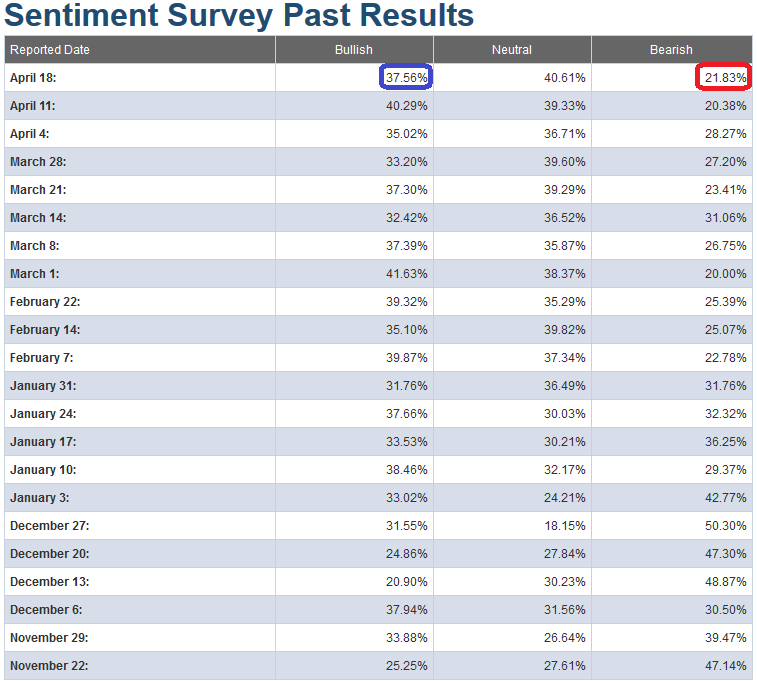

Last week we got an extreme read on sentiment which is frequently correlated with market pullbacks:

Warning signs from AAII Sentiment Survey results this morning (out of “No Man’s Land”)

We are now a week later and have gone sideways off the trigger (no pullback yet). The implication is that we either turn soon, or it is going to burn through this extreme in an atypical fashion.

The red vertical lines in the chart above correlate with those dates in which bullish sentiment hit an extreme level (>40) while bearish sentiment was subdued (~<30). You can see the inflection points and what happened. It has not yet happened this time and would need to happen soon for the trigger to be valid in this instance.

As with all indicators, they are to be used as barometers, not crystal balls. We take trades based on favorable statistical odds, not absolutes, which is why risk management is paramount to winning over a series of trades.