- Would Big Pharma Pay for the Wall? ()

- Saudis Say OPEC+ Oil Cuts on ‘Right Track’ to Balance the Market (Bloomberg)

- Cannabis company stock soars after Thiel-backed fund says it won’t sell shares (New York Post)

- How Companies Like Apple Sprinkle Secrets in Earnings Reports (New York Times)

- Carl Icahn Reportedly Building Stake in Caesars ()

What I’m reading today…

- Why the Fed Backed Off on Interest Rates (Barron’s)

- Airline Stocks Are Pricing In a Downturn. We Disagree (Barron’s)

- General Motors predicts stronger 2019 Earnings (NY Post)

- In the Riskiest Corners of the Stock Market, Exuberance Is Back (Bloomberg)

- January Option Expiration Week Trends Weak (Quantifiable Edges)

- Coming to America 2 Is Happening (Vanity Fair)

- Millennials Are About to Get Locked Out of the Real Estate Market—Again (Fortune)

- Robb Report Car of the Year 2018 (Robb Report)

- The Secret to Getting the Freshest Krispy Kreme Doughnuts (Reader’s Digest)

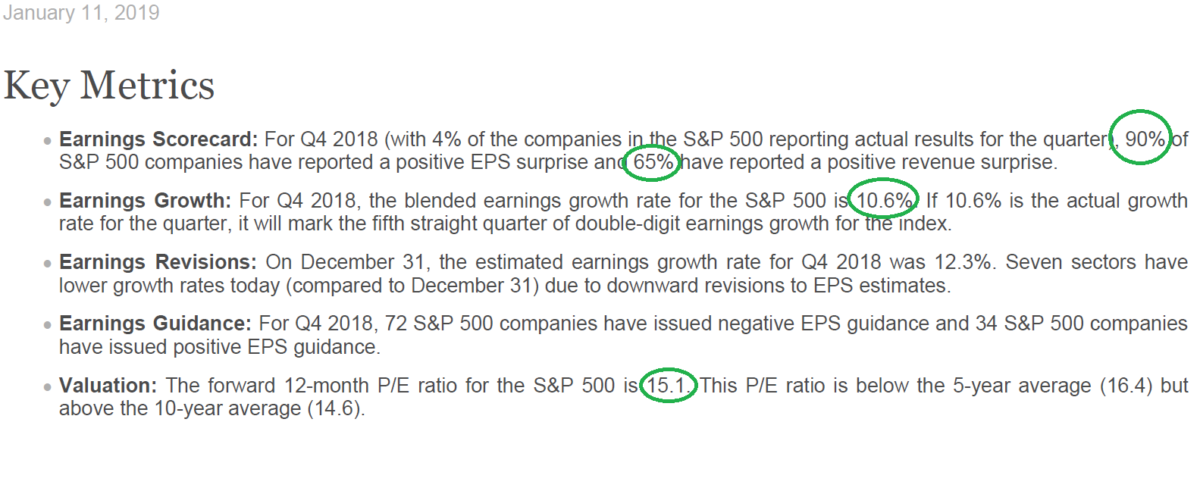

Early earnings results strong

Earnings still strong (different from 2008 & 2000) so far…

The 20 years of quarterly earnings history below are compliments of Howard Silverblatt – S&P Dow Jones Indices Senior Index Analyst. I have bolded those periods (2000 & 2007) where there was an abrupt drop in earnings (which portended a steep market correction). In 2007 we had fair Continue reading “Earnings still strong (different from 2008 & 2000) so far…”

Insider Buying

The CEO and CFO of Medtronic ($MDT) used the recent weakness on January 9 Continue reading “Insider Buying”

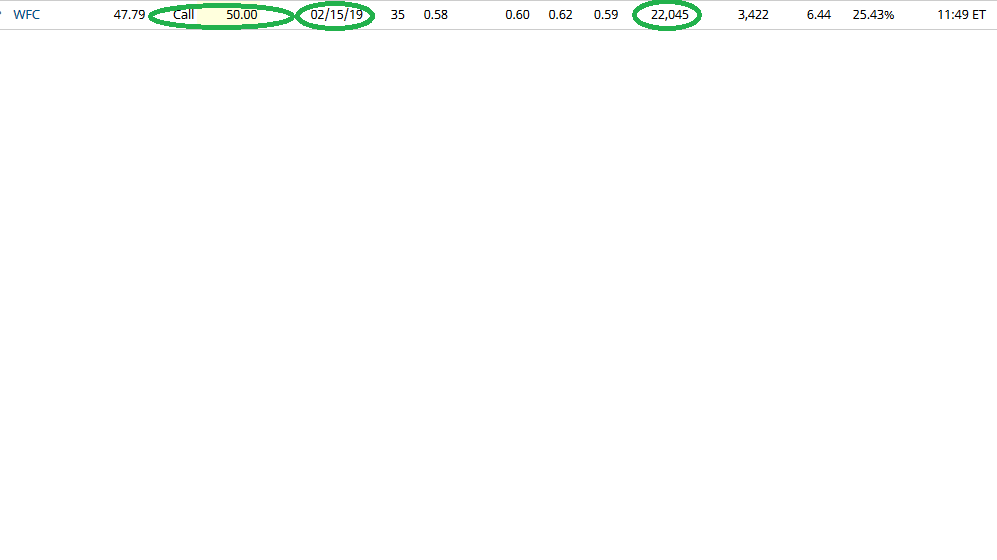

Unusual Option Activity

Today some institution/fund purchased 22,045 contracts of February $50 strike calls (or the right to purchase 2,204,500 shares of Wells Fargo at $50). This is an abnormally sized bet for this stock and contract as the open interest was just 3,422 prior to this purchase. Wells Fargo ($WFC) reports earnings 1/15/19.

