Key Market Outlook(s) and Pick(s)

On Tuesday, I joined David Asman on Fox Business “Varney & Co” to discuss OpenAI, DeepSeek, tariffs, and Alibaba. Thanks to Preston Mizell and Christian Dagger for having me on:

Watch in HD Directly on Fox Business News

On Wednesday, I joined Kristen Scholer on NYSE TV to discuss CPI, inflation, bonds, Crown Castle, and Hormel. Thanks to Kristen and Mel Montanez for having me on:

On Wednesday, I joined Oliver Renick and Tom White on Schwab Network to discuss Alibaba and Paypal. Thanks to Oliver and Tom for having me on:

Watch in HD Directly on Schwab Network

Alibaba Update

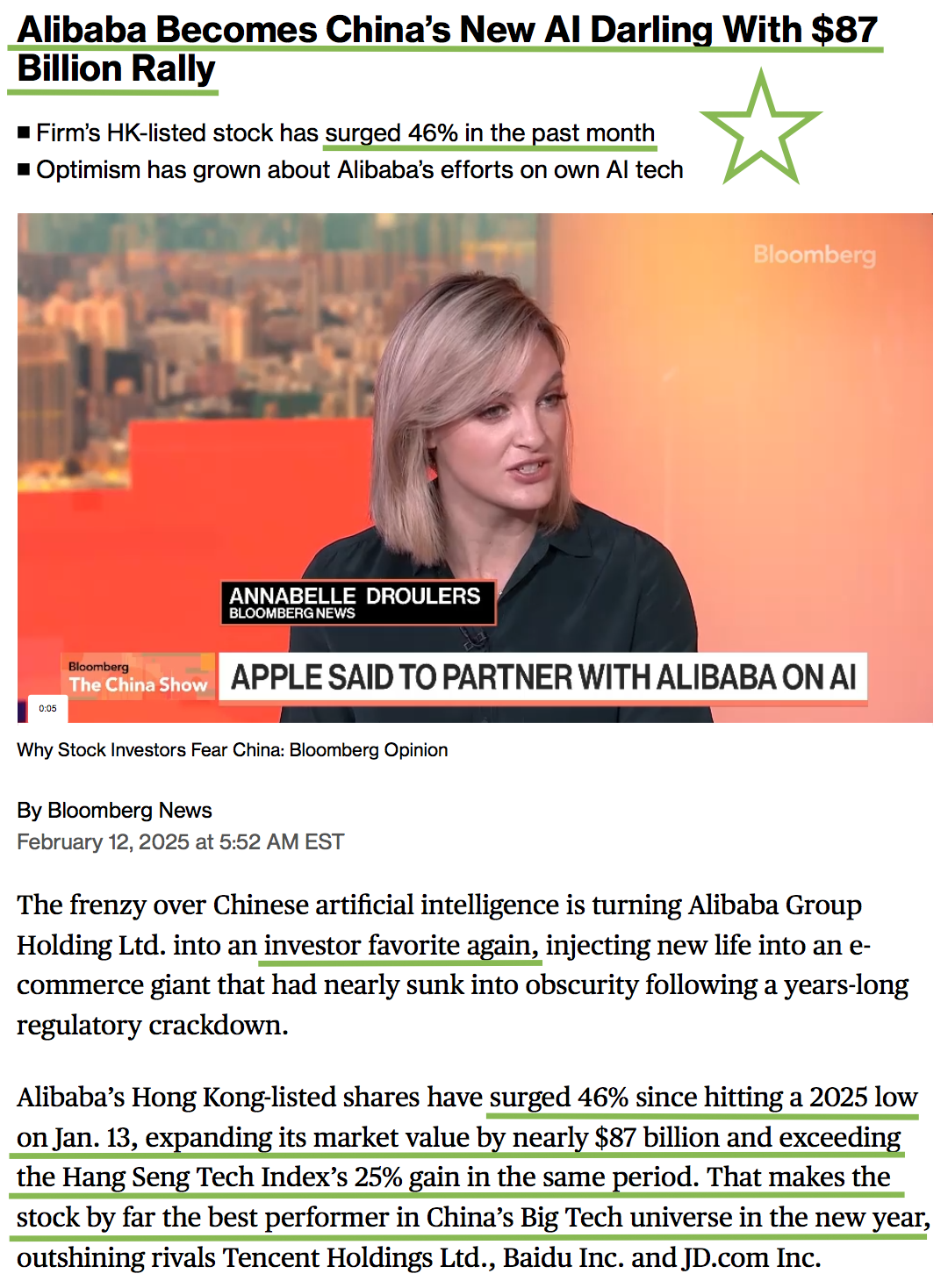

Yesterday, Alibaba proved once again why it’s called “China’s AI ETF.” Apple just partnered with Alibaba to bring the Qwen AI model to its devices in China after testing models from Tencent, Baidu, and Deepseek before ultimately choosing Qwen for its “cutting-edge” capabilities. The licensing fees and royalties will be nice, but the real win? The shift in sentiment. Apple just sent a loud and clear message to the world, confirming what we’ve been saying for the past couple of years. Alibaba is the undisputed leader in China’s AI race.

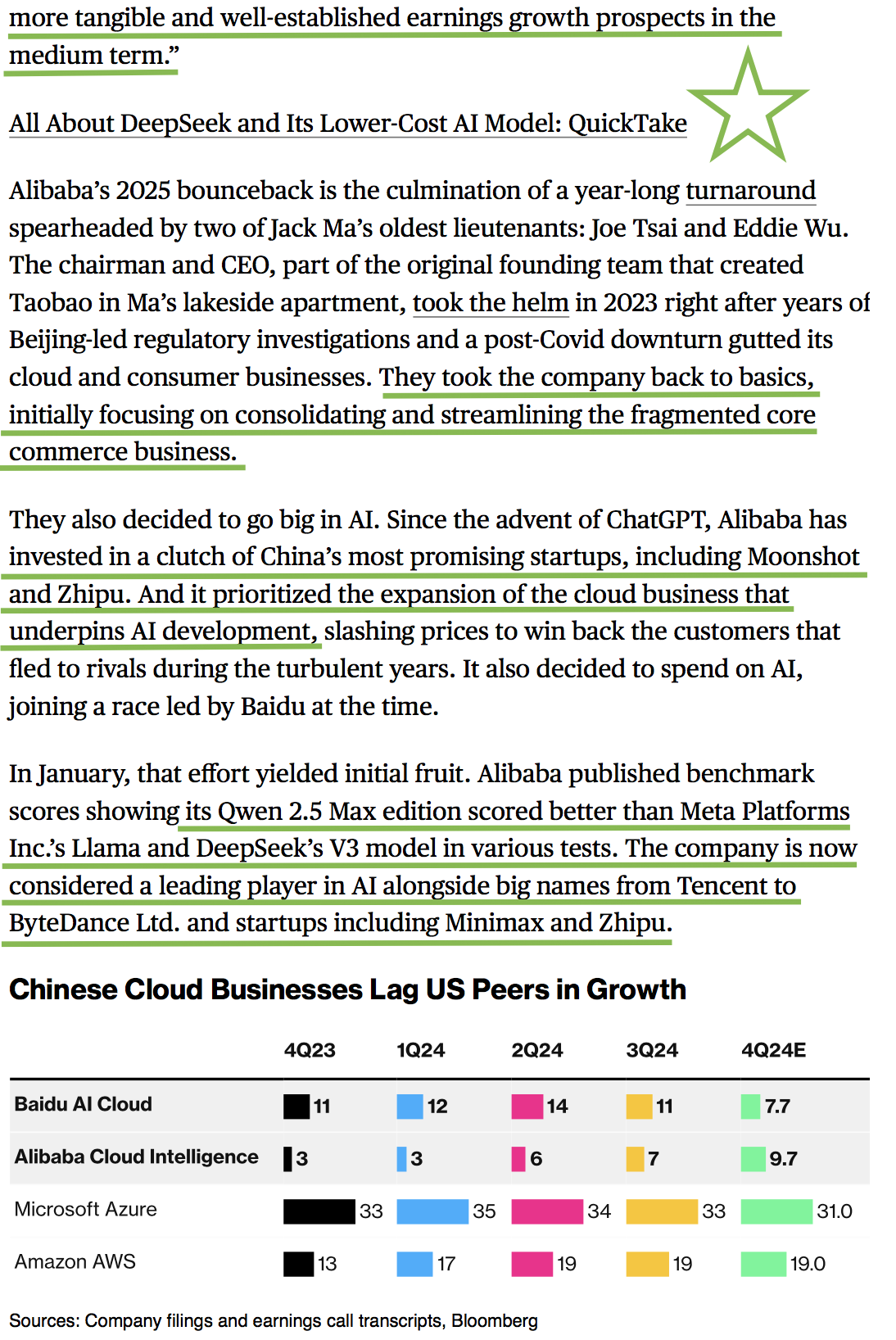

Keep in mind, this AI narrative inflection point is being driven by Alibaba’s Cloud Intelligence business, which accounts for just 11.3% of total revenue and a mid-single-digit percentage of overall operating income. But that’s just the cherry on top of the best play on China’s recovering middle class, with Taobao and Tmall, Alibaba International (+29% YoY), Cainiao Logistics (+8% YoY), local services (+14% YoY), digital media, and plenty of other segments that investors don’t even realize they’re exposed to. For my poker players out there, this is what it looks like to have a ton of outs. You can only keep a beach ball underwater for so long…

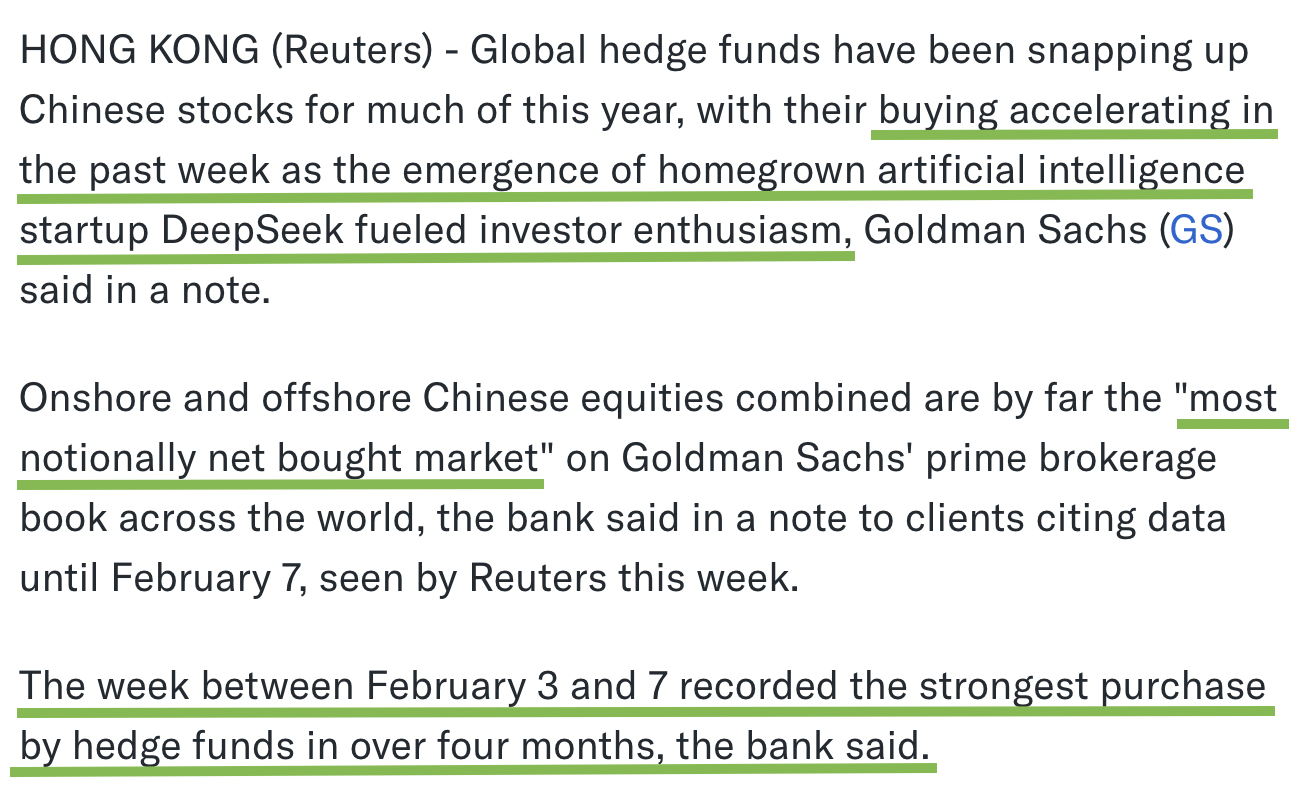

Sure enough, opinion follows trend, and we are beginning to see a massive rotation and shift of inflows into China equities.

Not only is retail chasing, but David Tepper just upped his stake in Alibaba by 18% this past quarter, bringing his holding to 11.8 million shares, worth over $1.2B (about 16% of his portfolio). His overall China exposure now sits at 37% of his portfolio.

Generac Update

Each week we try to cover 1-2 companies we have discussed in previous podcast|videocast(s) and/or own for clients (including personally).

