The AAII sentiment survey measures the percentage of individual investors who are bullish, bearish, and neutral on the stock market short term; individuals are polled from the AAII Web site on a weekly basis.

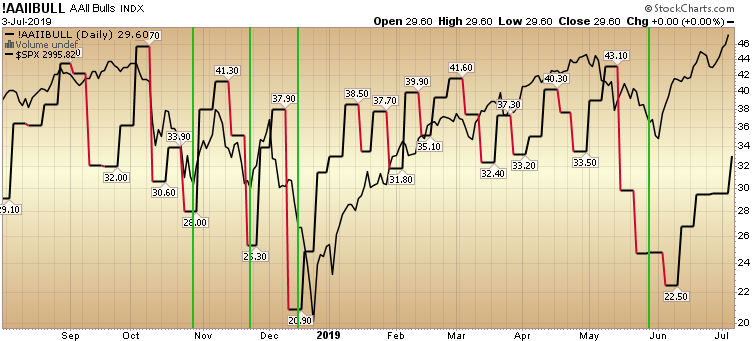

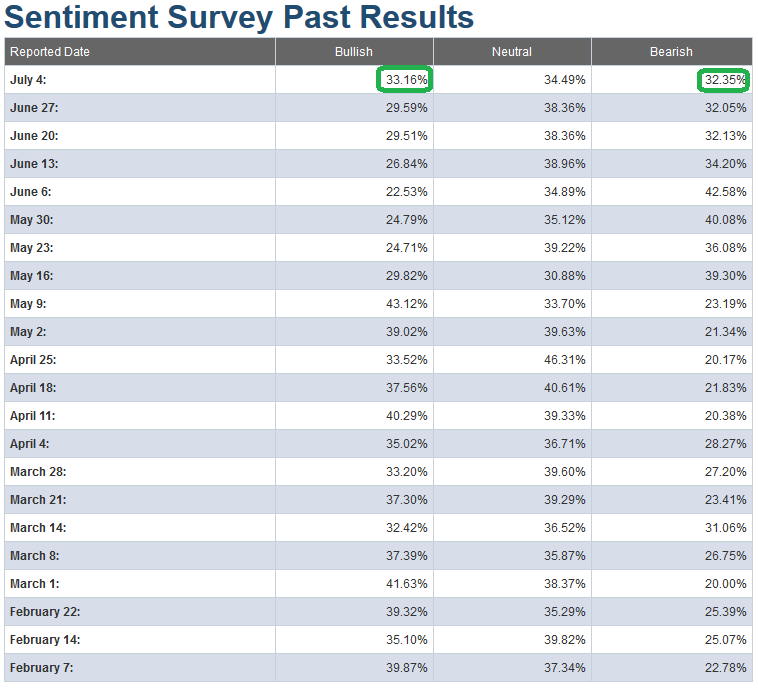

I was amazed to wake up this morning and find that we had made record highs on all three major indices and sentiment is mixed! I had fully expected Bullish Sentiment to be up around 37 or 38 and I would have said, “not the time to add aggressively, but rather hold what you have.” Instead, Bullish Percent came in just slightly above last week at 33.16 – which is still the lower end of the range. The implication? People don’t trust this rally as many were caught offsides in June. Rather than adjust from getting caught flat footed, they insist they are right and even try to short against the new trend doubling down on a bad idea – versus get out and wait for the tides to turn.

The implication? People don’t trust this rally as many were caught offsides in June. Rather than adjust from getting caught flat footed, they insist they are right and even try to short against the new trend doubling down on a bad idea – versus get out and wait for the tides to turn.

This happens to every single trader at some point in their career. It’s part of the right of passage – or the cost of education. The key is to learn from it and not keep repeating the same mistakes. “Being right” is too costly when the market is telling you you are wrong. Every trader/investor gets this lesson multiple times during their careers.

The persistent pessimism in the market makes sense as data has been slowing. The natural inclination is to extrapolate the most recent occurrence (that is fresh in mind) into the future, but that’s not how the market works. The market is a discounting mechanism, and it is currently discounting a few rate cuts (lower discount rate used to value future earnings/cashflow). Right now, future earnings estimates and cashflow are orders of magnitude better for the next 12 months than they were for the past 12 months. See my recent article here:

Rear View Mirror: Sideways Earnings = Sideways Price. Windshield View?

So what’s the takeaway from this week? Until Bullish sentiment gets up to the high 30’s/low 40’s and bearish sentiment plunges below 30, this market should continue to climb the wall of worry . We are probably 60-70% into this bounce at present (which means the probabilities continue to favor holding longs and adding only very selectively). You can follow along with what we have been saying for the last few weeks of data points here:

AAII: As Pessimism Persists, The Wall of Worry (to climb) Remains Intact.

As with all indicators, they are not foolproof. They should be used in combination with other fundamental and technical factors – as a barometer (not a crystal ball).