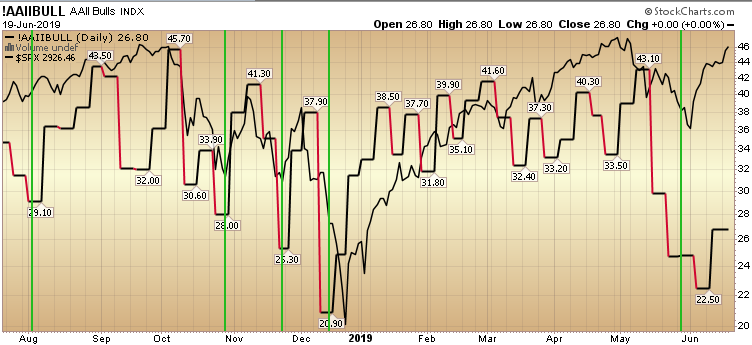

In the last few weeks – as pessimism prevailed in the AAII Sentiment Survey Results – we made the case to get long:

May 30:

AAII Sentiment Survey Results – Pessimism Reigns. What to do about it?

June 6:

June 13:

AAII Sentiment Survey Results Still Favor Bulls (Even After Bounce)

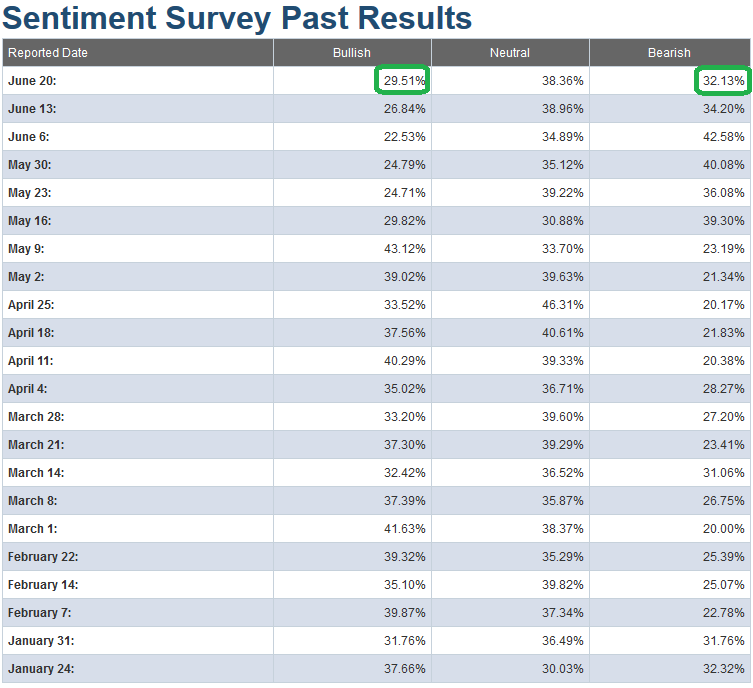

6/20/19 results (AAII):

While pessimism has begun to thaw a bit in today’s results (above), there is still meaningful pessimism in place (Bullish% <30 at 29.51%, Bearish % > 30 at 32.13%). The implication is the market has more room to climb this “wall of worry” and “off sides” institutional positioning from the past three weeks.

The reversal of sentiment/market opportunity is now in its mid-stages and not yet near euphoria that we would need to see in order to consider lightening up.

As with all indicators, they are not foolproof. They should be used in combination with other fundamental and technical factors – as a barometer (not a crystal ball). Always remember, extreme reads can stay extreme but the probabilities don’t favor it here.