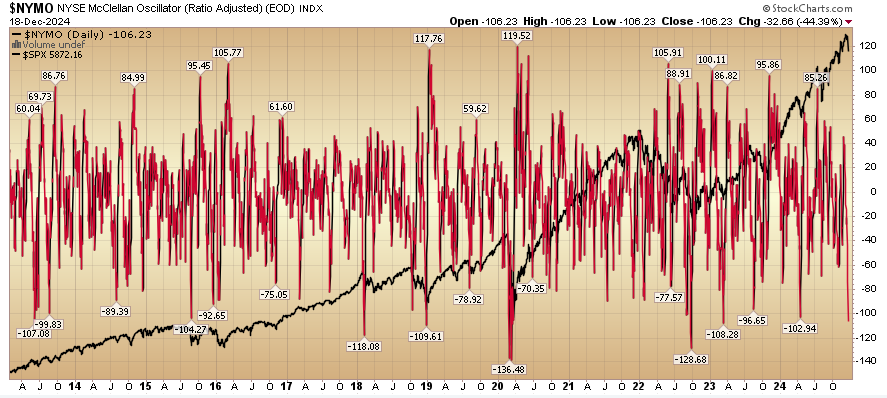

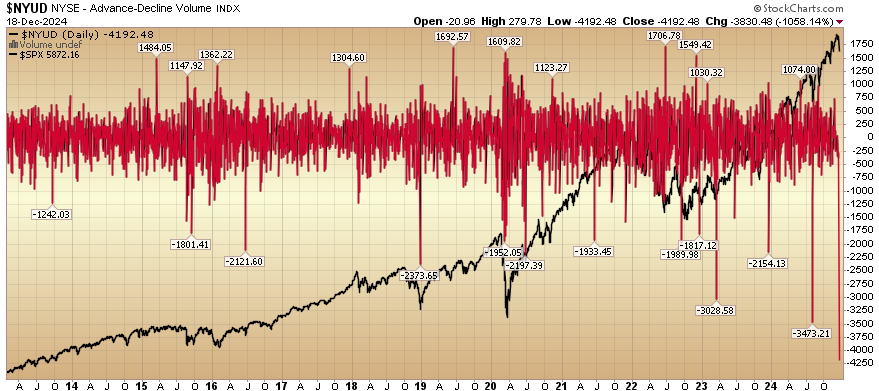

So when the fundamentals are irrelevant due to structural forced selling, I look to some technicals to see when the bleeding might begin to coagulate. I found a number of indications that we could be nearing that point and others that were mixed – leading me to think it could be couple day event but not a couple week event. Hence accepting imperfection and beginning to take advantage of opportunity where it makes amazing sense in the intermediate and long term. Here’s some of what I’m paying attention to at the moment:

Many of these are stretched to or near levels from which you would normally see a bounce back.

Key Market Outlook(s) and Pick(s)

Given my thoughts above, nothing changes in outlook from each of these different interviews:

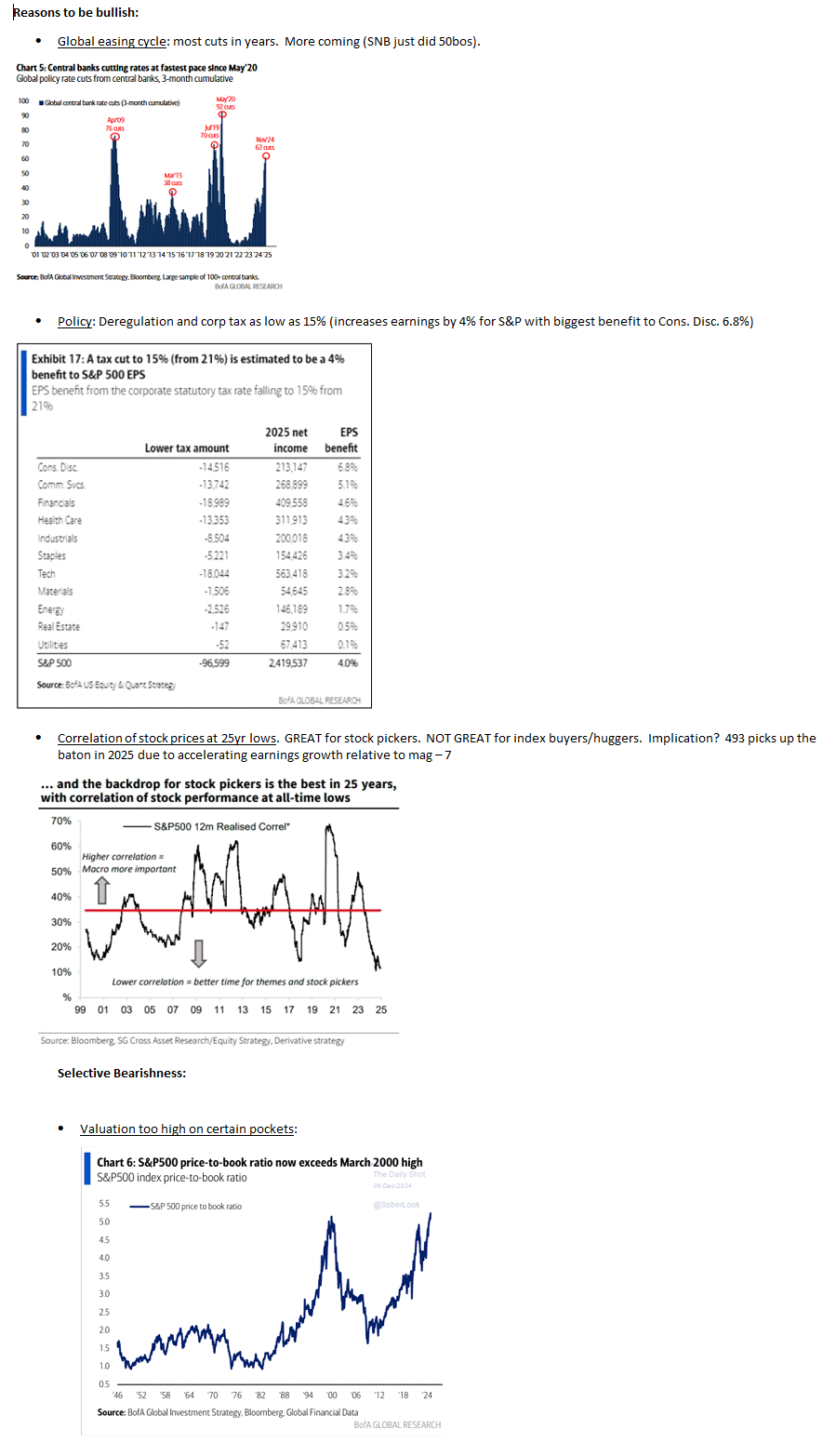

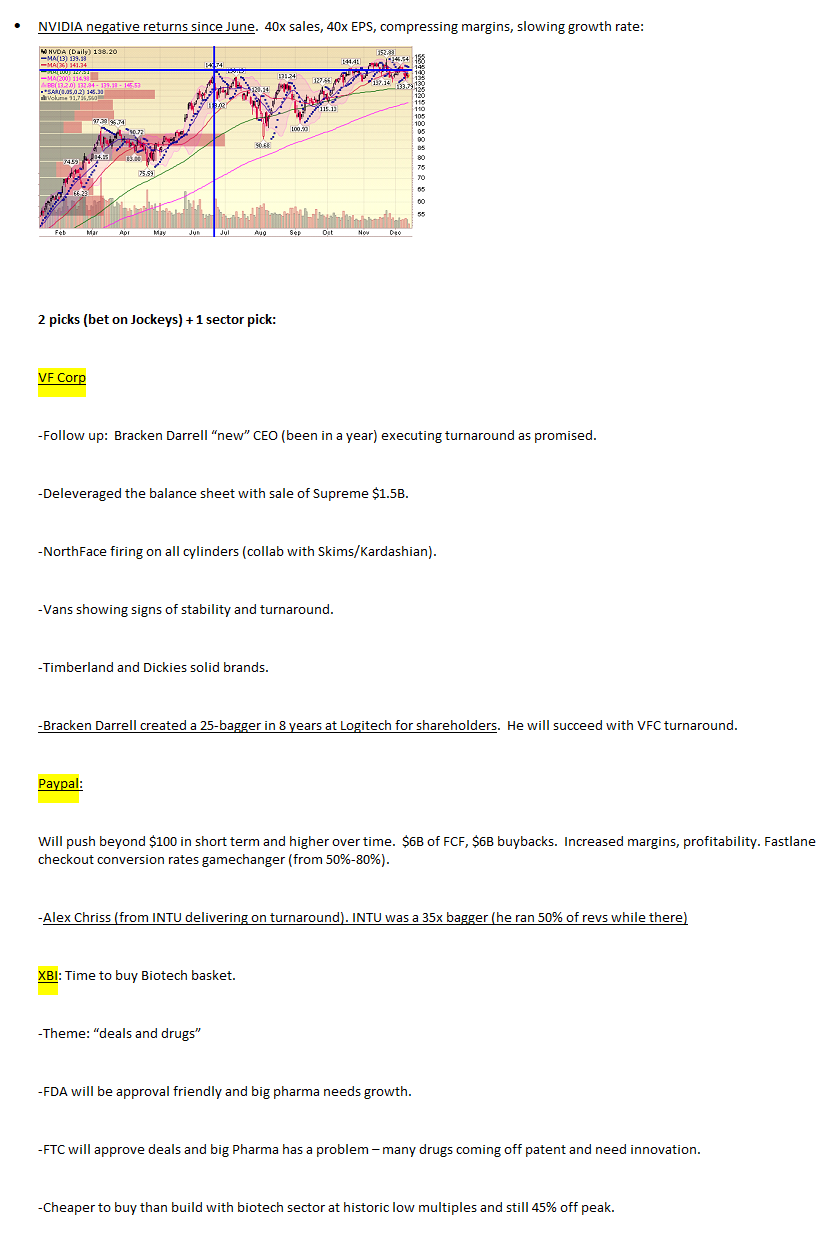

On Friday, I joined Stuart Varney on Fox Business to discuss Corporate Tax cuts, stock correlations, VF Corp and Paypal. Thanks to Stuart, Christian Dagger and Preston Mizell for having me on:

Watch in HD Directly on Fox Business

On Monday, I joined Kristen Scholer on NYSE TV to discuss markets, fed, picks and more. Thanks to Kristen, Jeff Cohen and Melissa Montanez for having me on:

Watch in HD Directly on NYSE TV

Here were my notes ahead of the segment:

Also on Monday, I joined Sean Callebs on CGTN America to discuss tariffs, US/China (Trump/Xi) relations and more. Thanks to Sean and Kamelia Kilawan for having me on:

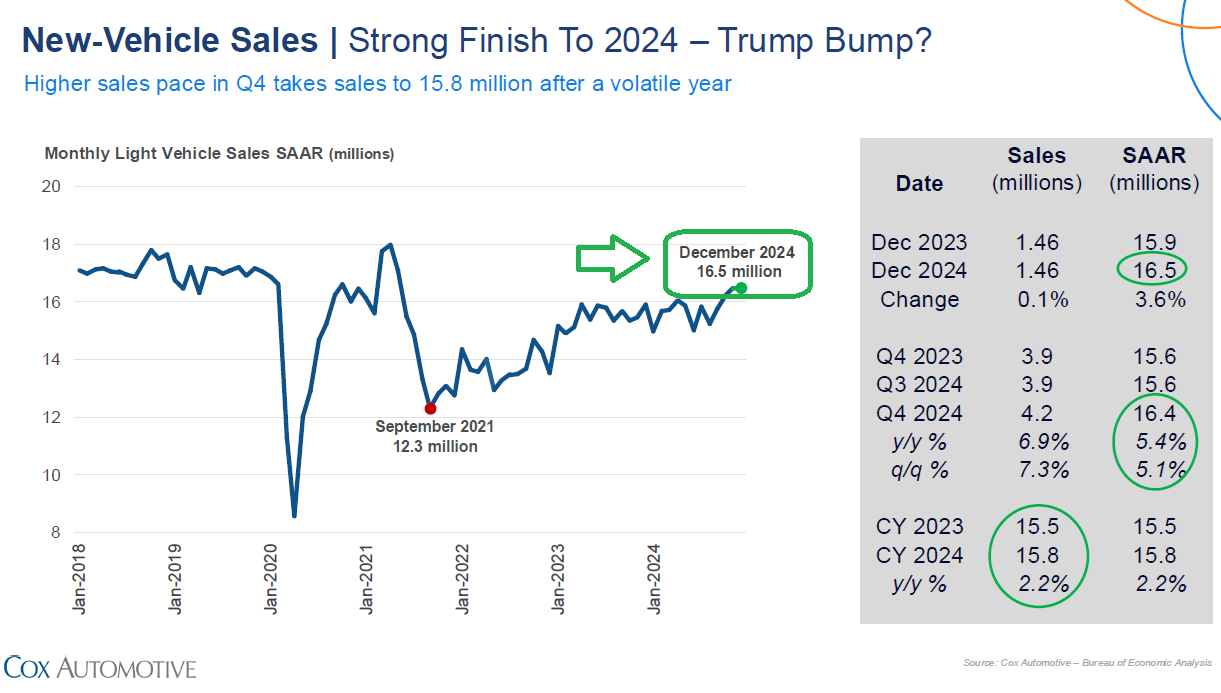

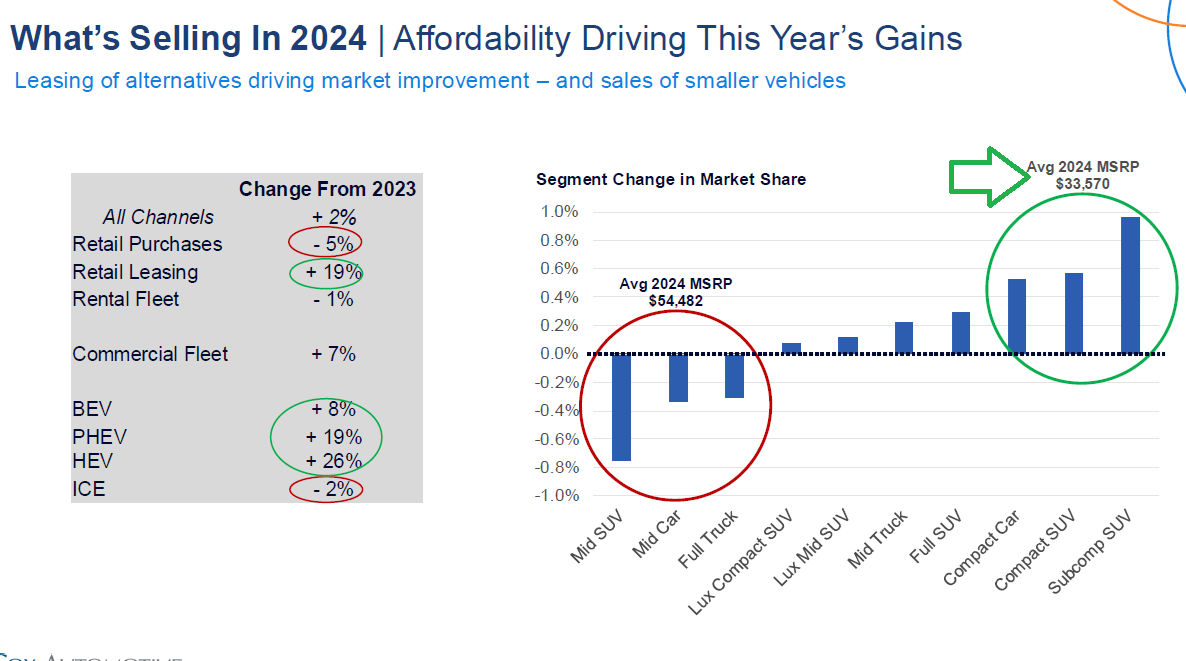

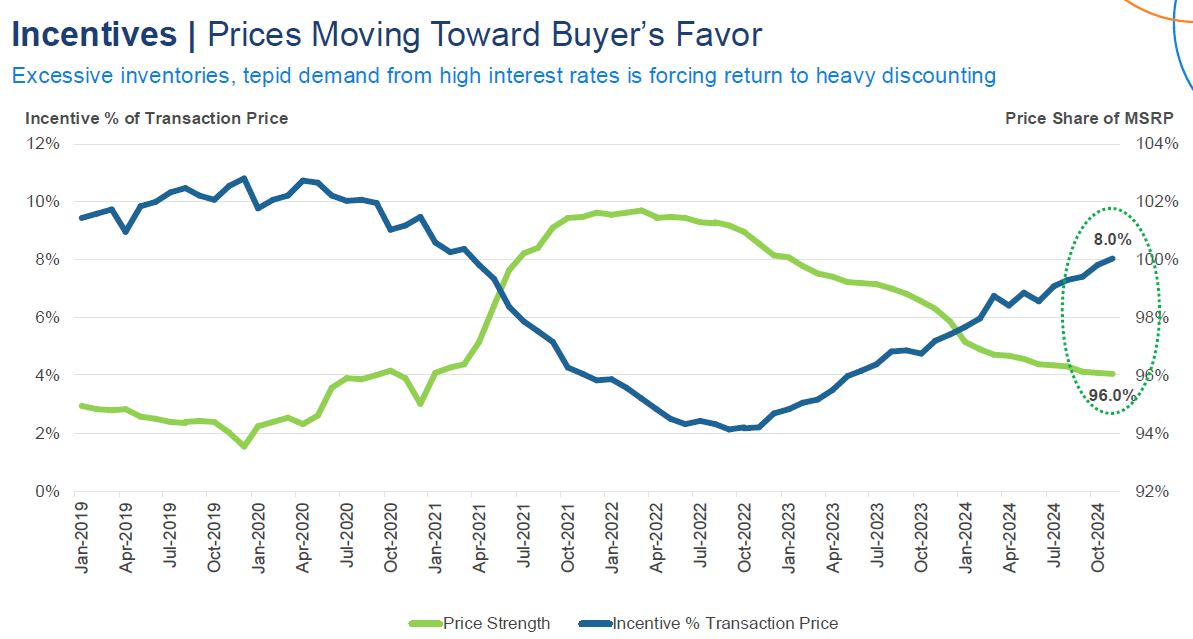

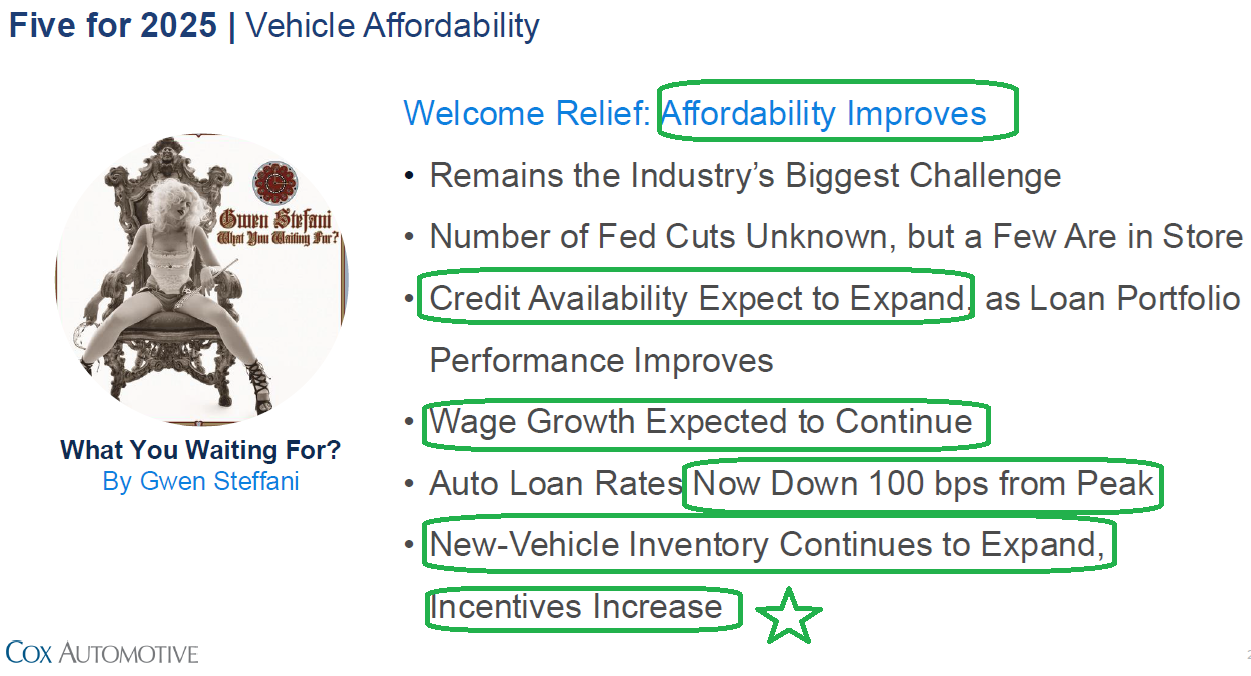

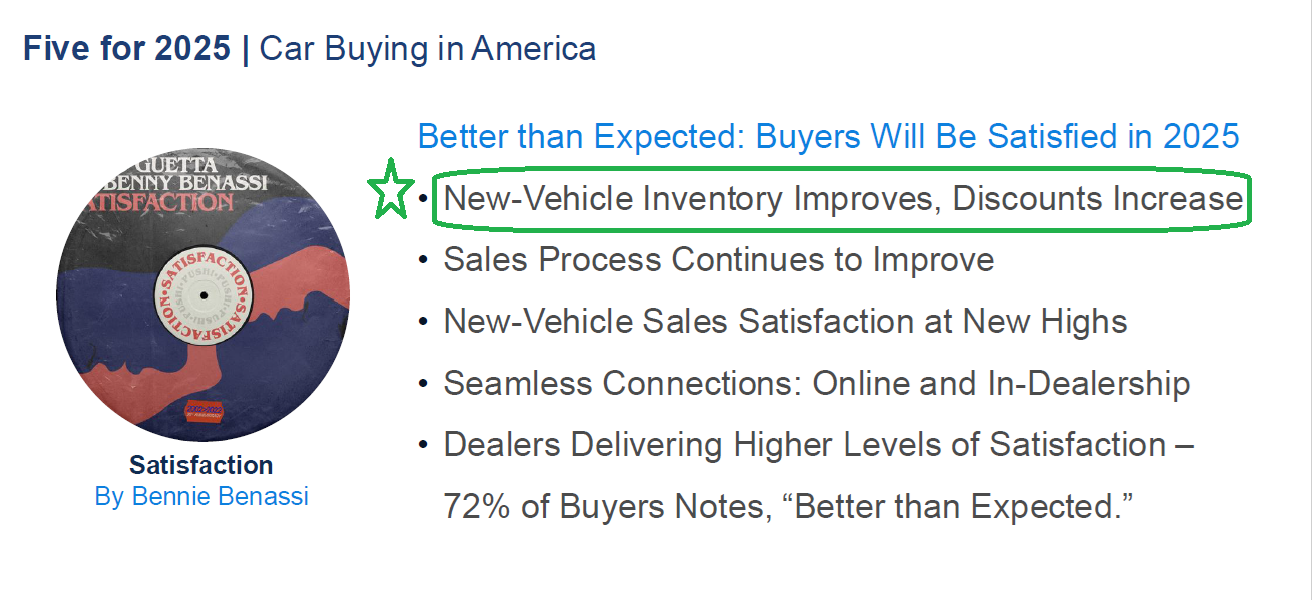

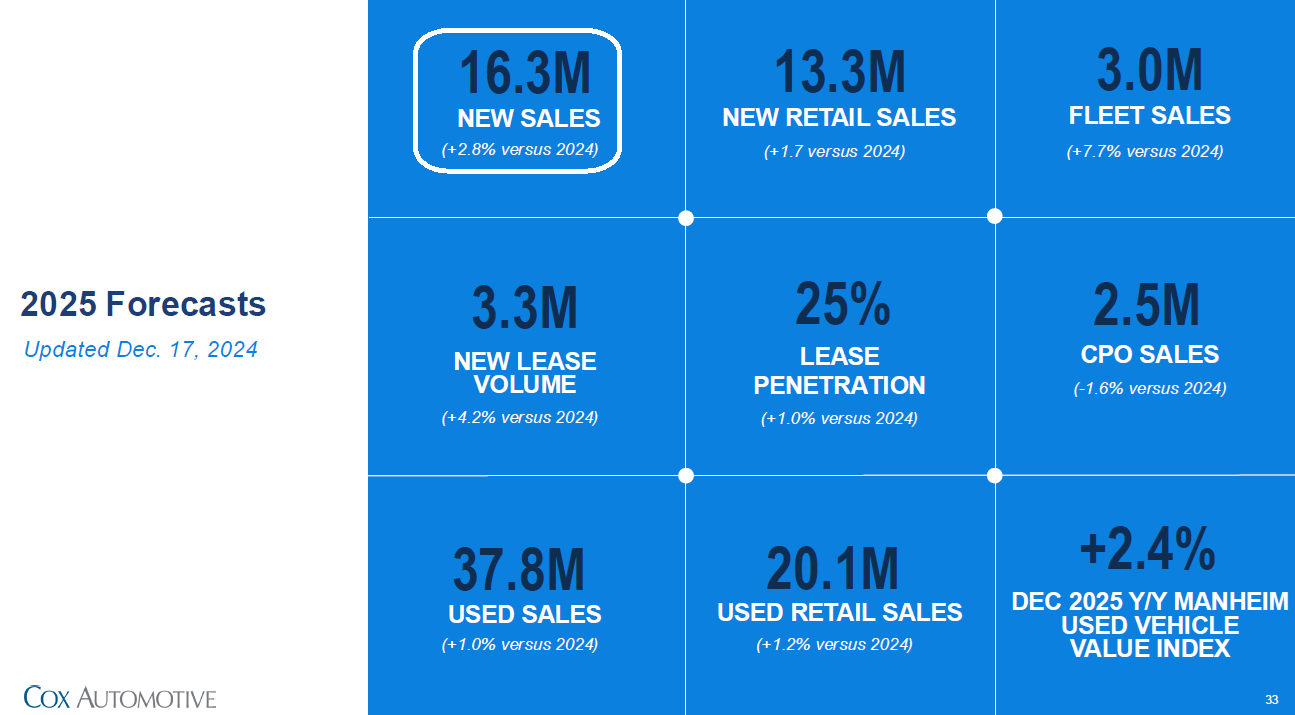

On Tuesday, I joined Stuart Varney on Fox Business to discuss Retail/Auto Sales and holding Etsy. Thanks to Stuart, Christian Dagger and Preston Mizell for having me on:

On Wednesday I joined Neil Cavuto on Fox Business to discuss Fed, rotation, Healthcare and more. Thanks to Neil and Jenna DeThomasis for having me on:

Here were my notes ahead for the segment:

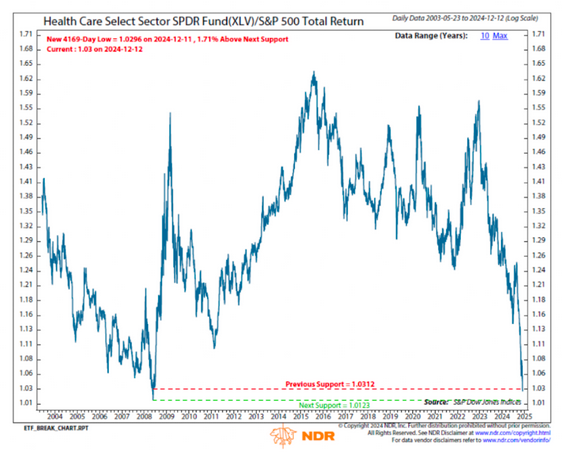

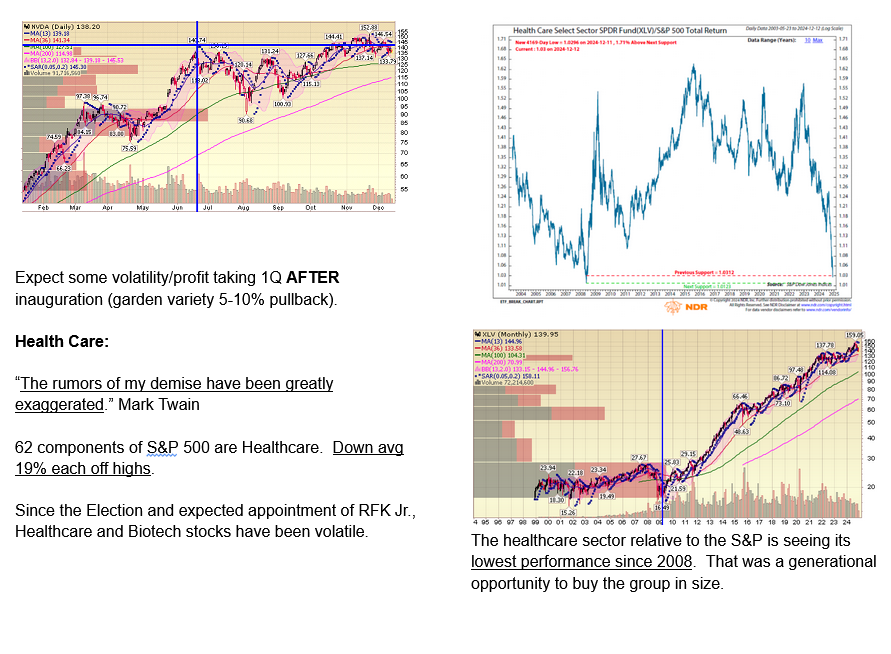

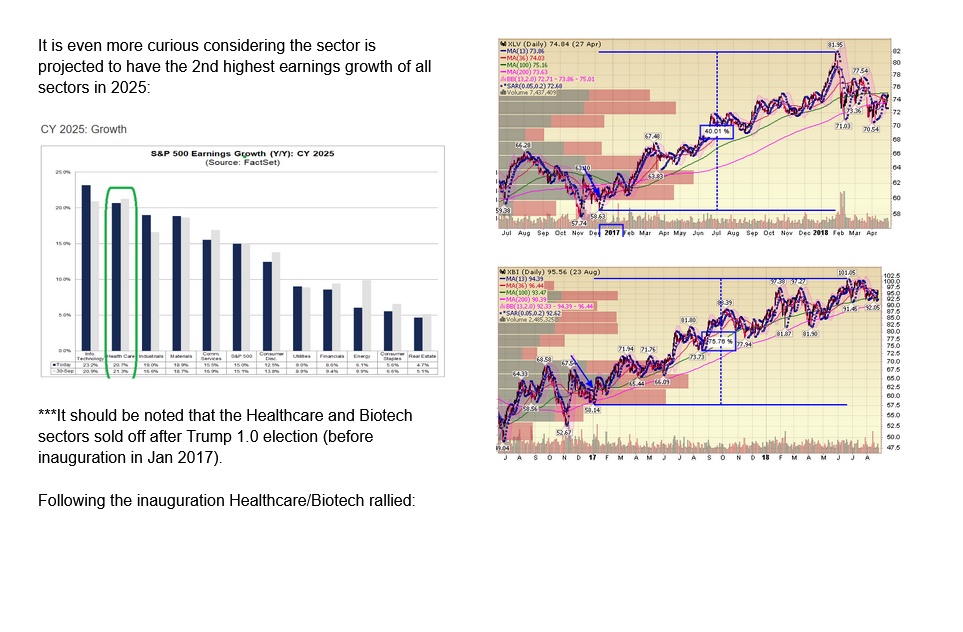

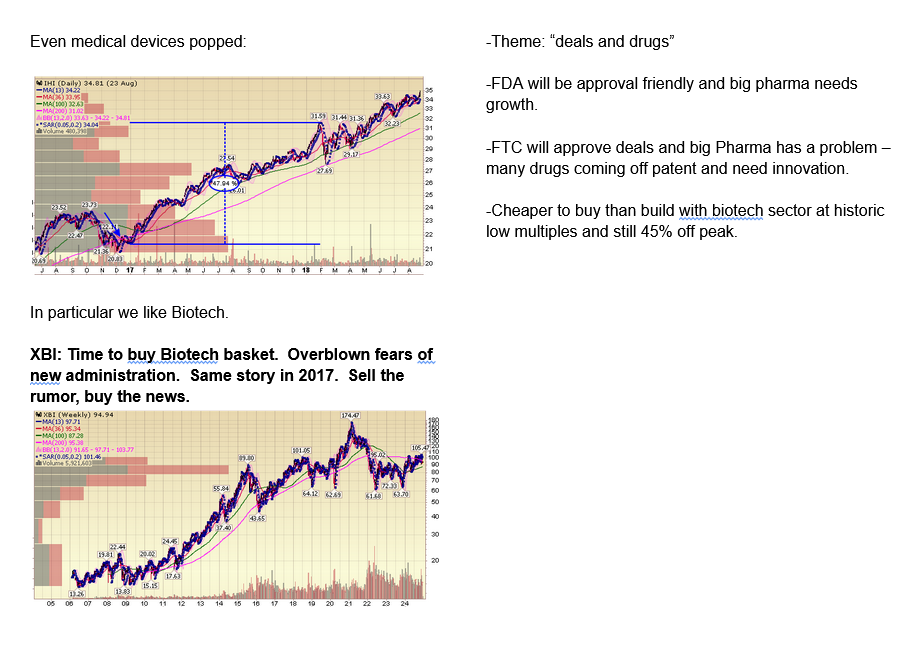

Why Healthcare is NOT Dead!

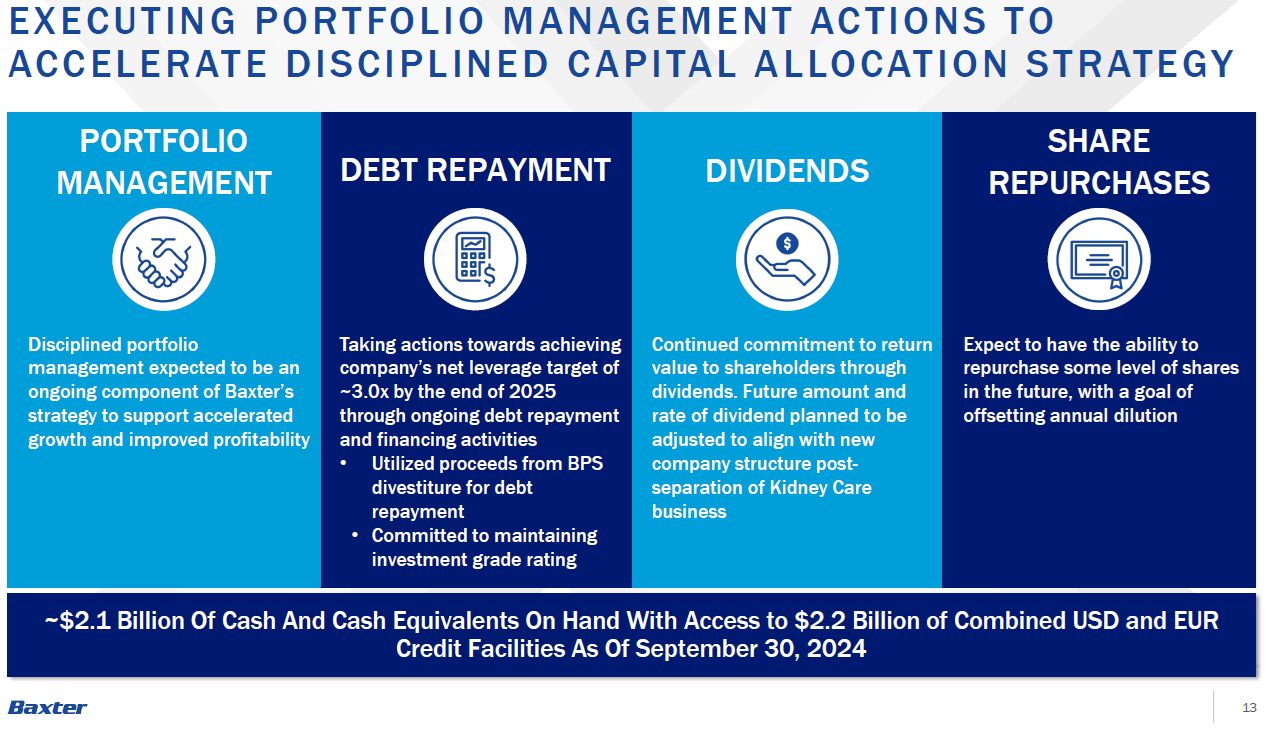

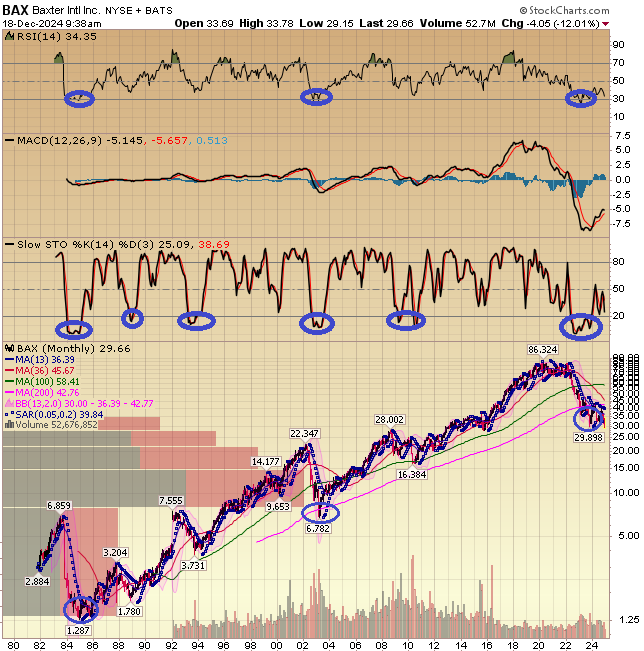

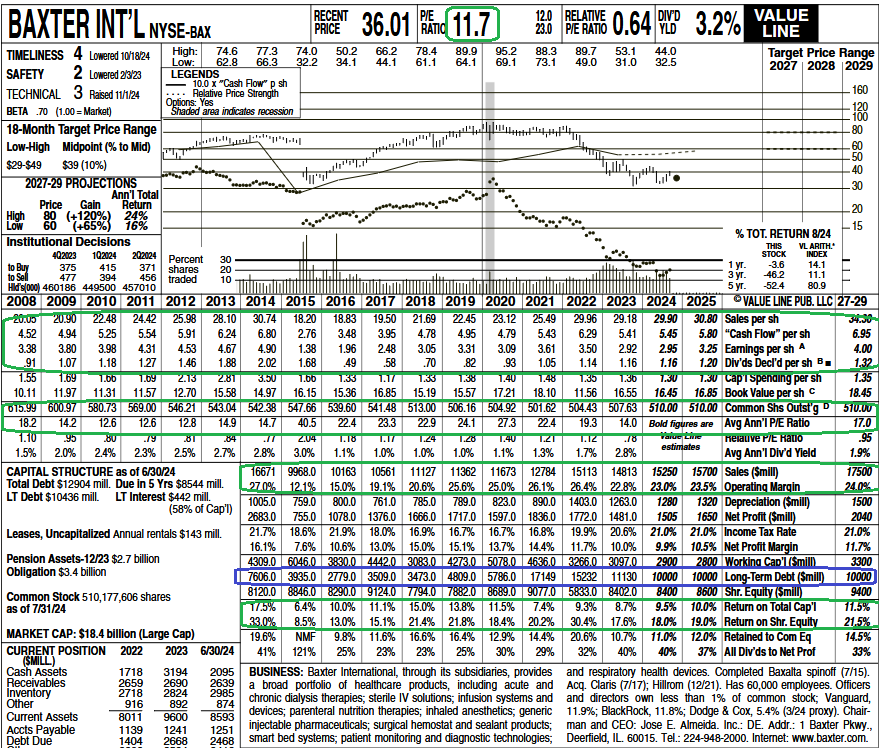

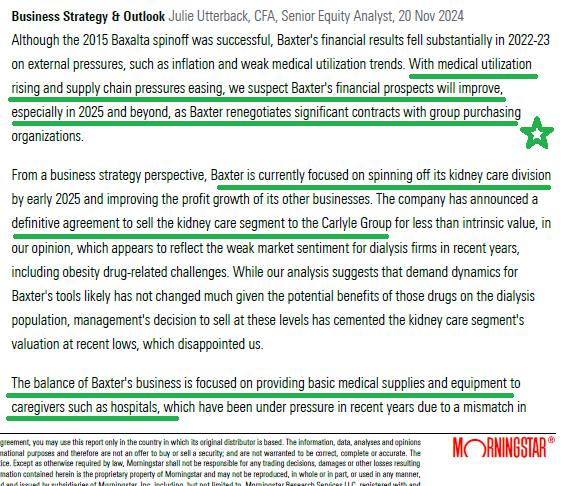

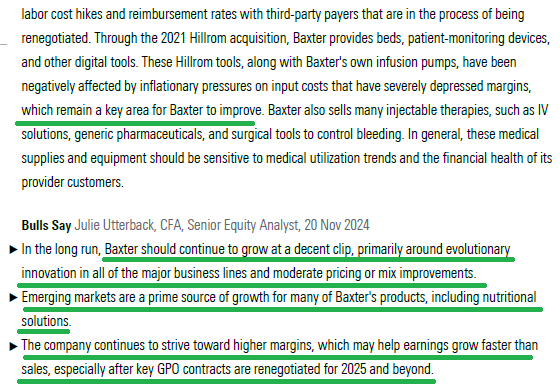

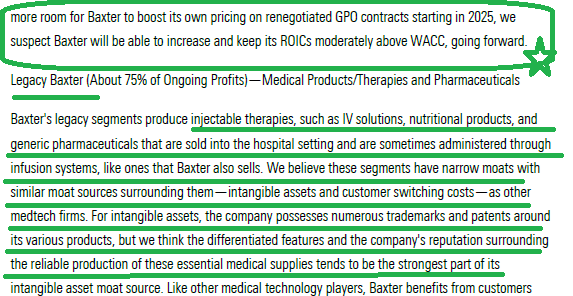

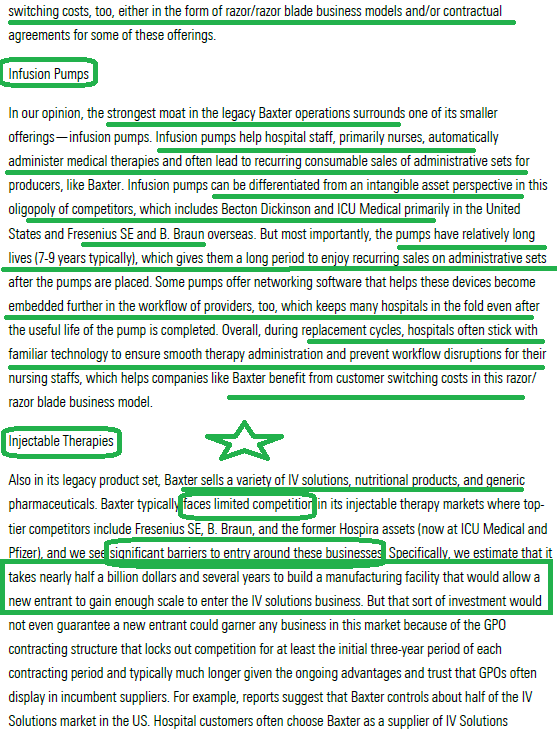

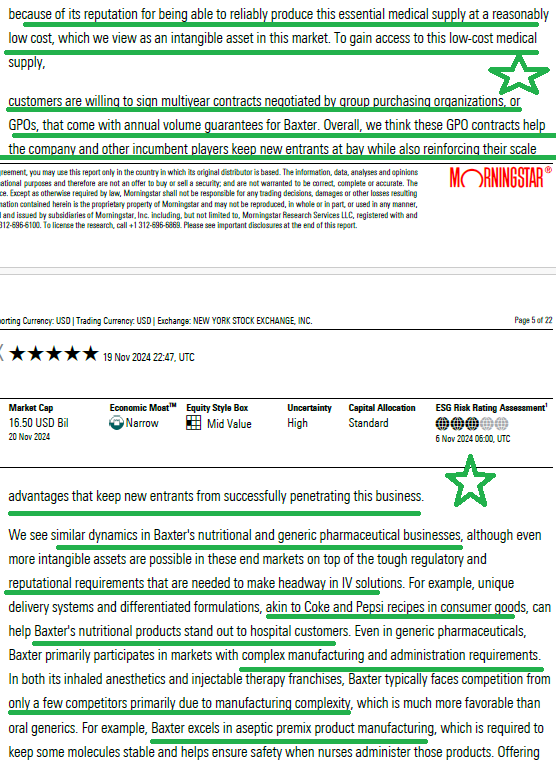

Why Baxter is NOT Dead!

