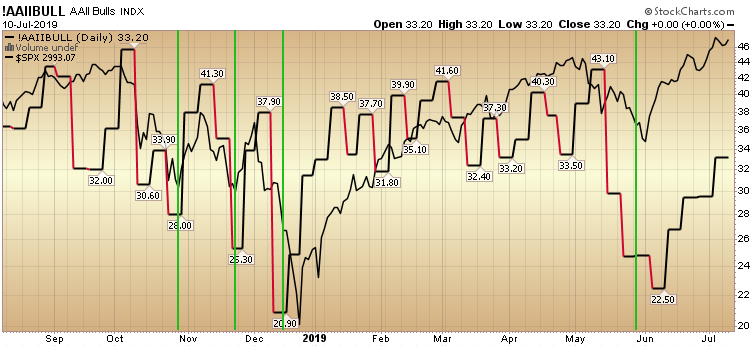

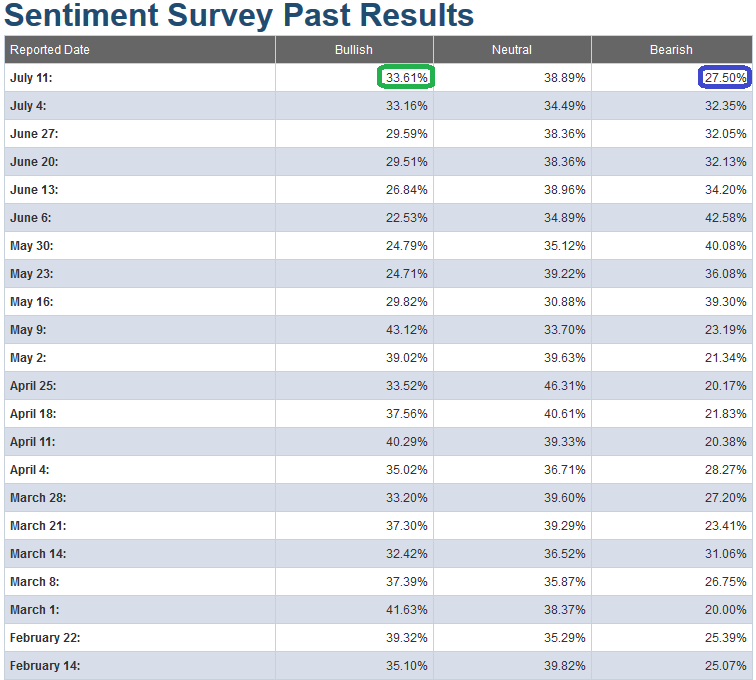

As was the case last week, the wall of worry is so high that the Bullish Percent continues to remain subdued at a paltry 33.61% – barely moving up from last week despite hitting 3000 on the S&P 500 yesterday. So what does this mean? It means that there is more room for the bulls to run higher as we are not yet near euphoric levels. As we get into the high 30’s and low 40’s I would be more inclined to take some profits selectively and lighten up, but we are not there yet – as there is no euphoria.

This mildly warm sentiment is confirmed by CNN’s “Fear and Greed” indicator – which is also at the milquetoast level of 58. We would want to see this indicator in the low 80’s before lightening up. The one development that did show change this week is the fact that the bears dropped from 32.35% to 27.50% which means they are slowly giving up. When they go into full hibernation (in the low 20’s) and start to join the ranks of the Bulls (taking that % up to the high 30’s/low 40’s) we’ll know to start to lighten up and get more defensive (possibly initiating some selective shorts at the time).

The one development that did show change this week is the fact that the bears dropped from 32.35% to 27.50% which means they are slowly giving up. When they go into full hibernation (in the low 20’s) and start to join the ranks of the Bulls (taking that % up to the high 30’s/low 40’s) we’ll know to start to lighten up and get more defensive (possibly initiating some selective shorts at the time).

But for now, as the market ticks up it is forcing all of the institutional cash that was built up in May/June back into the market. Shorts have to cover the new highs, and finally as they initiate longs we’ll have everyone back in the boat – just in time for the trap door to open.

We’ll take it day but day and week by week – but for now, the sentiment data continues to support the bulls.

As with all indicators, they are not foolproof. They should be used in combination with other fundamental and technical factors – as a barometer (not a crystal ball).

If you want to see how we tracked the AAII survey results in previous weeks, click here for last week’s article which has the previous weeks’ links inside:

AAII Sentiment Survey: The Wall of Worry is Steep. Keep climbing!