Key Market Outlook(s) and Pick(s)

On Friday, I joined Ash Webster on Fox Business “Varney & Co” to discuss the bottoming process, Warren Buffett, sentiment, positioning, and outlook. Thanks to Ash and Christian Dagger for having me on:

On Thursday, I joined Mike Larson for a special “Market Roundtable” episode of the MoneyShow Masters Podcast, alongside Kenny Polcari and Jim Bianco. We discussed the unwinding of the Mag 7, the carry trade, macro trends, the Fed’s next move, and upcoming topics for the MoneyShow Miami Conference. Thanks to Mike for having me on:

As a reminder, I’ll be speaking at the MoneyShow Miami Conference on May 17th at 12:15 on the main stage and at 1:45 in a breakout room.

The topics of my conversation will be:

Turnaround Tom’s Top Stock Picks for 2H and Outlook

How the “Un-Investible” Became “Investable”

Get your tickets here:

Registration

Boeing Update

In 1964, Bob Dylan released “The Times They Are a-Changin’,” a song that served as a call to action — a warning that those who ignored the changing tide would be left behind.

When I read the following verse, I couldn’t help but think of Boeing (naturally), the subject of this week’s market commentary and one of our favorite positions.

Boeing’s story follows a similar arc. When we first got involved with the stock, it was a company stuck in the past, grounded by mishaps, quality control issues, regulatory scrutiny, and legal challenges — pretty much everything under the sun. Put it this way: we boarded Boeing when it was a broken-down jet stranded on the tarmac.

But just like Dylan’s message that change is inevitable, Boeing’s turnaround was only a matter of time. Bad news can only last so long (especially when you operate in a legal, growing global duopoly). Over the past year, that once grounded plane has been repaired, systems checked, and most importantly, a seasoned pilot, Kelly Ortberg, has taken the controls.

Today, the plane’s engines are humming as it taxis toward the runway. Once the FAA lifts the 38 per month production cap, likely in the second half of this year, that will be our ‘cleared for takeoff’ moment.

From there, we’re set for a long, smooth flight with tailwinds from the ongoing replacement cycle, surging demand in emerging markets, and most importantly, GOBS OF FREE CASH FLOW.

Buckle up — this thing is just getting started because the times, indeed, are a-changin’!

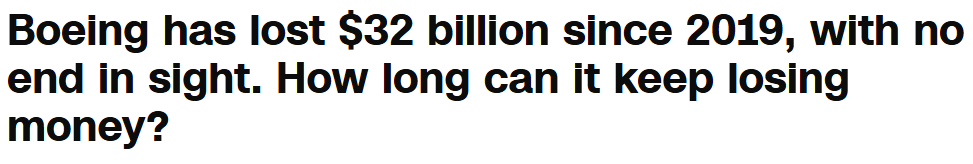

Speaking of writers and critics who prophesize with their pen, when we got involved, there was no shortage of ink. Take a look at some of the headlines below:

This can all be summed up with a great line from Robert Arnott:

“In investing, what is comfortable is rarely profitable.”

Fortunately for us, we’ve never been afraid of a little discomfort. As we like to say, Wall Street is the only place where, when there’s a clearance sale, everyone runs out of the store! That’s when we calmly step in, scoop up the bargains others left behind, and walk away smiling so wide we could eat a banana sideways…

Now, back to Boeing’s latest update.

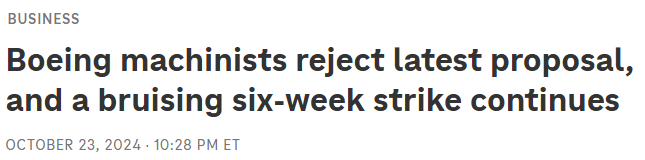

At the recent BofA Global Industrials Conference, Boeing’s CFO, Brian West, gave some great updates on cash flow, production, and more. Here’s everything you need to know:

Key Points

- Free cash flow is expected to come in at HUNDREDS OF MILLIONS better than previously expected, thanks to less impact from working capital drag.