10 key points from the November 8 Baxter International Earnings Call:

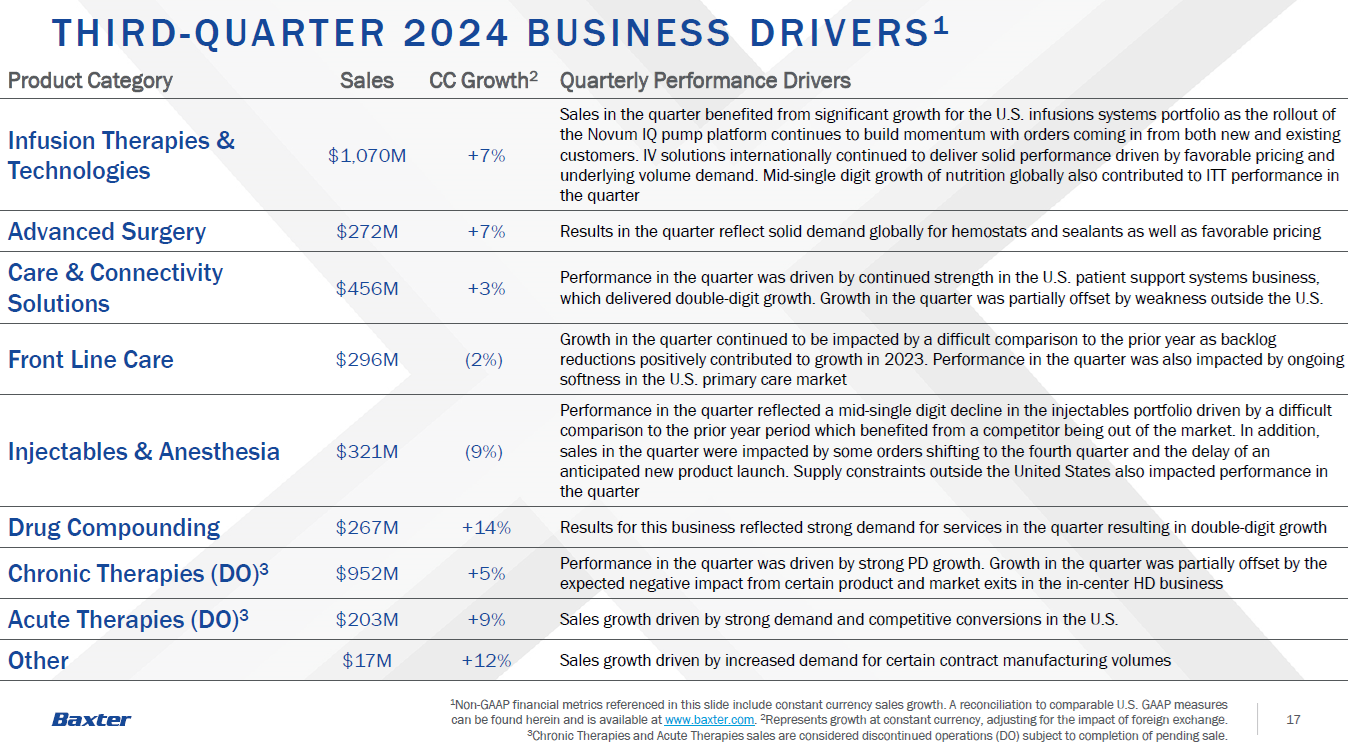

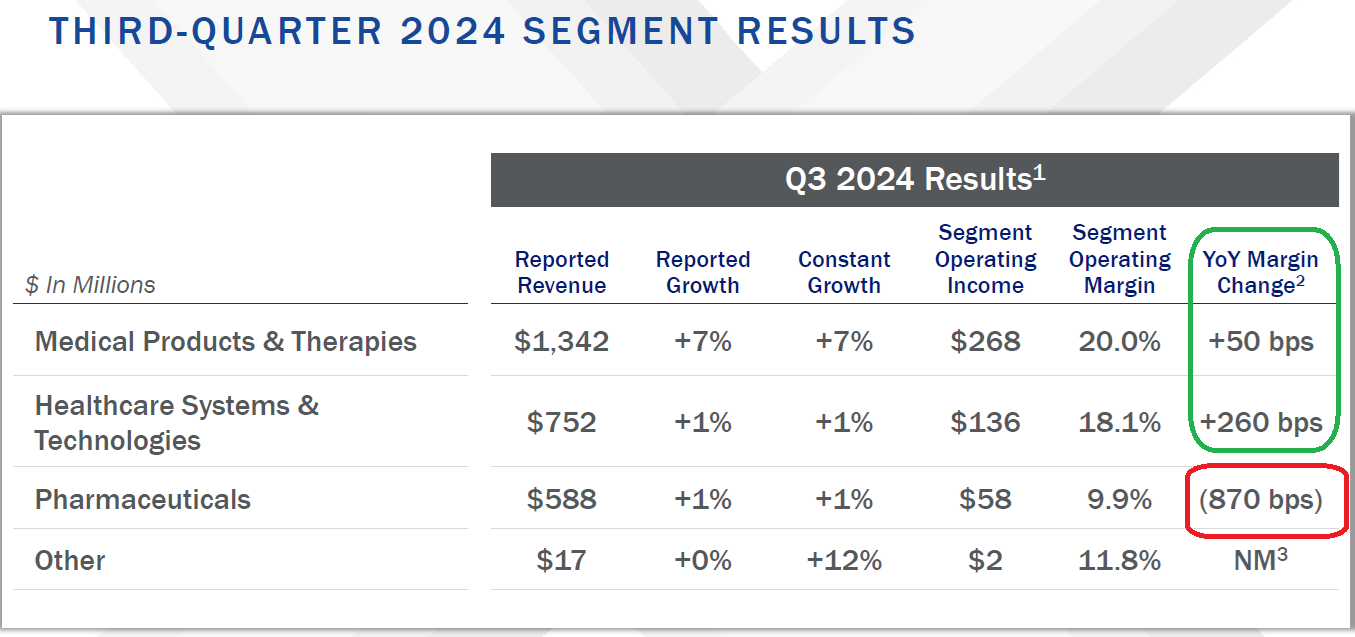

- Strong Revenue Growth: Baxter International reported total company sales growth of 4% on both a reported and constant currency basis, driven by strength in Medical Products & Therapies and Kidney Care segments.

- Beat Earnings Expectations: The company’s adjusted earnings per share of $0.80 beat the guidance range of $0.77 to $0.79 per share.

- Improved Operational Efficiency: Baxter achieved significant expansion in operating margins, with adjusted operating margins increasing 260 basis points year-over-year in the Healthcare Systems & Technologies segment.

- Growing Demand for Novum IQ: The company’s Novum IQ platform saw strong uptake in the U.S., with orders coming in from both new and existing customers.

- Increased Productivity in Research and Development: Baxter is focused on enhancing the productivity of its research and development efforts, which is expected to drive future growth.

- Strong Performance in Advanced Surgery: The company’s Advanced Surgery division saw 7% growth globally, driven by demand for hemostats and sealants.

- Growing Demand for Patient Support Systems: Baxter’s Patient Support Systems business delivered double-digit growth in the U.S., driven by strong orders and competitive wins.

- Positive Outlook for 2025: The company expects to deliver 4% to 5% top-line growth and achieve an adjusted operating margin of 16.5% in 2025.

- Strategic Transformation Progress: Baxter is making progress on its three-pillar strategic transformation, including the pending sale of its Kidney Care business.

- Commitment to Innovation: The company is committed to driving innovation and launching new products, which is expected to contribute to future growth.

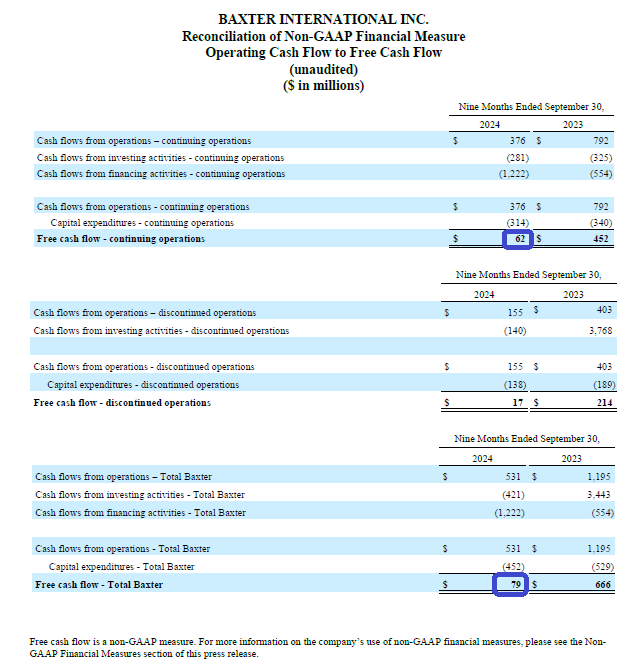

2 things you want to see in a turnaround are currently present:

1) Improving balance sheet (solvency risk off the table) through asset sales.

2) Free Cash Flow positive (gives runway for operating improvements to take hold).

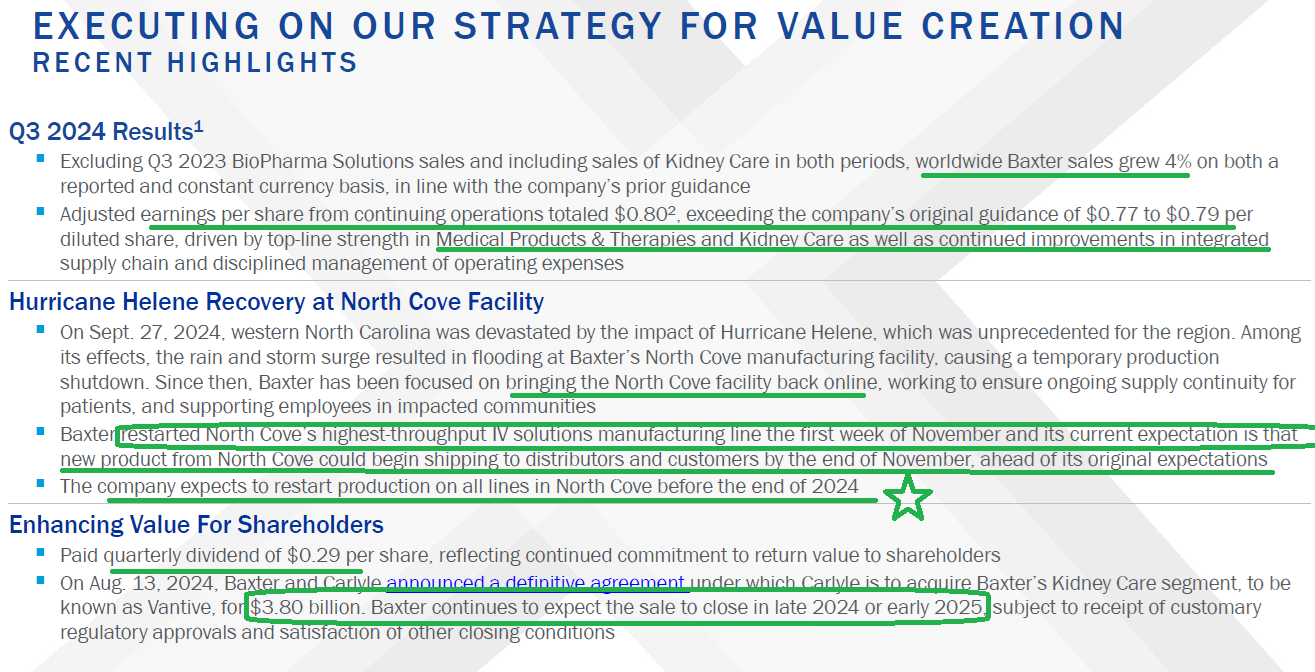

Bank of America Fund Manager Survey Update

On Tuesday, we put out a summary of the monthly Bank of America “Global Fund Manager Survey.” This month they surveyed institutional managers with ~$450B AUM:

December 2024 Bank of America Global Fund Manager Survey Results (Summary)

Here were the key points:

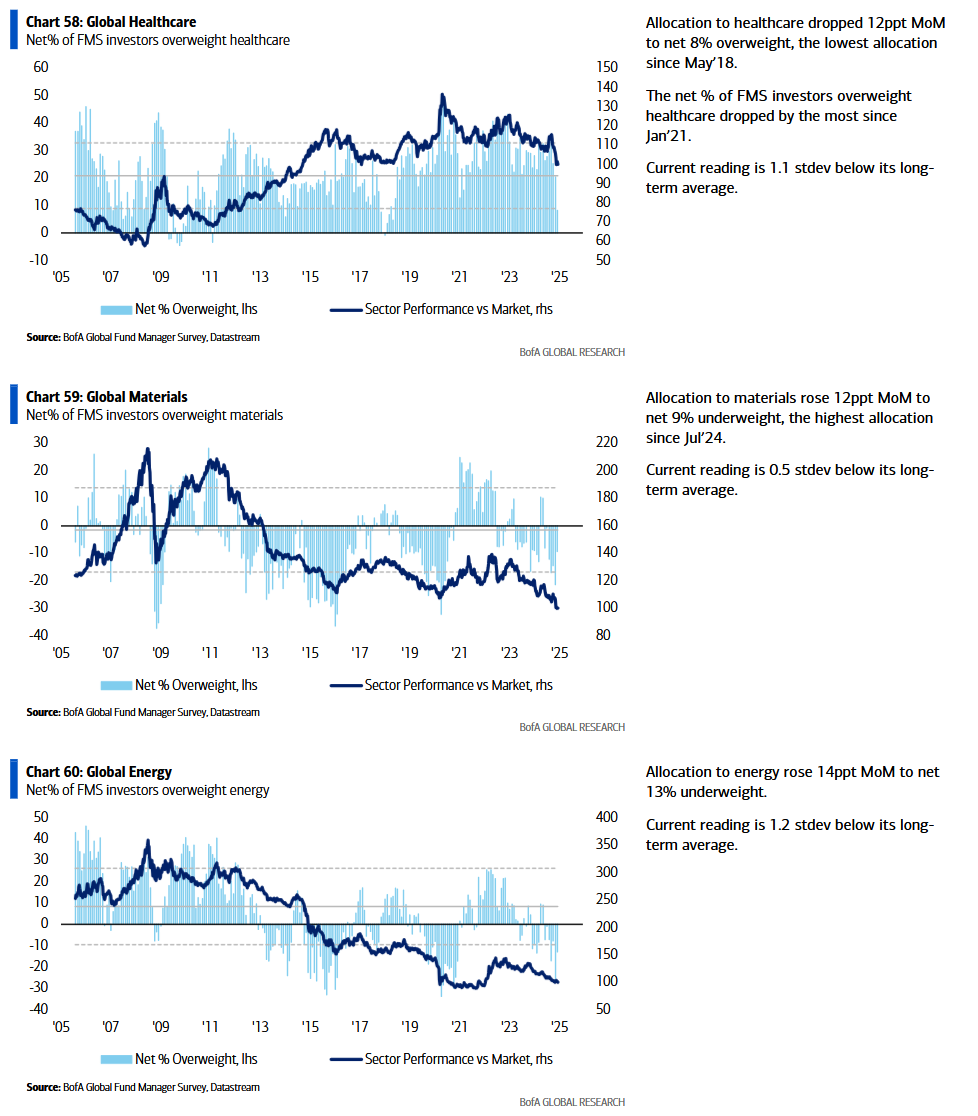

1) Most bullish catalyst for 2025 could be “China Growth Accelerates” –  2) No one wants Healtcare, Materials, Energy. Opportunities to be had:

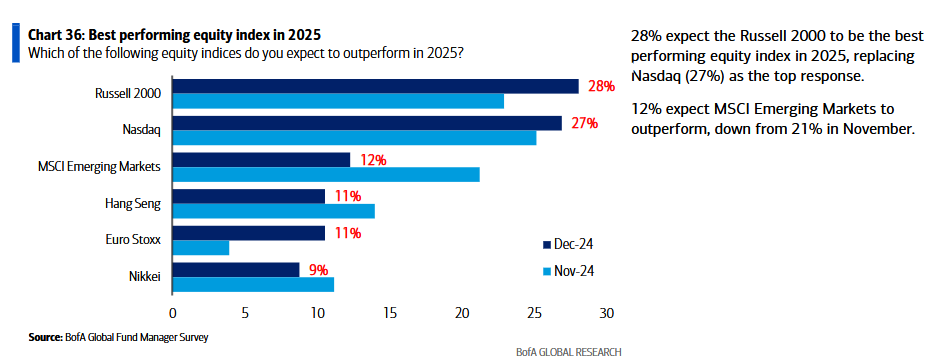

2) No one wants Healtcare, Materials, Energy. Opportunities to be had: 3) Some love for small caps and China starting in 2025:

3) Some love for small caps and China starting in 2025:

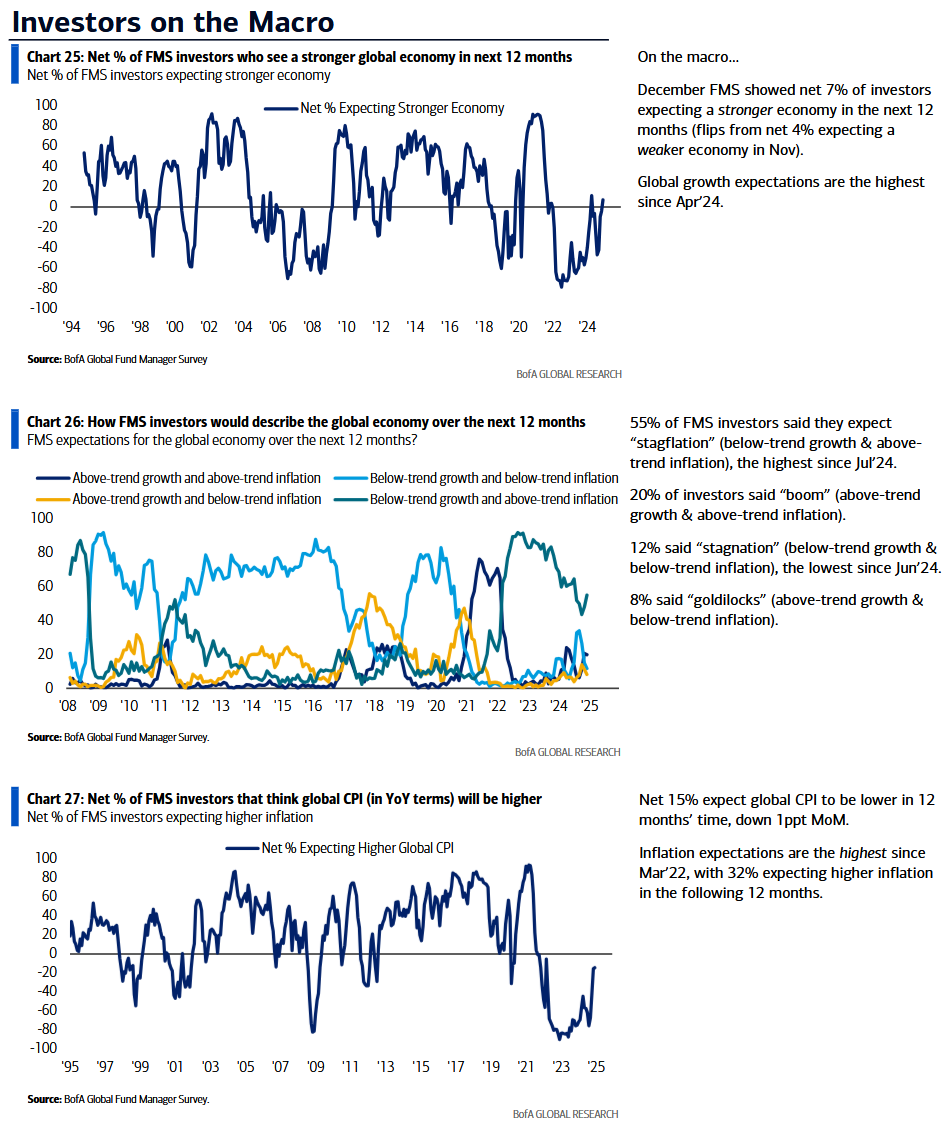

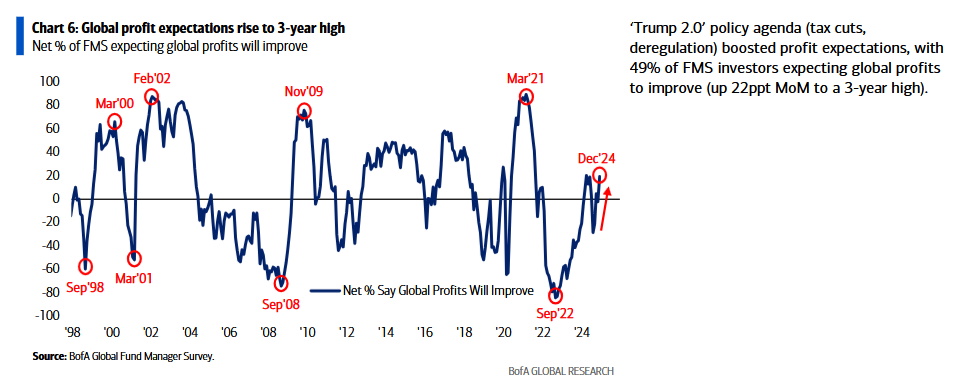

4) Macro outlook solid, but room to improve: 5) Profit expectations improving, but not extreme:

5) Profit expectations improving, but not extreme:

Cooper Standard Update

Perfectly on track. Nothing more to add…

Go here for most recent earnings update and original thesis:

General Market

General Market

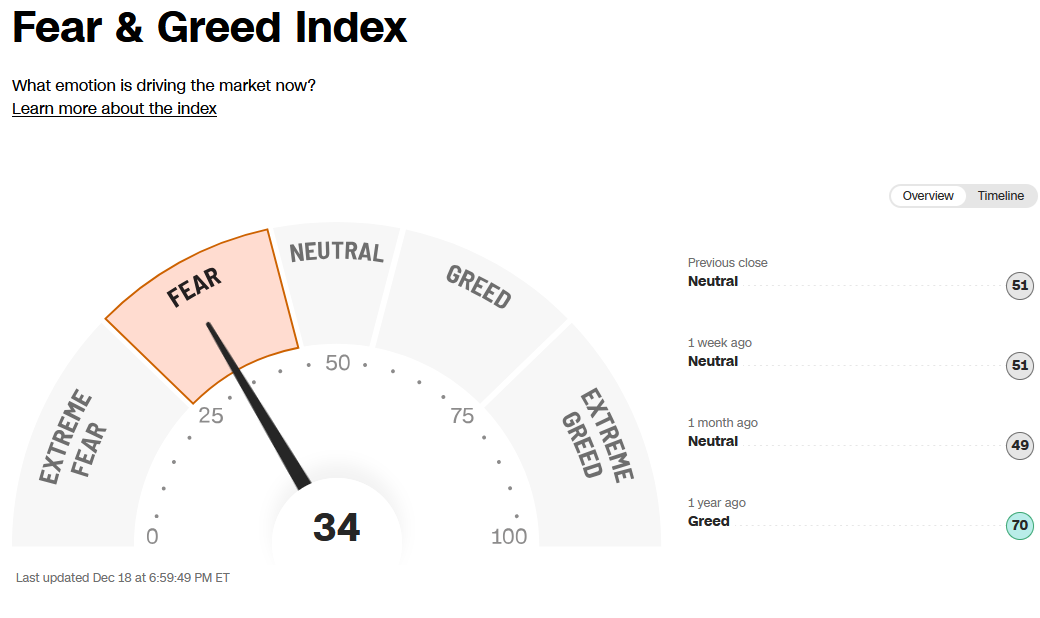

The CNN “Fear and Greed” collapsed from 52 last week to 34 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

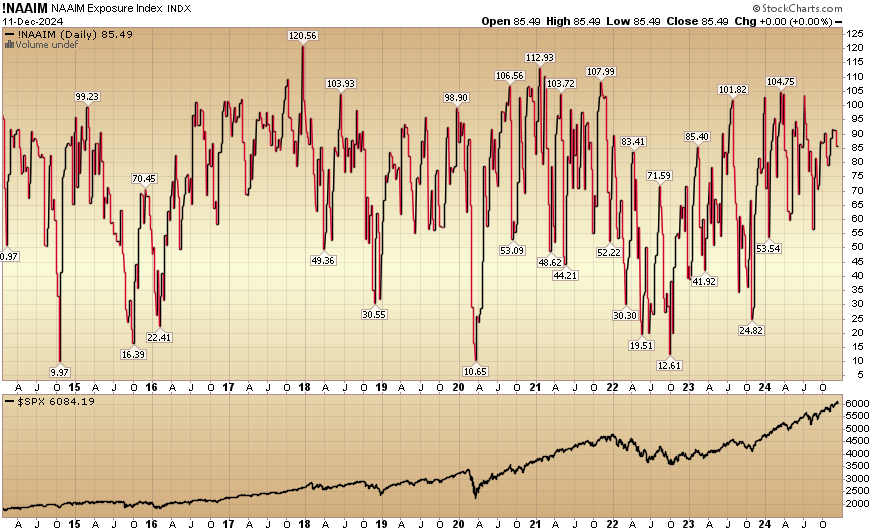

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) jumped to 99.24% this week from 85.49% equity exposure last week.

Our podcast|videocast will be out sometime Thursday. We have a lot of great data to cover this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here

*Opinion, Not Advice. See Terms