Earnings Results

10 Key Points

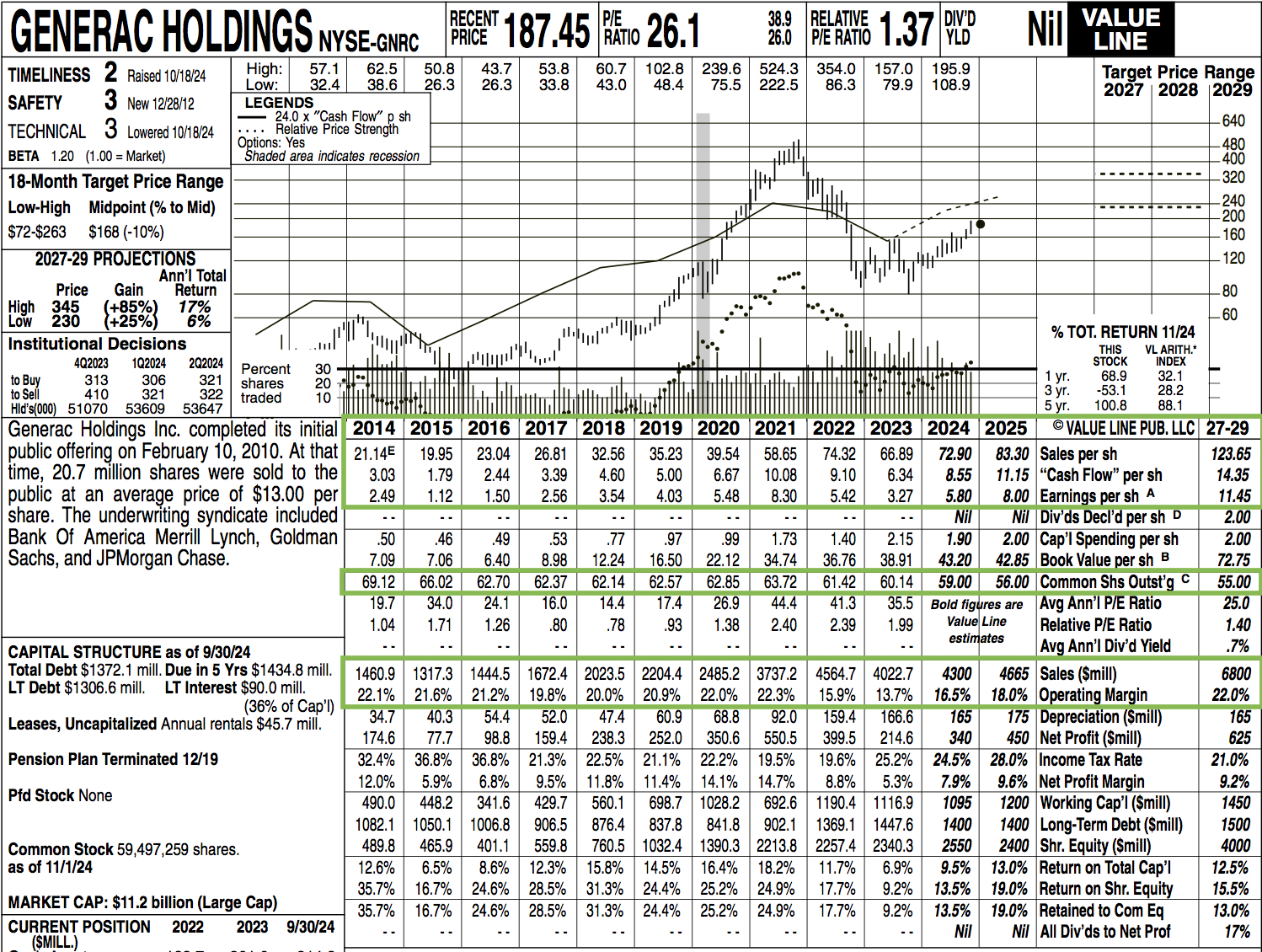

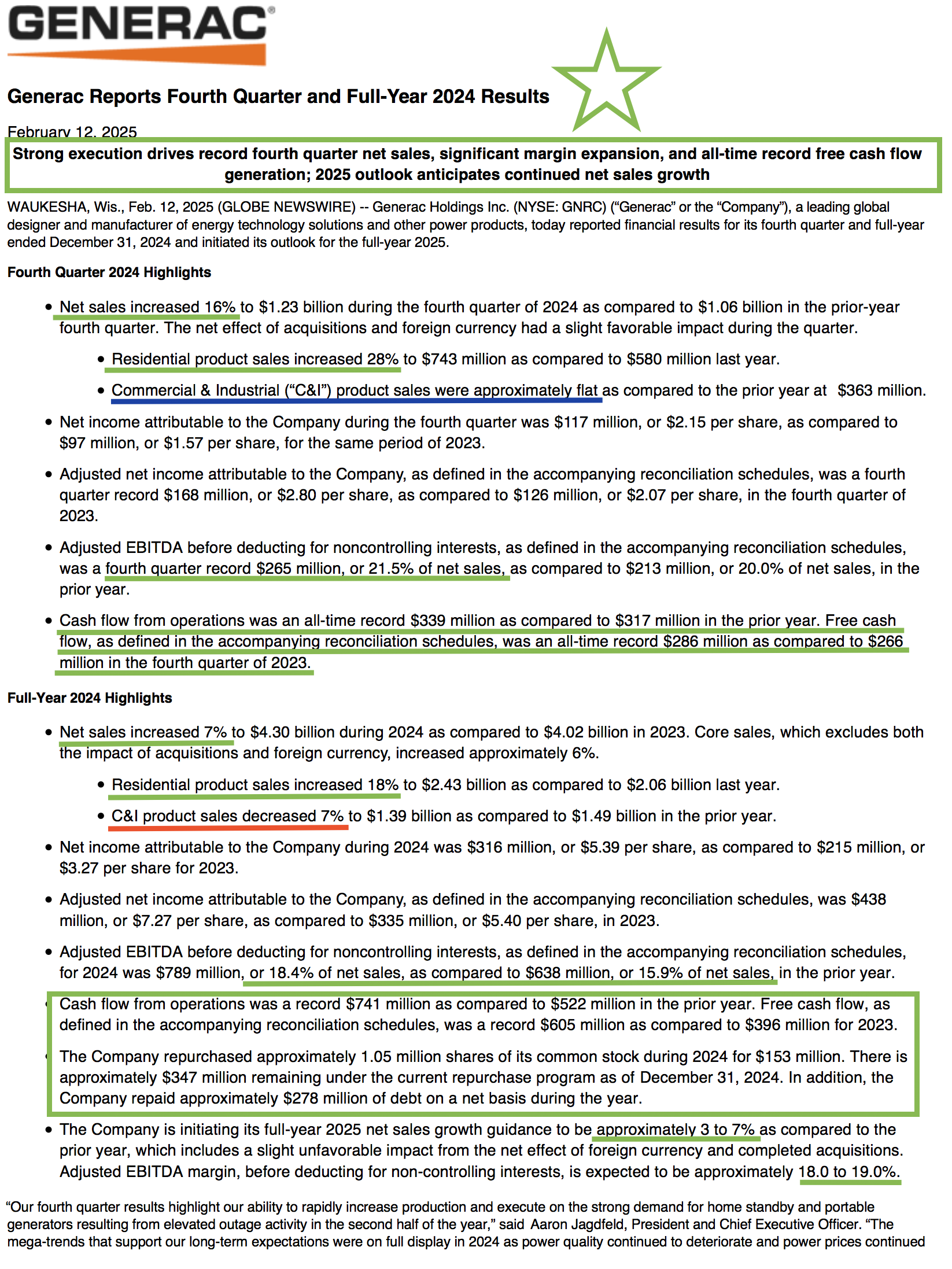

1) Earnings Beat: Q4 Non-GAAP EPS of $2.80 beat estimates by $0.27, with revenue up 16% YoY at $1.23B, meeting expectations.

2) Record Residential Performance: Residential product revenue jumped 28% YoY, with record home consultations in H2 2024 and more than doubled portable generator sales.

3) Expanding Dealer Network: Ended the year with an all-time high of ~9,200 residential dealers, adding ~500 new dealers YoY.

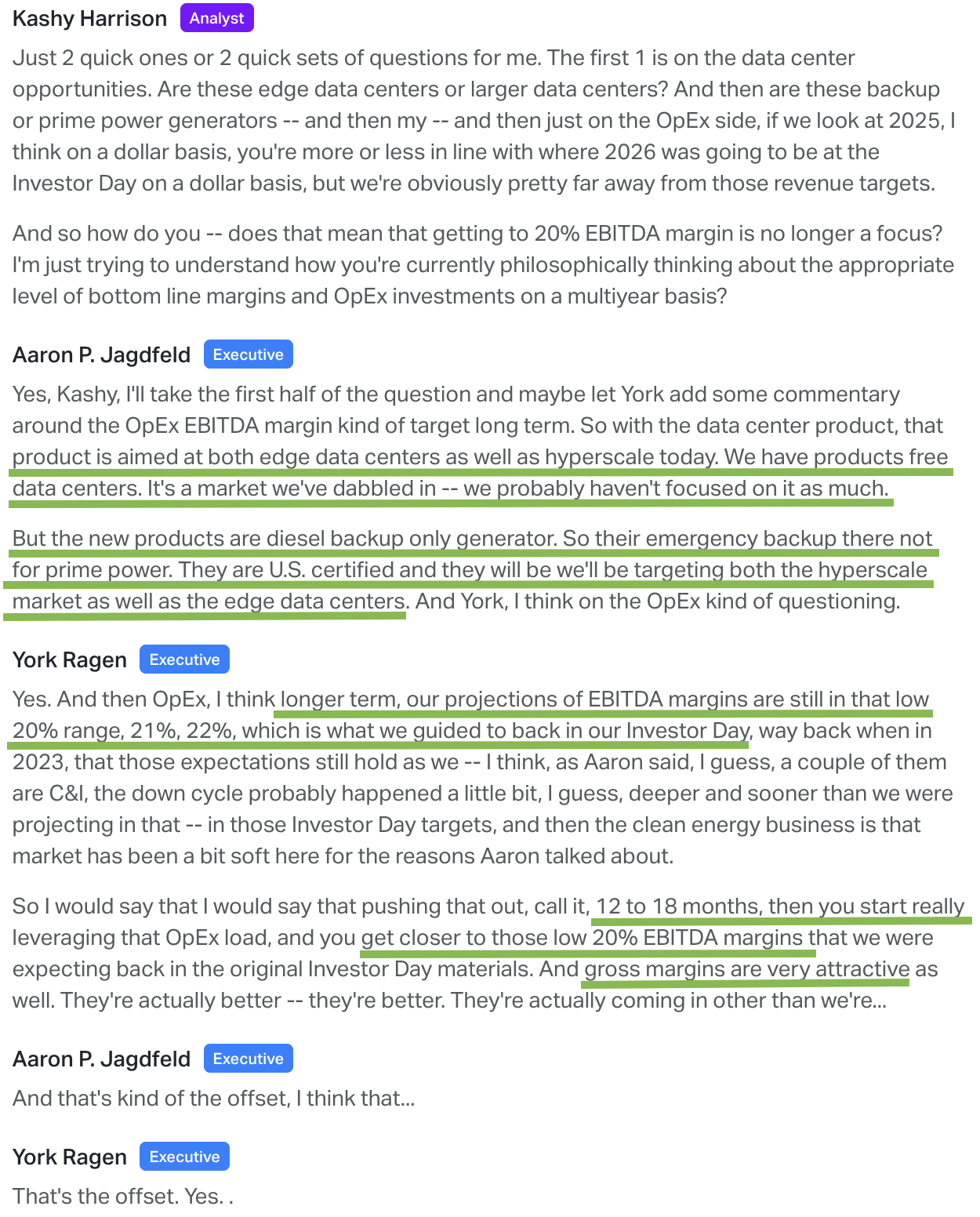

4) Profitability Boost: Gross margins reached 38.8%, the highest since 2010, up nearly 500 bps YoY, with adjusted EBITDA margins rising from 15.9% to 18.4%.

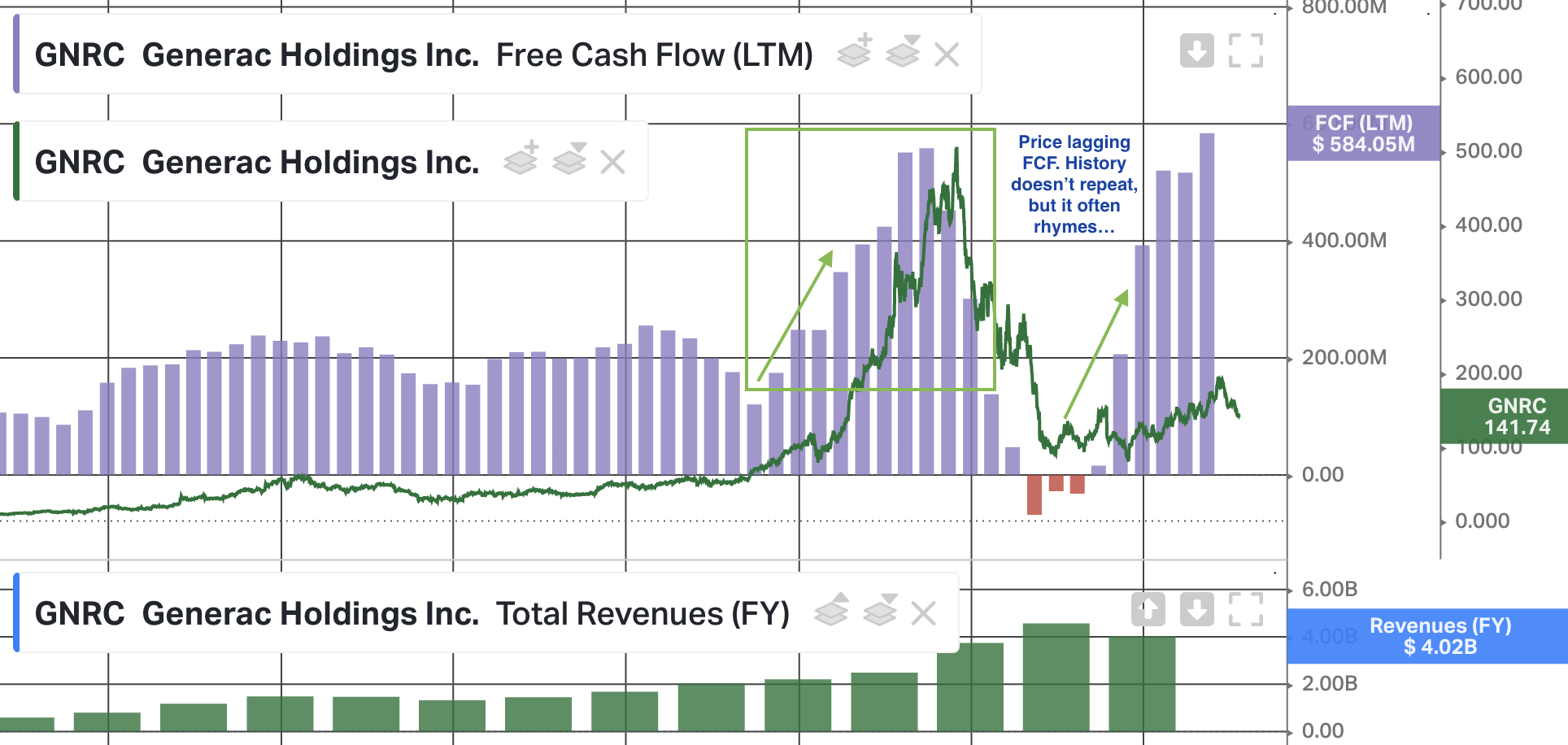

5) Cash Flow Strength: Record-high free cash flow of $605M in 2024 (vs. $396M in 2023), fueling the repurchase of 1.05M shares.

6) Power Outage Surge: 2024 saw the most power outages on record since tracking began in 2010 with nearly 1.5 billion lost hours in the U.S. due to three major hurricanes. Looking ahead, the North American Electricity Reliability Corporation warns that large portions of the U.S. and Canada face power outage risks from supply shortfalls over the next five years. These trends are also driving electricity costs higher, adding to the 30 percent increase in average U.S. electricity prices since 2020 with more increases expected.

7) Massive Market Opportunity: Home standby generator penetration remains just 6.5% of U.S. owner-occupied single-family homes over $175K, with each 1% increase worth ~$4B in retail value.

8) Expanded Capacity: Investments in automation and the Trenton plant, which has been online since mid 2022, have significantly improved lead times and enhanced the ability to respond to surges in home standby generator demand.

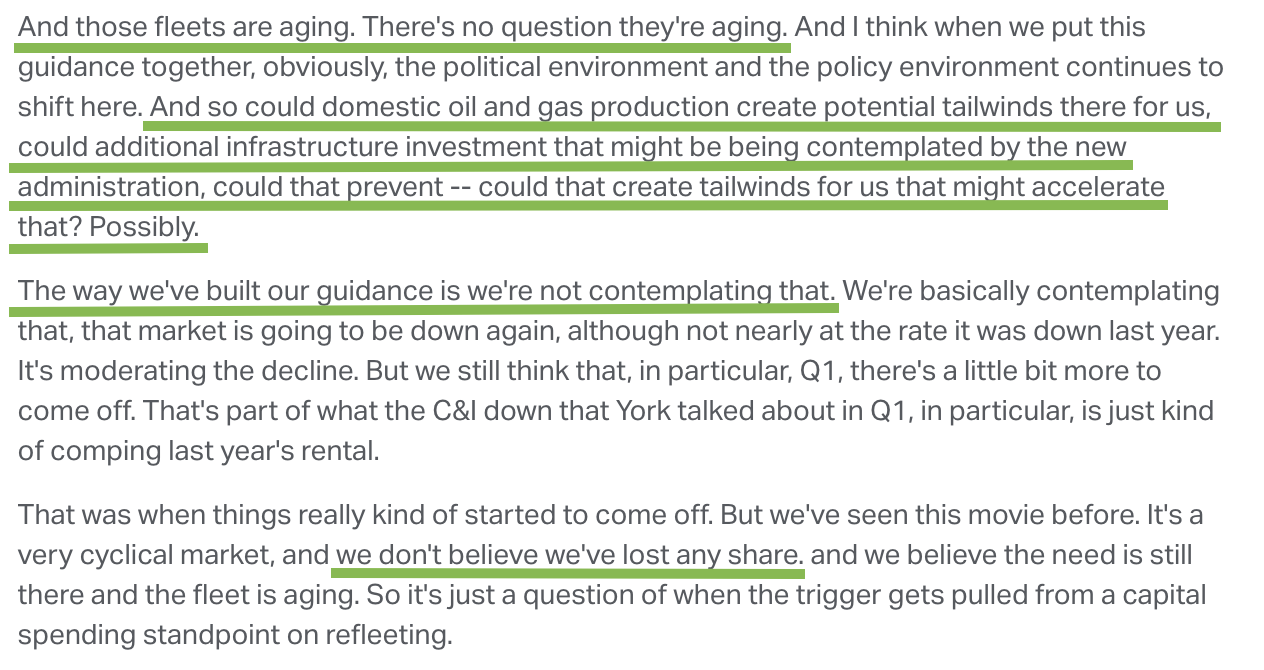

9) C&I Product Innovation: A new diesel backup-only generator for data centers and hyperscalers is set to launch, with quoting beginning in Q2 and first shipments expected later in 2024. The telecom market continues to gain momentum as tower and hub counts expand. With backup power penetration still at roughly 50 percent, there is a massive runway for growth, with over 400,000 potential sites still up for grabs.

10) Strong Outlook: Residential sales expected to grow in the high single digits, flat C&I sales, further gross margin expansion, and strong adjusted EBITDA margins of 18–19%. Management’s guidance assumes zero major power outages, leaving room for potential upside.

Q&A Highlights

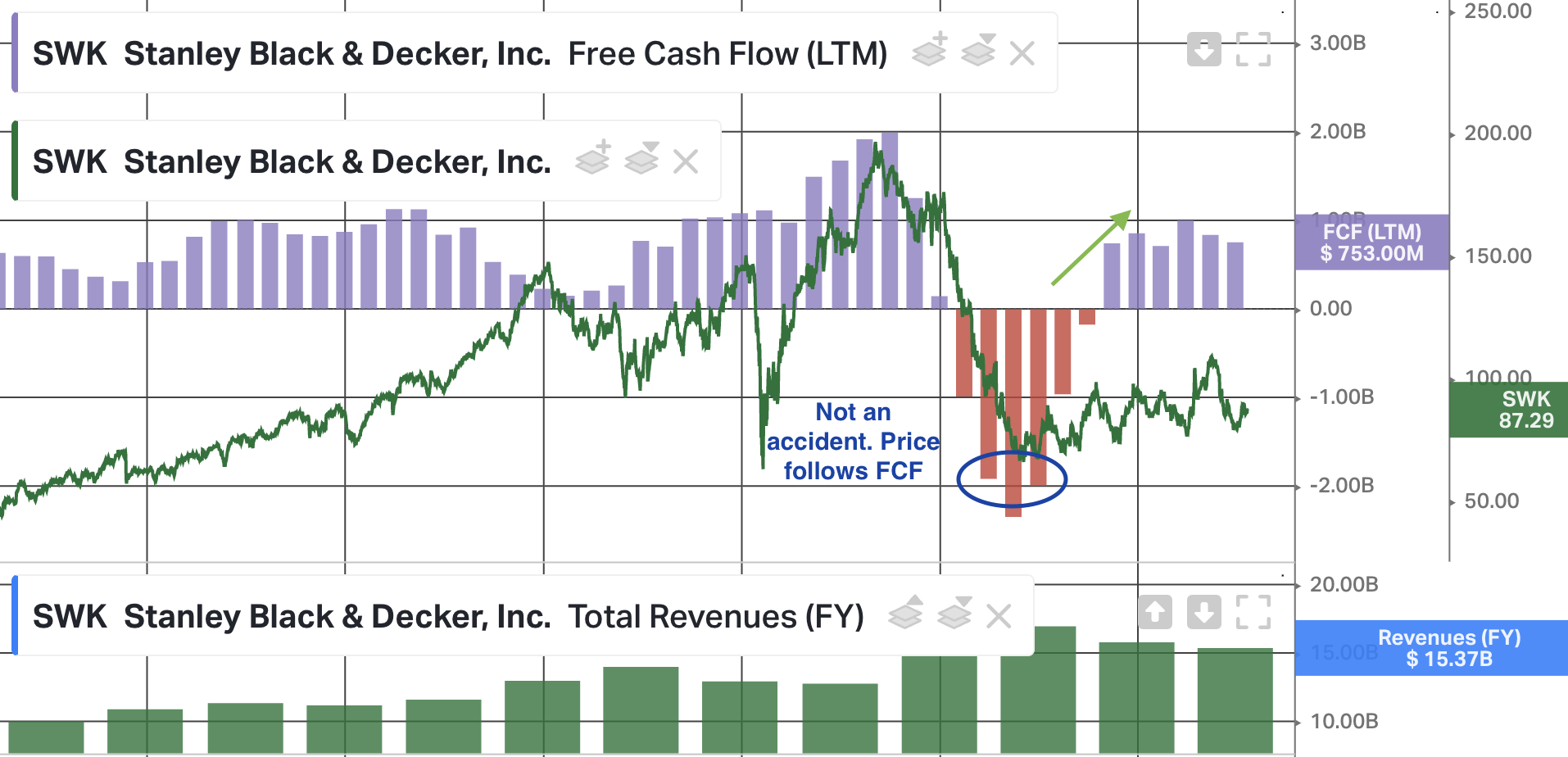

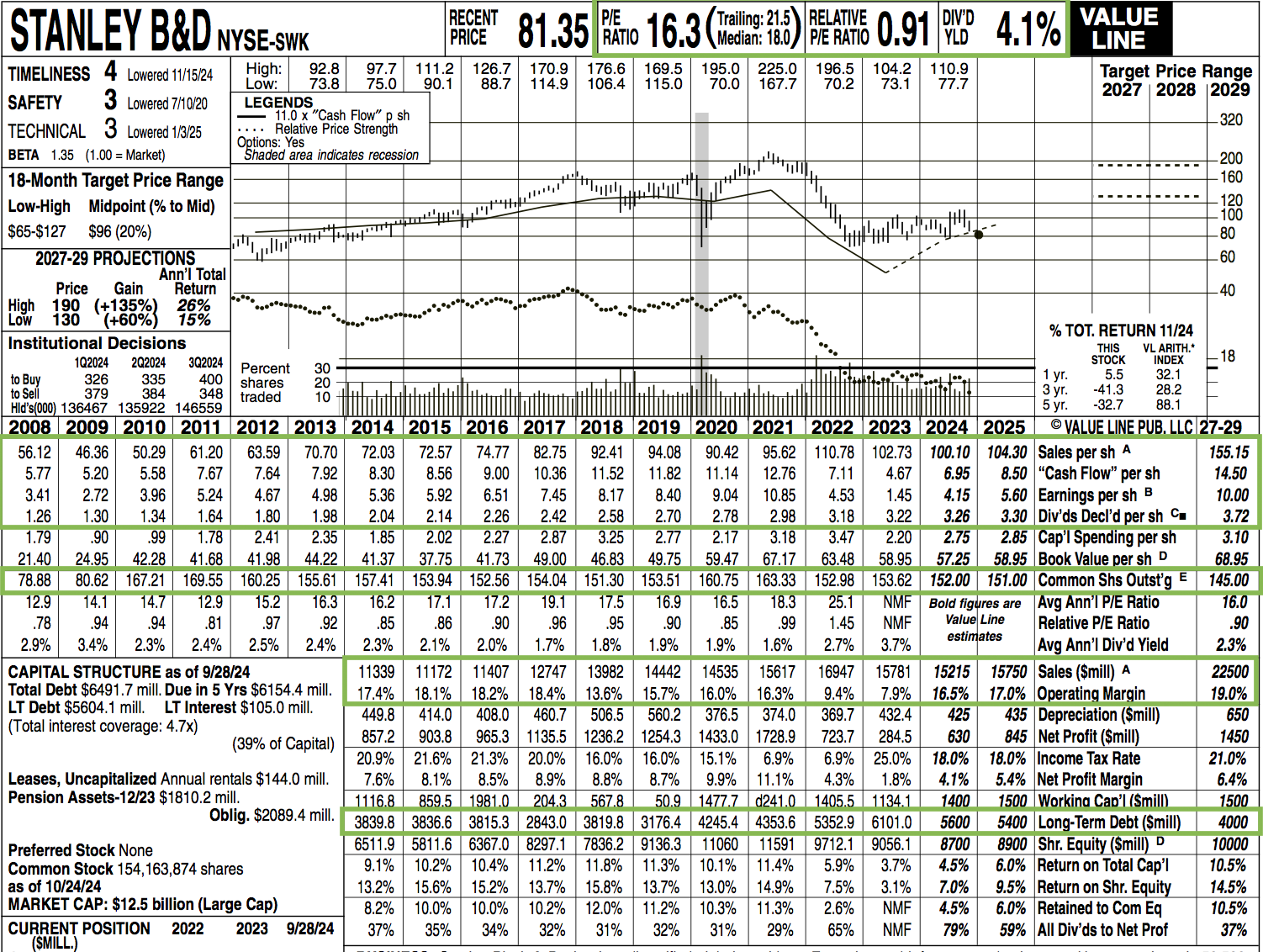

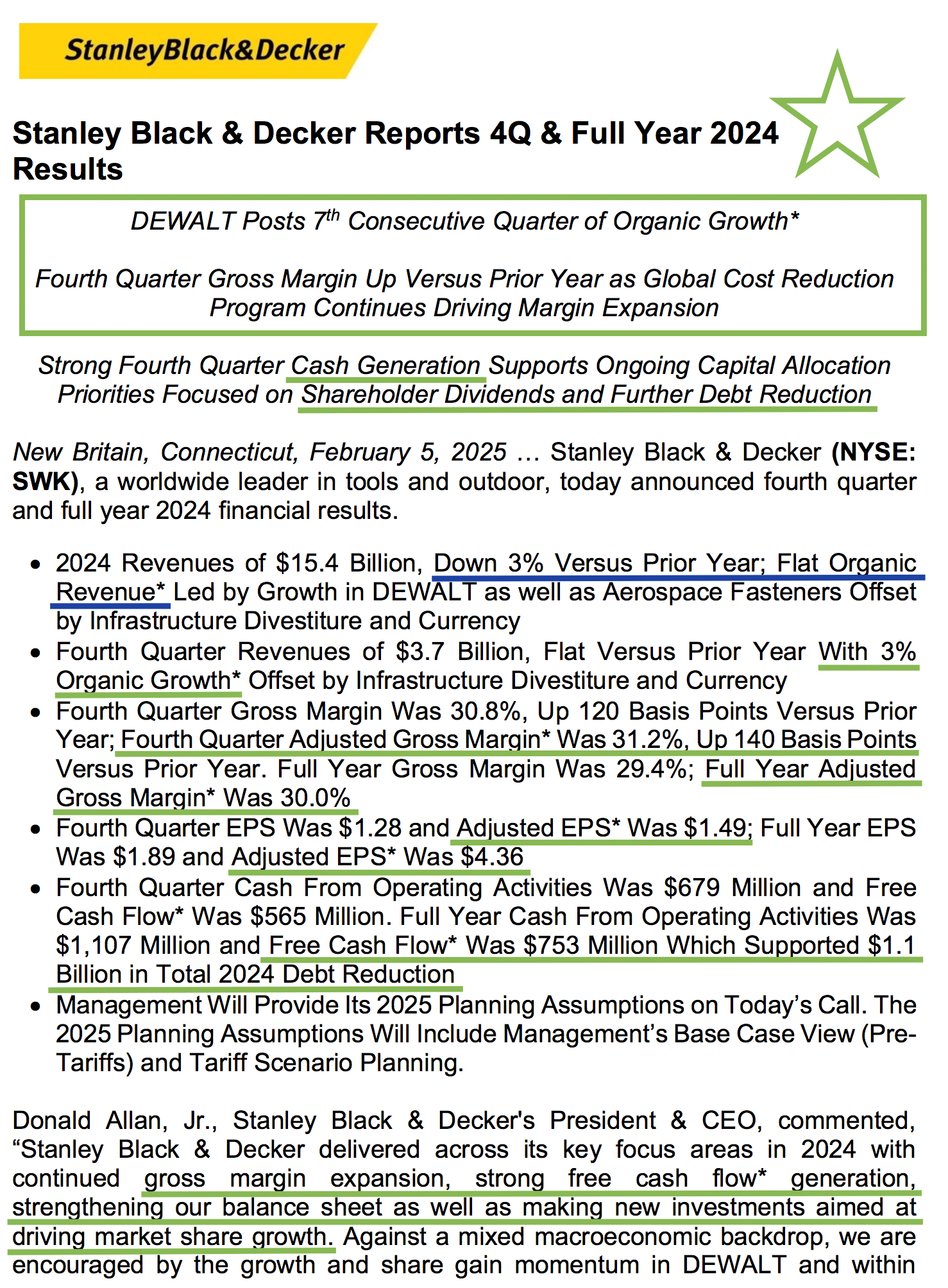

