- China Sets Strong Growth Target as It Hits Back at U.S. Tariffs (wsj)

- Beijing Ramps Up Efforts For Tech Independence (wsj)

- Dollar Dinged by Trump Tariffs, Suffers Worst 2-Day Decline Since 2023 (barrons)

- Disney to Cut More Staff as It Gears Up for Netflix Battle. Here’s Why. (barrons)

- Germany’s ‘Whatever It Takes’ Moment Powers European Markets (wsj)

- Trump to Decide on Canada, Mexico Relief Today, Lutnick Says (bloomberg)

- Weekly mortgage demand surges 20% higher, after interest rates drop to the lowest since last year (cnbc)

- Trump says he wants interest on car loans tax deductible if US-made (usatoday)

- Europe Leads Emerging-Market Rally as US Dominance Is Challenged (bloomberg)

- Investors should be wary of analyst ratings (ft)

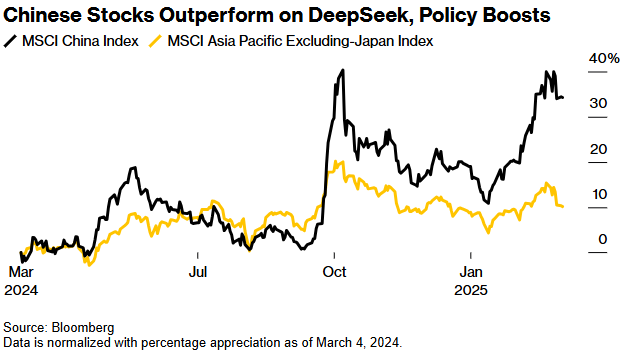

- NPC Preview, China Markets Shake Off Tariffs (chinalastnight)

- Commerce Secretary Howard Lutnick: This is not a trade war, this is a drug war (youtube)

- Bernstein lifts China internet stock targets on AI momentum (streetinsider)

- China to Issue $69 Billion in Special Bonds for Big Banks (bloomberg)

- Trump’s Broad Canada-Mexico-China Tariffs, Explained (wsj)

- TSMC Faces Pressure to Keep Some Chip Tech in Taiwan. What That Means for Intel. (barrons)

- UK Housing Set for 2025 Recovery, Building Suppliers Say (bloomberg)

- “America Is Back” – 12 Takeaways From Trump 47’s First Major Policy Speech To Congress (zerohedge)

- Treasury Secretary Scott Bessent shrugs off Wall Street’s Trump tariff ‘selloff’ (nypost)

- On Second Count, ABC Says Oscar Viewership Increased (nytimes)

- The 10 Best Dividend Stocks (morningstar)

- US private payrolls slow sharply in February (reuters)

- Tesla Offers Buyer Perks to Drum Up Interest With Sales Slumping (bloomberg)

Be in the know. 23 key reads for Wednesday…