- March deliveries are expected to come in line with February’s strong numbers, which included 31 737s and 5 787s. Boeing remains on track to reach 38 737s per month later this year, with plans for incremental increases of +5 every 6 months, and expects to hit 7 787s per month later in the year,

- The defense business is stabilizing, with positive signs from the administration regarding funding for next-generation aircraft modernization programs and strengthening defense deterrence. Global defense demand continues to ramp up and is seeing a lot of interest.

- Management does not expect any material near-term impact from tariffs. With 80% of commercial spend and over 90% of defense spend in the supply chain being US-based, and nearly all aluminum and steel sourced from the US, tariff exposure remains below the 1%-2% range. The $0.5 trillion backlog and the ability to focus on North American customers will help mitigate potential tariff impacts.

- No supply chain constraints are expected, with plenty of inventory to cushion any impact, even with the recent SPS Technologies fire.

- All six KPIs are performing well and continue to improve.

- Company culture remains a top priority and continues to improve. There’s a lot of excitement and energy among employees as the factories stabilize and production ramps up.

This quote from Brian West sums it all up and is everything you need to know:

“What I can tell you is that we’re very confident in our long-term demand profile, $0.5 trillion in backlog. And then we see no reason why the business can’t get back to historical financials once we get through stability. We know exactly what we have to go do. We have to go produce 737s and 787s, ramp them and deliver them. We have to execute on these development programs that we just talked about. We have to return BDS to its historical financial profile and we have to continue to deliver a steady services business that’s been doing just great.”

For reference, here’s what Boeing did in 2018 when the stock was $400+:

Revenues: $101.10 billion

Earnings Per Share: $17.85

Free Cash Flow: $13.60 billion

Returning to financials like that means MUCH MORE THAN JUST A DOUBLE from current levels. The times, they are a-changin’…

Morningstar Analyst Note

Alibaba Update

Over the summer of ’24, after a photo of Nvidia CEO Jensen Huang signing a fan’s bra came out, we published an article titled “The Next Pain Trade.” See the full article below:

Since then, Nvidia has fallen ~20%, while the S&P 500 has returned around 4%.

Now, here’s a paragraph from the article I’d like to focus on:

“NVDA is still a semiconductor company, which has never been a secular business – it’s cyclical. Always has been, always will be. As for 70%+ gross margins, as Bezos famously said, “your margin is my opportunity.” NVDA has not cured cancer. There will be more and more competition going forward. Intel’s Gaudi 3 is 50% faster than NVDA’s H100 and 40% more energy efficient. AMD is gunning for them. The game is just beginning and NVDA will be forced to share the pie as no buyer wants to be beholden to one company.”

The bad news is that I didn’t realize when I wrote this that I had left out a KEY COMPETITOR in my list that would be gunning for NVDA.

The good news is that this KEY COMPETITOR also happens to be one of our favorite and largest positions, ALIBABA.

For those who know poker, we’ve always said that Alibaba is like a position with endless “outs.”

With a hand in so many different businesses, it’s par for the course to wake up and find out Alibaba has sold off billions in non-core assets, owns a stake in a company, or is doing something we never even knew about.

This week, Alibaba dropped another surprise: it’s now producing its own chips.

And not just any chips. These chips, alongside those from Huawei, DELIVER COMPARABLE PERFORMANCE TO WHAT COULD BE HAD USING NVIDIA’S H800 CHIP, WHICH ISN’T EVEN PERMITTED TO BE EXPORTED TO CHINA, WHILE ALSO DELIVERING COST SAVINGS OF ~20%.

At one point, investors were puking out of Alibaba in the $60s and $70s after news broke that tighter export controls would “choke off” China’s access to top US chip models.

Now, it seems this could end up being the catalyst that opened the door to Alibaba’s next multi-billion-dollar opportunity.

