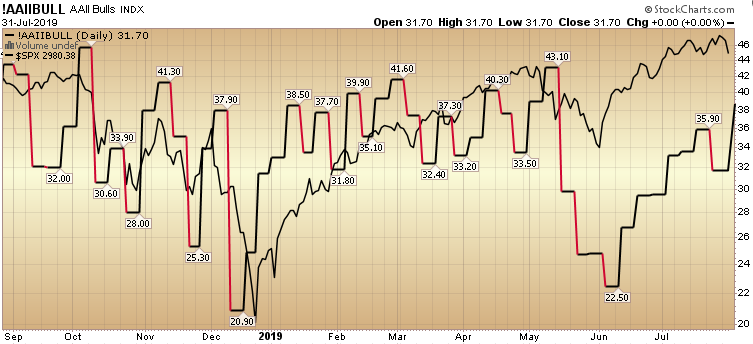

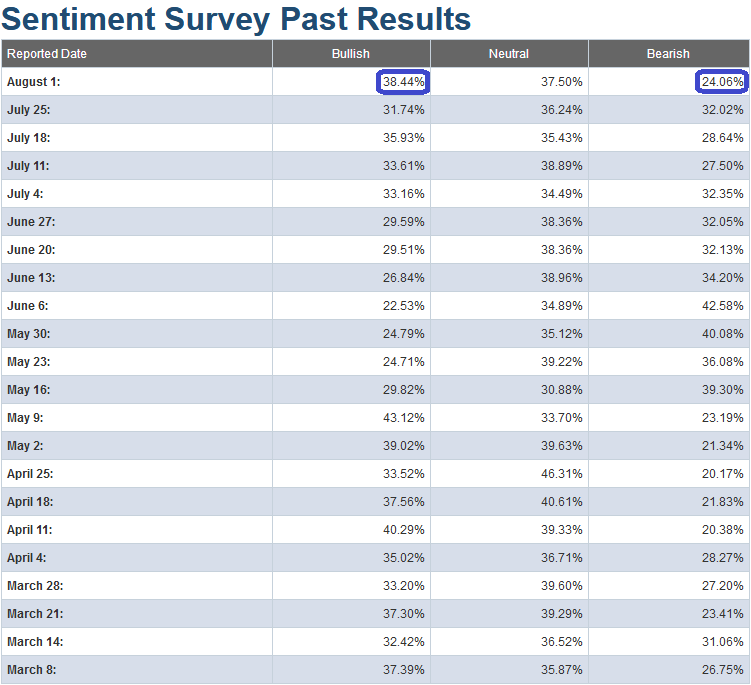

While bullish sentiment jumped in the past week from 31.74% to 38.44%, we likely still have a little room to run. This is not the level that I would be aggressively adding risk (only selectively on laggard names that haven’t participated – if at all). In the lexicon of sell side analysts we are at a “hold.”

As we said in last week’s review, “Once the boat is full again, the trap door can open to abruptly let everyone out without notice, but we are not there yet.”

We are still not quite there, but getting closer to levels where we would start to consider harvesting profits on selected longs that have run. Ideally, we want to see the bullish percent above 40. And once it gets to that level, it does not mean there will necessarily be an abrupt reversal, it simply means the odds favor being on alert – while it runs. Bearish percent did plummet this week implying complacency is returning with only 24.06% bearish.

We have material liquidity now entering the market starting today, so that should be a supportive tailwind to stocks in coming weeks, but we will keep a keen eye on sentiment to make sure we don’t get swept away in a wave of euphoria – if it comes to pass…

Here is an explanation of what the end of “Quantitative Tightening” means moving forward: