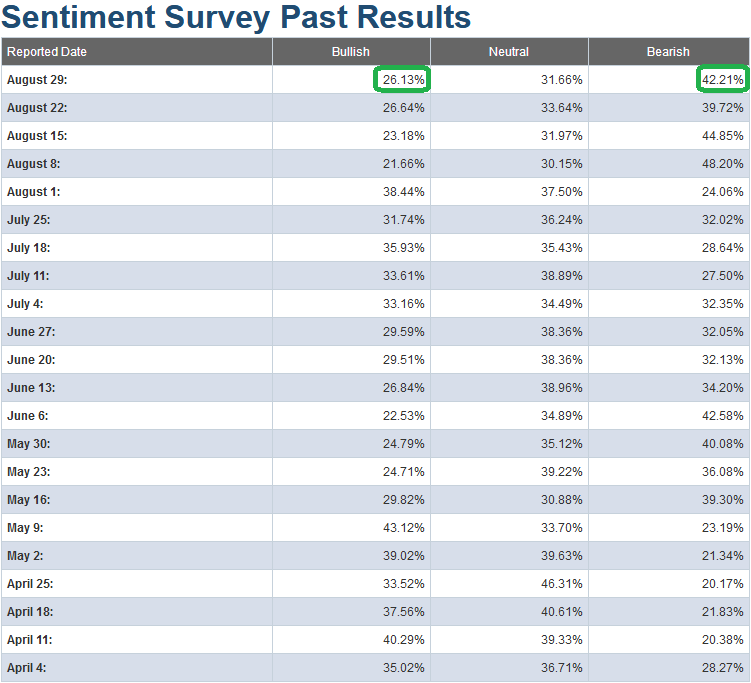

In the last two weeks we made the case that with Bullish Percent so low (now 26.13%) and Bearish Percent high (now 42.21%), history favors stepping in as a buyer – when everyone else is fearful (and underweight equities).

AAII Sentiment Results: Pessimism Persists, Opportunity Abounds…

While the markets have remained in a sideways chop for the past two weeks (with sentiment matching), the story remains the same: historical statistics favor (not guarantee) stepping in as a buyer with sentiment this low.

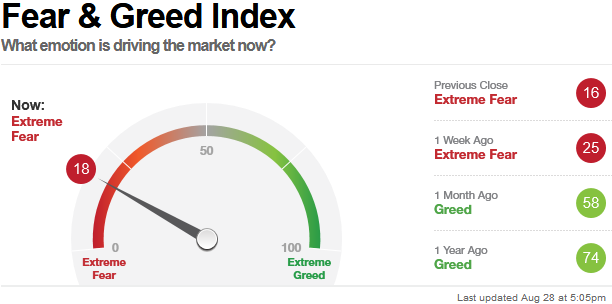

CNN’s Fear & Greed index continues to support the favorability of stepping in long when fear has peaked. It remains in a range that has historically supported being a buyer versus being a seller.

Many of our other indicators are confirming the viewpoint that it pays to be getting some long exposure when pessimism is in this range. We have published a couple of dozen indicators we look at over the past few weeks (each in a ~60 second video so that you not only get the “academic” explanation, but you can see how it applies works/doesn’t work in real life).

https://www.hedgefundtips.com/category/market-indicators/