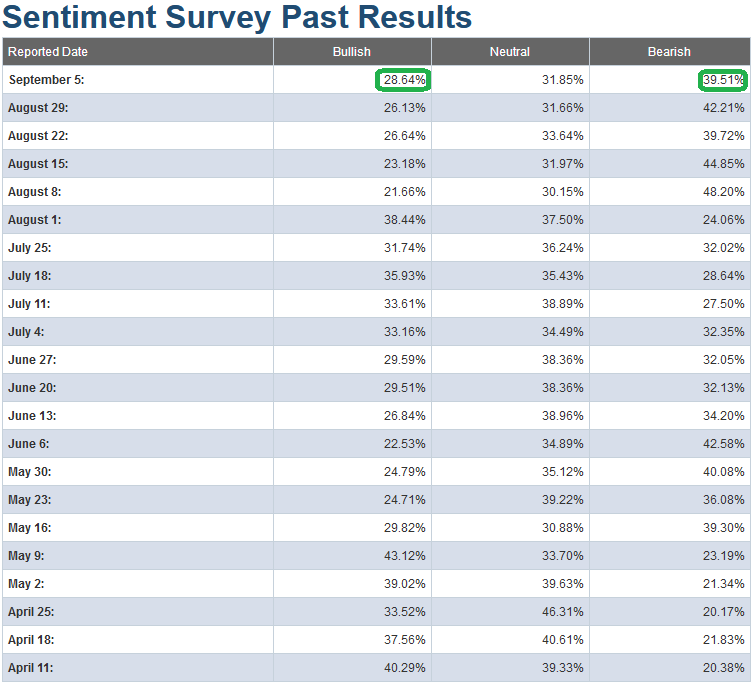

This week the AAII Sentiment Survey results came in slightly improved from last week. Bullish sentiment rose from 26.13% to 28.64% and Bearish Sentiment is beginning to thaw (dropping from 42.21% to 39.51%), but there is still a long runway of opportunity before euphoria starts to take hold – at which time we would become cautious.

Over the past three weeks, we have said that with bullish percent in the mid-twenties (at an extreme fear level), probabilities favored stepping in as a buyer – versus selling when everyone else was dumping stocks to buy bonds:

AAII Sentiment Results: Pessimism Persists, Opportunity Abounds (Part Deux)

While most folks were panicking out of stocks, bond flows (among individual investors) reached a six year high in August. Pessimism readings chopped sideways at an extreme (mid 20’s) along with the stock market.

August AAII Asset Allocation Survey: Highest Fixed-Income Exposure in 6 Years

With sentiment still bearish, probabilities favor doing the opposite of what the crowd is doing. They are rushing out of stocks and into bonds. The opportunity (not guarantee) is to take the other side of the trade (and manage your risk).

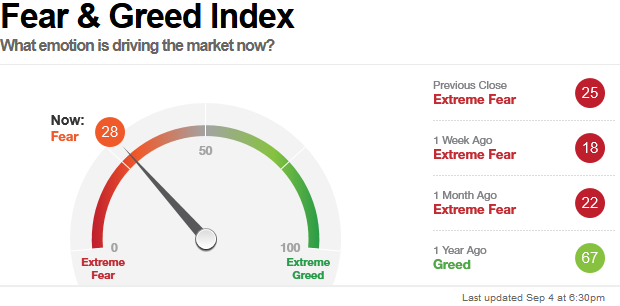

This week’s CNN Fear & Greed indication (above) is confirming this view at a read of 28. It has paid to be a buyer in the mid to low 20’s and a seller in the mid to low 80’s with this confirmatory indicator.

This is one of dozens of indicators we have covered in recent weeks in our “Indicator of the Day in ~60 Seconds” video trainings that you can find here:

Market Indicator Video Library

One of those videos covers the AAII sentiment survey we are discussing in this article. You can watch it here:

The pounding of the drum “late cycle, on the verge of a recession, yield curve inversion” was the narrative of the day in August and early September. Unfortunately for bears (and perma-bears), market tops don’t start with Grandma asking if we are going to have a recession because everyone on TV is talking about the yield curve inverting. When everyone expects the same outcome, odds favor not getting it (right away).

So if tops don’t start with everyone looking for a recession, what does?

Possibly, BLOW OFF tops in which the subsequent 12-24 months (~18 month average) when everyone expects a recession and moves to cash/bonds, the market starts edging up, and the more it edges up, the more managers sweat because they have job risk. Then the market edges up some more and they have to chase and add leverage to catch up to their benchmark, and then you get that average mid 30’s%+ gain (melt up) in less than two years after a 2/10 inversion – before a final top.

At that point the narrative is not “it’s late cycle,” but rather, “this time it’s different, everything looks good, we have new industries emerging, etc.” That is the time that the bears and permabears will make their killing and be able to say they were right all along – if they make it through the blow off/melt up period.

The other factor we have to consider is recency bias. Most managers in my generation (X), are always waiting for the next shoe to drop because that’s all we know. Just when things get going BOOM, tech wreck. You recover from that, feeling a bit better and BOOM financial crisis (two of the biggest crashes since before we were born in the early/mid-1970’s and prior to that early to mid-1930’s).

So of course when things get going we look for the big tsunami to wipe it all out – BUT, what if the next recession is milder than expected? What if it’s along the lines of an early 1990’s flavor and unemployment goes to 7% instead of 10%+? What if the 85 million millennials – who are just starting housing formation – drive the bus from 2020-2040 like the 80 million baby boomers who drove the bus from 1980 to 2000 did? What if much of the volatility of the past 19 years was driven by the drop in housing formation (aggregate demand) as my generation was only 65 million relative to the baby boomers that preceded us with 80 million? Why were the global central banks around the world able to print ~$10 Trillion to overcome this generational demand drop and yet have no meaningful inflation during the same period?

In other words, be open to the possibility that the next recession – whether it comes in 1, 2 or 4 years is mild and what comes after that could be a period that my generation has never seen before and the baby boomers know it’s what made them rich. Maybe the biggest risk is not waiting for the next shoe to drop, but forgetting to put your running shoes on…