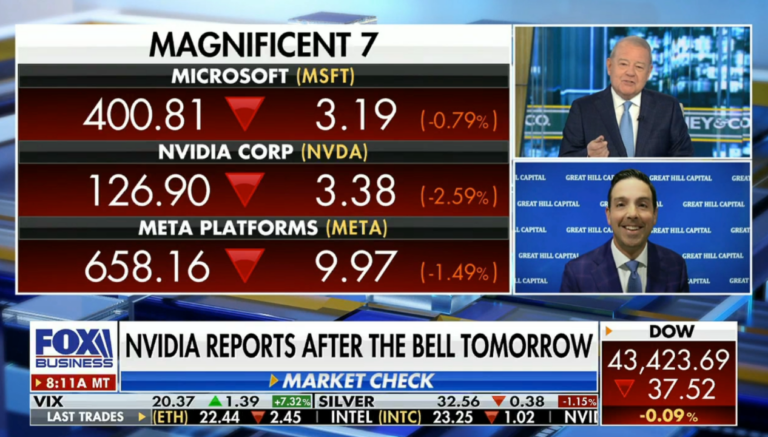

Thomas J. Hayes is the Founder, Chairman and Managing Member of Great Hill Capital, LLC – a long/short equity money manager based in New York City. Great Hill Capital, LLC runs a concentrated equity Hedge Fund strategy for Qualified HNW/UHNW individual clients, Family Offices and Institutions.

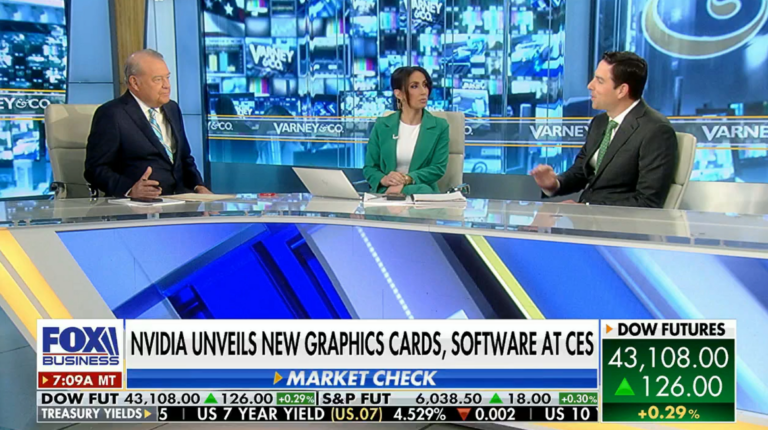

Tom has been Featured On Fox Business TV, CNBC, BBC, Yahoo! Finance TV, Wall Street Journal, Barron’s, Bloomberg, CNBC Asia, New York Post, Fortune, NYSE TV, CGTN America, Financial Times, Reuters, MarketWatch, U.S. News & World Report, Kiplinger, TheStreet, CNA Asia, ZeroHedge, Inside Futures, BarChart, Seeking Alpha, Fidelity and other venues.

Contact Tom Here

Tom Hayes – CV/Bio (Below Images):

Thomas started Hedge Fund Tips® – HedgeFundTips.com – as a platform to share actionable insights, tips and research for Hedge Funds, Institutions and Individual Traders to benefit from – based on what he has learned in his years of experience in the Hedge Fund industry. A free 21- trial membership and description is available here: FREE TRIAL | TESTIMONIALS

On a weekly basis, Tom publishes his timely stock market commentary, “Hedge Fund Tips with Tom Hayes” VideoCast and Podcast. It has a wide following in the investment management, hedge fund and media community. It is the #1 top-ranked podcast by Feedspot in the Hedge Fund category.

PROFESSIONAL INVESTMENT EXPERIENCE

Great Hill Capital, LLC

Chairman and Managing Member

New York, NY

January 2015 – Present

Long/Short Equity Strategy for accredited investors and qualified institutions.

Responsible for generating investment ideas and managing portfolios.

Cornwall Capital Management, LP

Commodity/Equity Research Consultant

New York, NY

January 2013 – January 2015

The firm predicted the 2008 credit crisis (featured in Michael Lewis’ Book/Movie, “The Big Short”) Offered position after generating 500% return short trade (long puts) on Soybeans late summer/fall 2012.

Responsible for generating actionable investment ideas/trades (Commodities, Equities, Currencies) with derivatives expression.

Bedford Oak Advisors, LLC

Managing Director

Mt. Kisco, NY

January 2009 – January 2013

Long/Short Equity Hedge Fund

Responsible for generating investment ideas for portfolio and co-managing fund positions/business.

Wright Investors’ Service Holdings f/k/a NPDC Chief Operating Officer

Mt. Kisco, NY

February 2011-January 2013

$27mm public cash shell controlled through a fund at Bedford Oak Advisors, LLC (Bedford Oak owned ~33% of common equity outstanding). Mario Gabelli (Chairman & CEO of GAMCO, Ticker: GBL) owned ~13%. Dr Phillip Frost (Fmr. Chairman of Teva Pharmaceutical Industries, Ticker: TEVA) owned ~10%.

Charged with the responsibility to analyze and restructure shell – over two years – through managing the sale of non-core assets.

Sourced, negotiated and signed up the deal (purchase of Wright Investors’ Service $1.6B AUM – Asset Manager).

Generated 100% return for owners/doubled Company net worth in 18 months.

Board Position: Town of Ridgefield, CT Pension Commission

January 2017 – January 2025 (multiple-terms)

Appointed by Board of Selectmen

Responsible for overseeing ~$140MM pension investments for municipal employees.

EDUCATION

Columbia University – Bachelor of Arts

HOBBIES

Family Time, Golf, Reading, Watching Daughters’ Water Polo Games and Swim Meets, Hockey, Movies, Playing Cards with Friends, Exercise