Key Market Outlook(s) and Pick(s)

On Monday, I joined Taylor Riggs on Fox Business “Claman Countdown” to discuss Alibaba, Apple, and Emerging Markets. Thanks to Taylor, Liz, Jack Regan, and Jack Mack for having me on:

On Tuesday, I joined Stuart Varney on Fox Business “Varney & Co” to discuss general markets, DOGE, earnings, and guidance. Thanks to Stuart, Christian Dagger and Preston Mizell for having me on:

On Wednesday, I joined Kenny Polcari on his Yahoo! Finance show “Trader Talk” to discuss tariffs, stock market, and my favorite Italian dish (at the end)! Thanks to Kenny for having me on:

Watch full show in HD directly on Yahoo! Finance

Bank of America Fund Manager Survey Update

On Tuesday, we put out a summary of the monthly Bank of America “Global Fund Manager Survey.” This month they surveyed 205 institutional managers with ~$482B AUM:

Here were the 5 key points:

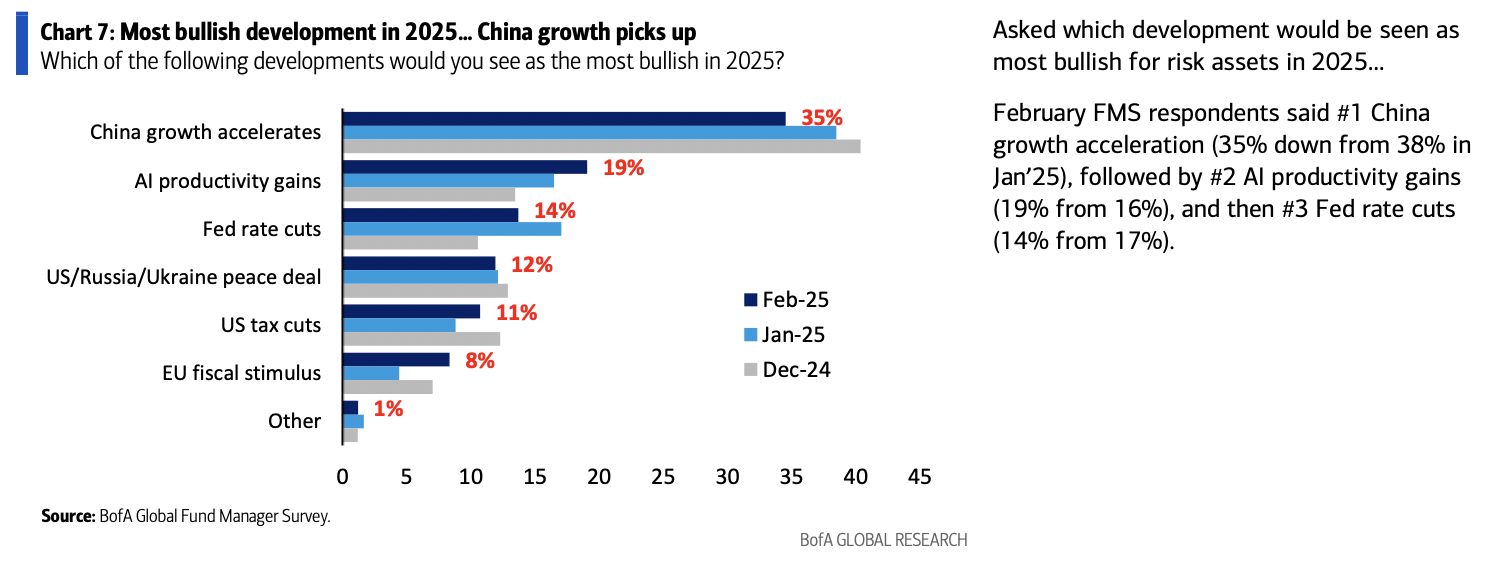

1) The most bullish development for 2025 remains China’s growth acceleration:

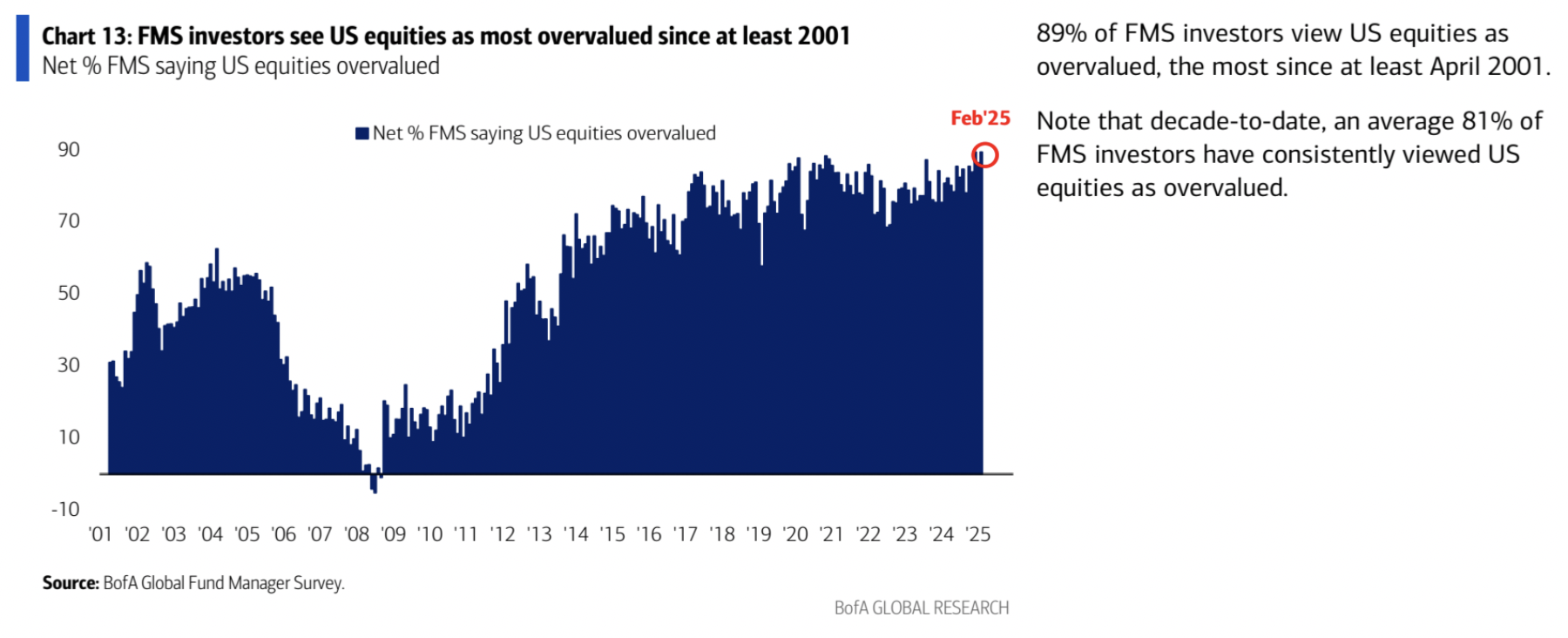

2) Managers’ view U.S. equities as the most overvalued since at least 2001:

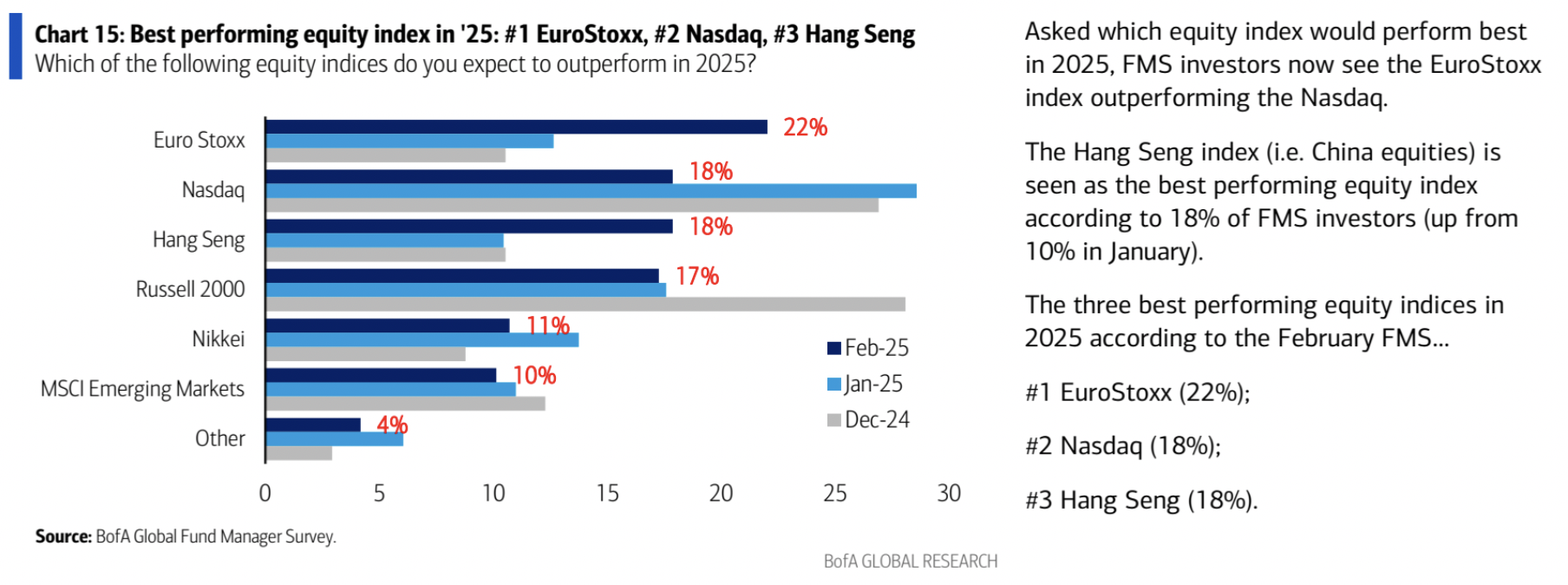

3) The Euro Stoxx Index is now expected to be the top-performing equity index in 2025:

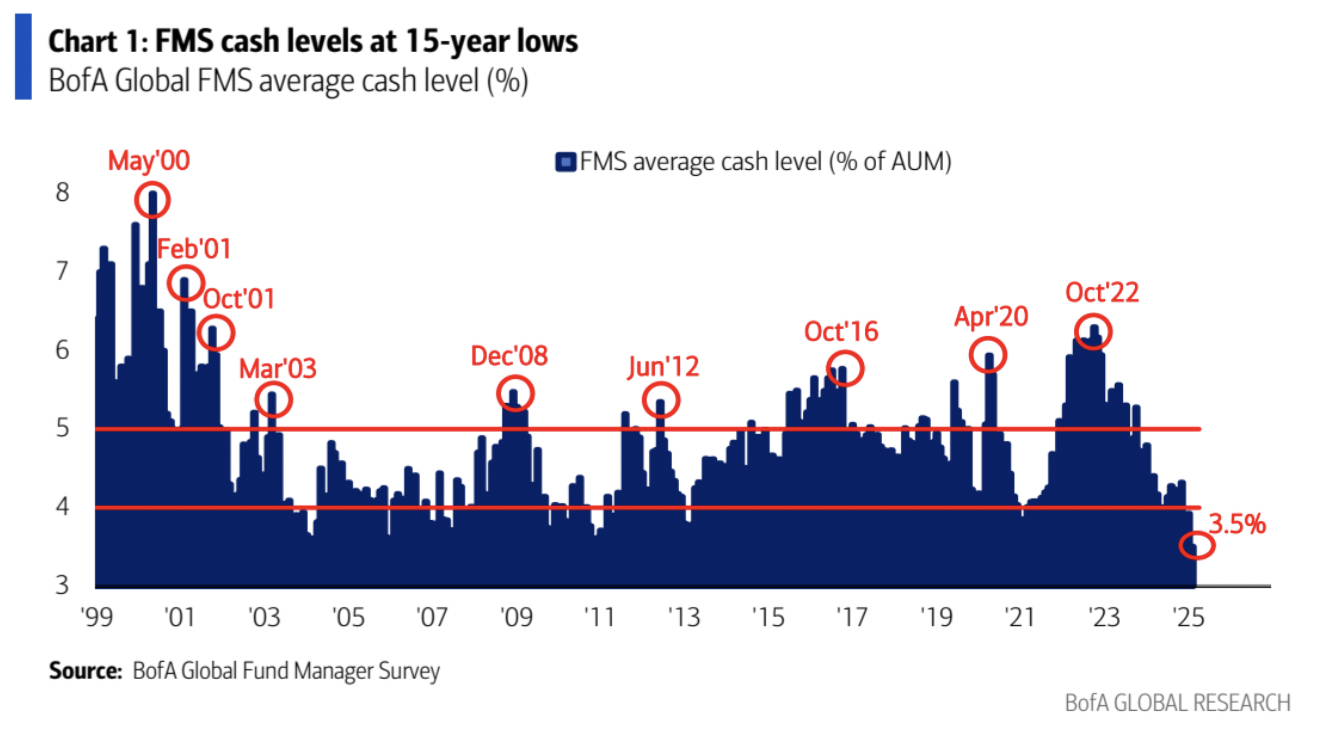

4) Managers’ cash levels drop to 15-year lows:

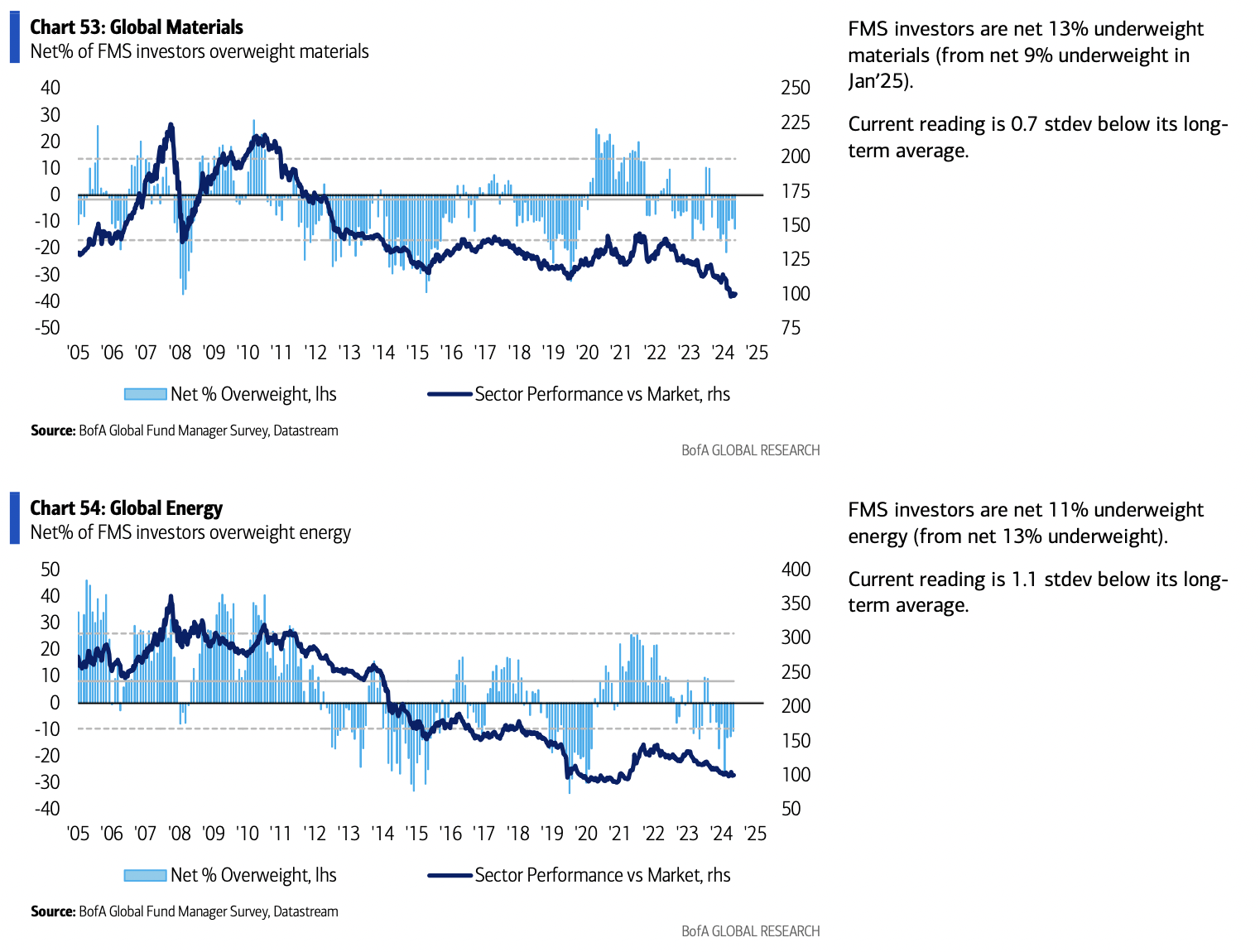

5) Managers remain dramatically underweight Materials and Energy:

GXO Logistics Update

Each week we try to cover 1-2 companies we have discussed in previous podcast|videocast(s) and/or own for clients (including personally).

