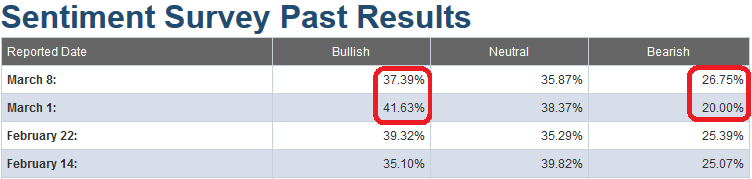

Last week we warned that AAII sentiment was getting extreme with Bullishness above 40% and Bearishness collapsing to 20%. This week we are seeing the Bullishness start to come down and Bearishness start to rise as the market comes in a bit.

Ideally we would like to see the reverse: Bullishness drop to the low 30’s/high 20’s and Bearishness up around 40% before we start considering adding longs opportunistically. How long it takes is unknown (could be next week or longer), but we’ll just wait for the data and adjust accordingly.

As always, AAII is just one of a handful of indicators/oscillators we consider as a barometer to skew the odds in our favor. No indicator/oscillator is foolproof or should be used as a crystal ball. Here is the post from last week which detailed our outlook:

Warning signs from AAII Sentiment Survey results this morning…

If you found this post helpful, please consider visiting a few of our sponsors who have offers that may be relevant to you.