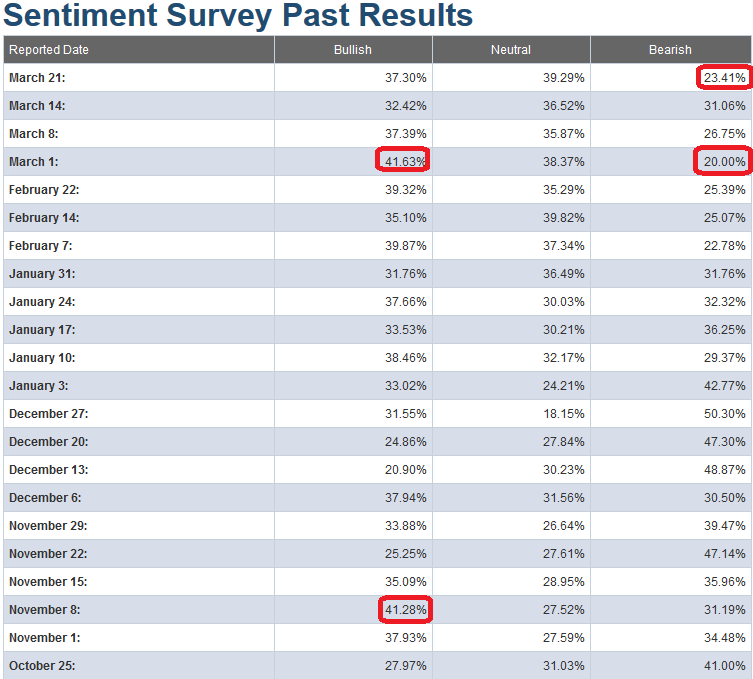

I generally like to pay attention to the AAII sentiment indicator when it is at true extremes. This week the bullish sentiment moved from 32% back up to 37%. I would be a lot more interested if it got over 40% to get aggressively short (versus modestly short/defensive), but it is not there (although a 37 read was certainly enough on December 6, 2018). Couple this with the fact that bearishness did collapse back down to the low 20’s today (23.41% to be exact), which IS an extreme level. Extreme for sure, but not always indicative of a meaningful pullback without the confirmation of bullish percent over 40%.

So that said, we are again in “No Man’s Land” with a tilt toward being cautious/bearish and on alert for a pullback as there is considerable complacency among the bears, despite solid – but not yet exuberant – sentiment among the bulls.

Just because these readings correlated with pullbacks in the recent past does not mean they will do so this time. It does however mean we should be paying attention. It is possible we can burn through these elevated readings and go higher, but the odds don’t favor it. As with all indicators, they are to be used as barometers, not crystal balls.

If you found this post helpful, please consider visiting a few of our sponsors who have offers that may be relevant to you.