NYMO short term oscillator

Yesterday I put out a post about the AAII Sentiment survey and that it would potentially portend a few days to a week of sideways/possibly down consolidation to work off the short term exuberance. Another short term indicator I have used for many years is the NYMO or the NYSE McClellan Oscillator Continue reading “NYMO short term oscillator”

What I’m reading today…

- Big Carvana Holder Buys Up More Stock (Barron’s)

- Robot Chefs Ready To Make You Burgers, Fries, Bread, Coffee (Investor’s Business Daily)

- The Yield Curve Is Warning Investors to Exit Bank Loans (Barron’s)

- Junk-Bond Sale Ends 40-Day Market Drought (Wall Street Journal)

- Investors Were Spooked About Profits. Now Come the Facts (New York Times)

- Roku aims to expand cord cutting ()

- ‘Extraordinary’ Month Heaps Further Pain on Hedge Funds (Bloomberg)

- Beaten-down value stocks will see a 2019 comeback (CNBC)

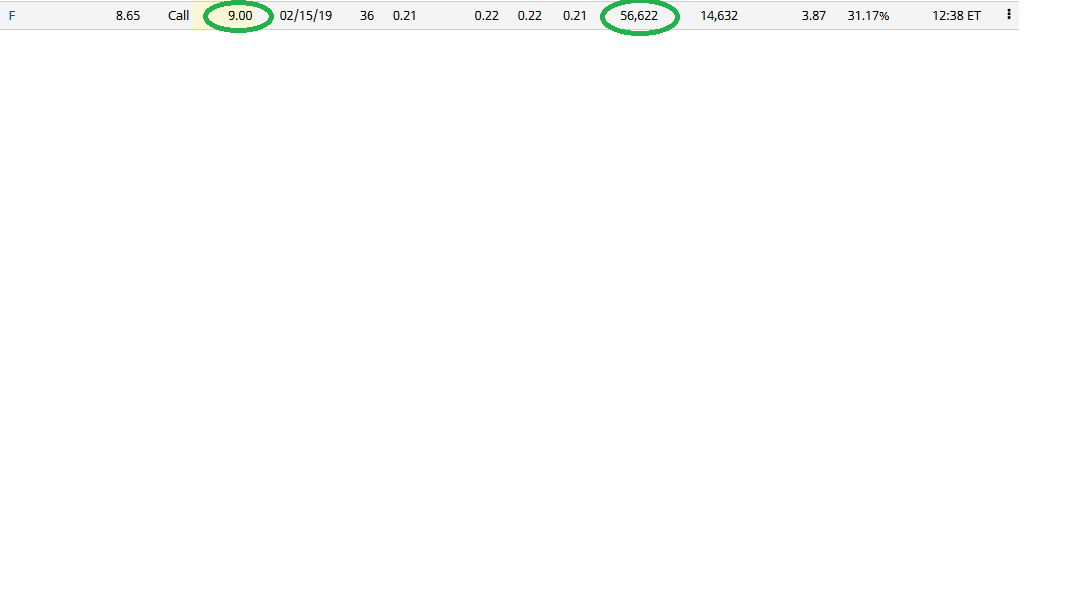

Unusual Option Activity

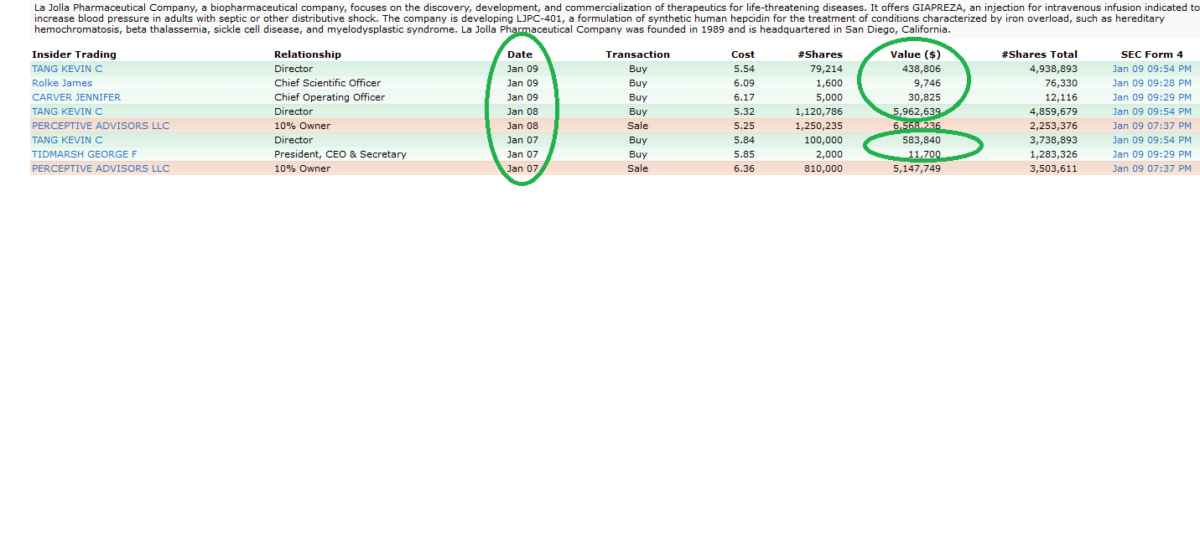

Insider Buying

Insiders seemed unfazed by the additional ~47.7% drop in $LJPC La Jolla Pharmaceutical Company on Jan 7 – as they have been in the market scooping up shares since the company announced preliminary operating Continue reading “Insider Buying”