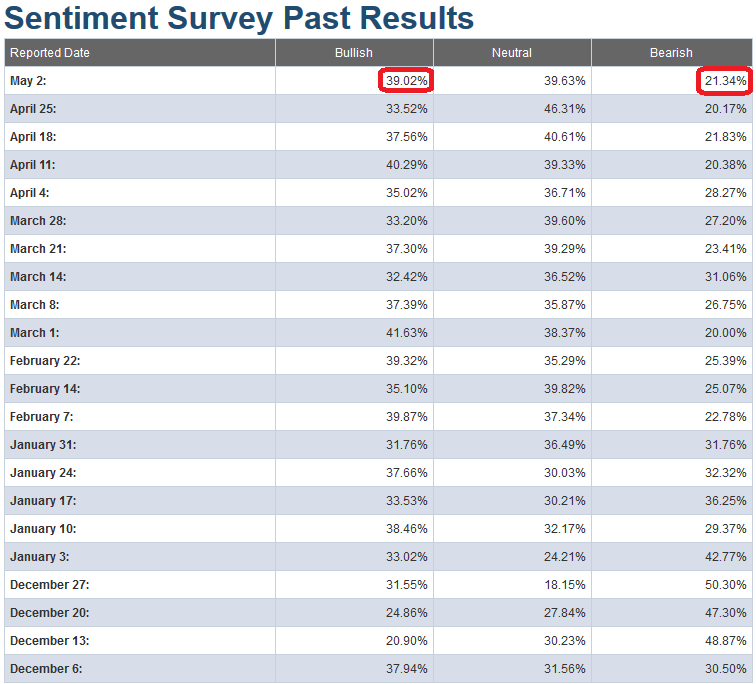

This week, bullishness came in at 39.02% which is near an extreme (I look for reads at or above 40 as potential triggers). Bearishness is still at historic lows – coming in at 21.34% (I look for reads below 30).

So is it time to sell everything and get short? I would lean toward “no”. However, it may make sense to trim some high-beta names and move some long exposure into “defensive” areas like selected healthcare/pharma/larger biotech names that have lagged the broader market. While many of the names have jumped since our recent post, there will be many opportunities in the coming days and weeks to get exposure:

As for shorting the general market here? We’re not at the total extreme I would like to see for a call like that so I will look for specific names that make sense. Generally, I think there is more opportunity to get long in the laggards than pick the right high-beta names to get short (right now). That may change, but right now that’s what the data implies.

The last “extreme” reading came in on April 11 and it burned right through (with a correction in time – sideways, versus price (immediate down)). While that is the exception, it’s also a possibility again – so be selective as no indicator is a perfect crystal ball. They are best used as barometers.

https://www.hedgefundtips.com/aaii-sentiment-survey-results-the-pause-that-refreshes/