NECESSITY IS THE MOTHER OF INVENTION…

General Market

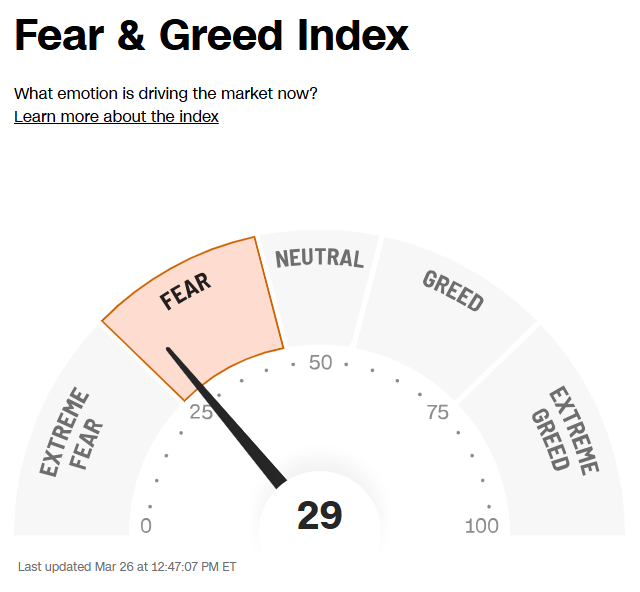

The CNN “Fear and Greed Index” ticked up from 22 last week to 29 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

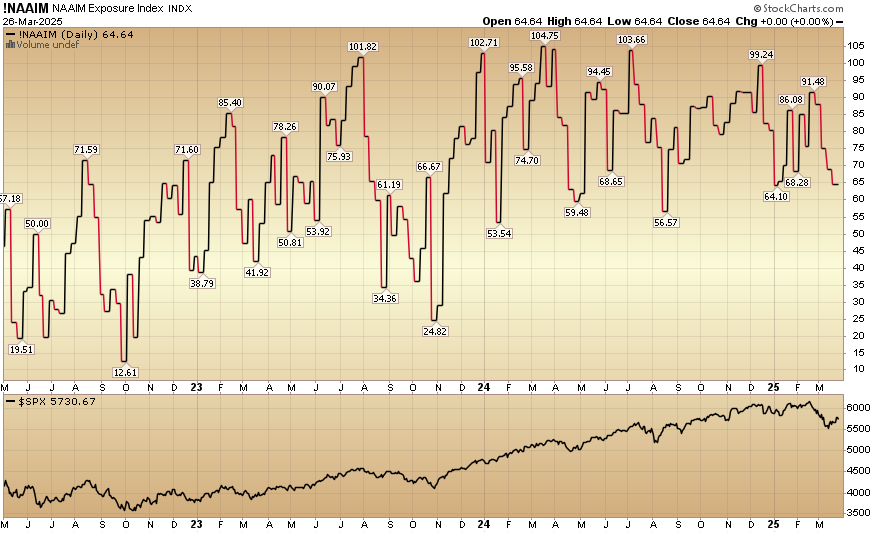

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked down to 64.64% this week from 68.80% equity exposure last week.

Our podcast|videocast will be out sometime on Thursday or Friday. We have a lot of great data to cover this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

Congratulations to all of the new clients that came in during our 2024 and Q1 2025 raises. You could not be better positioned for what we believe will continue to be a highly rewarding year in 2025. This view is based on what has already taken place in 2025 as well as much of the data we have shared in recent weeks on our podcast|videocast(s), coupled with our proprietary methods of expressing and executing upon those views on your behalf.

We will re-open to smaller accounts $1M+ again starting April 1st.

Congratulations to all of you I had the pleasure of speaking with and on-boarding last week – when we opened up the queue for inquiries. Several of you have already had your applications approved by IB so that we can begin deploying capital on your behalf imminently.

To see if you qualify and to take advantage of this opening click here. Larger accounts $5-10M+ can access bespoke service at their preference here.

*Opinion, Not Advice. See Terms