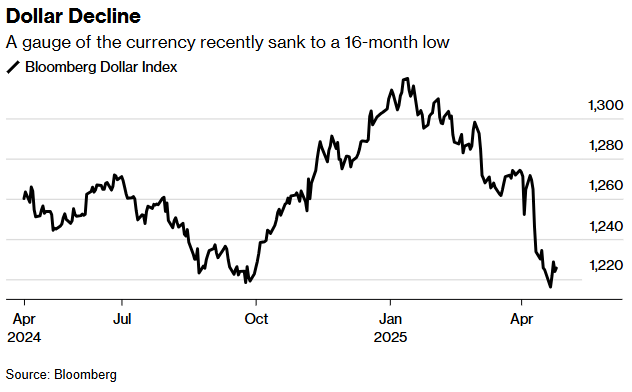

- Unhedged and Burned, Stock Investors Brace for More Dollar Pain (bloomberg)

- The Dollar’s Weakness Creates an Opportunity for the Euro. Can It Last? (nytimes)

- Morgan Stanley’s Wilson Says Weak Dollar Will Buoy US Stocks (bloomberg)

- China moves to protect economy from trade war, vows to hit 5% growth target (scmp)

- China rolls out employment support and hints at more stimulus as U.S. tensions escalate (cnbc)

- Goldman says China funds to buy US$110 billion of Hong Kong-listed stocks (scmp)

- China’s Huawei Develops New AI Chip, Seeking to Match Nvidia (wsj)

- Goldman Sachs Offers Advice on Tariffs to Countries Scrambling to Please Trump (wsj)

- Philippines Aims to Lower US Tariff to Zero During Talks (bloomberg)

- Emerging-Market Stocks Extend Rally Amid Earnings Optimism (bloomberg)

- Riyadh Air willing to buy Boeing planes from cancelled Chinese orders, CEO says (reuters)

- Bernstein raises Boeing stock rating, price target to $218 (investing)

- Boeing Stock Is Rising for Two Reasons (barrons)

- Inflation Fear Is Making Some People Spend More—and Others Less (wsj)

- Home prices starting to crack: Here’s why (youtube)

- The 7-year car loan is here. Do you really want to be paying off your car in 2032? (usatoday)

Be in the know. 16 key reads for Monday…