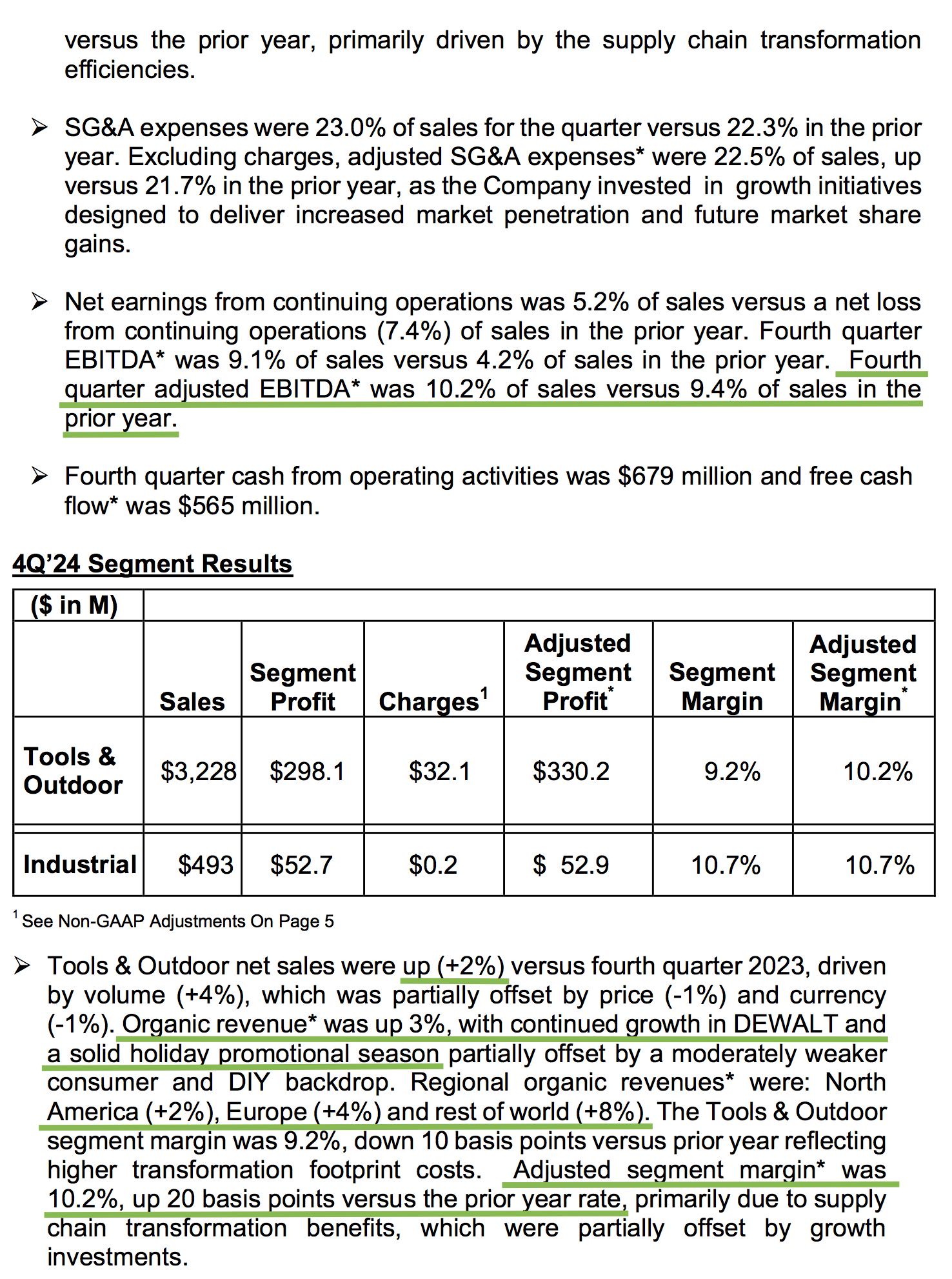

Stanley Black & Decker Update

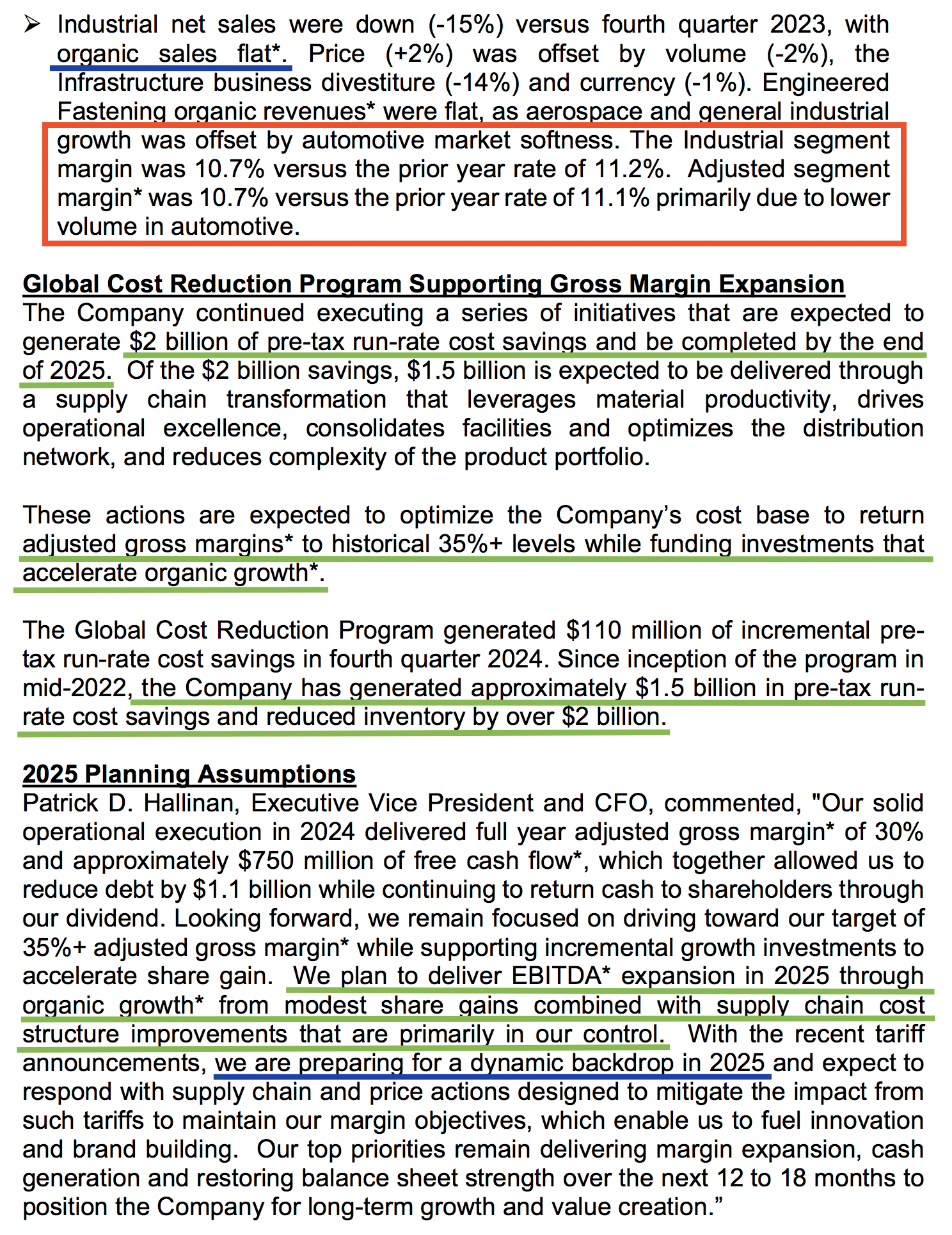

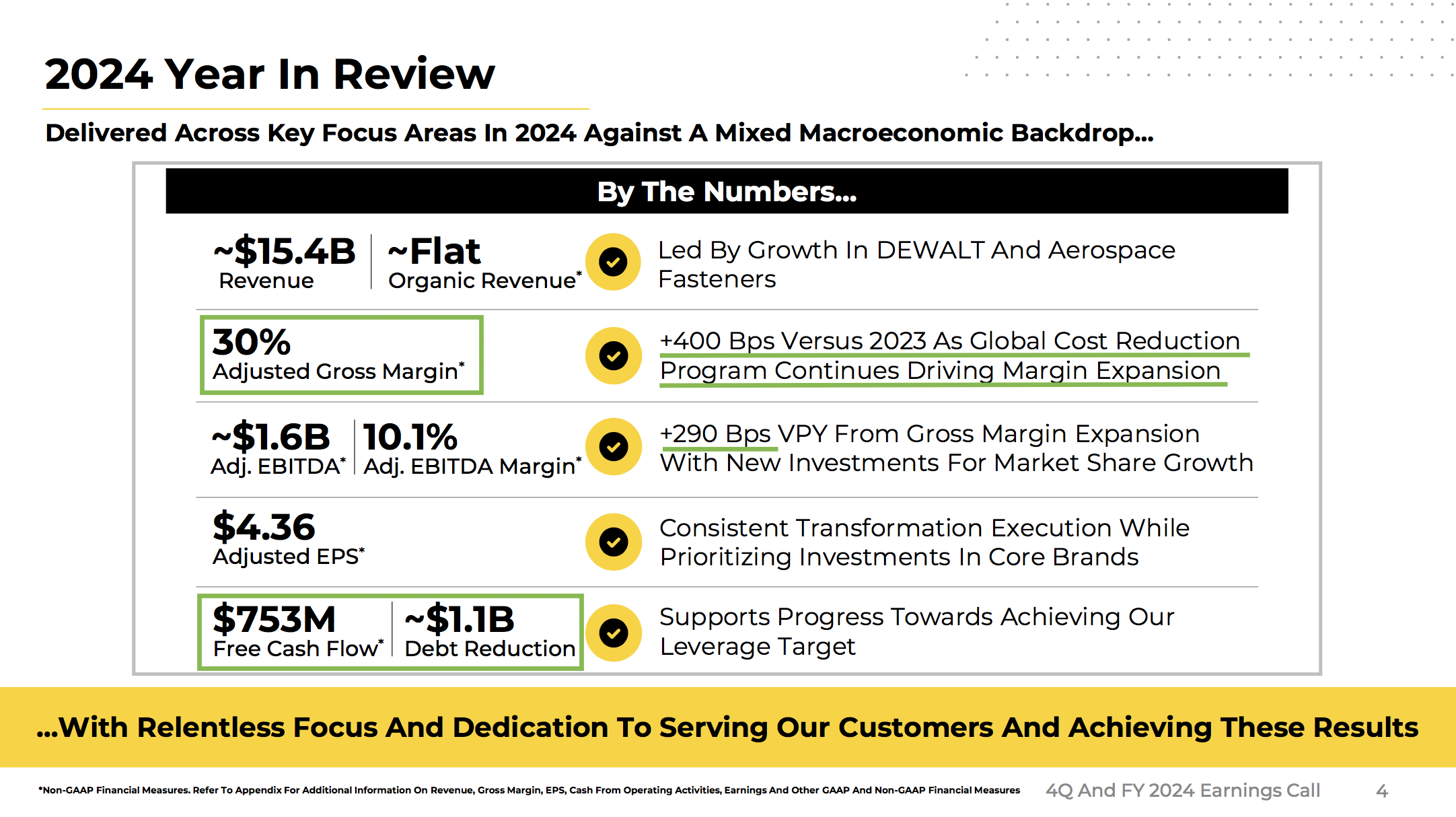

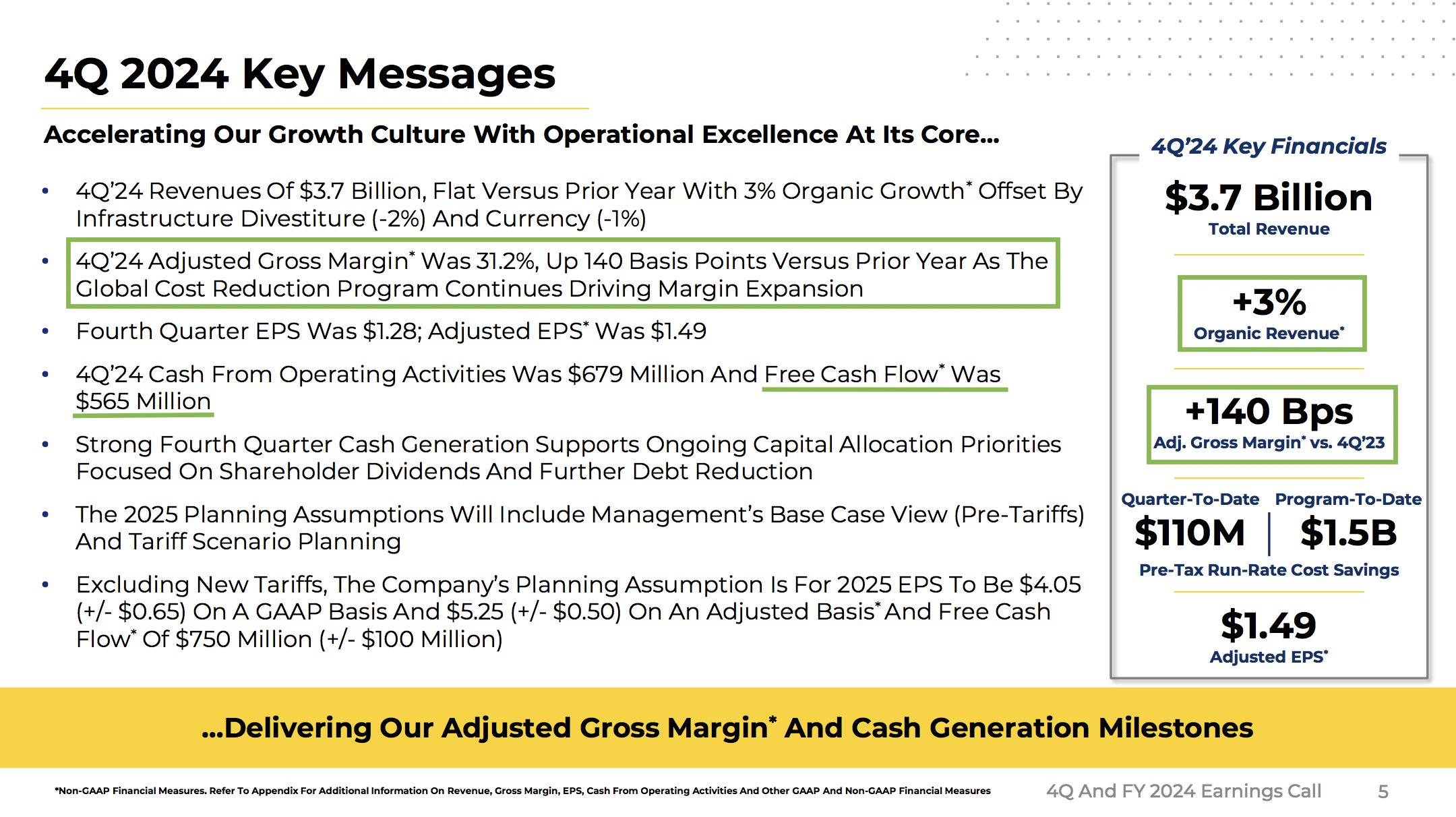

Last week, we shared a quick update with key takeaways from SWK’s Q4 earnings. There were some important points covered, so here’s a more in-depth look at the earnings report.

Earnings Results

Key Points

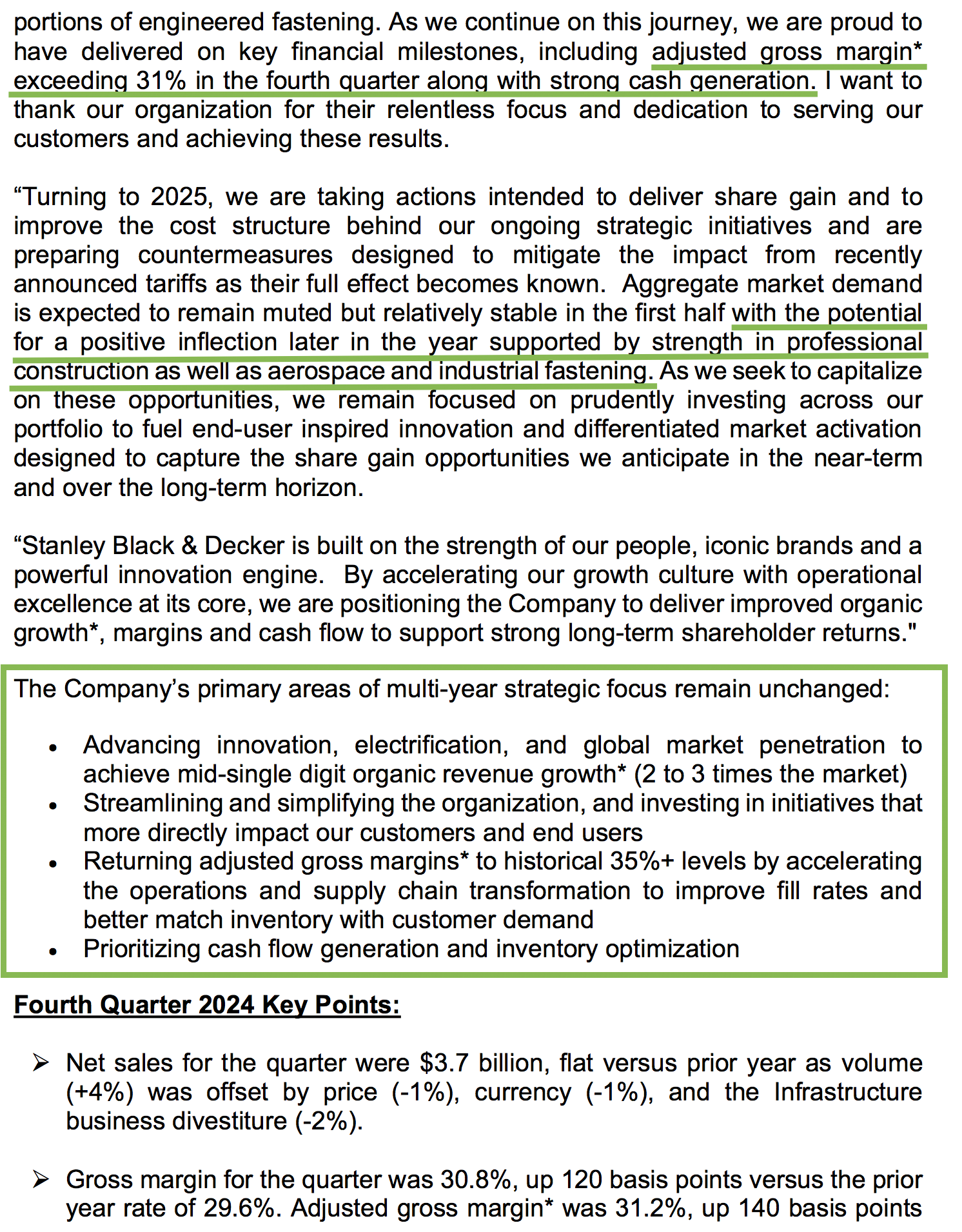

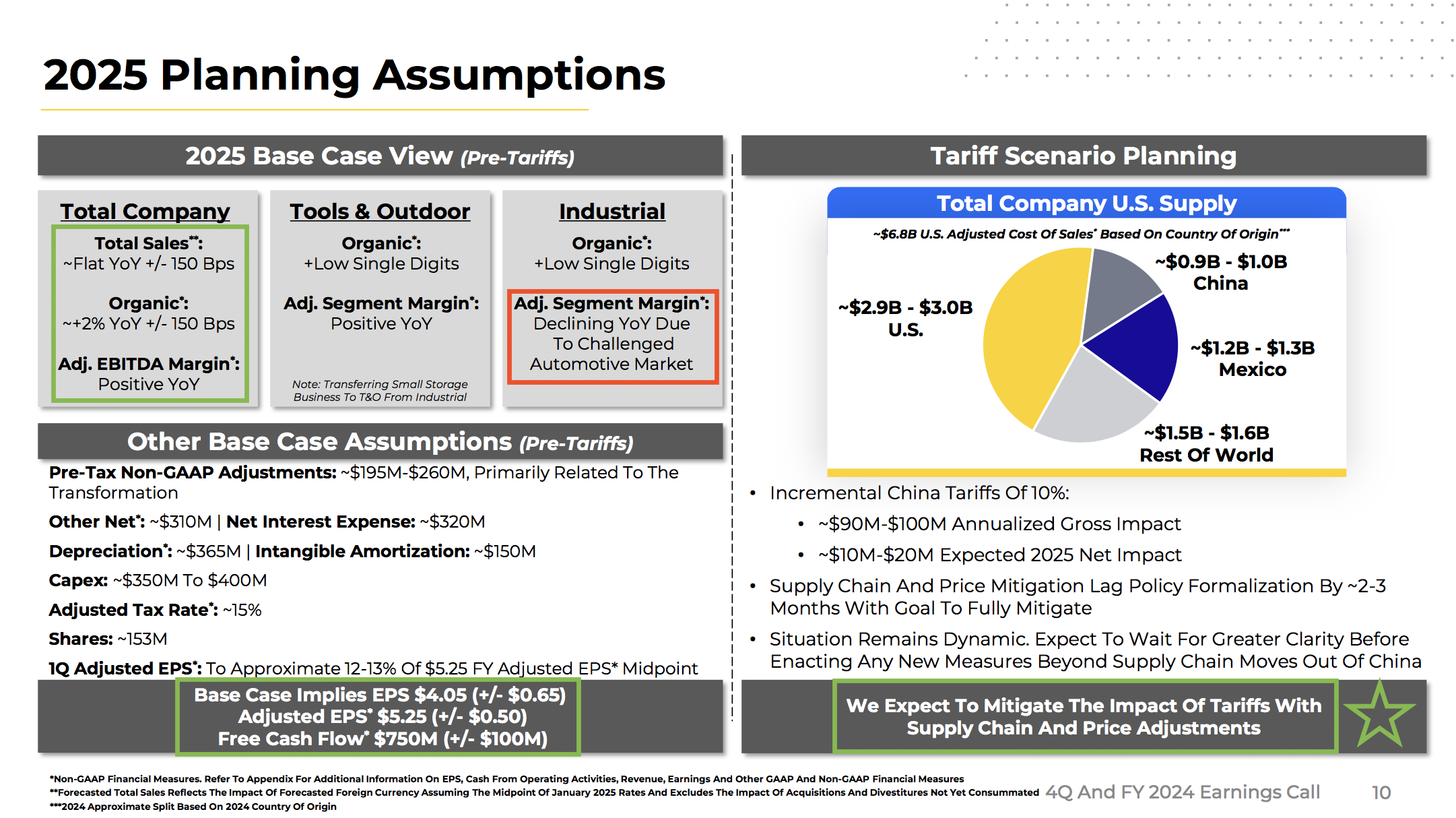

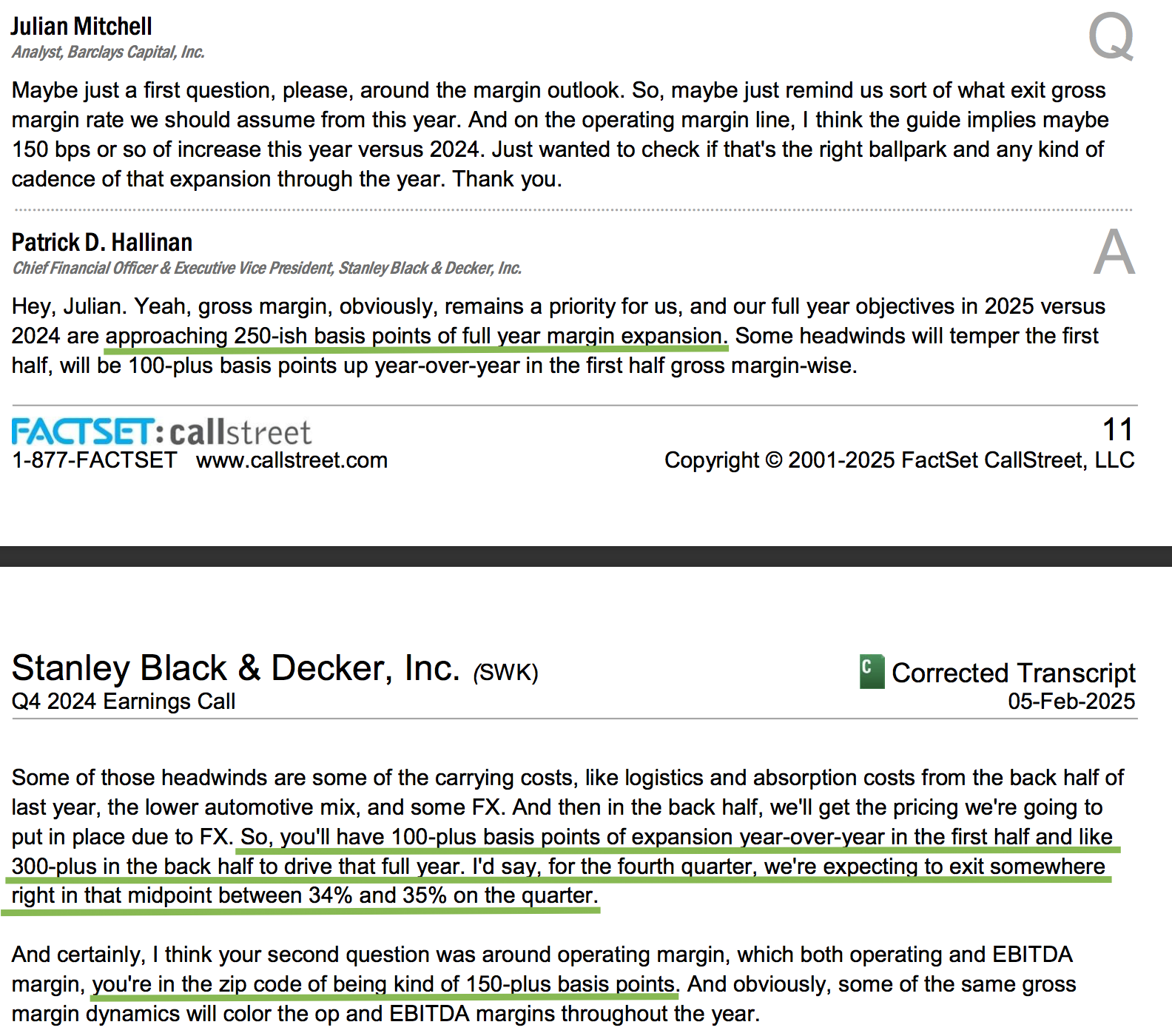

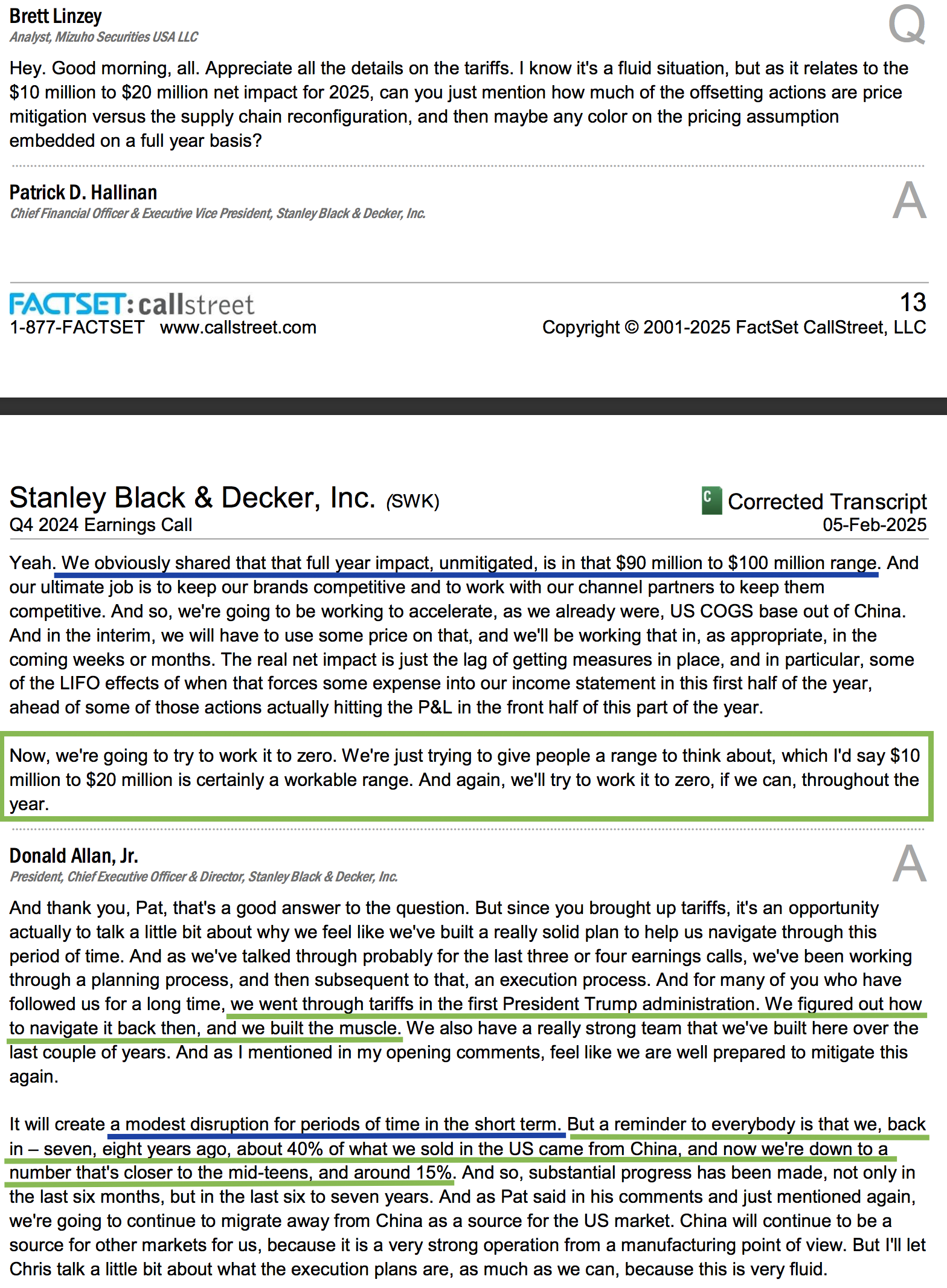

Fears over tariffs are overblown: The market sold off SWK as soon as tariffs were mentioned on the earnings call. The key takeaway here is that management has already reduced its exposure to Chinese manufacturing (cost of sales) from around 40% to 14% since Trump 1.0. If we see sustained 10% incremental China tariffs, management expects a net impact of $10M to $20M. The bottom line? Tariffs won’t affect the long-term adjusted gross margin target of 35% or the 2027 EBITDA goal of $2.5B, and that’s all we care about. In the unlikely event of broader, sustained tariffs, expect SWK to leverage its large U.S. manufacturing footprint (~44% of cost of sales) and potentially benefit from any domestic incentives (i.e., tax breaks for domestic manufacturers).

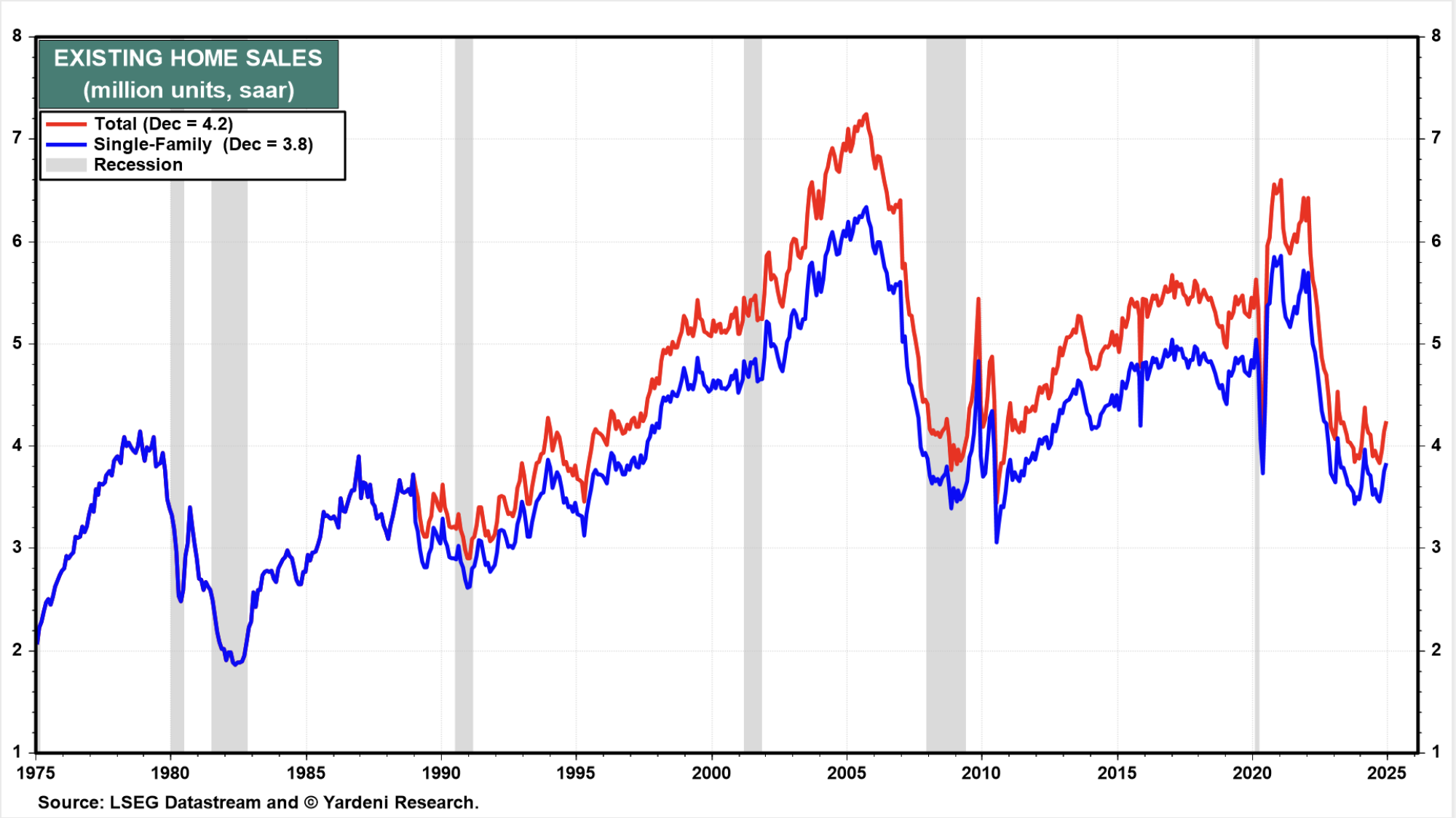

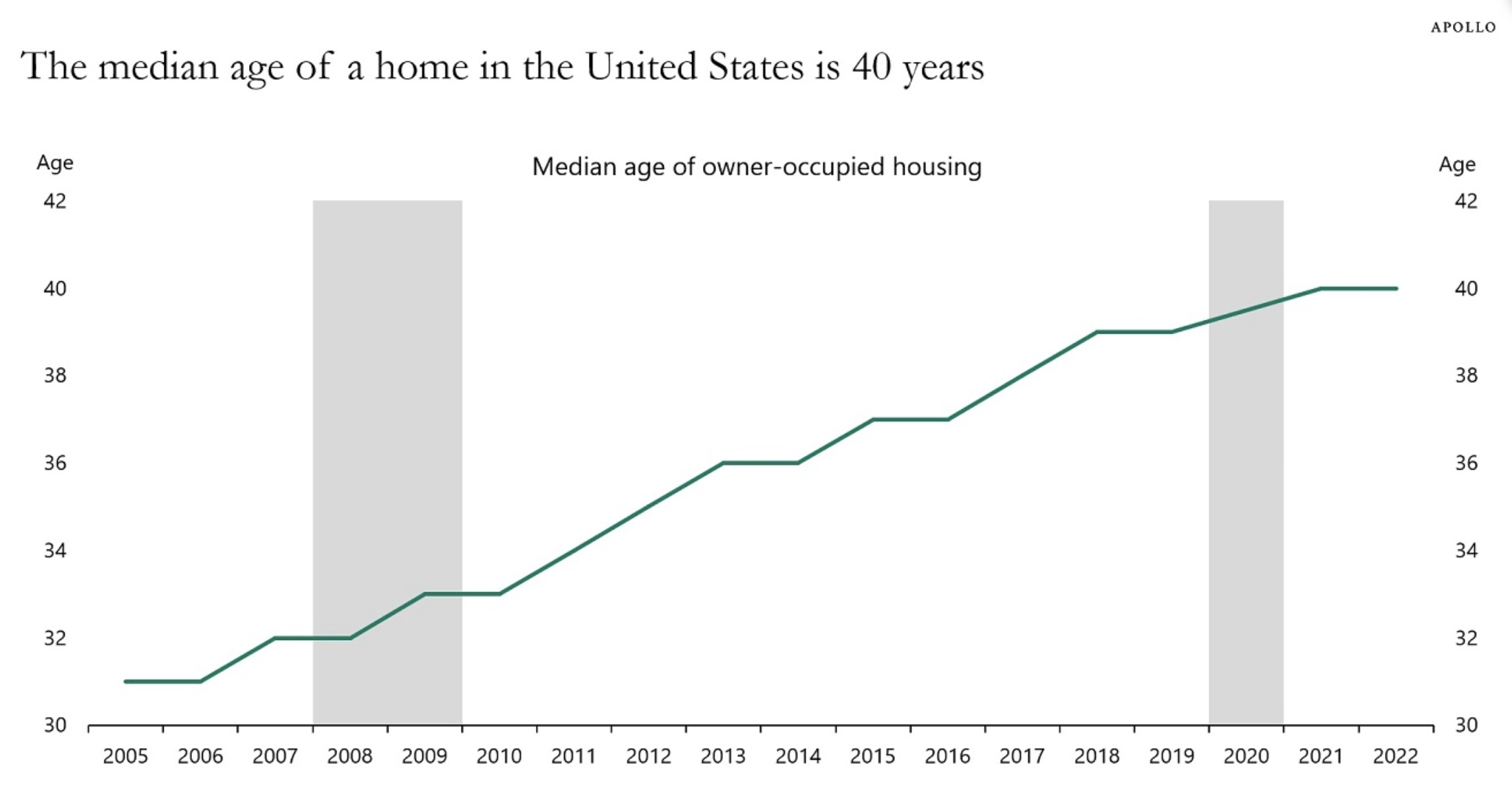

Long-term fundamentals remain attractive: Looking ahead, management continues to forecast mid-single-digit growth, 200 to 300 bps above expected low-single-digit GDP growth. This is a pure play on the recovery of the residential housing market, with existing home sales hitting their lowest levels since 1995 and the median home age around 40 years old. As rates come down, management expects an uptick in repair and renovation activity, potentially driving a positive inflection in the back half of 2025 (which is not yet reflected in guidance).

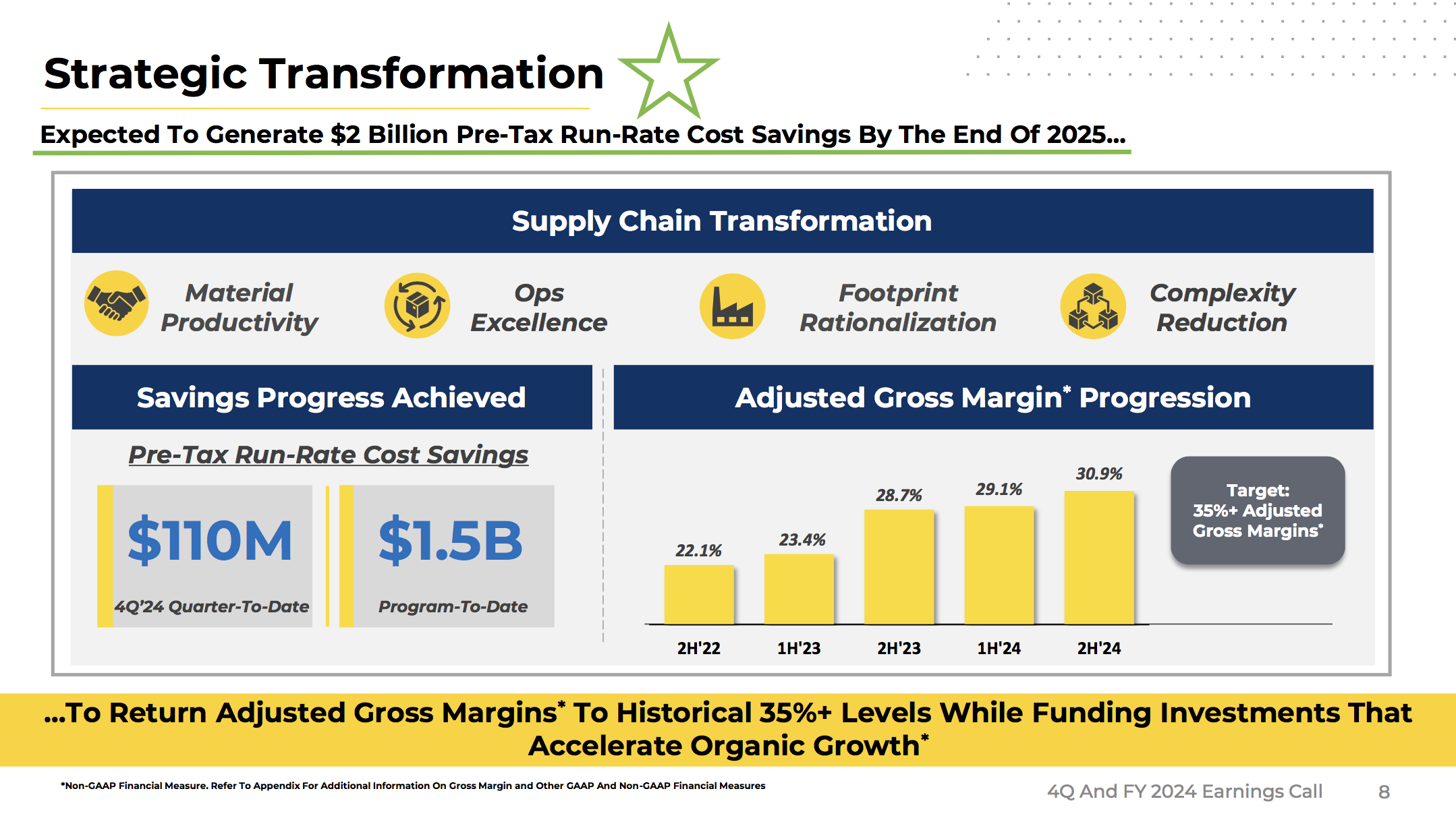

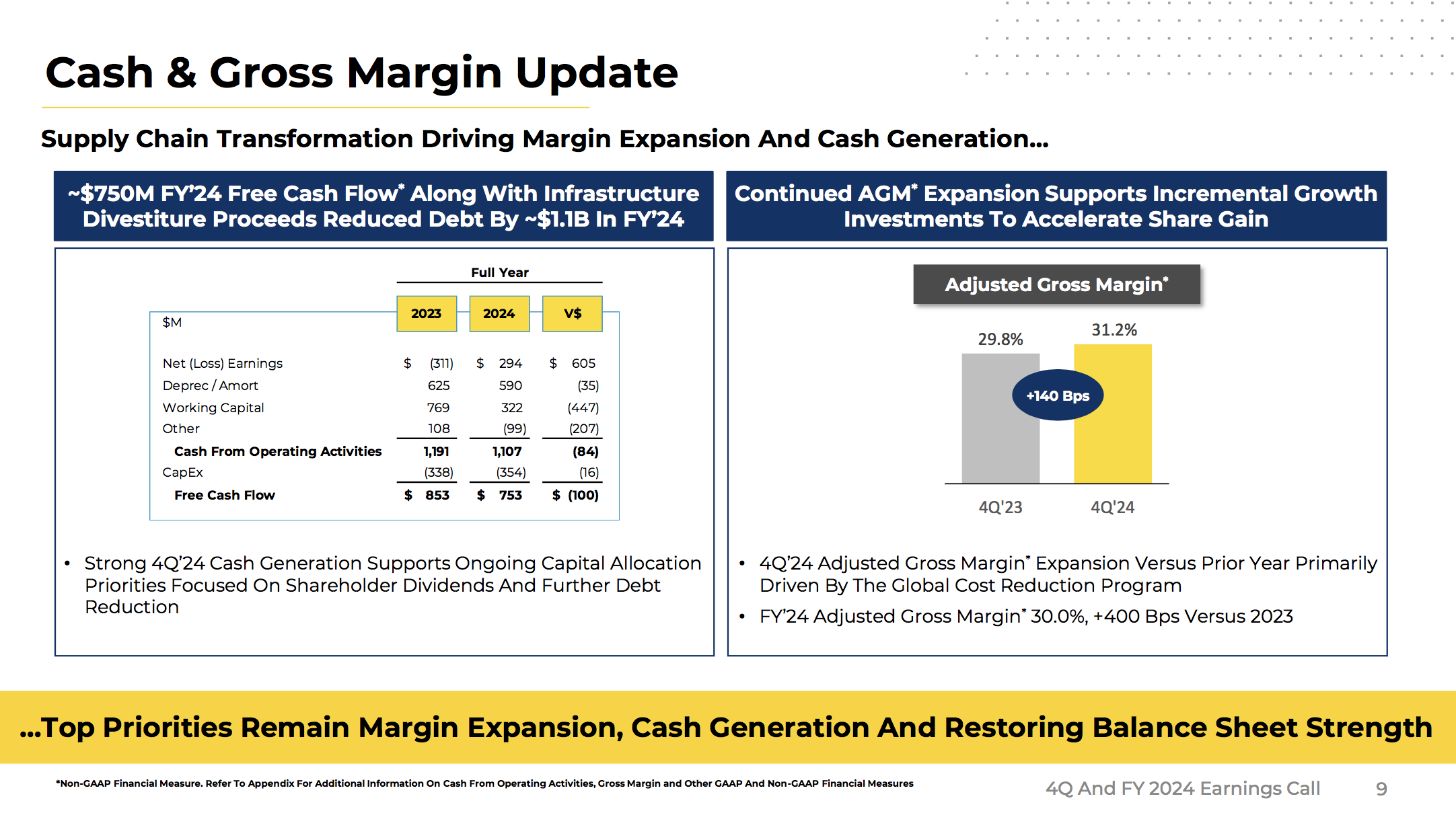

Margin Expansion and Cost Savings: Management expects to complete the $2B pre-tax run rate cost savings by the end of 2025, with $1.5B already achieved to date. Adjusted gross margins finished the year at 30% and are expected to reach the key target of 35% as we exit 2025.

Most importantly, management reiterated their confidence in the 2027 targets set at the recent capital markets day. These targets include the following:

Net sales: $16.5B to $17.0B

Adjusted Gross Margin: >35%

Adjusted EBITDA: $2.5B (~15% EBITDA margins)

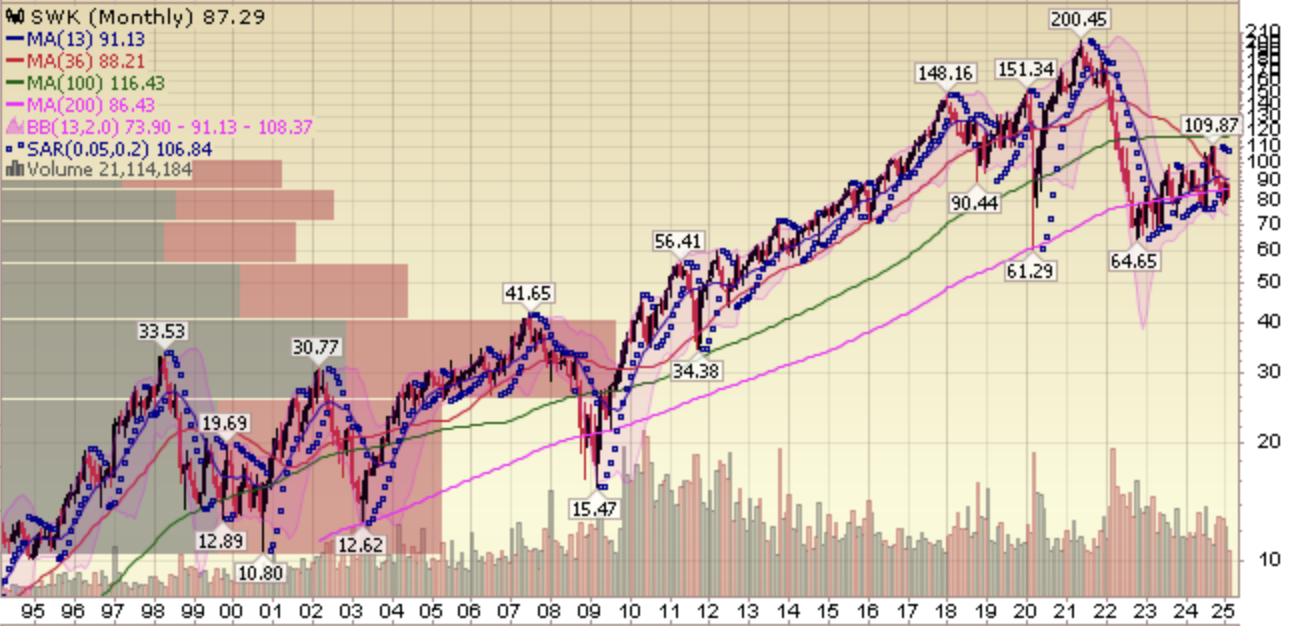

The last two times SWK generated EBITDA in this range were 2021 ($2.44B) and 2020 ($2.6B), when the share count was up to 5% higher than it is today. Back then, the company earned $10.55 and $7.85 in EPS, consistently traded between $170 and $190, and hit an all-time high of nearly $220 in 2021. With fewer shares outstanding since those peaks and the potential for buybacks between now and then, EPS will increase off similar EBITDA. The real question is what multiple will the market apply? Peak or trough, our margin of safety at these levels remains highly attractive.

