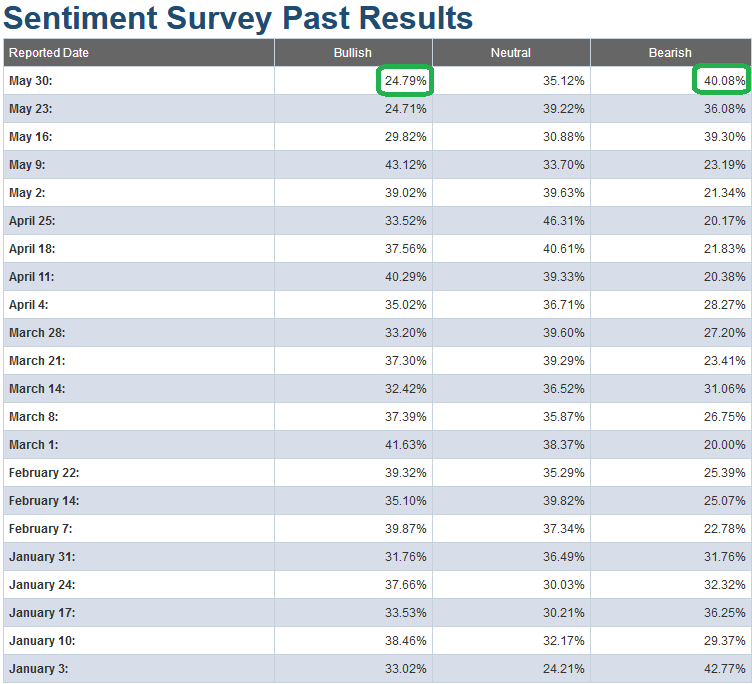

The only things that have changed between last week and this week’s AAII sentiment survey report are:

- We have built a sentiment base below 30 read for “bullish sentiment.”

- Bearishness hit an extreme above 40.

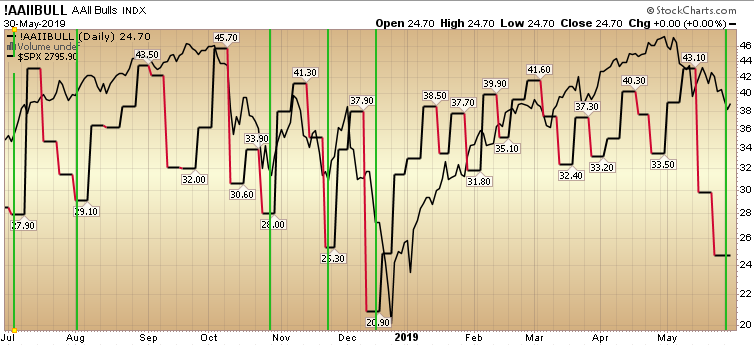

- The market has been basically flat for 11 trading sessions (we are around same levels as May 13 on the SPX).

Here is last week’s report:

Per the chart above it has paid (both in uptrending and downtrending markets) over the past year to buy the market when the AAII bullish percent levels out below 30. The only exception was mid-December when the market went lower after a similar read but quickly recovered. You can compare the chart above with the table below.

As you can see the probabilities favor “fading pessimism” and getting selectively long. As with all indicators, they are not foolproof. They should be used in combination with other fundamental and technical factors. Always remember, extreme reads can stay extreme but the probabilities don’t favor it.