Earnings Results

Key Takeaways

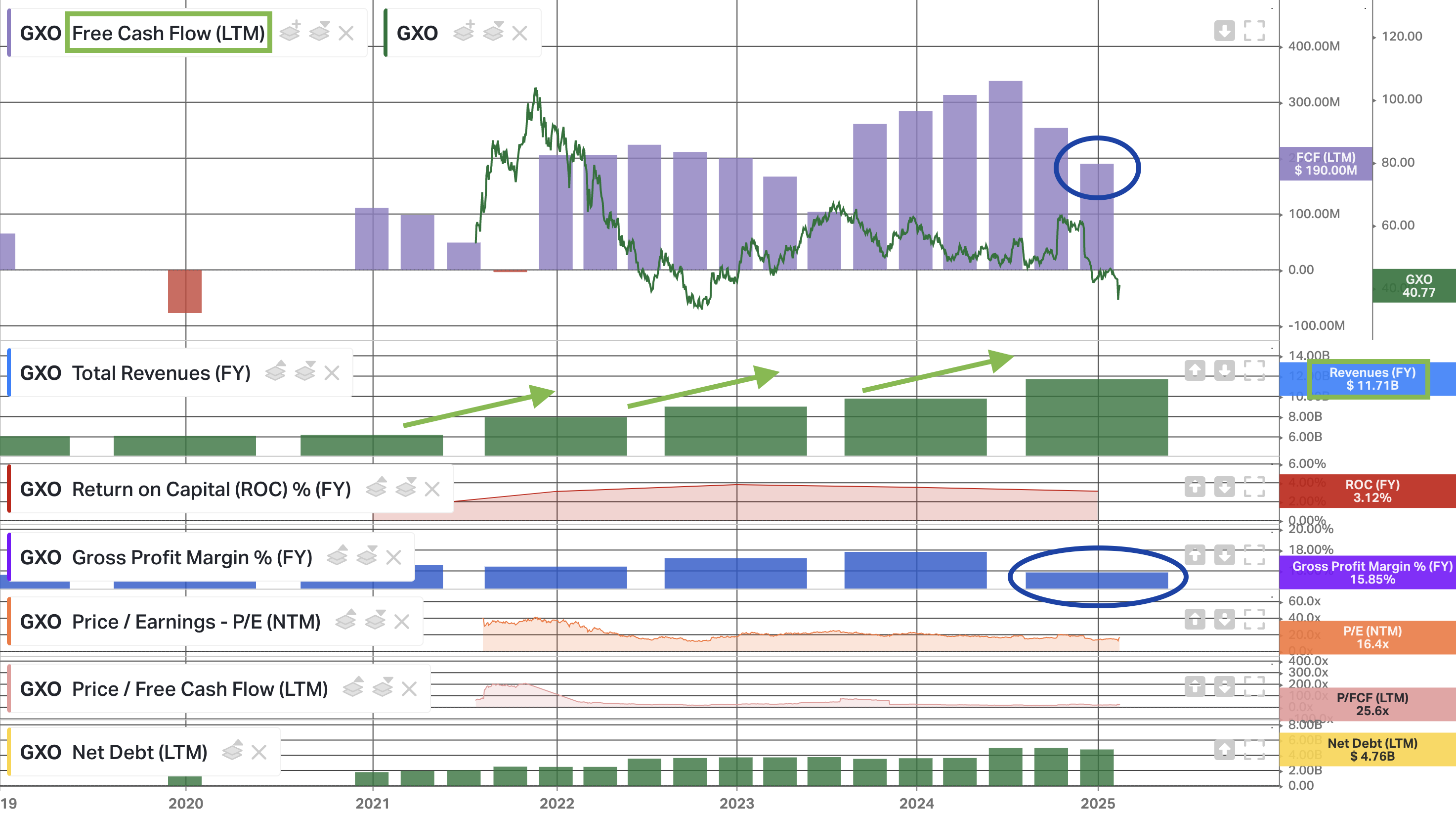

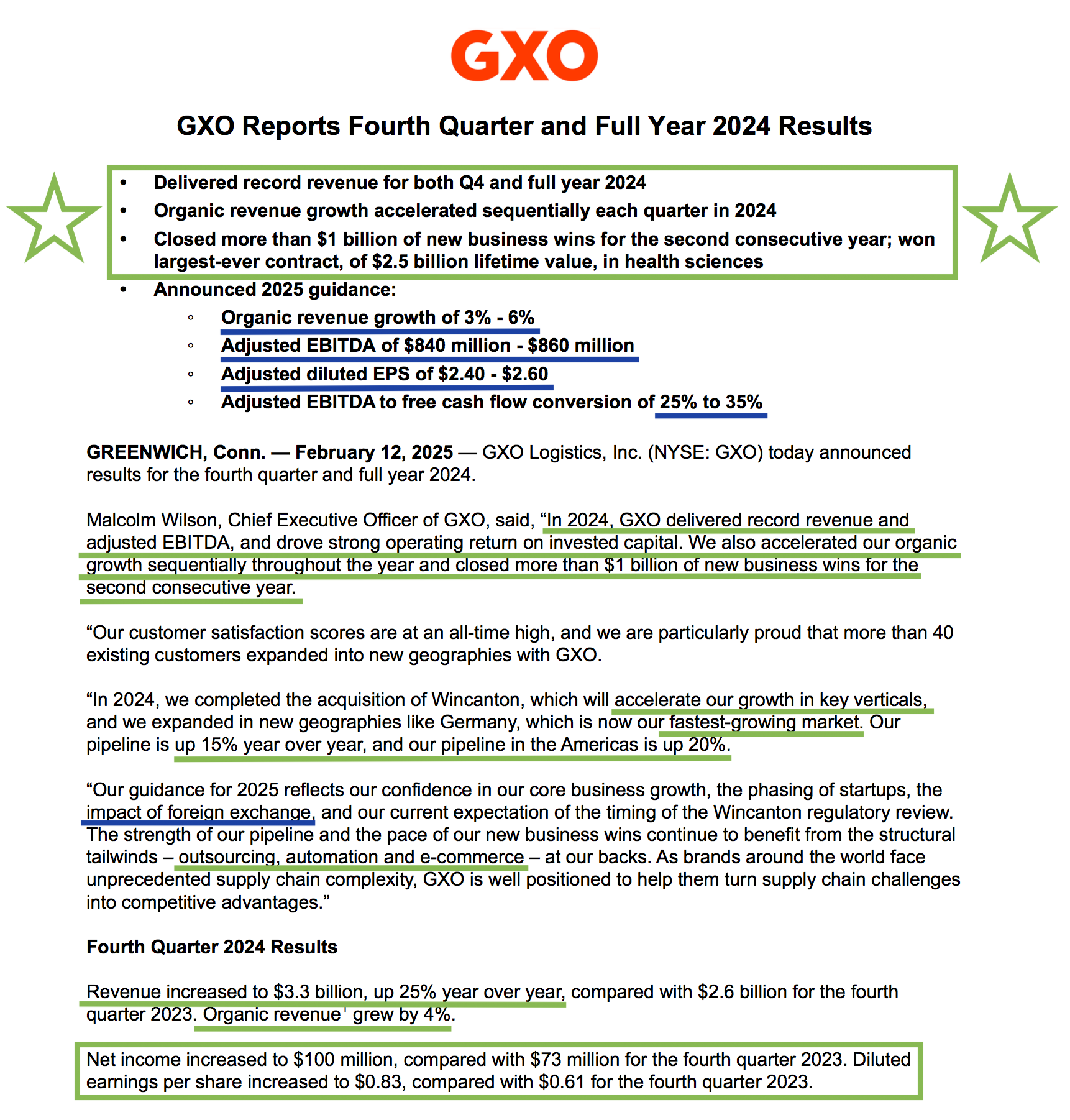

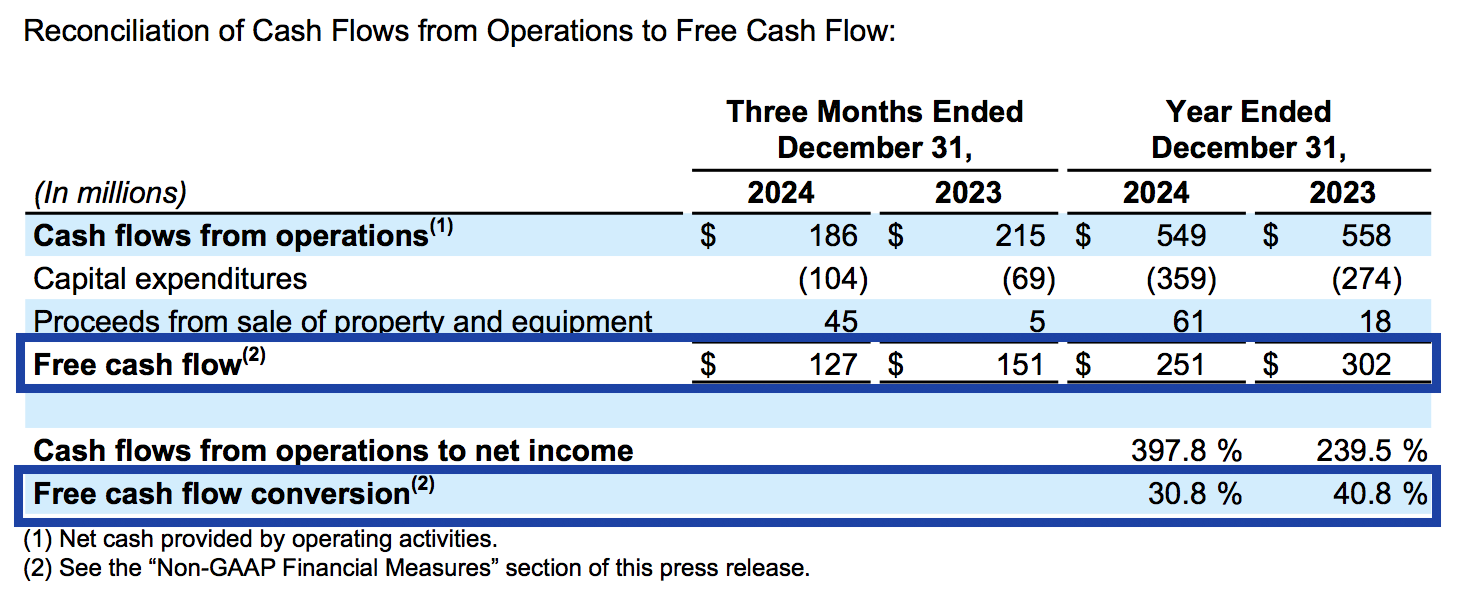

GXO reported Q4 earnings last week. Here are the key highlights:

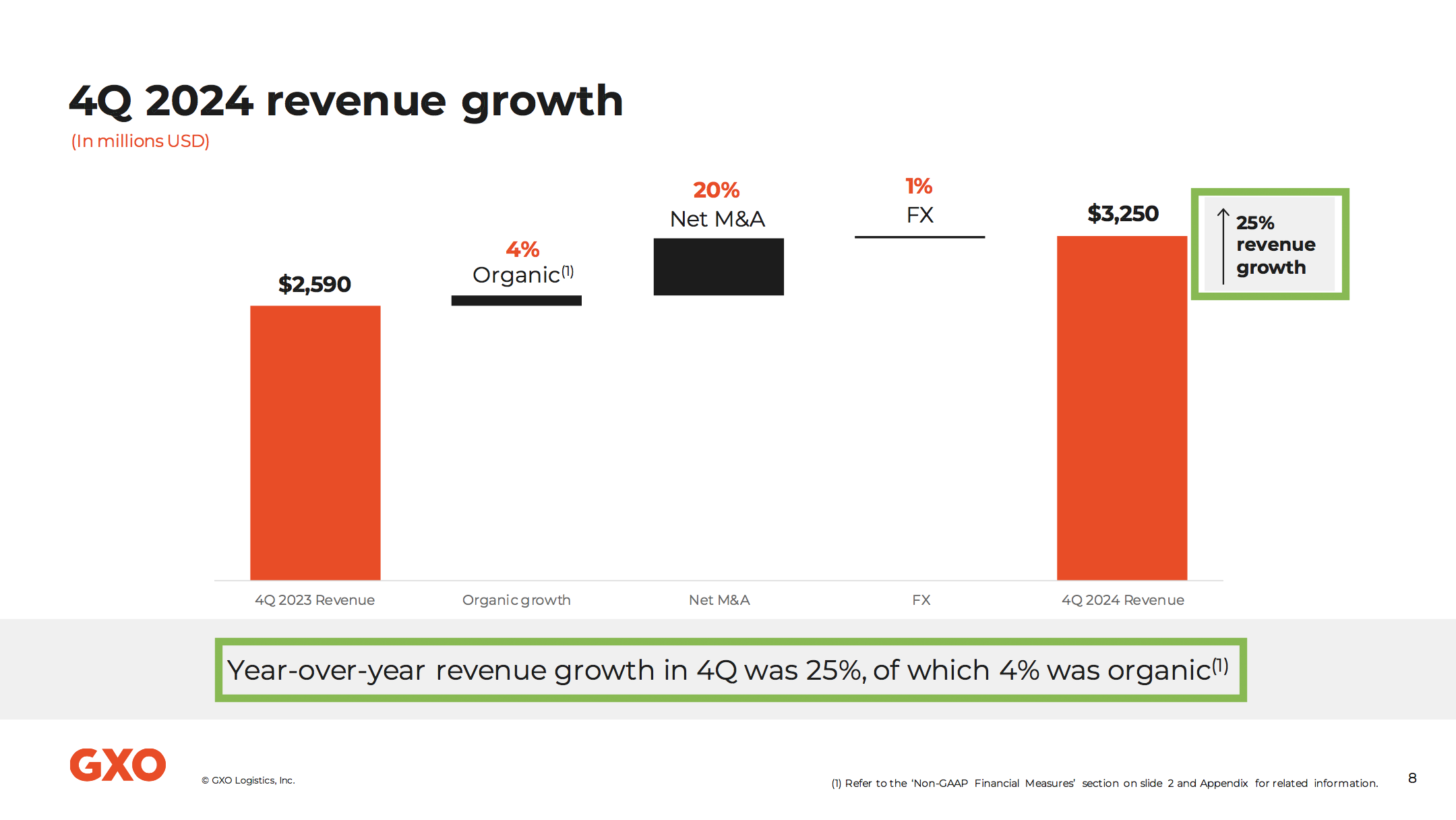

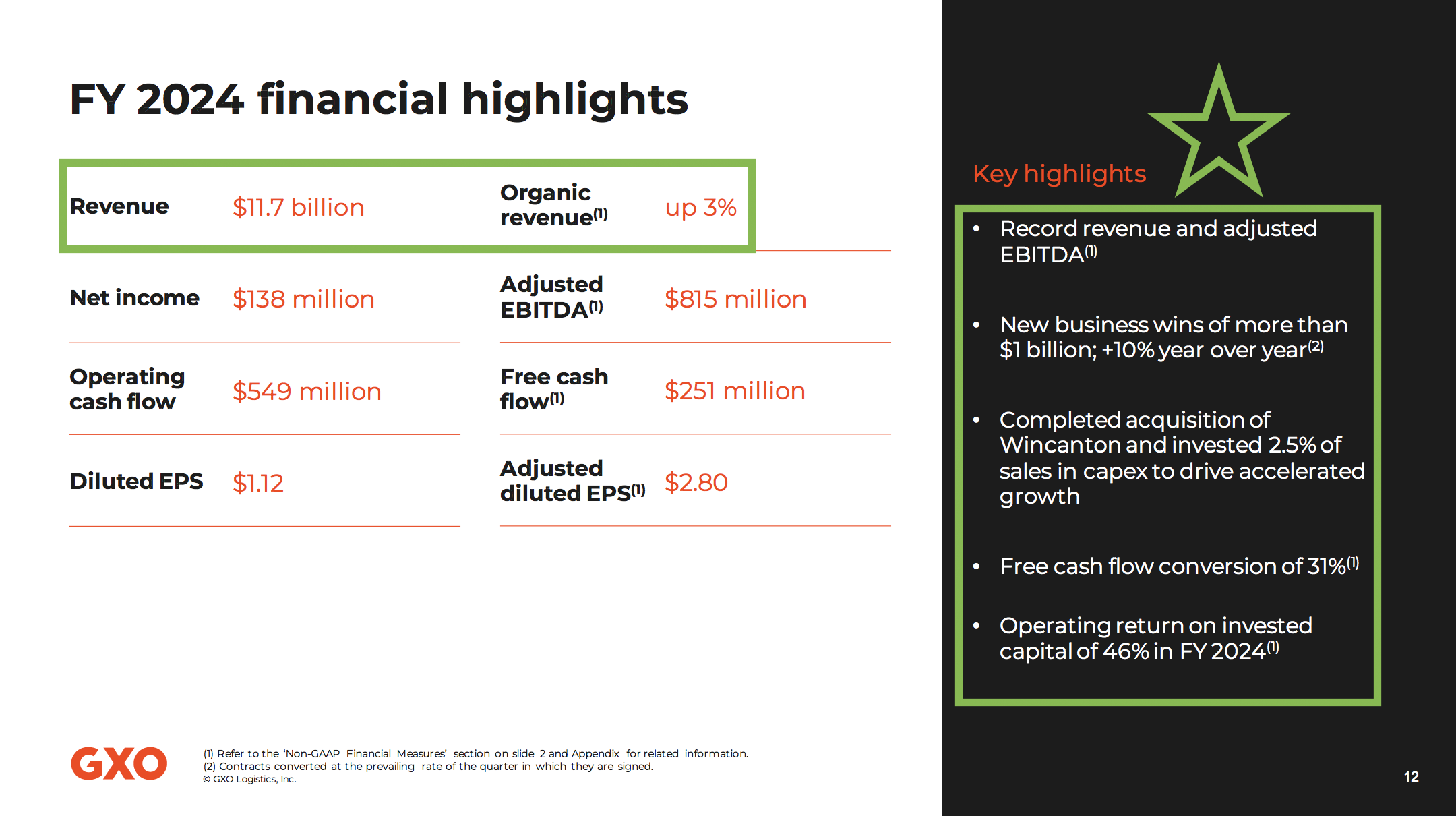

- Revenue of $3.25B (+25% YoY), beating estimates by $50M

- Non-GAAP EPS of $1.00, beating estimates by $0.05

- Record revenues for both Q4 and the full year, with total revenues of $11.7B, up 19.7% YoY, including 3% organic growth

- Organic growth accelerated sequentially throughout 2024, reaching 3.9% in Q4

- Over $1B in new business wins for the second consecutive year, up 10% YoY

- Secured the largest contract in company history—a $2.5B lifetime value deal in health and sciences—driven by synergies from the 2022 Clipper acquisition

