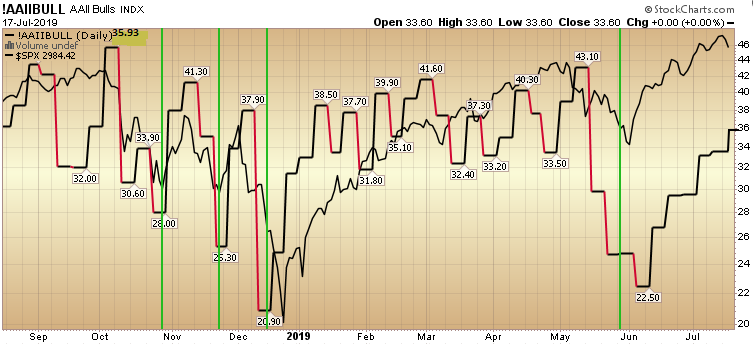

Data Source: AAII

While the market indices all made new highs this week, sentiment did not. This is a hated rally because most institutions were caught offsides in May/June and raised too much cash.

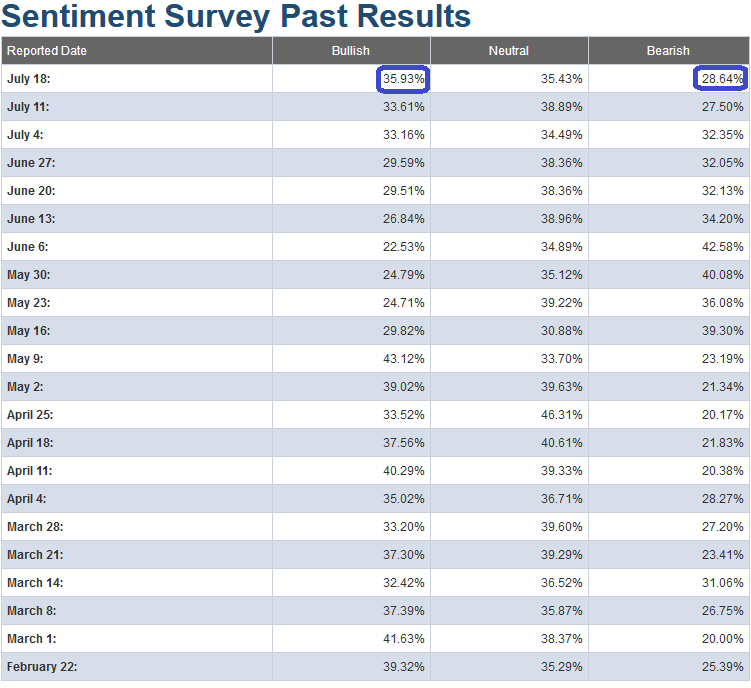

AAII bullish sentiment edged up to 35.93% which is not an extreme reading (high to mid 40’s level is). Surprisingly, bearishness ticked back up to 28.64% from 27.5% last week. This shows that the skeptics are still lurking – which is fuel to move even higher before it becomes time to get defensive again. We really want to see the bears capitulate to the mid/low 20’s before starting to adjust positioning on a short term basis.

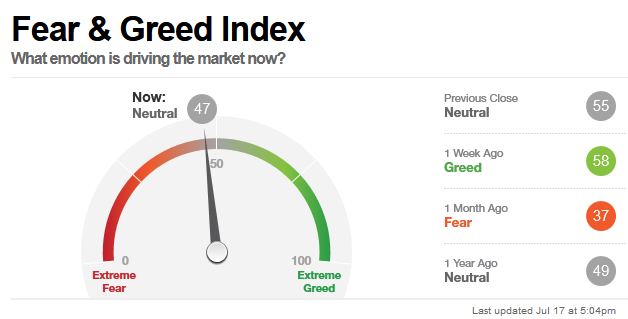

Of additional note is the fact that the CNN Fear & Greed index ticked back materially from the high 50’s to the high 40’s in the past week. This short term indicator is confirming that not everyone is back in the boat yet and that there is more room to run until we get closer to euphoric levels where it pays to lighten up, get defensive and potentially add some selective shorts.

So for the time being, the probabilities favor holding what you have and selectively getting long laggard industries/names that haven’t yet participated but are starting to look healthier. There will be a time to take profits and lighten up, but it does not appear that time has come as of yet.

We’ll take it day but day and week by week – but for now, the sentiment data continues to support the bulls.

As with all indicators, they are not foolproof. They should be used in combination with other fundamental and technical factors – as a barometer (not a crystal ball).

If you want to see how we tracked the AAII survey results in previous weeks, click here for last week’s article which has the previous weeks’ links inside: