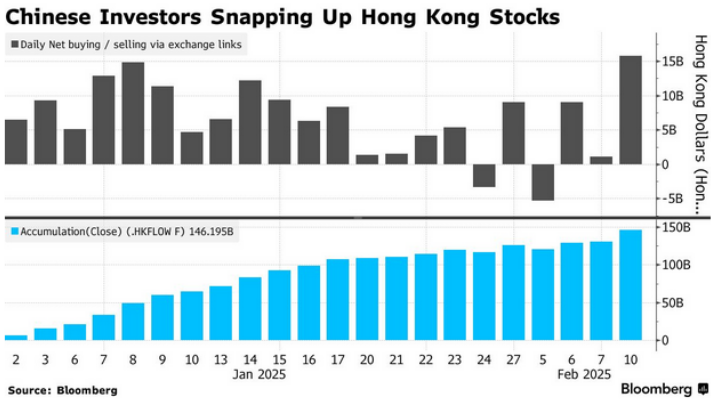

- Chinese Investors Drive Hong Kong Rally With $19 Billion Inflow (bloomberg)

- AI for the price of a sandwich: Alibaba’s Qwen enables US breakthroughs(scmp)

- Europe’s Unloved Stocks Are Suddenly on Top of the World (wsj)

- European gas prices hit two-year high as cold weather boosts demand (ft)

- Japan’s borrowing costs soar to 14-year high (ft)

- Good news for thrifty car buyers: Automakers bring back the base trim (marketwatch)

- Tepper Lifts China Bet, Undaunted as Stimulus-Fueled Rally Fades (bloomberg)

- Appaloosa added to stakes in Alibaba (marketwatch)

- Alibaba’s DeepSeek Integration Fuels Rally (chinalastnight)

- The ‘Magnificent Seven’ companies just did something they haven’t in two years. Goldman says it’s time to make a shift. “This marks the first quarter with no positive sales surprises for the [‘Magnificent Seven’] since 2022,” Kostin and his team told clients in a recent note. (marketwatch)

- These cheap stock markets could make you more money than the usual picks (marketwatch)

- A Sore Spot in L.A.’s Housing Crisis: Foreign-Owned Homes Sitting Empty (wsj)

- Billionaire Investor Tepper’s Firm Loves China. Alibaba Is Its Biggest Bet. (barrons)

- Value Stocks Are Outearning Forecasts. (barrons)

- 3 Reasons It’s Time to Sell Some Magnificent 7 Stock (barrons)

- The New Wave of AI Is Here (wsj)

- Elliott Builds $2.5 Billion-Plus Stake in Phillips 66 (bloomberg)

- Alibaba offers more DeepSeek AI models, denies investment rumours (scmp)

Be in the know. 18 key reads for Tuesday…