- Germany emerged as the fastest-growing market, with revenue up 60% YoY, highlighting another successful geographic expansion synergy from the Clipper acquisition

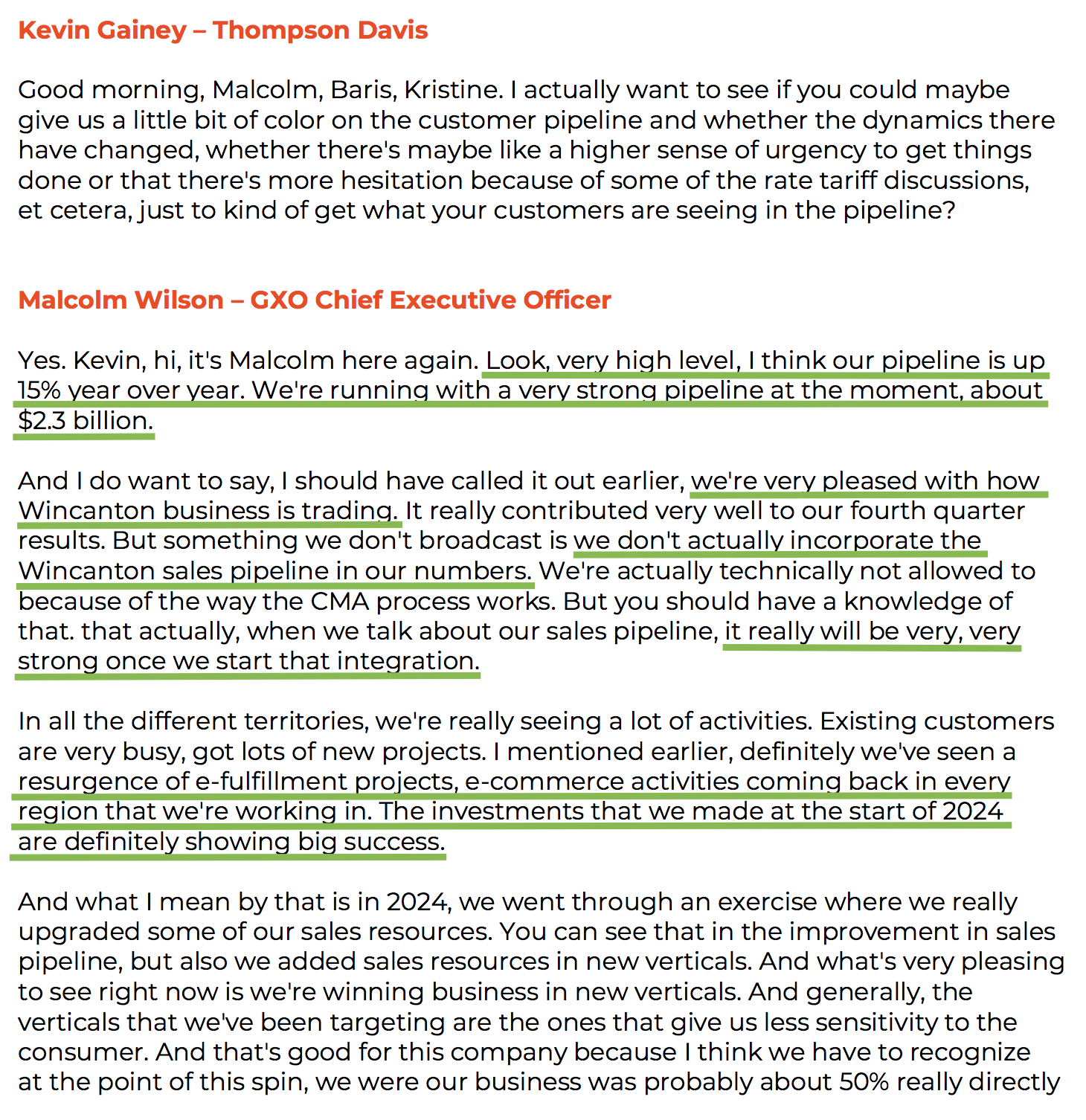

- Total sales pipeline increased 15% YoY to $2.3B, excluding Wincanton’s pipeline

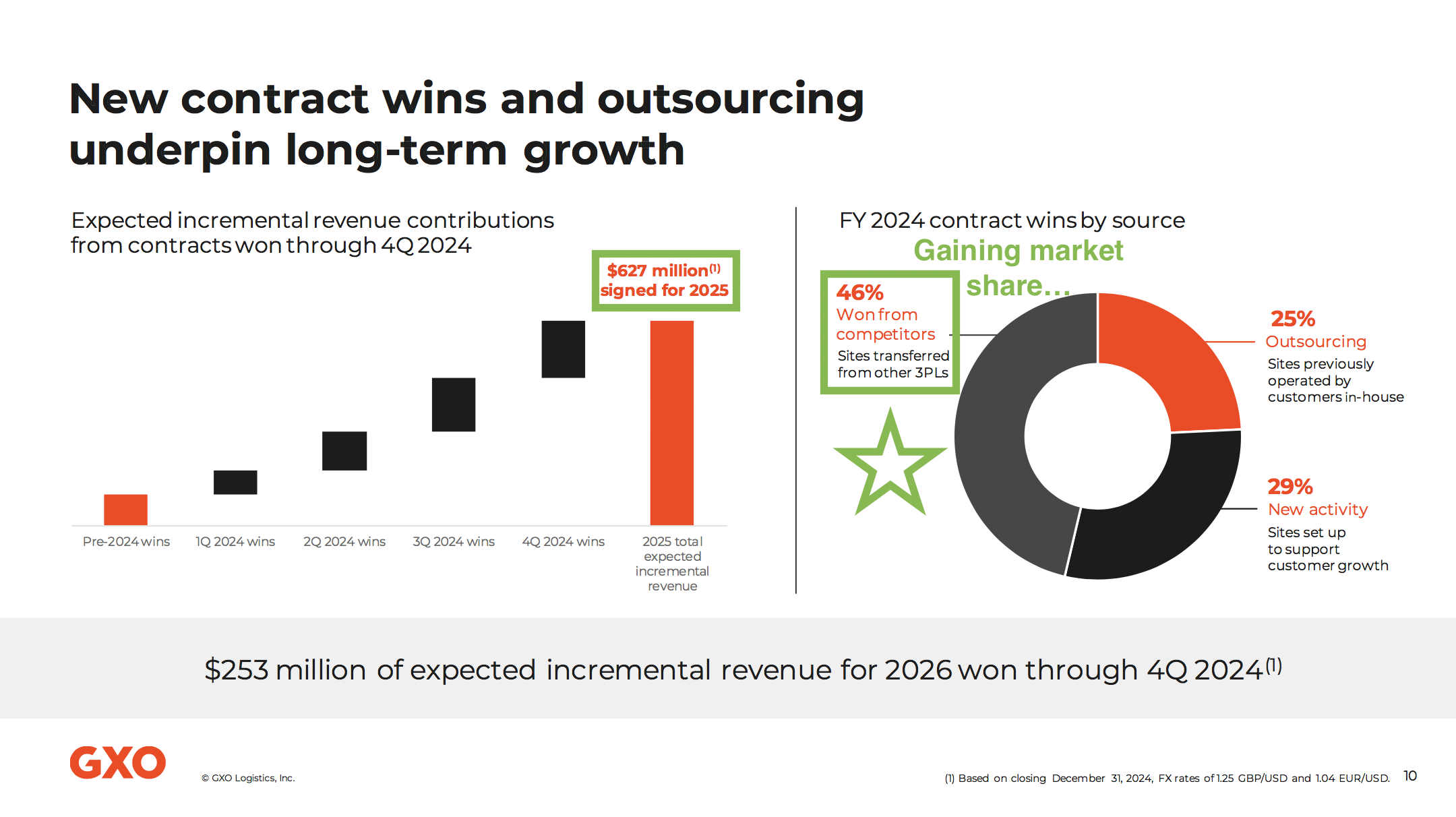

- $627M of incremental FY2025 revenue already booked through Q4, with average contract length exceeding the long-term average of 5 years and 10% higher than this time last year

- Continued market share gains, with 46% of new contracts being site transfers from competitors

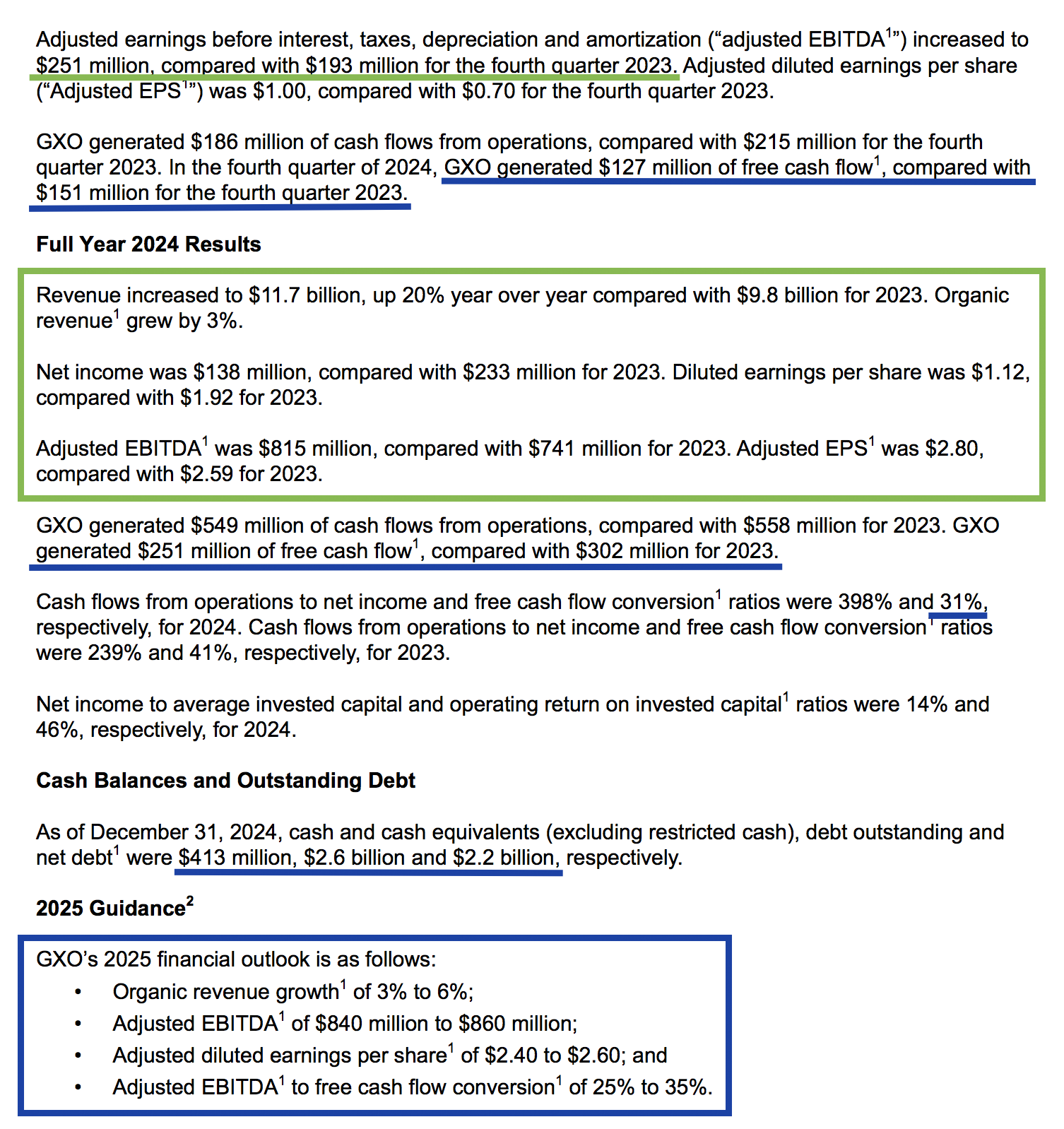

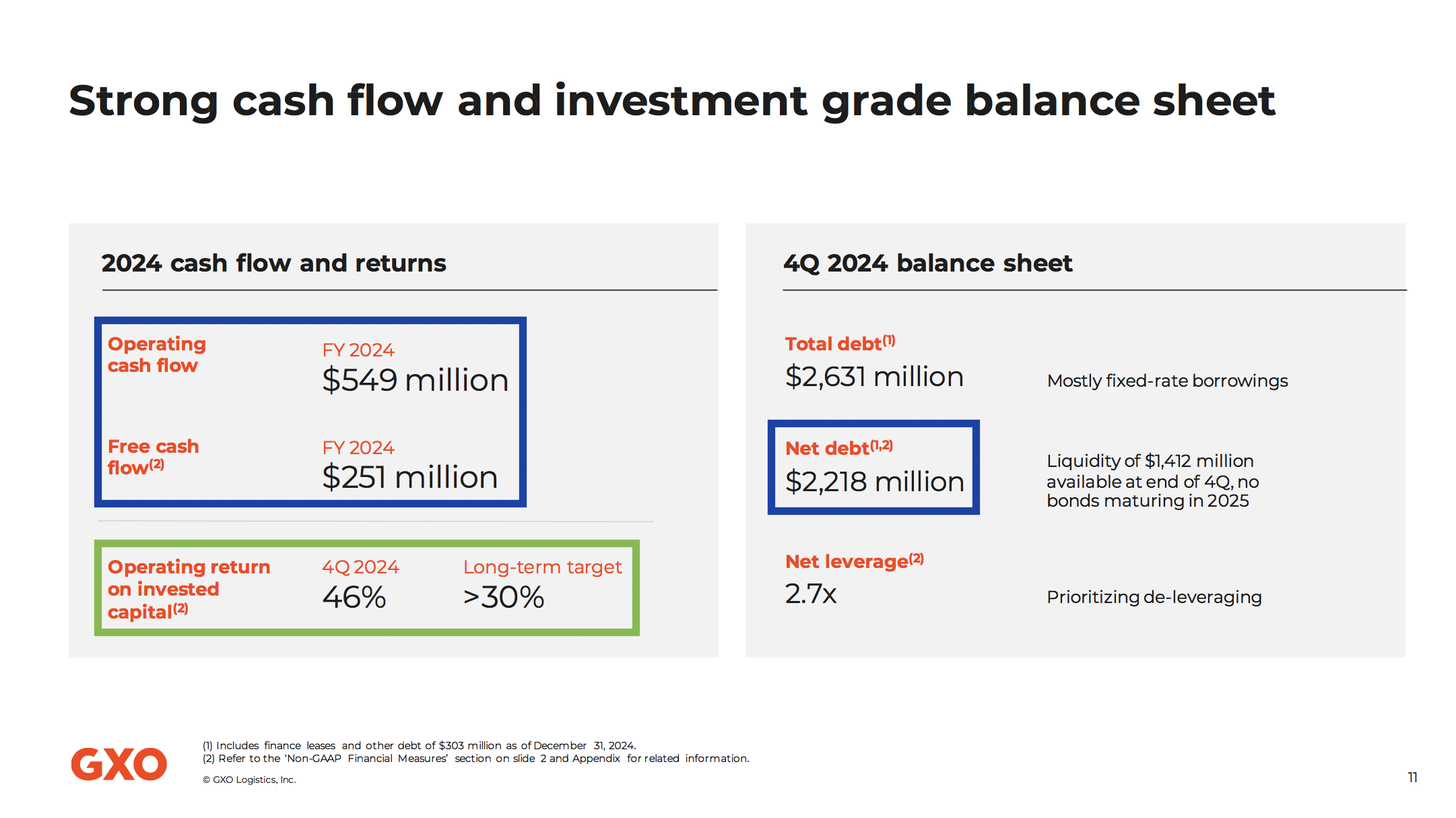

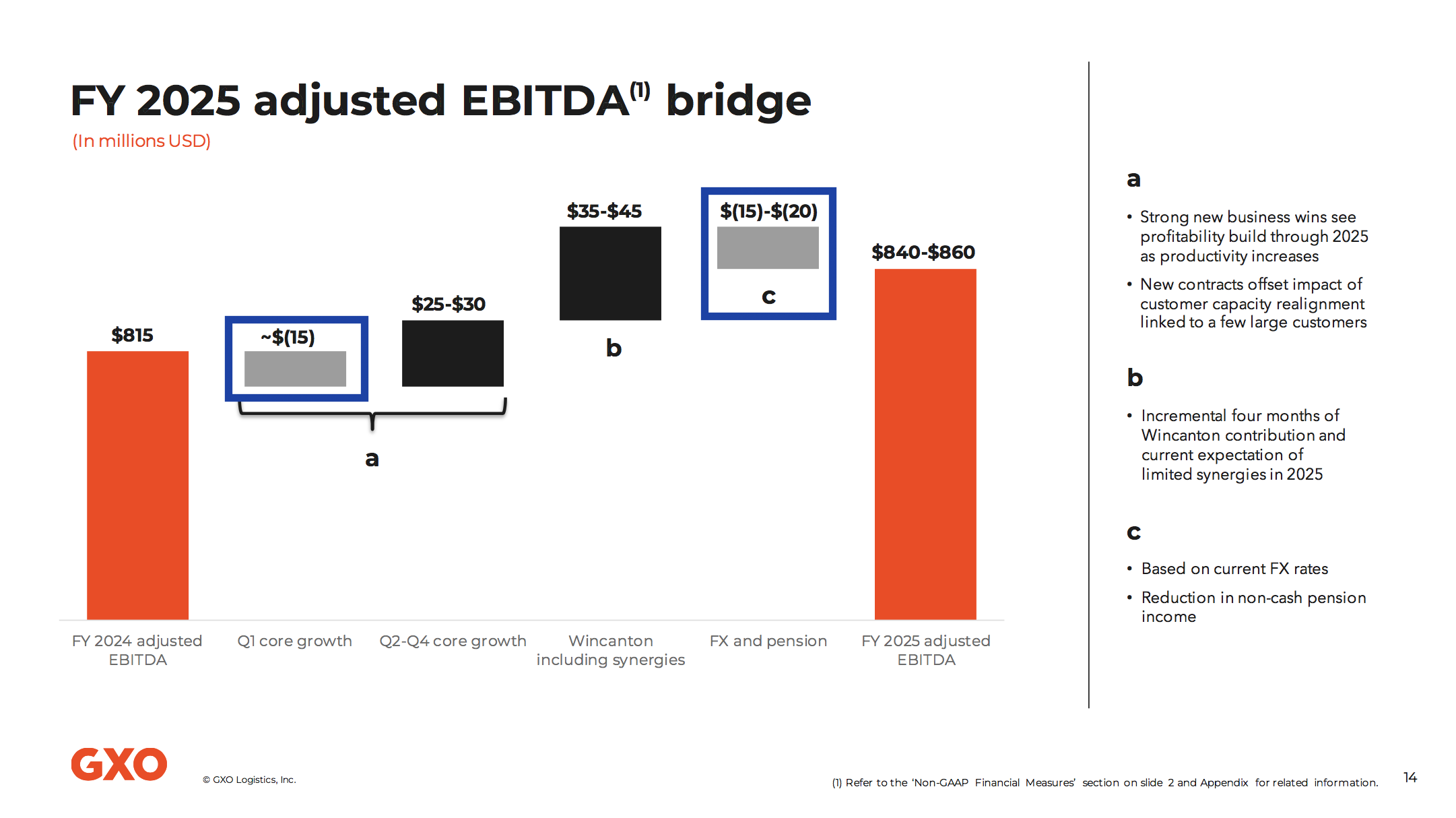

- Adjusted EBITDA of $815M (7% margin), meeting the midpoint of the previously raised guidance

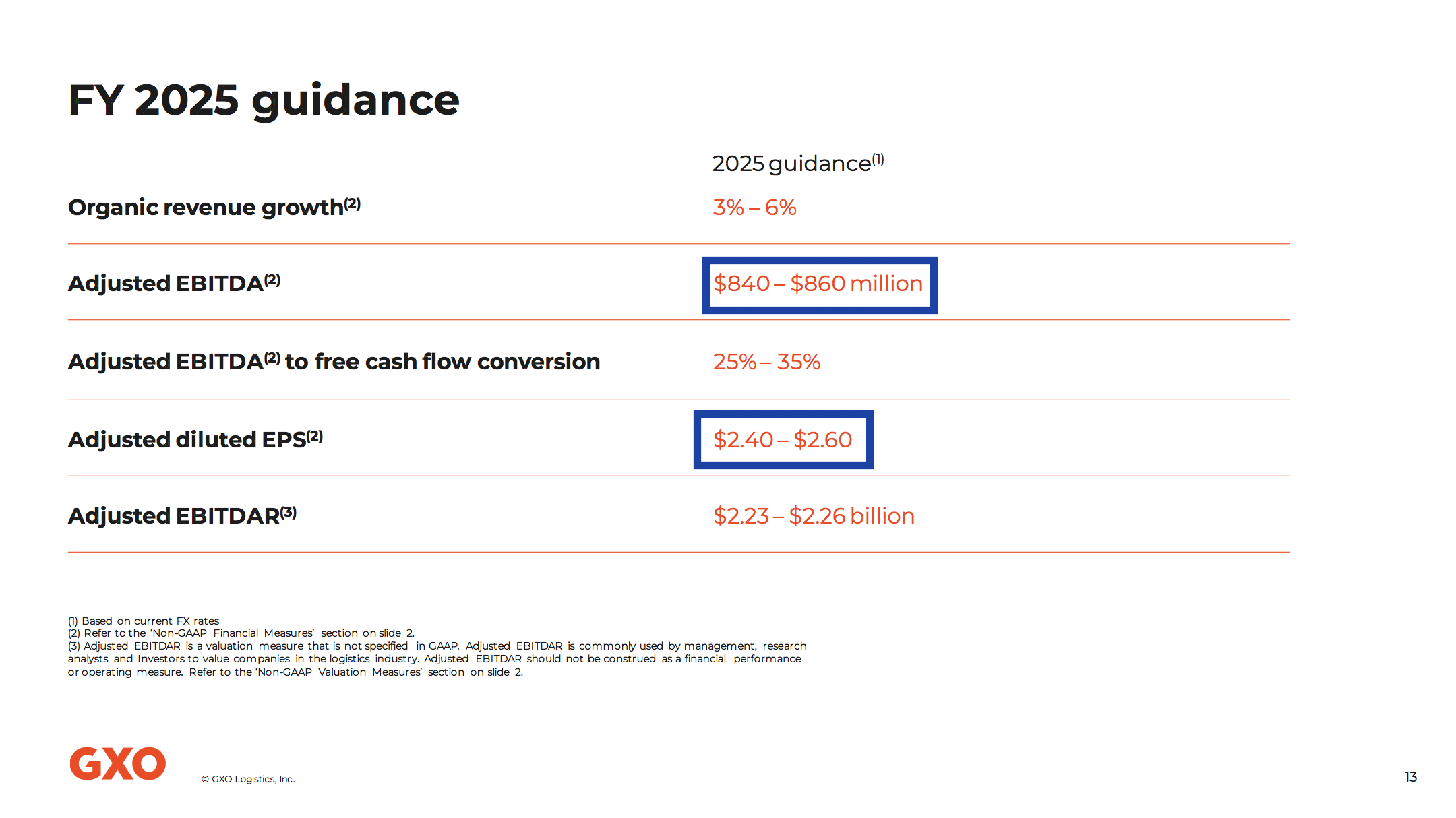

Similar to PayPal’s sandbagged guidance a few weeks ago, the stock sold off on weaker-than-expected FY2025 guidance. Management is guiding for:

- Organic revenue growth of 3% – 6%

- Adjusted EBITDA between $840M – $860M ($894M consensus)

- Adjusted diluted EPS of $2.40 – $2.60 ($3.09 consensus)

- Free cash flow conversion of 25% to 35% from adjusted EBITDA

The softer-than-expected top and bottom line guidance is driven by a couple of factors, with the two biggest being a few customer realignments in Q1 and the delayed realization of the full $55M Wincanton synergies due to the CMA Phase 2 review.

Taking a closer look at each of these three customer realignments:

Customer 1: A relatively large, mature customer exiting a site. However, GXO continues to win new business from this customer, with four additional sites going live throughout 2025

Customer 2: An automated site in a prime location where the customer adjusted capacity. GXO is holding the lease and has already secured another customer, expected to contribute profits beginning in the second half of 2025

Customer 3: A long-standing, mature site customer that realigned its network due to lower consumer volumes but remains a good customer with GXO

Overall, the realignment is expected to create a ~$15M hit to EBITDA during Q1. GXO dealt with a similar situation in 2022, which was resolved later that year. The key point is that this realignment is a SHORT-TERM, ONE-OFF impact and, most importantly, DOES NOT REPRESENT LOST CUSTOMERS. As the new sites begin to reach maturity—typically taking about six months to contribute to profitability and 12 months to achieve full run-rate revenue—this is actually expected to be a NET BENEFICIARY for GXO.

As for Wincanton, management now expects $35M to $45M in EBITDA synergies, down from $55M, thanks to CMA delays. The good news? Management confirmed these savings are still safe, just pushed into 2026.

The bottom line is that this “disappointing” FY2025 guidance is being driven by two temporary, one-off headwinds, not a structural weakness in the underlying business. If your holding period is beyond quarter to quarter, this is just noise. Adjusting for these one-offs (including the $15M EBITDA hit and the full $55M in Wincanton synergies), FY2025 EBITDA would have been around $900M, COMING AHEAD OF CONSENSUS ESTIMATES.

With all that said, management’s FY2025 top-line organic growth still looks extremely conservative, even with the headwinds. The $627M in incremental revenue already booked for 2025 translates to organic growth of 5.35% on its own. This means management’s 3%–6% guidance range, which assumes flat customer volumes, leaves little room for any new contract wins to contribute to organic growth in 2025. That feels hard to believe, with a sales pipeline up 15% YoY, including a 20% jump in the Americas.

SANDBAGGED TO THE EXTREME.

The other headwind weighing on GXO has been the CMA Phase 2 review of the Wincanton acquisition. Management had expected an interim update this week, and luckily for this article, it was released today.

The CMA found no issues with most of the Wincanton acquisition, only flagging the grocery sector (less than 10% of Wincanton’s revenue) as a potential competitive concern. GXO disagrees with this assessment and is pushing for full clearance by the end of April.

This is good news for GXO. The CMA’s concerns are narrowly focused on grocers, which is a manageable issue compared to broad anti-competitive worries. The real upside in the Wincanton deal lies in synergies from new verticals like Aerospace and Industrials, and we don’t see a few supermarket chains jeopardizing the deal’s attractiveness.

Ideally, the deal will pass through with full clearance. Given the CMA’s focus on such a small part of the deal, the risk of a complete block seems extremely low at this point. If needed, some behavioral commitments around the grocery business would be a manageable remedy. Historically, Phase II decisions in 2023-2024 saw 50% approved unconditionally, with 25% prohibited or abandoned and 25% approved with remedies.

Obviously, the best-case scenario would have been no issues with the deal, but this outcome is the next best thing. Overall, this should be seen as a positive.

The next big catalyst will be the announcement of a new CEO, expected in the next few months. Brad Jacobs, who’s all about strong leadership, will get this right.

Last but certainly not least, GXO announced a new $500M buyback program, about 10.4% of the market cap. When you can repurchase $1 of intrinsic value for 50 cents, it’s a no-brainer…

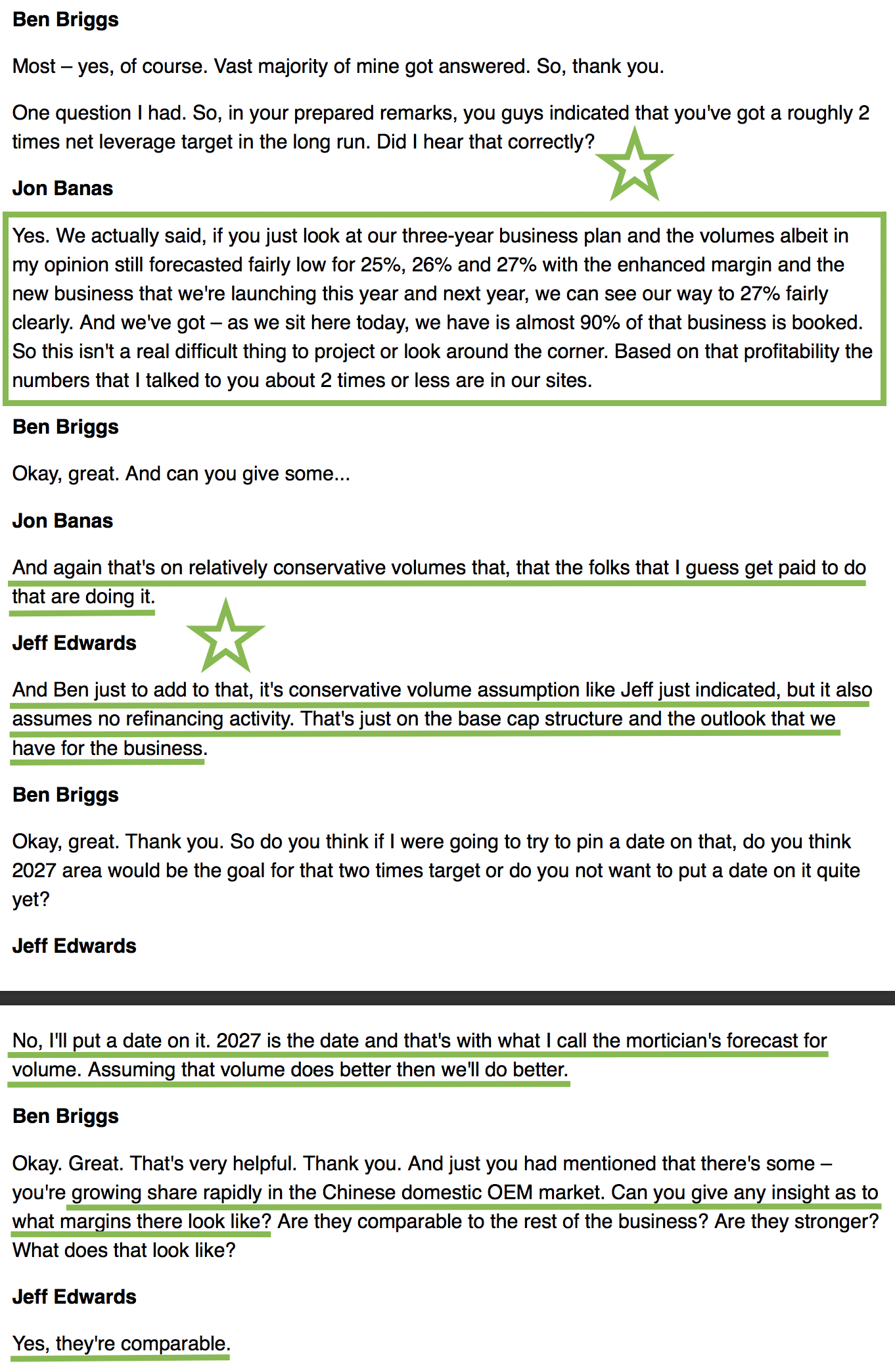

Earnings Call + Q&A Highlights

Cooper Standard Update

In May 2022, we built up a position in Cooper Standard at a basis of ~$5.50. We discussed it on our podcast|videocast to clients and public viewers alike. On June 7, 2022 we broke our Cooper Standard (CPS) thesis publicly on Fox Business for the first time (when it was trading ~$6/share):

The stock is up about 2.9x so far, and we believe it hasn’t even left the station yet.

Here is some information from our original thesis and updates:

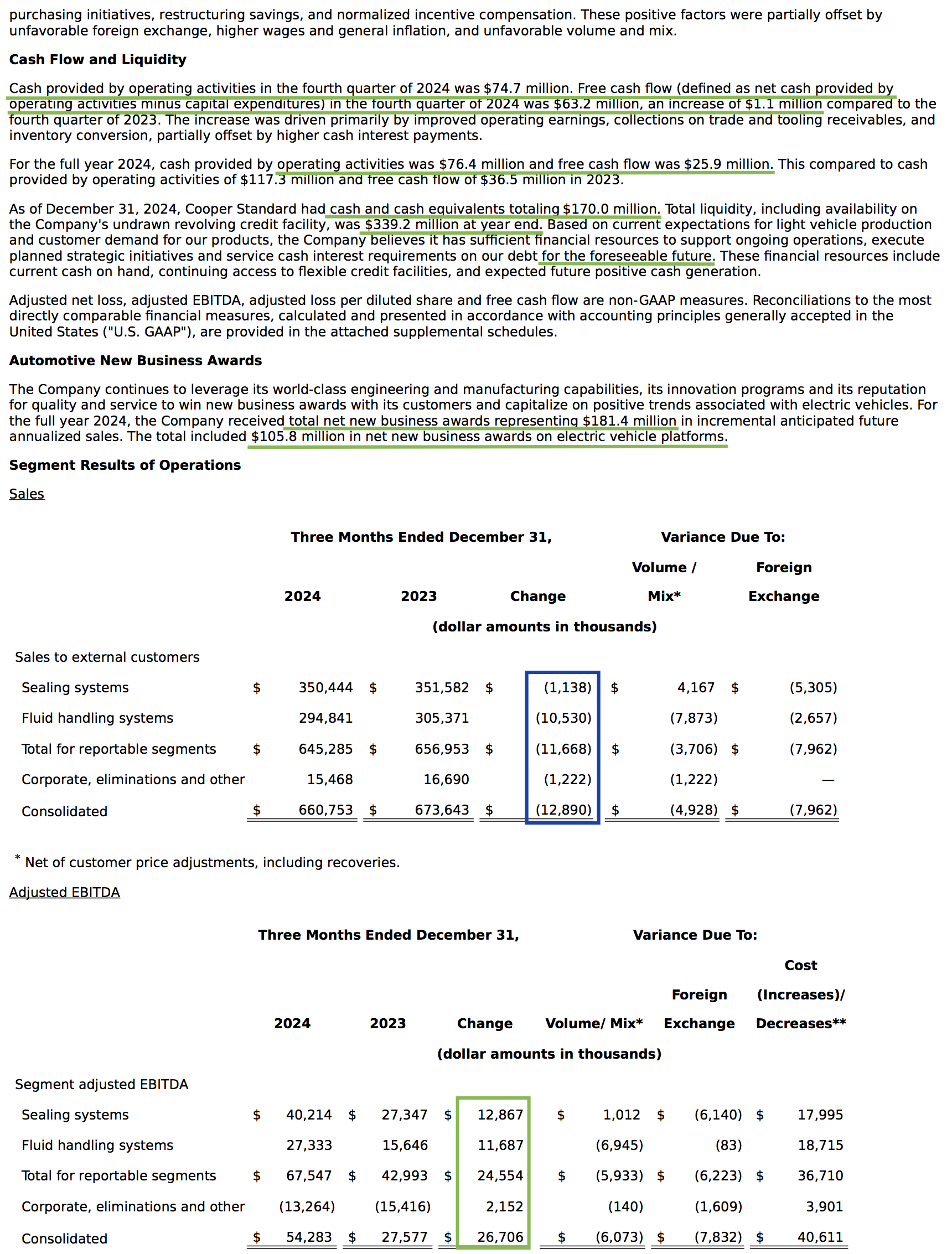

Earnings Results

Key Takeaways

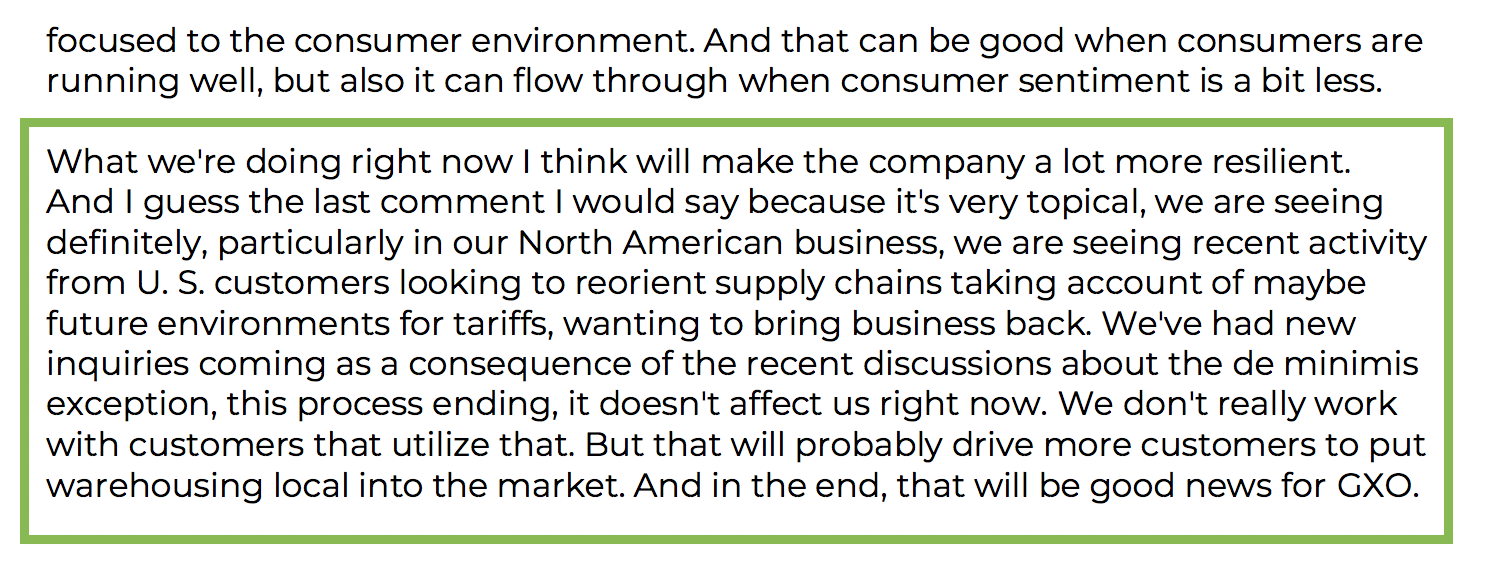

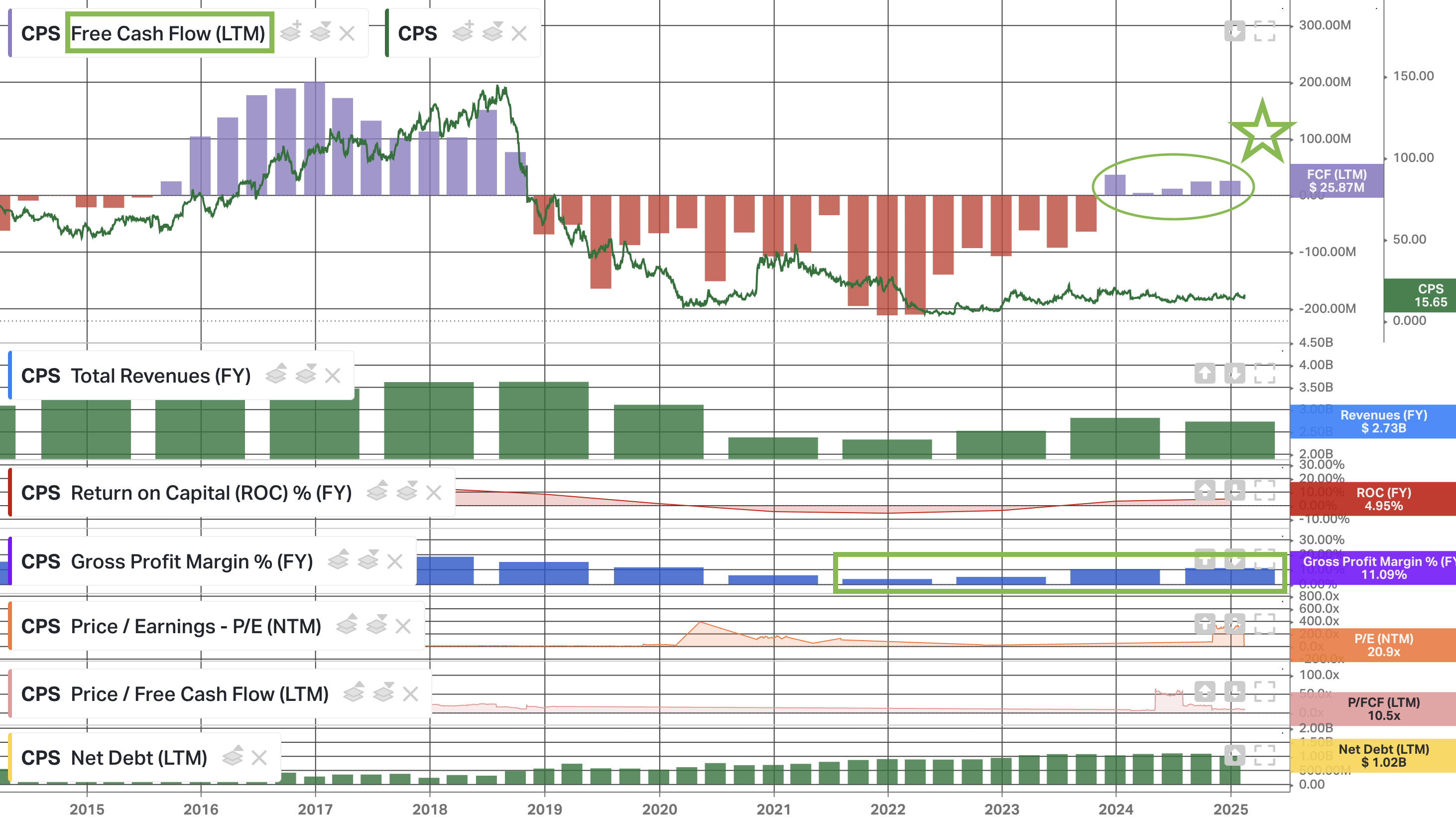

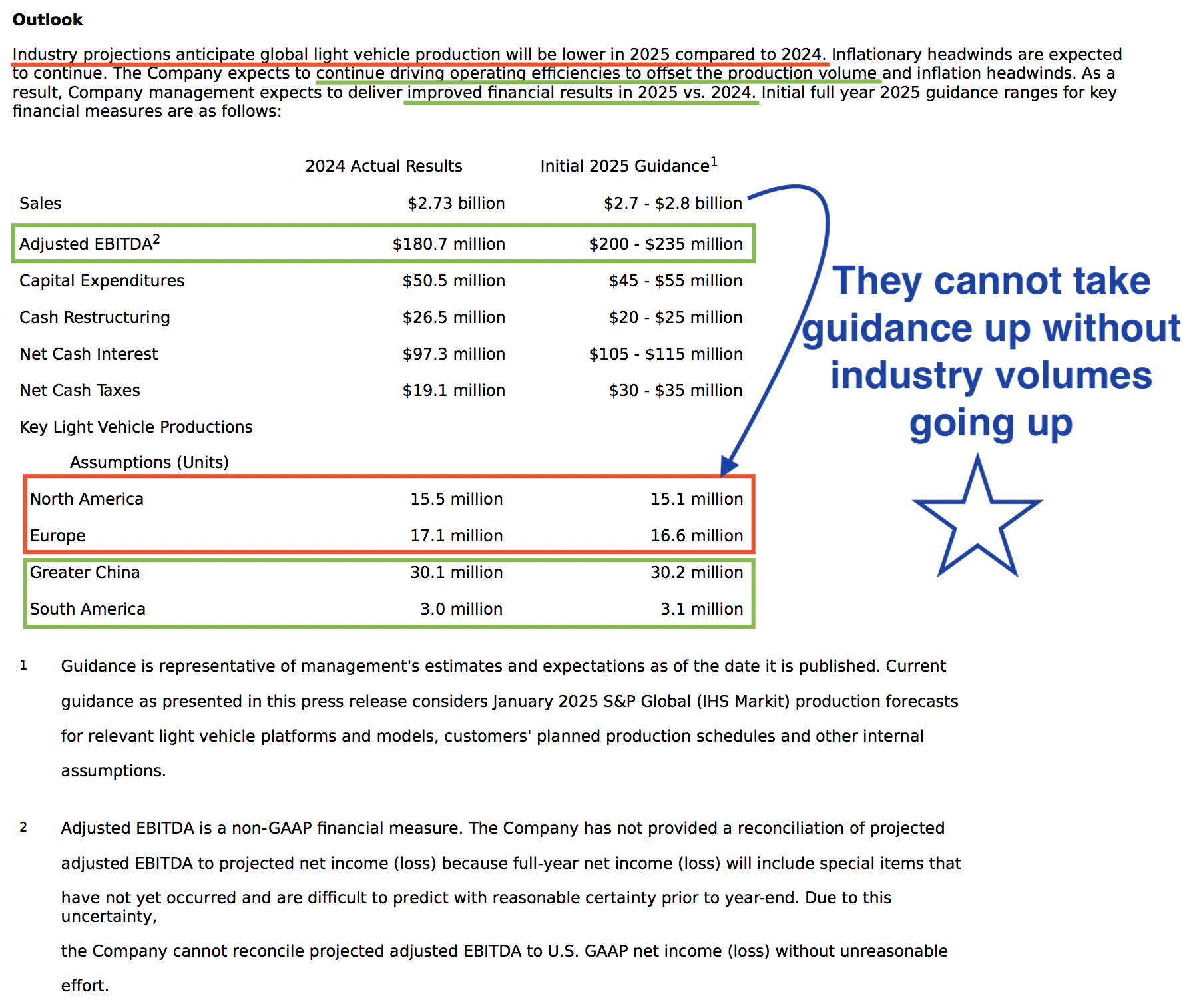

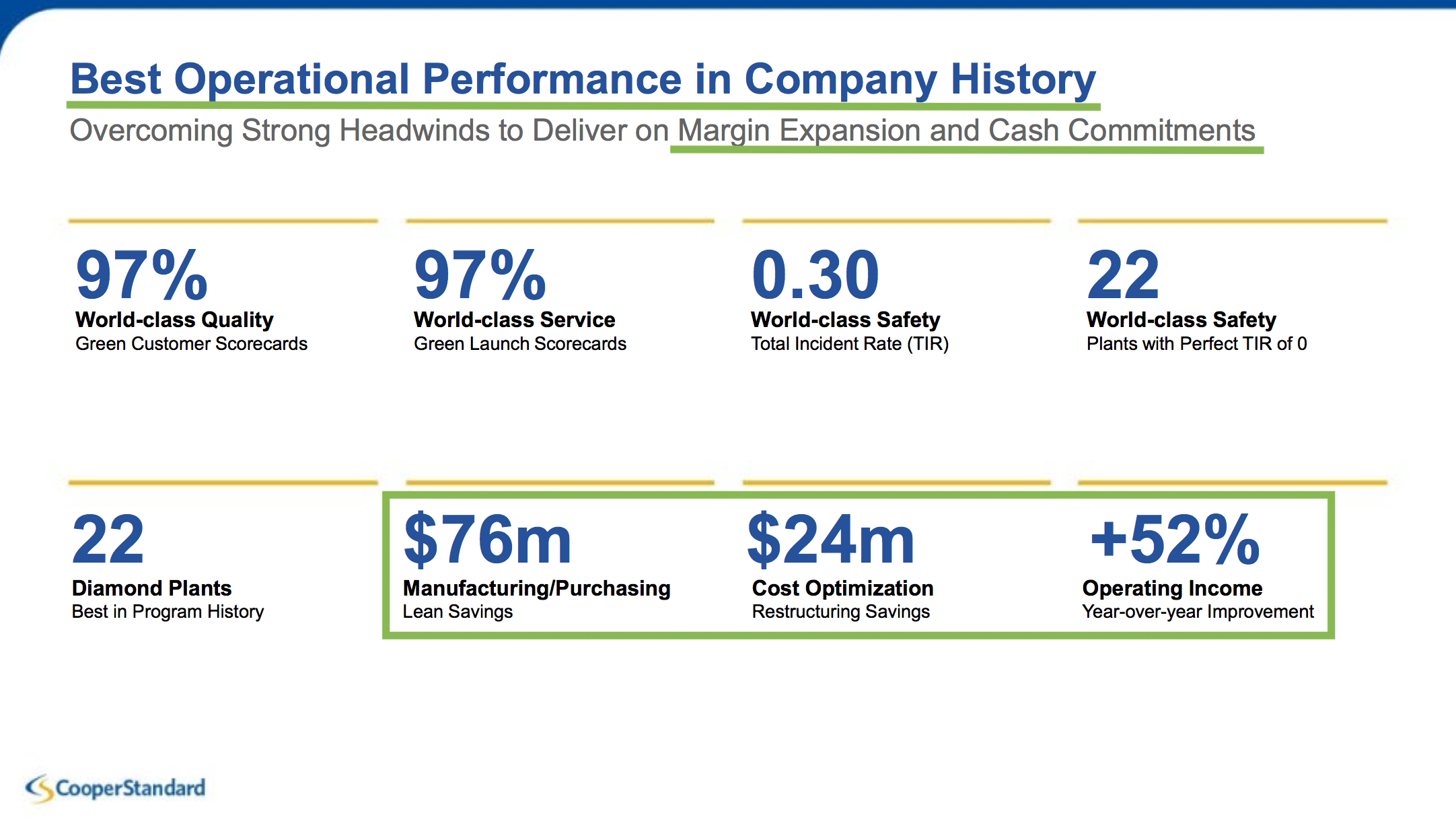

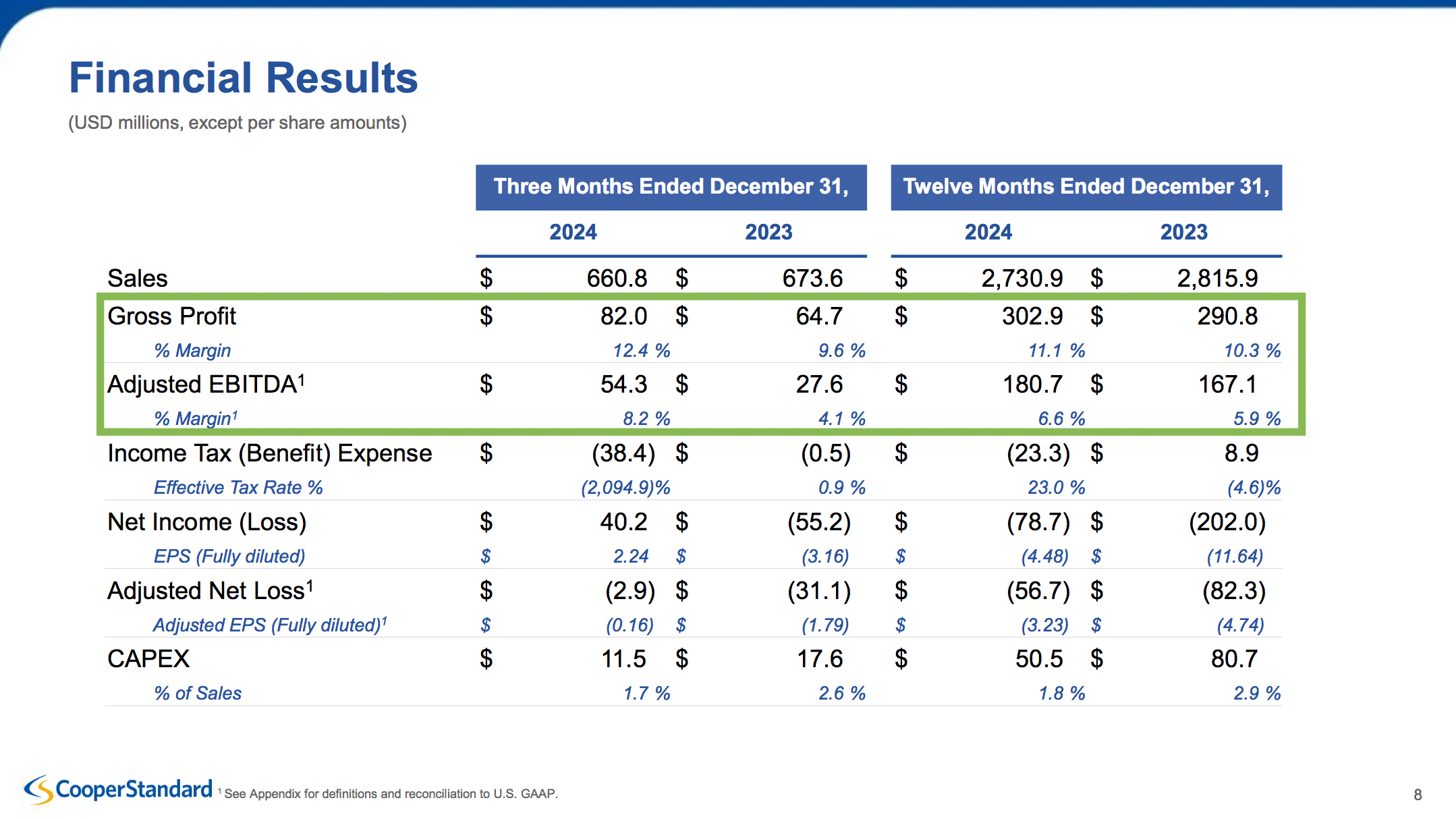

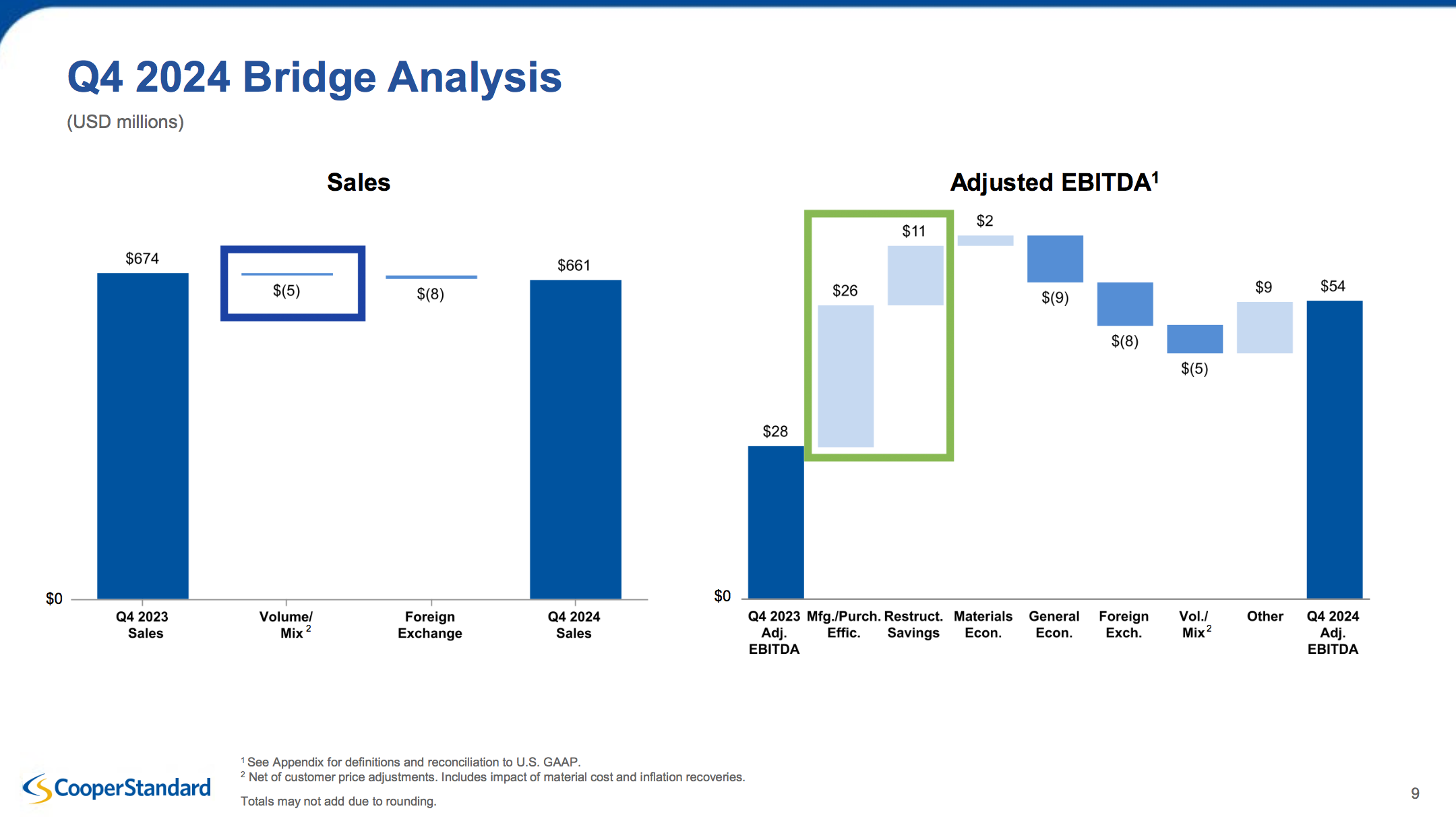

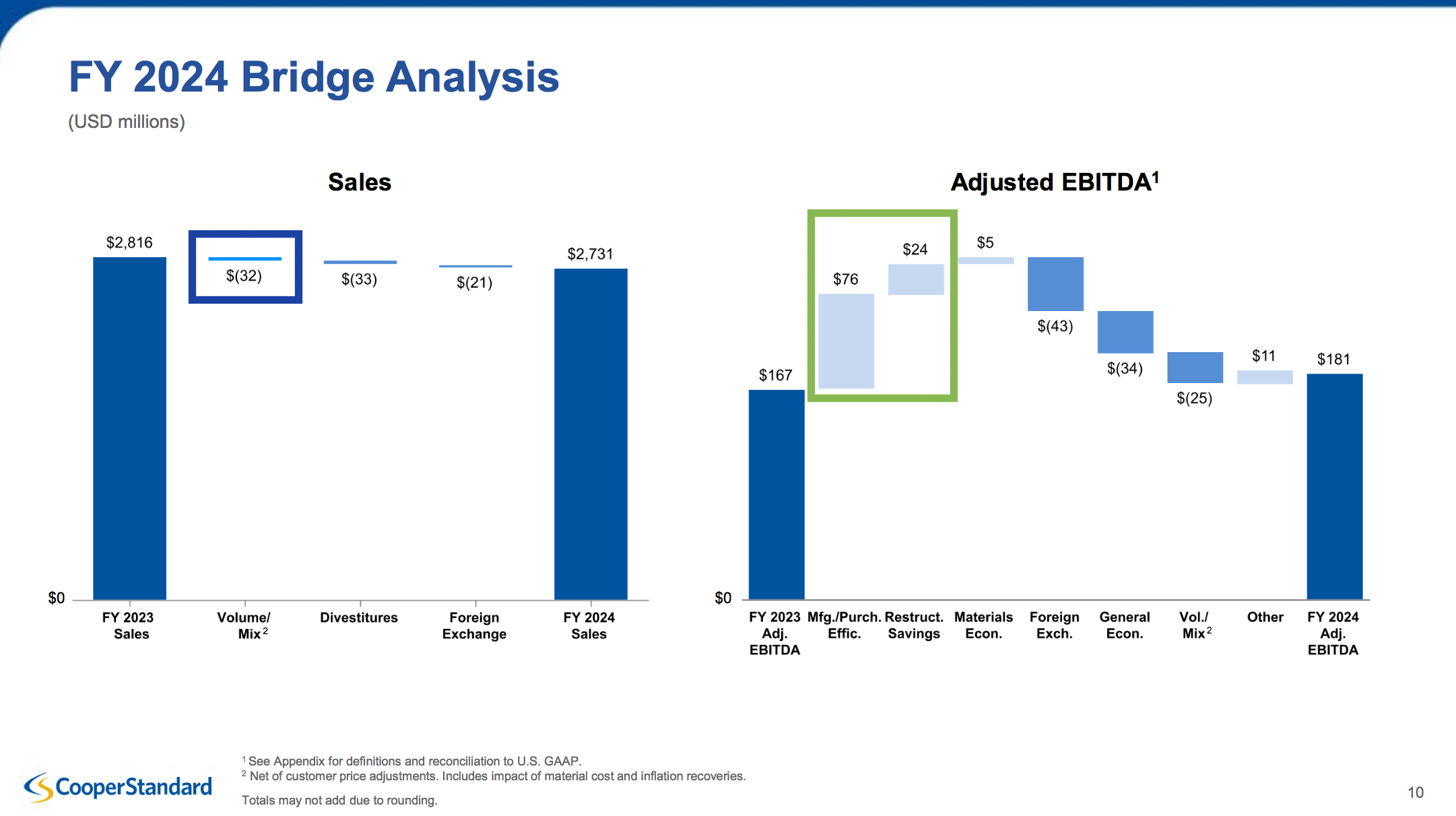

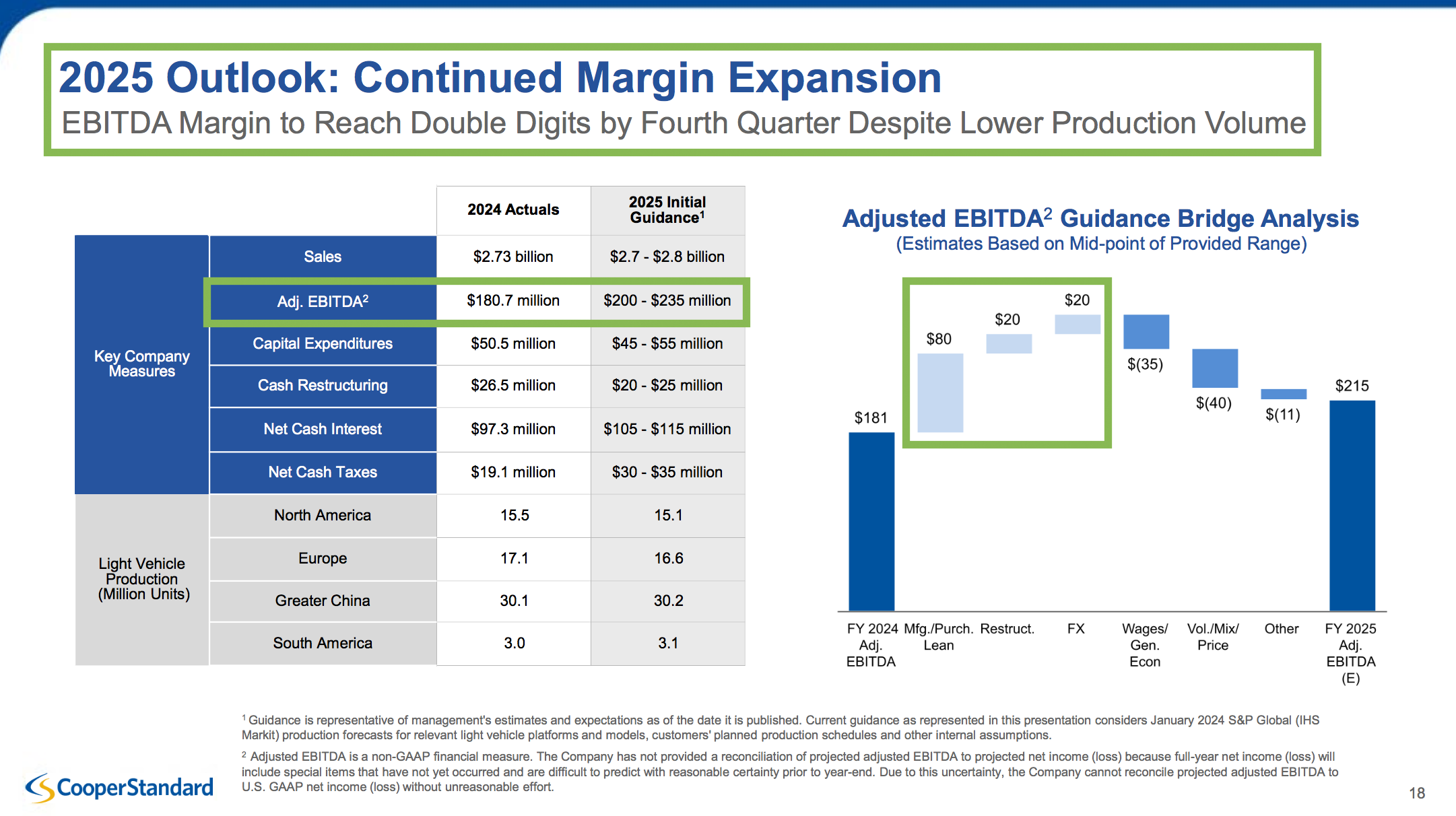

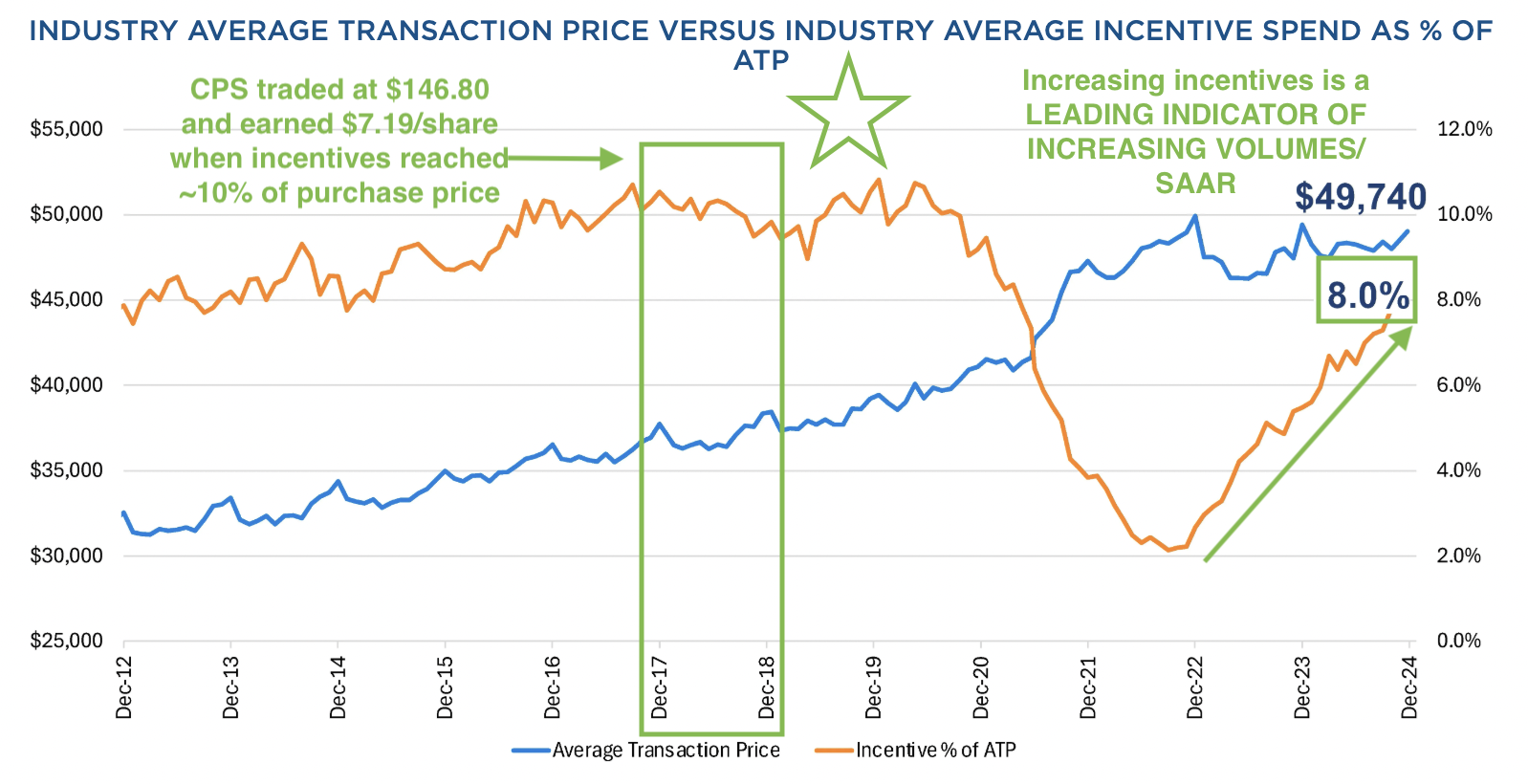

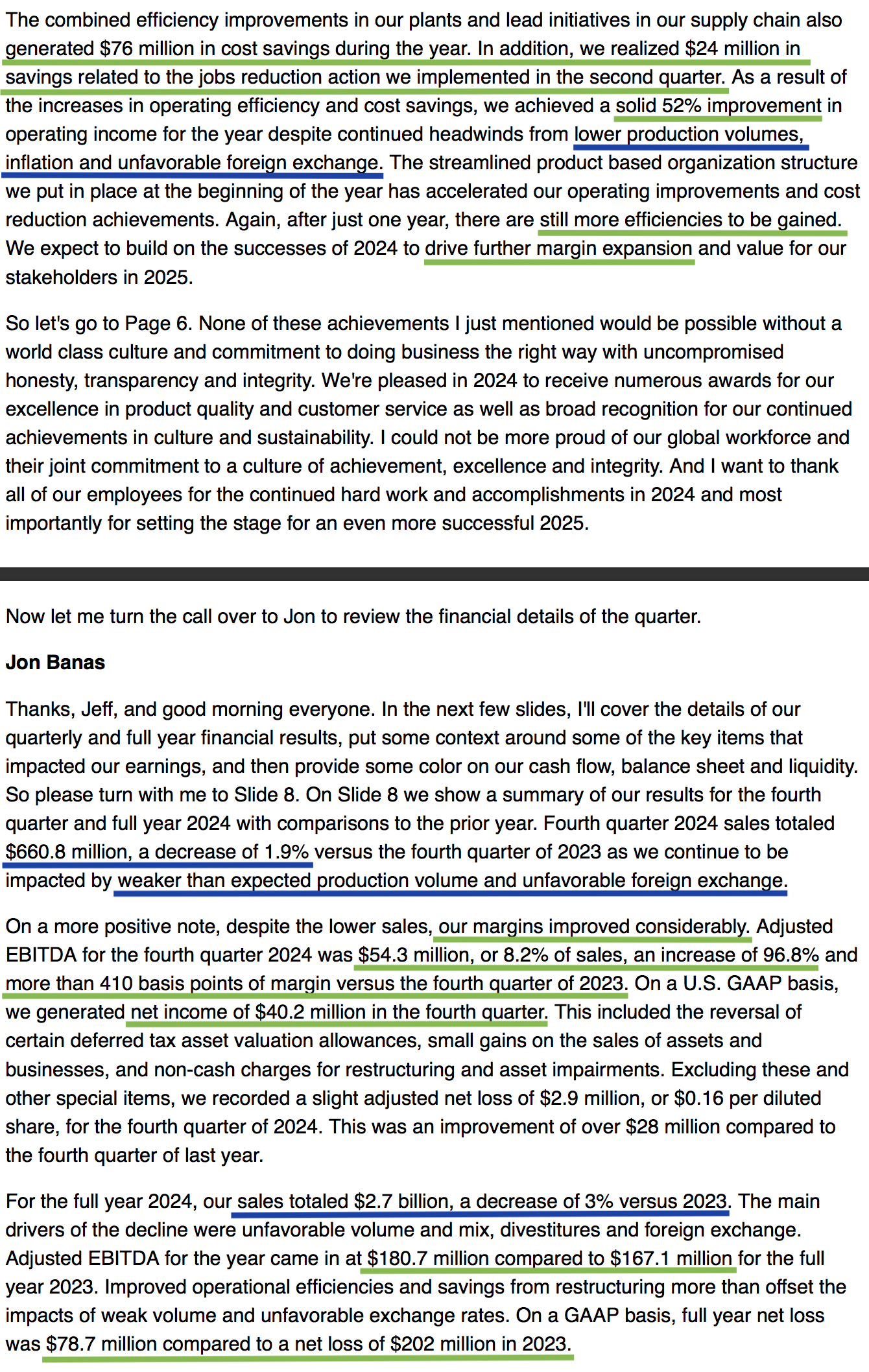

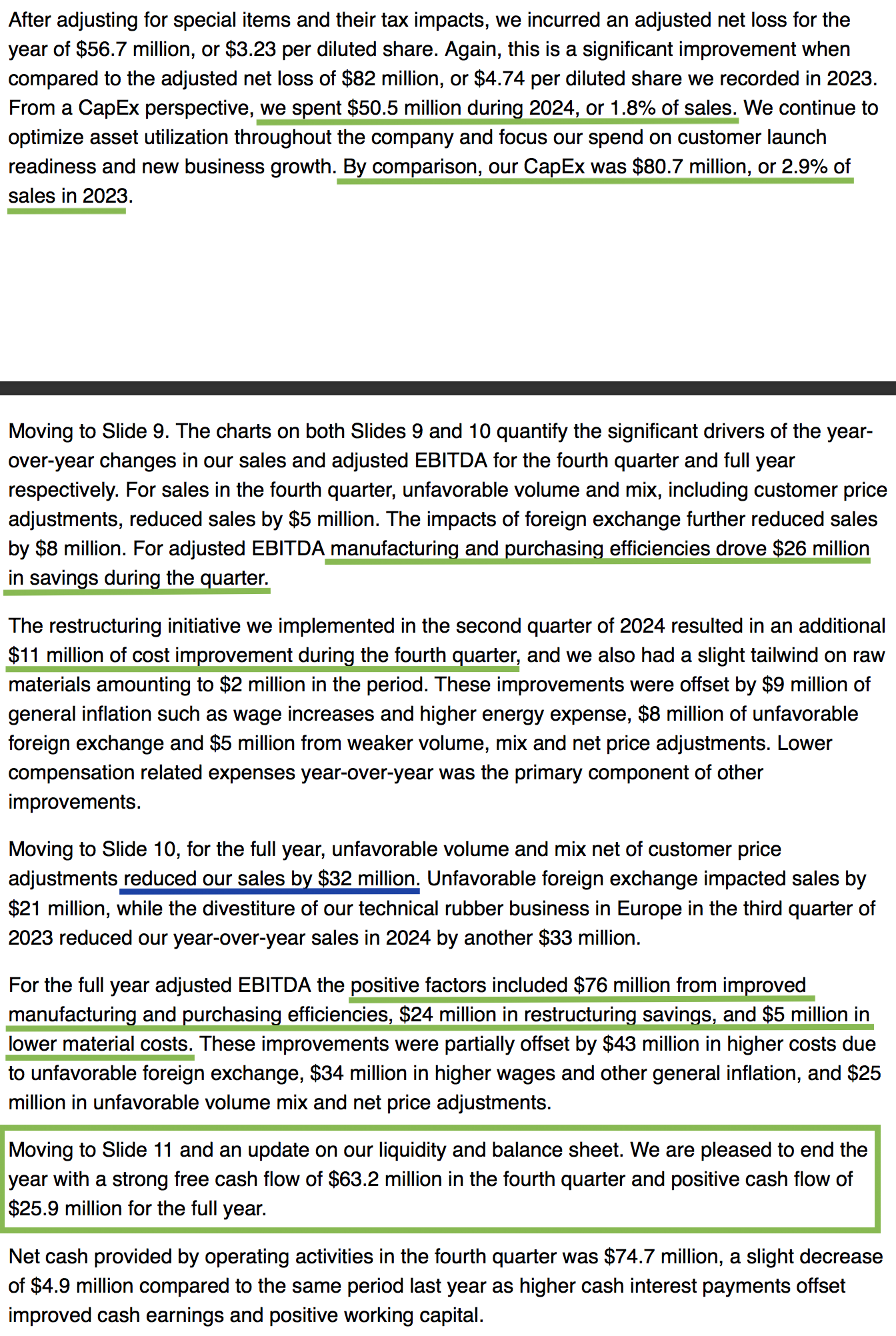

1) Delivered $180.7M in adjusted EBITDA (6.6% margin) for 2024, up from $167.1M (5.9%) in 2023, exiting Q4 at 8.2%. Double-digit margins by the end of 2025 remain on track, implying that EVEN WITH ZERO GROWTH from the LOW END of the guidance range, 2026 EBITDA will hit at least $270M, a 50% increase from 2024

2) Achieved $100M in cost savings, including $76M from manufacturing and purchasing efficiencies and $24M from restructuring, bringing total sustainable cost savings impact on adjusted EBITDA to $630M since 2019

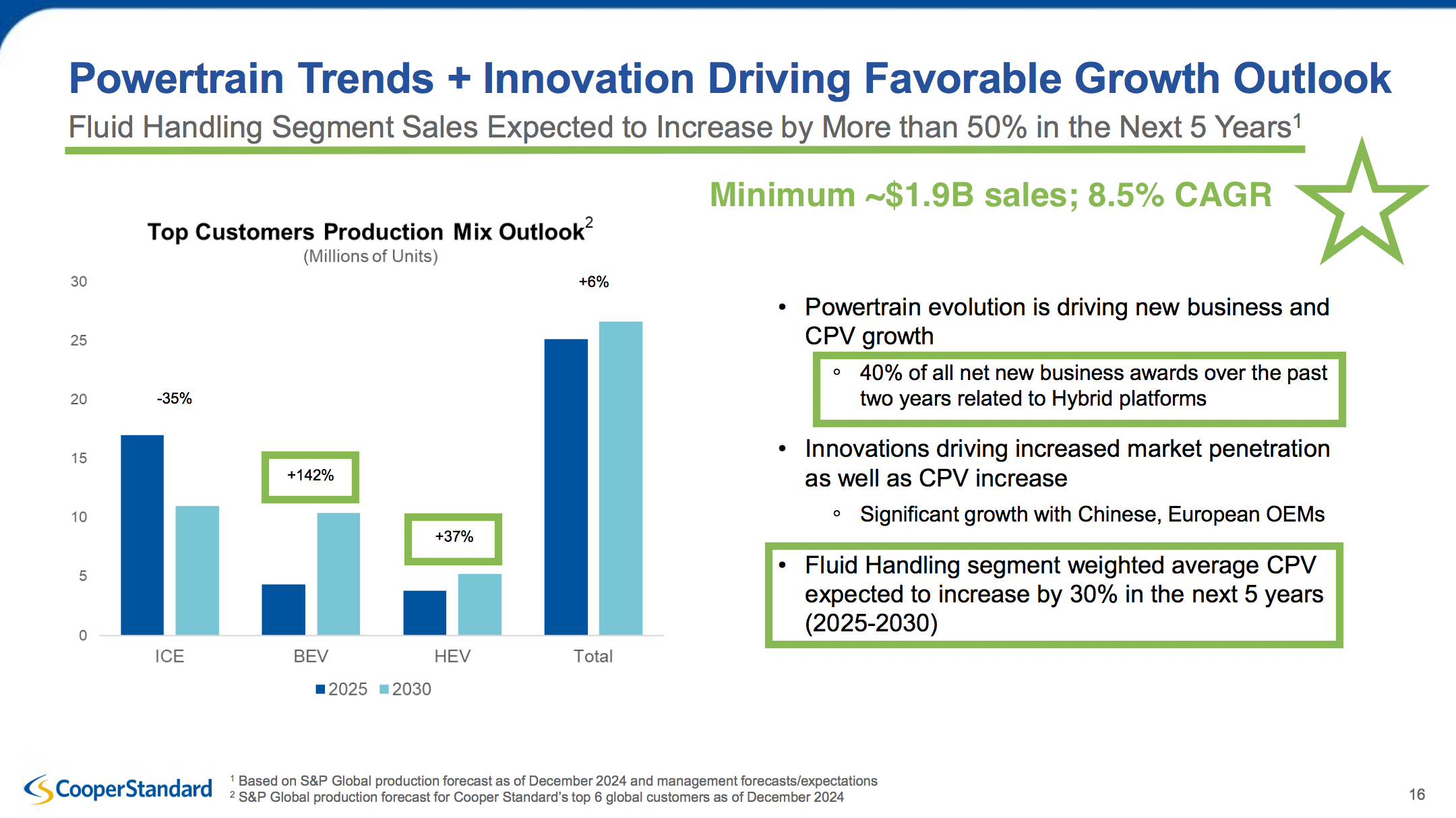

3) Fluid handling sales are set to jump over 50% in the next five years. With 2024 revenue at ~$1.24B, that implies at least $1.9B by 2030, an 8.5% CAGR based on HIGHLY CONSERVATIVE industry production forecasts

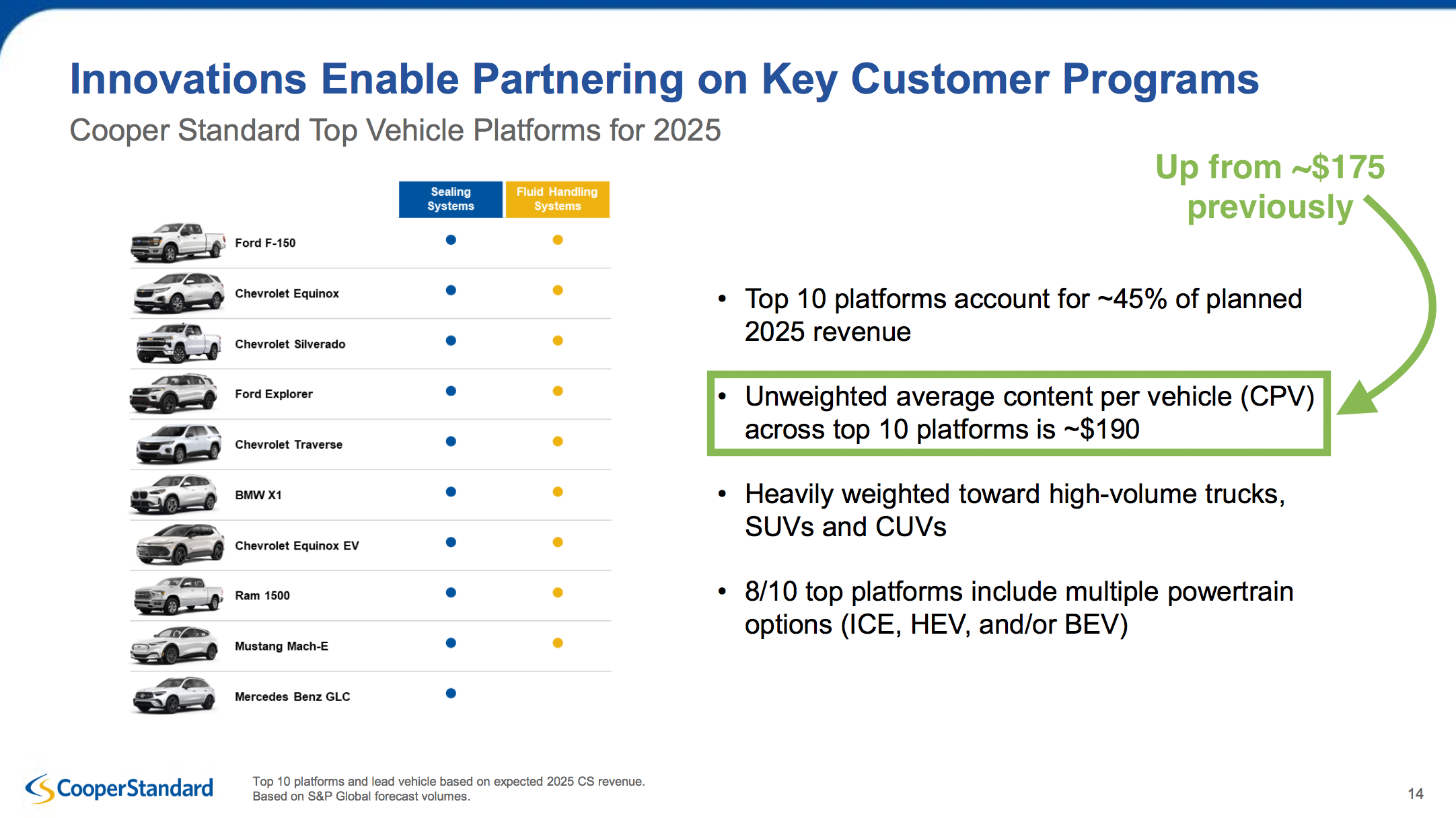

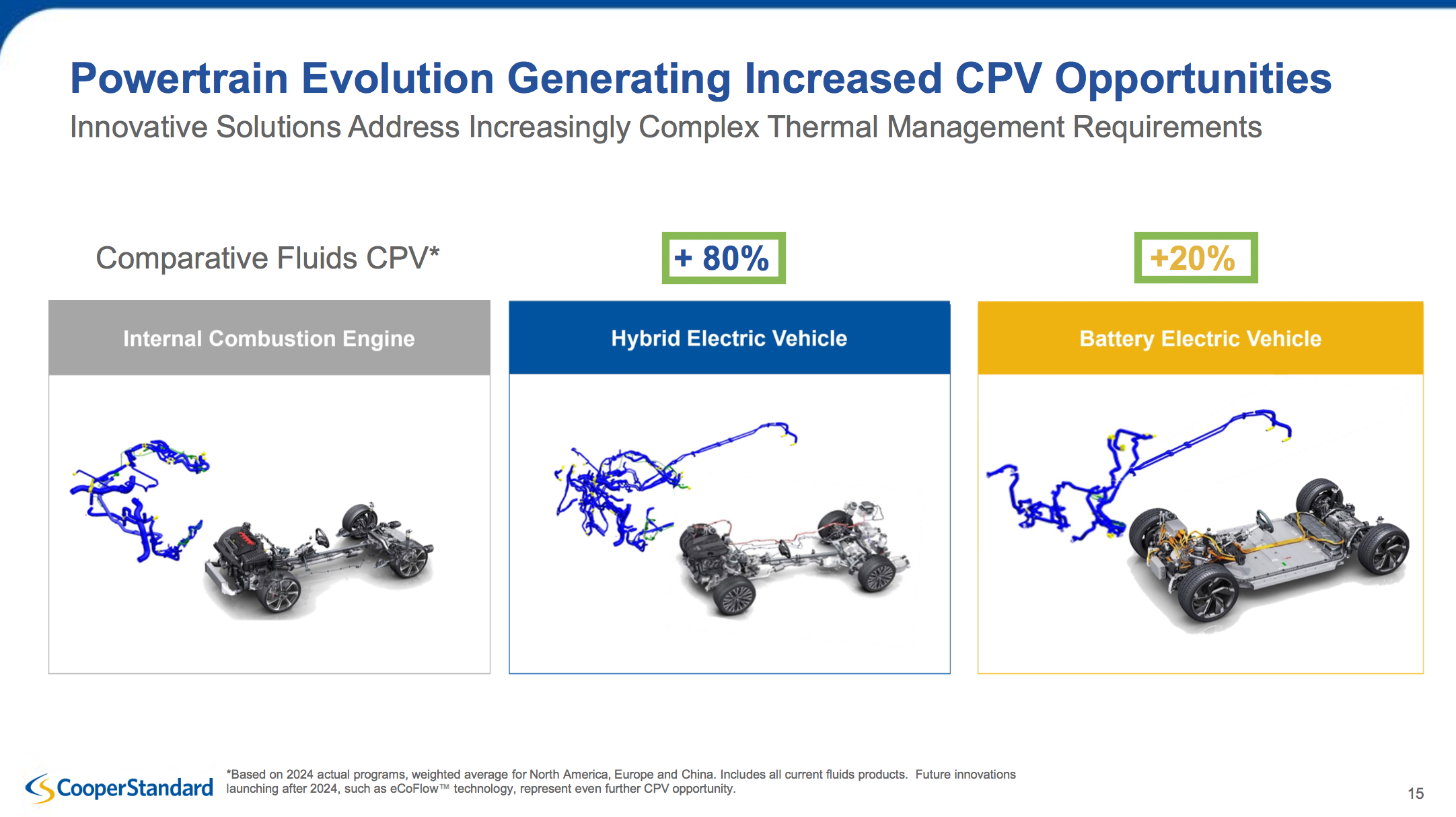

4) Hybrid platforms accounted for 40% of new business in the past two years. With hybrids offering +80% CPV and EVs +20%, the average CPV jumped to ~$190 from ~$175. Management has a CLEAR LINE OF SIGHT through 2027, with 90% of revenue already booked

