We’ve spoken about the potential for dividend cuts on banks in recent Podcasts/VideoCasts – and that given how they were trading before the fact (like death) – it could likely be a “sell the rumor, buy the news” event.

Tonight, Wells Fargo announced that it will cut its dividend and announce the magnitude of the cut on the earnings call July 14th (CNBC). Bloomberg has a consensus estimated cut to $.20 from $.51.

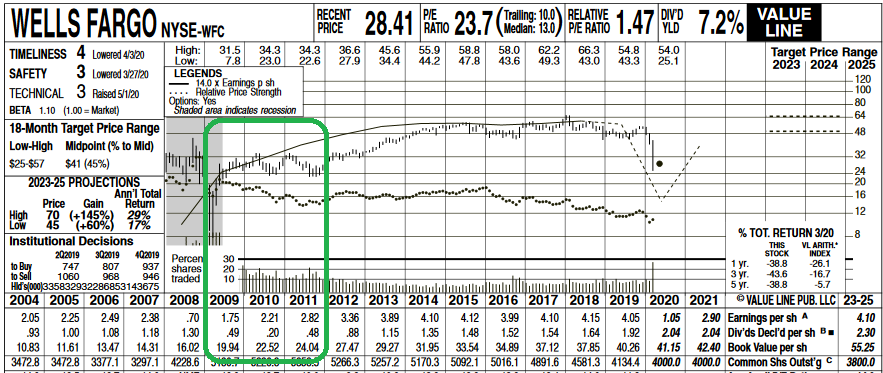

Something to keep in mind regarding the Wells Fargo dividend cap/cut: The last time WFC cut its dividend was Mar 6, 2009 (from $.34 to $.05/share). It marked the bottom of the stock, not the top: SEC Filing (March 6, 2009)

The stock rallied 256% over the next 2 months (sell the rumor, buy the news) – from $5.84 low to $20.80 (see 2009 chart above).

What’s interesting is that it traded right up to its book value after the announcement (~$20/share in 2009). Currently Wells Fargo trades at $25.54 (after hours/announcement). Its current book value is ~$40/share in 2020. We’ll see how it plays out in coming months…

I like owning durable franchises at steep discounts to intrinsic value. We will likely buy more if the opportunity presents itself before earnings. (Opinion, Not Advice – see “Terms” above).