Q&A Highlights

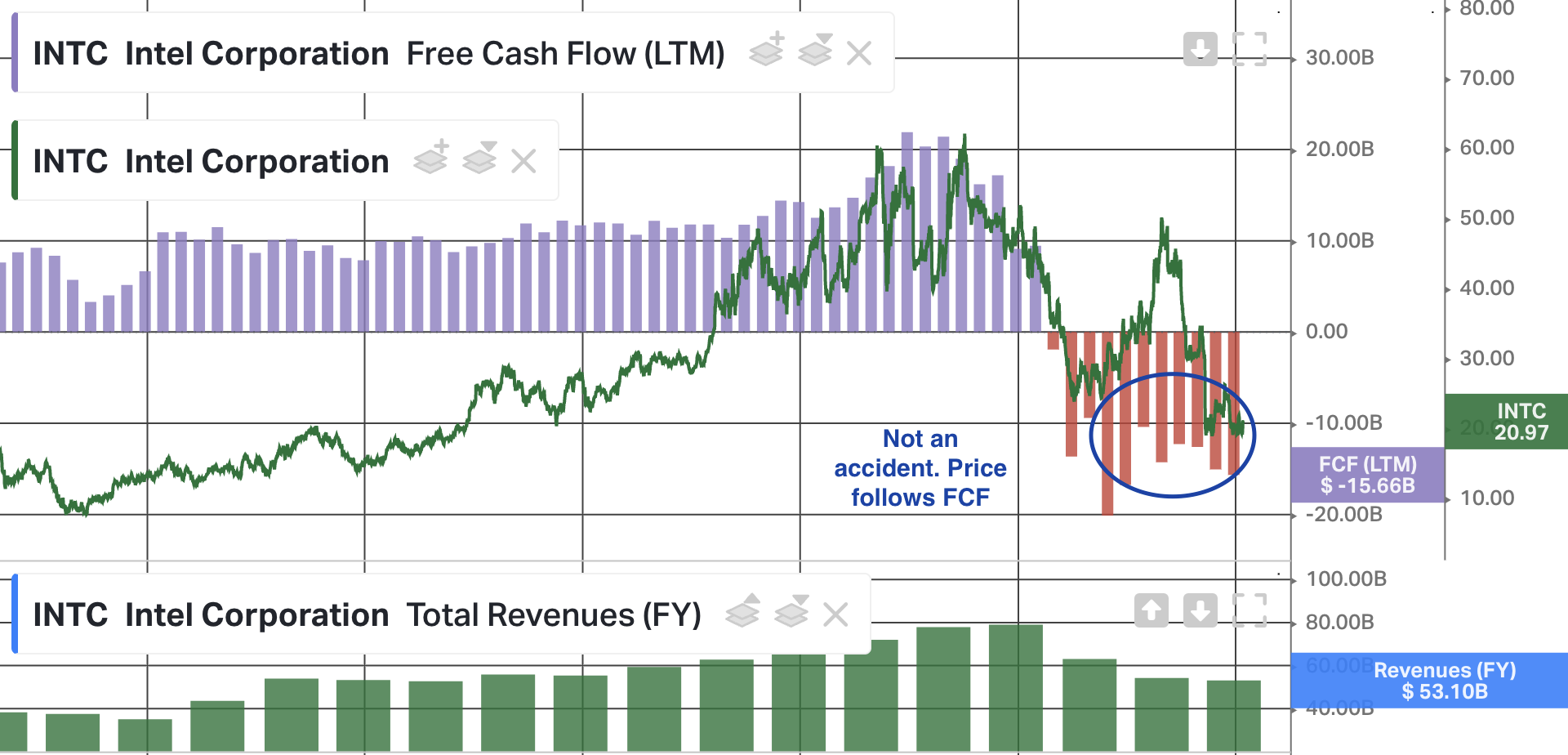

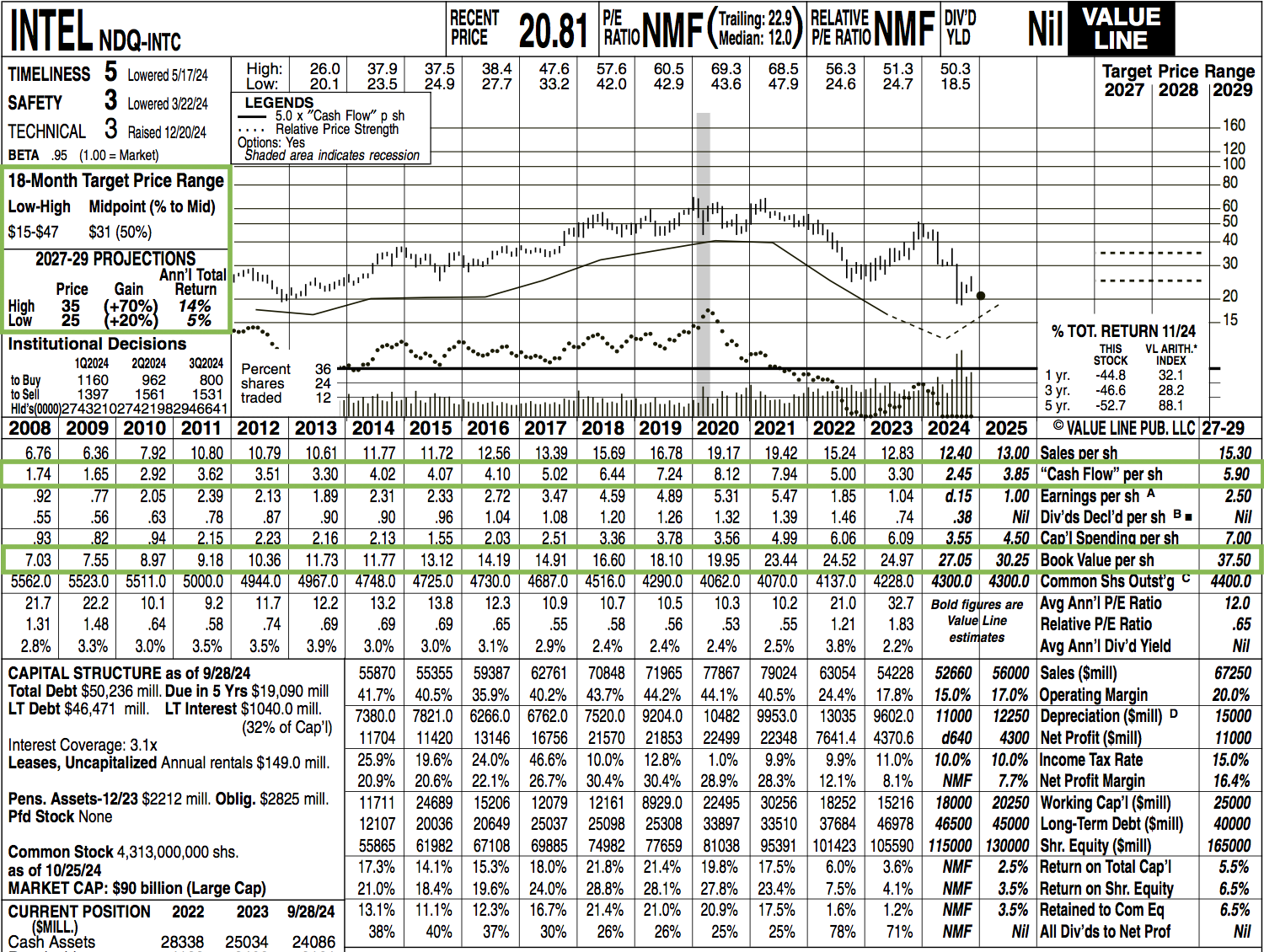

Intel Update

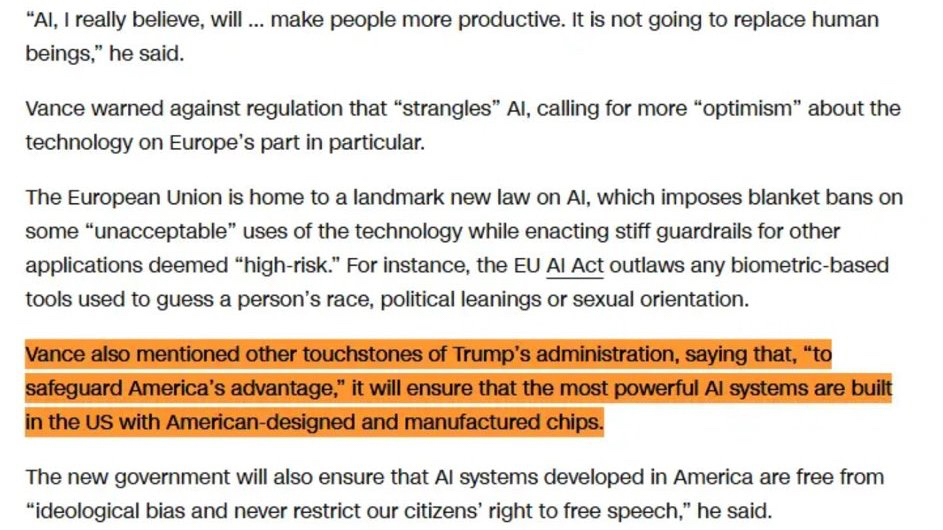

Over the past couple of months, we’ve been saying Intel is dead money until a new CEO is named. Earlier this week, VP JD Vance decided to change that when he spoke at the AI Action Summit in Paris.

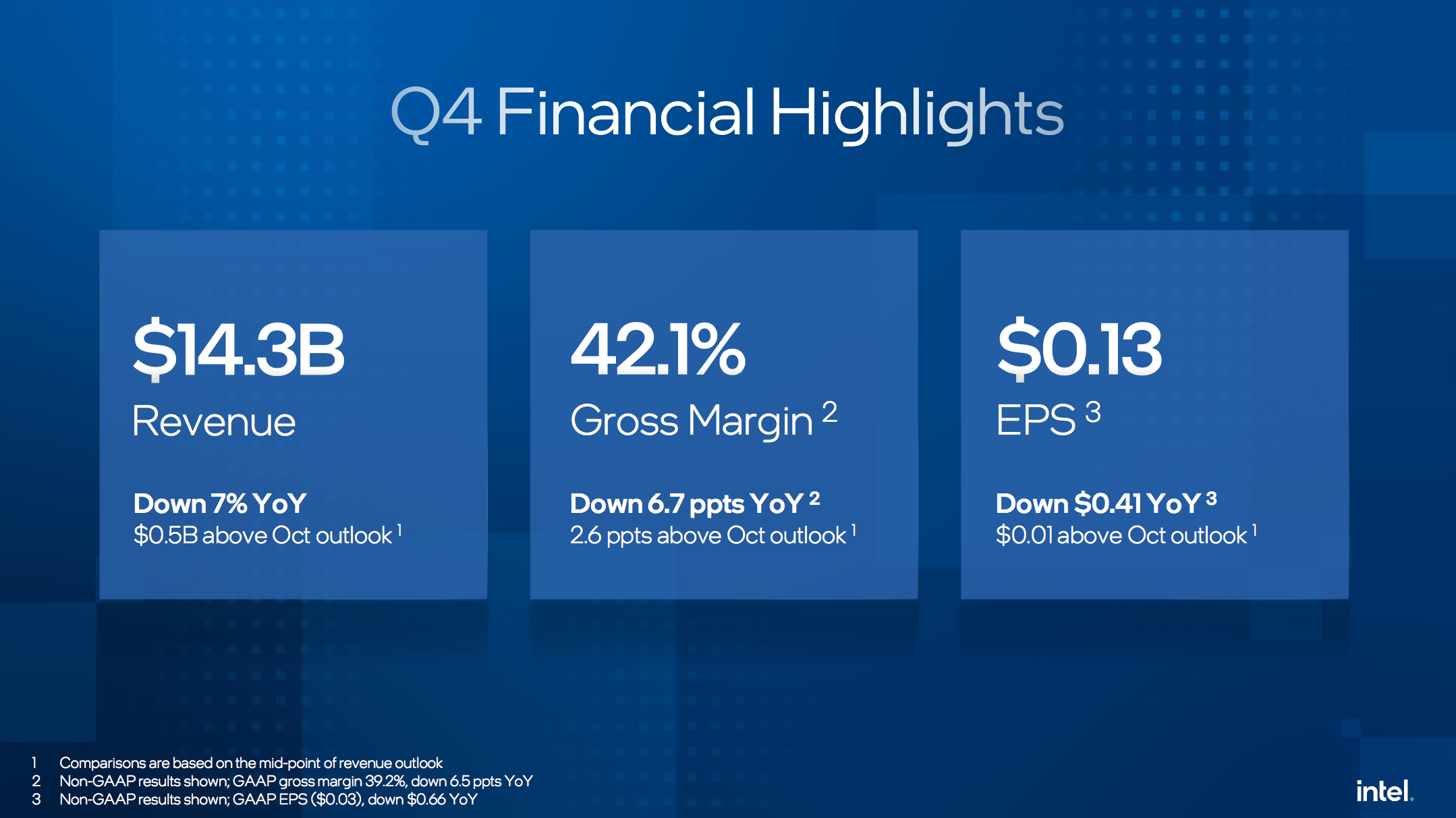

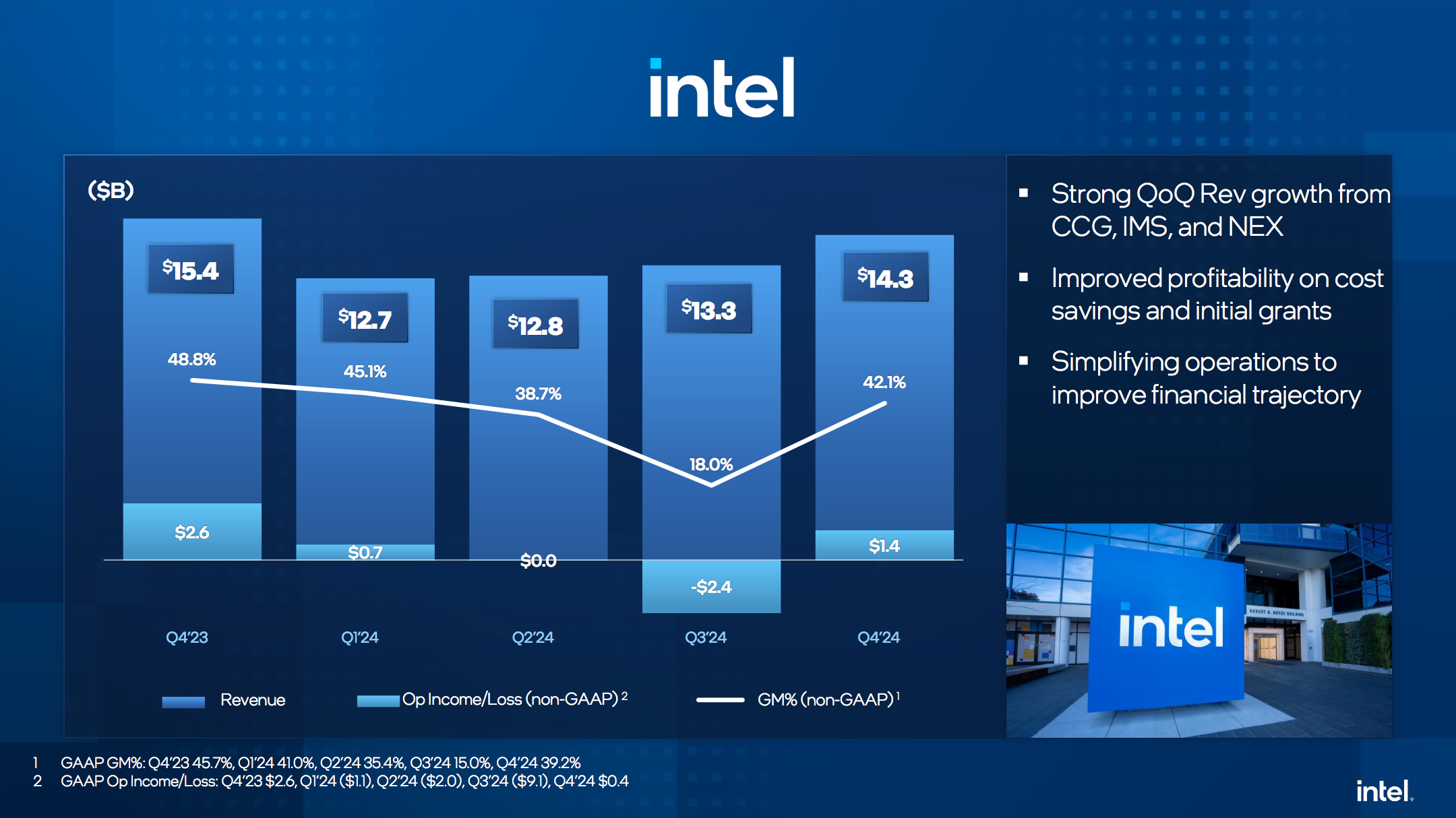

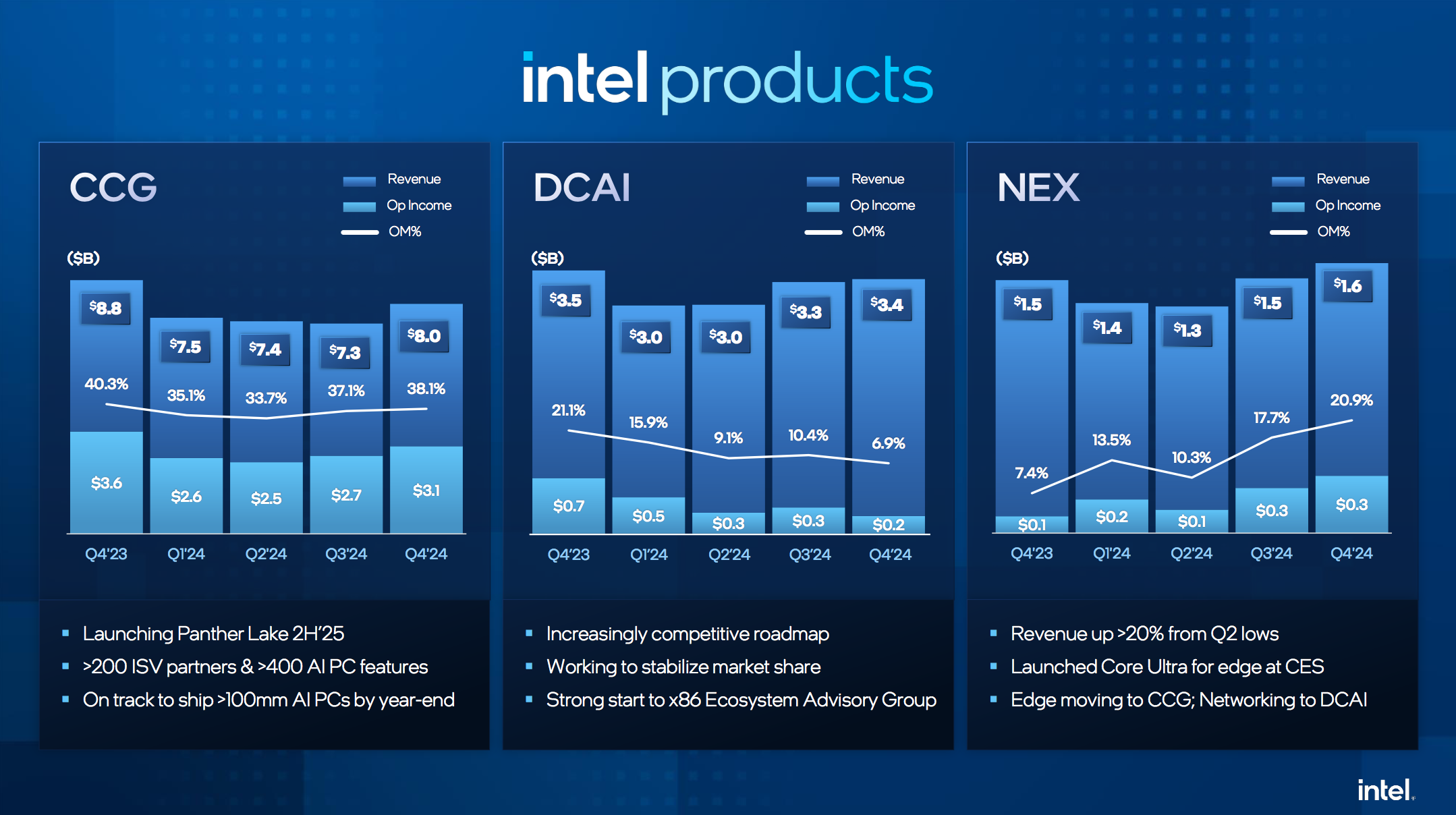

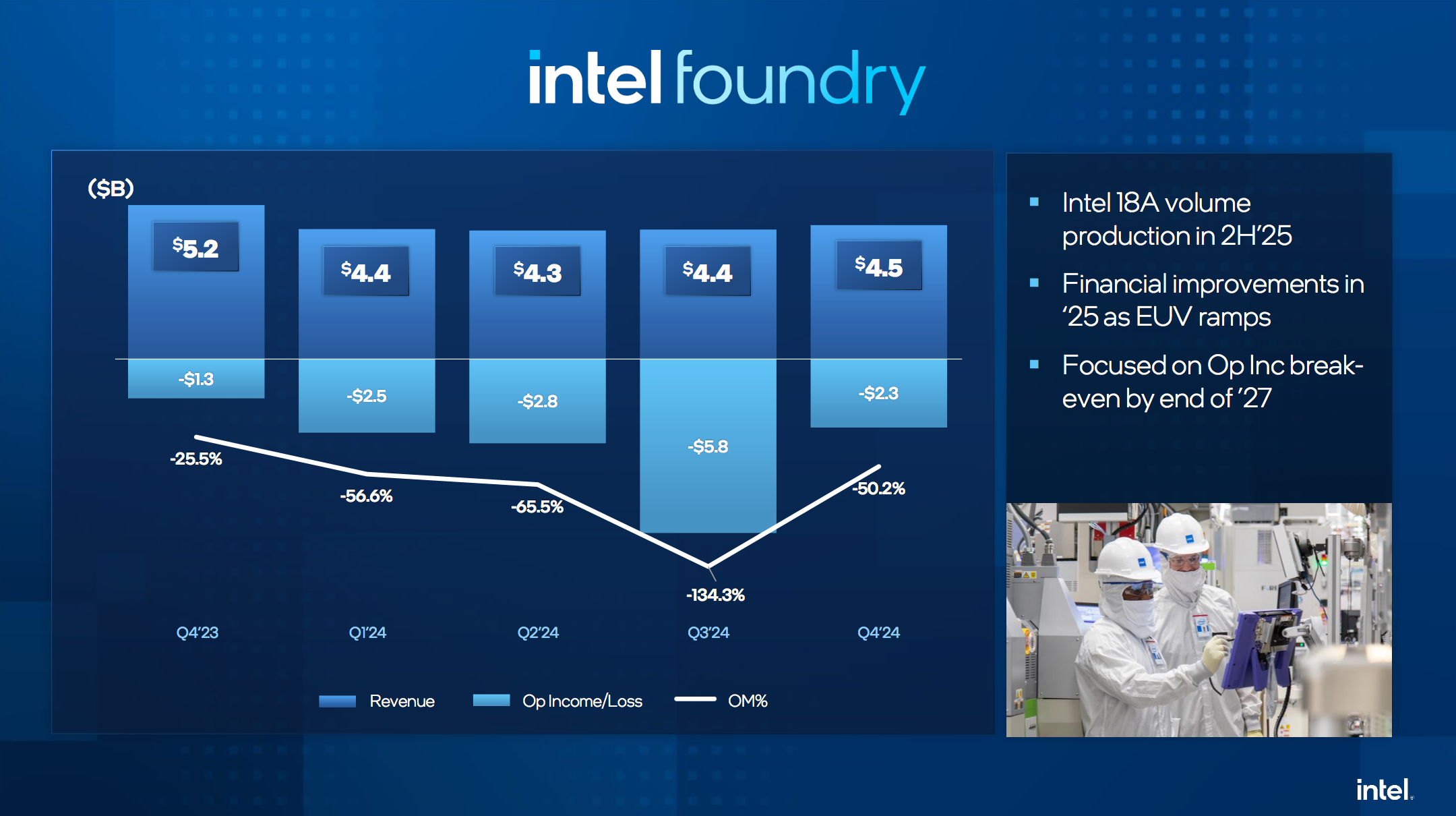

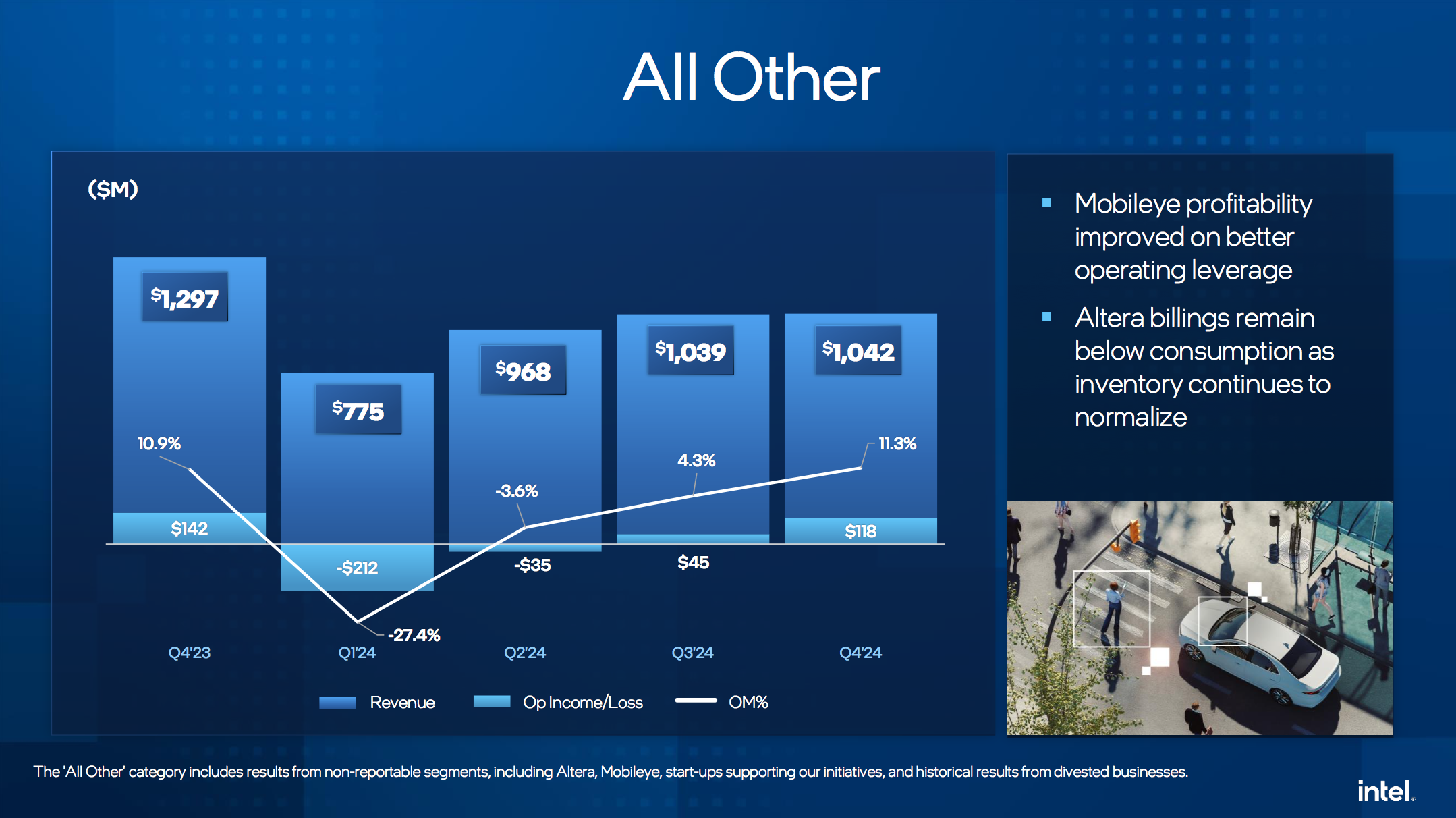

Earnings Results

General Market

The CNN “Fear and Greed Index” ticked up from 39 last week to 44 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

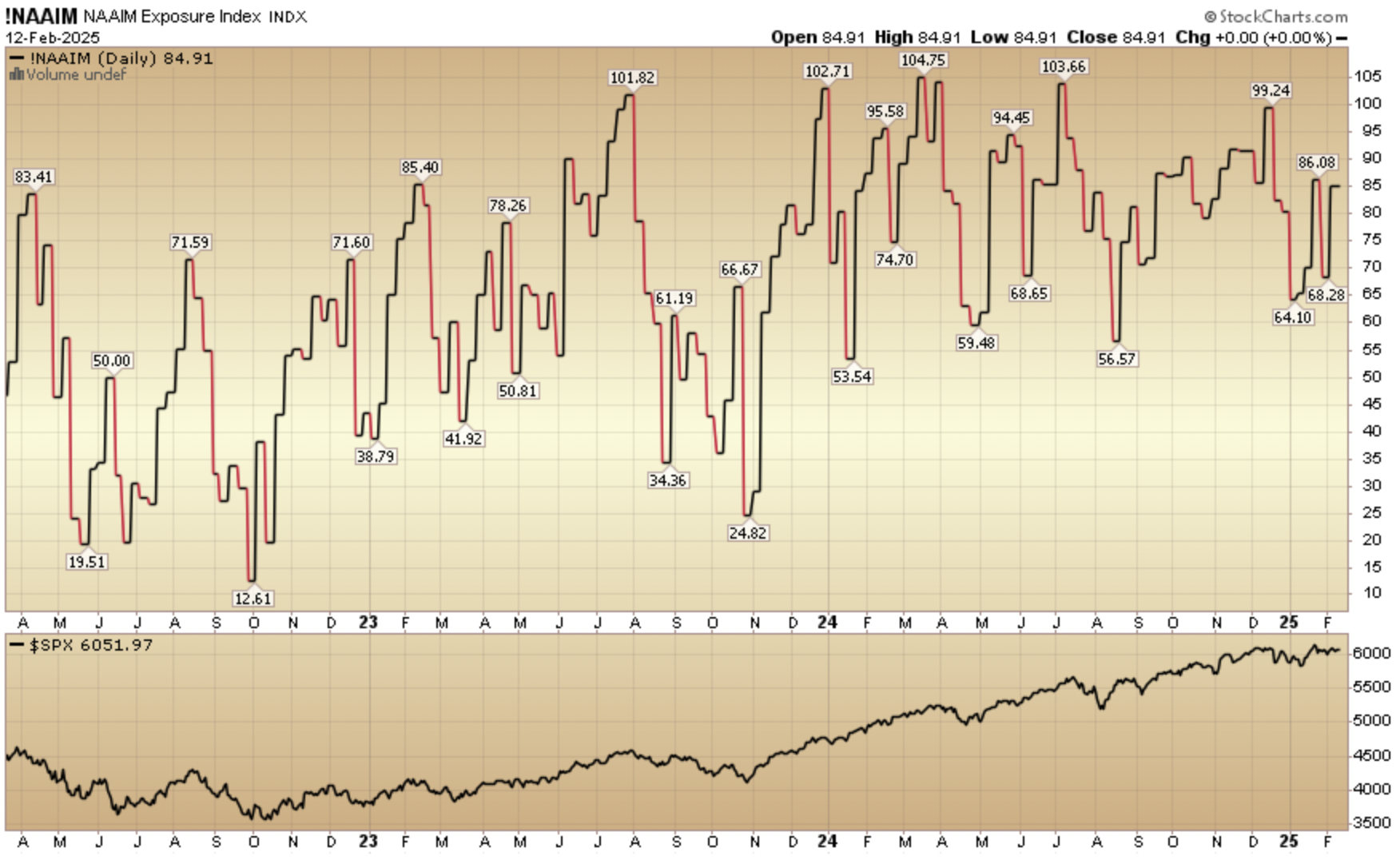

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked up to 84.91% this week from 68.28% equity exposure last week.

Our podcast|videocast will be out sometime on Thursday or Friday. We have a lot of great data to cover this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here

*Opinion, Not Advice. See Terms