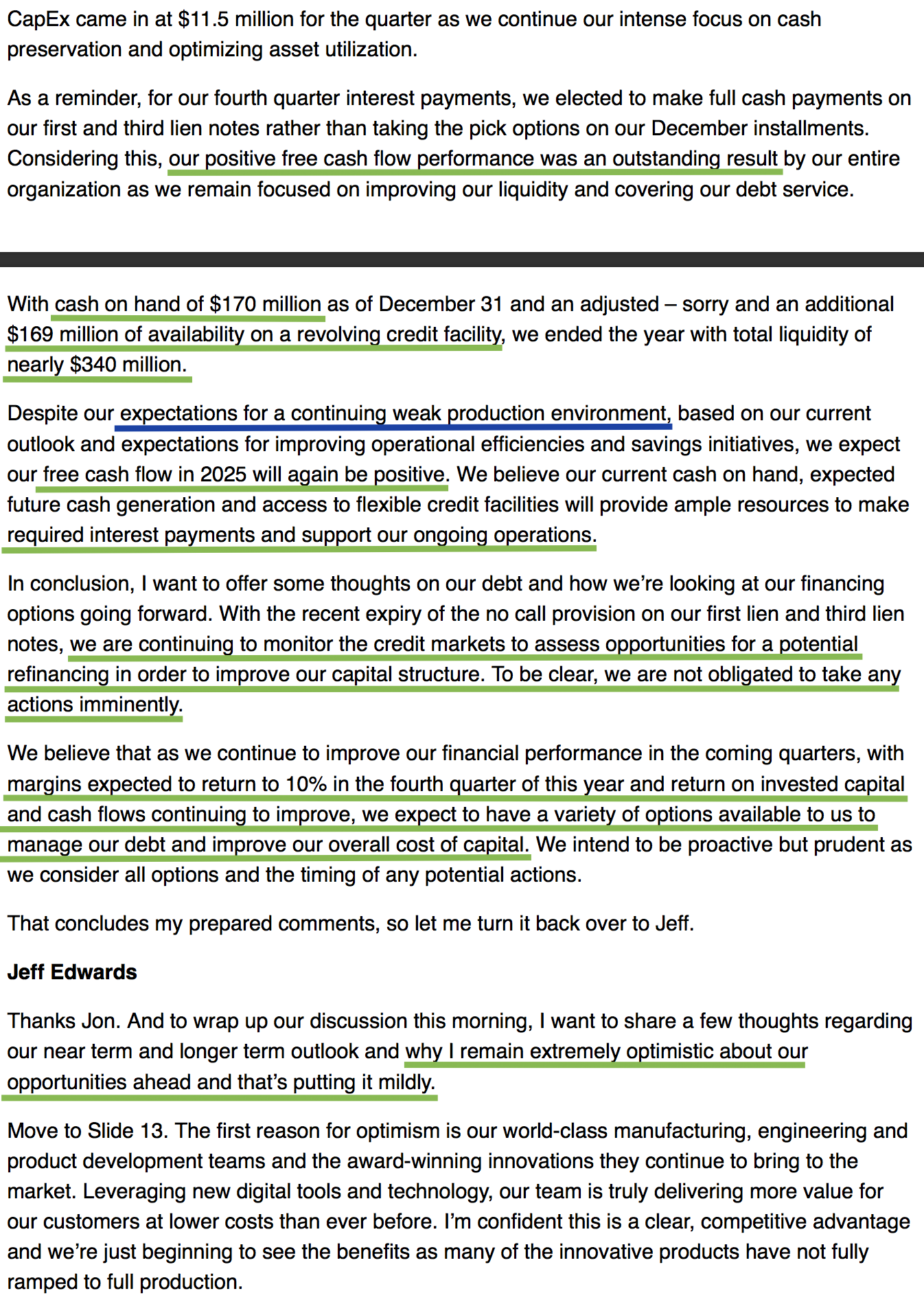

5) By the end of 2027, and with the “mortician’s forecast for volume,” management expects to achieve 2x net leverage or lower, WITHOUT CONTEMPLATING A REFI. This compares to ~5x net leverage at the end of 2024

6) Management is closely monitoring credit markets for potential refinancing opportunities, which includes the ~$610M in notes at 13.5% (issued during the treacherous closed credit market in Q4 2022). With margins rebounding to 10%, double-digit ROIC, and strong cash flow, they foresee a “variety of options available” for managing debt. Refinancing at better rates would DRAMATICALLY reduce interest expenses (FY2025 guidance: $105M–$115M)

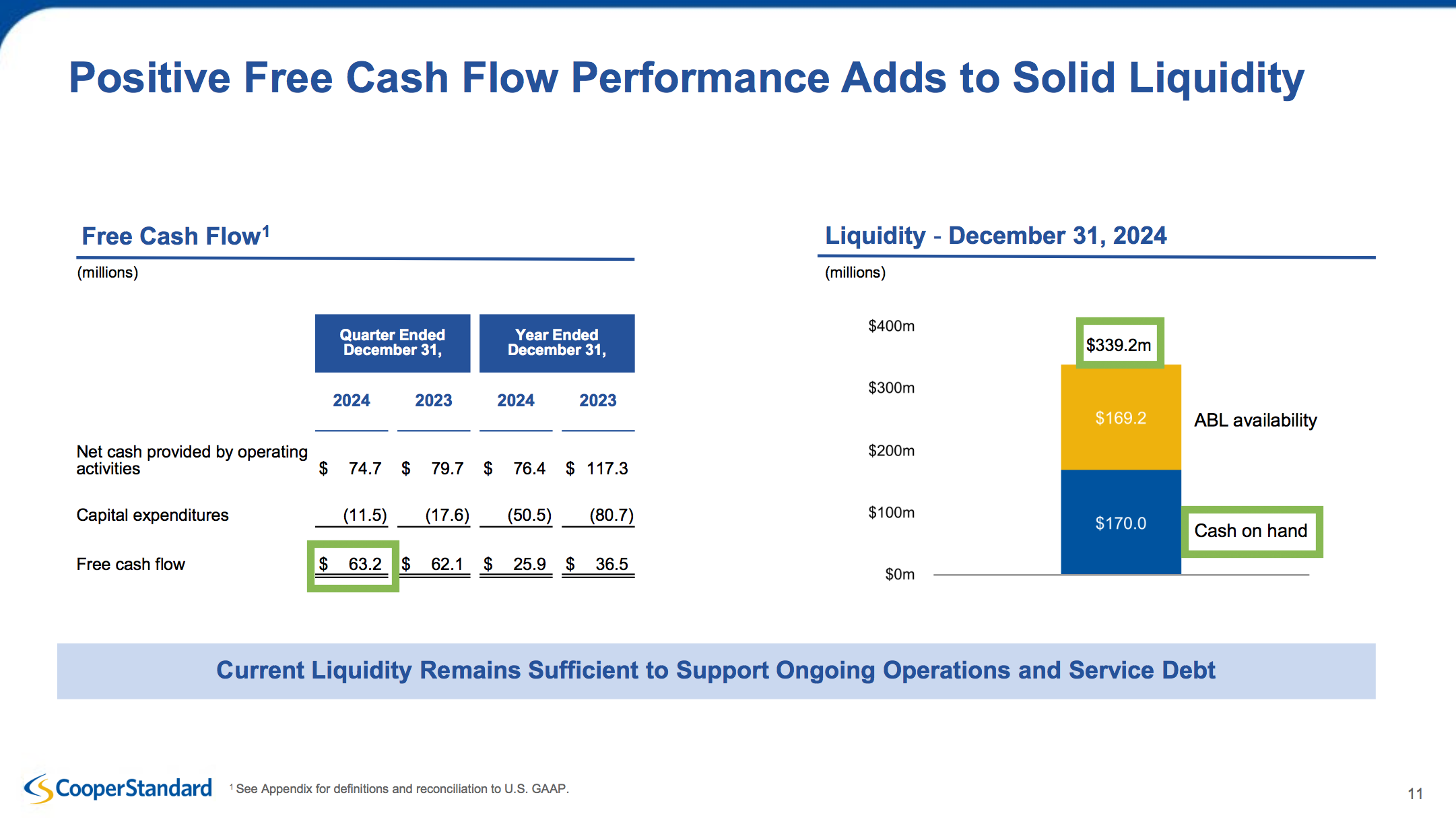

7) Capex spend decreased to $50.5M (1.8% of sales) from $80.7M (2.9% of sales) in 2023. Management expects to keep it in the 2% to 3% range over the next couple of years and is not planning to return to the previous 5% to 6% levels (EVEN IF/WHEN VOLUMES RAMP UP)

8) China has become the major future growth driver. From 2012 to 2020, revenues were split approximately 80% from Western OEMs and 20% from Chinese domestic business. By 2026, this split is expected to shift to 65/35, and by 2027, it will be closer to 80/20 in favor of China. This growth is driven by significantly higher revenue expectations for 2026 and 2027 compared to prior years. Chinese margins are comparable to those of Western OEMs and require less investment

9) Strong free cash flow of $63.2 million in Q4 and positive cash flow of $25.9 million for the full year. This marks the second consecutive year of positive free cash flow, and management expects another positive year in 2025. With approximately $170 million in cash on hand and $169 million in revolving credit available, total liquidity stands at $339 million

10) In the event of tariffs, management has been proactive in communicating with OEMs, with the understanding that any additional costs will be passed on to customers

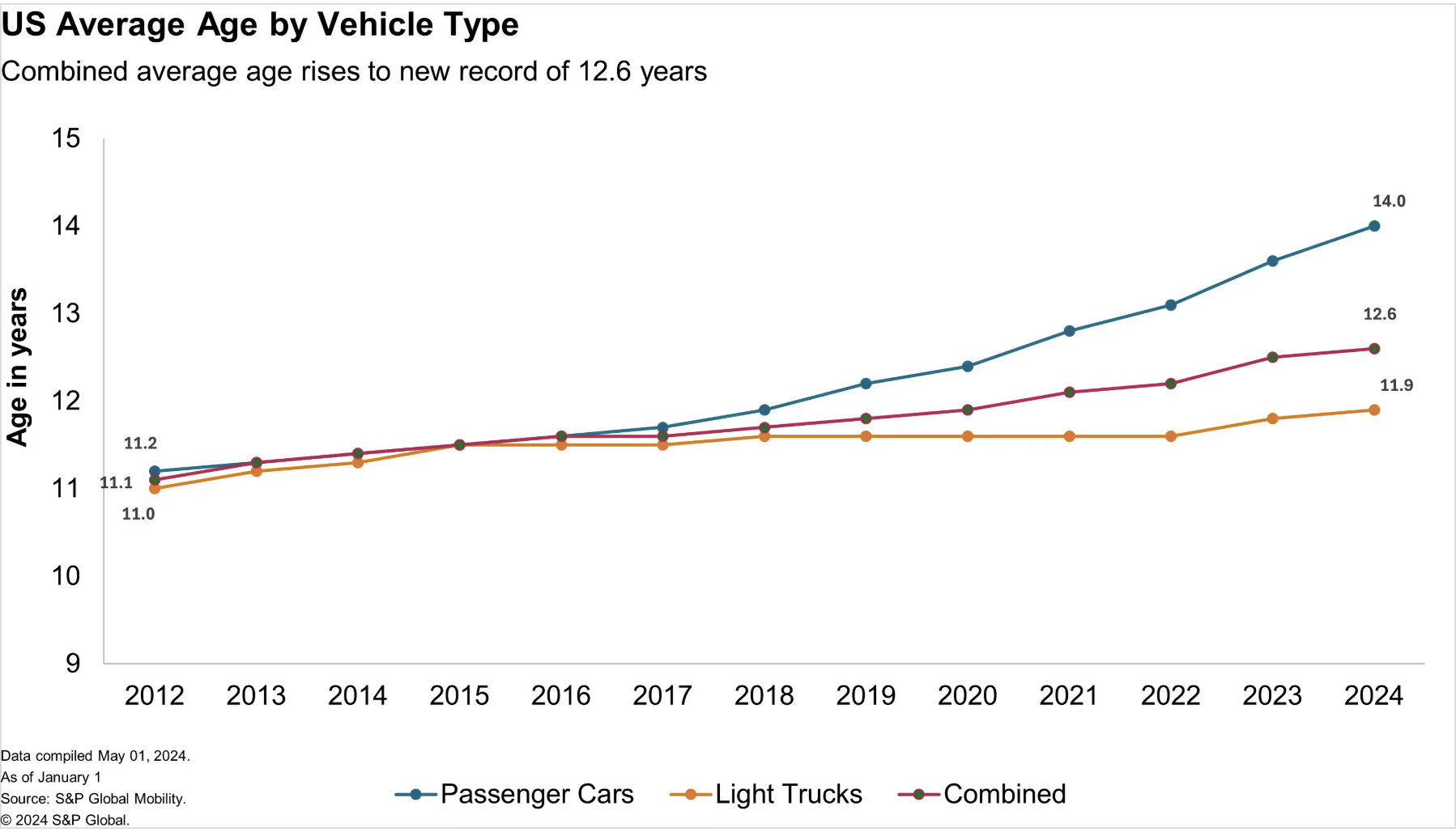

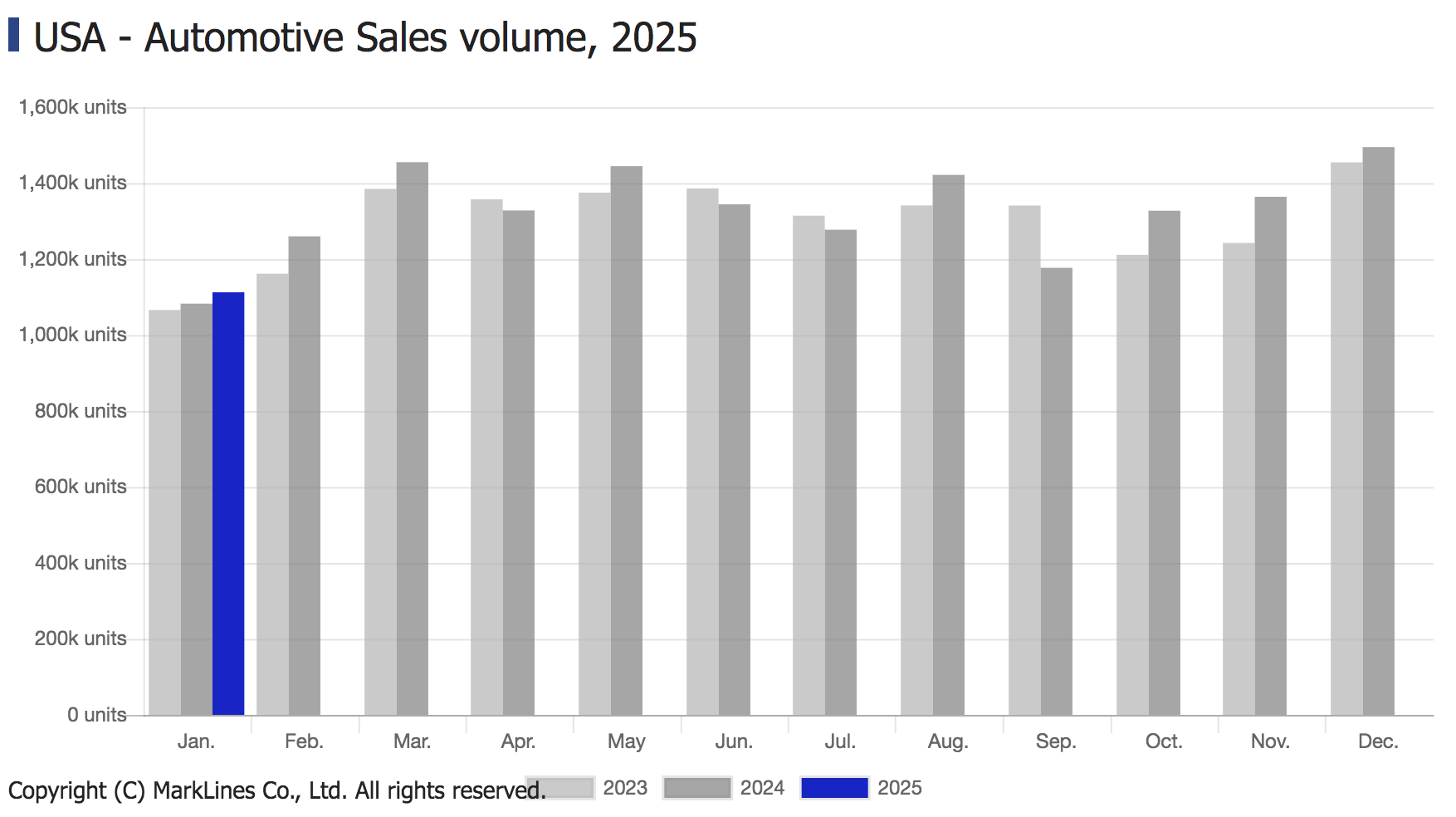

Record high average vehicle age 12.6 years

Fourth consecutive month of gains in U.S. Auto Sales

Rising new vehicle incentives (+44% YoY in December)

Rising new vehicle incentives (+44% YoY in December)

Earnings Call + Q&A Highlights

Etsy + Canada Goose Quick Update

We plan to cover both companies in depth next week, but for now, here are the key highlights from their latest earnings

Etsy

- Delivered record Q4 revenue of $852.2M, up 1.2% YoY

- Etsy Marketplace GMS totaled $3.3B, down 8.6% YoY, with similar expectations for Q1 2025; however, several factors are in place to improve GMS performance beyond Q1

- Depop saw 60% YoY U.S. GMS growth in Q4, bringing total GMS for 2024 to $789M (+31.6%) and making it the fastest-growing U.S. fashion resale player

- Generated $709M in free cash flow during FY2024, up from $666M in 2023

- Repurchased 12.2M shares for $723M, ending the year with $1.2B in cash and $1B still available under the share repurchase program

- Bringing Etsy’s app penetration in line with peers represents up to a $1B GMS opportunity

Canada Goose

- North America DTC comp sales grew 3% in Q3 and jumped 22% YoY in the month of December

- Reduced inventory levels by 15% YoY, marking five consecutive quarters of improvement

- The Snow Goose campaign hit a record 30 billion media impressions, driving record media coverage and a three-year high in brand search interest

- Management renewed its normal course issuer bid (NCIB), authorizing the repurchase of ~10% of the public float

- Gross margin rose to 74.4%, up 70 basis points, boosted by favorable pricing and lower inventory provisions

General Market

The CNN “Fear and Greed Index” ticked up from 44 last week to 49 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

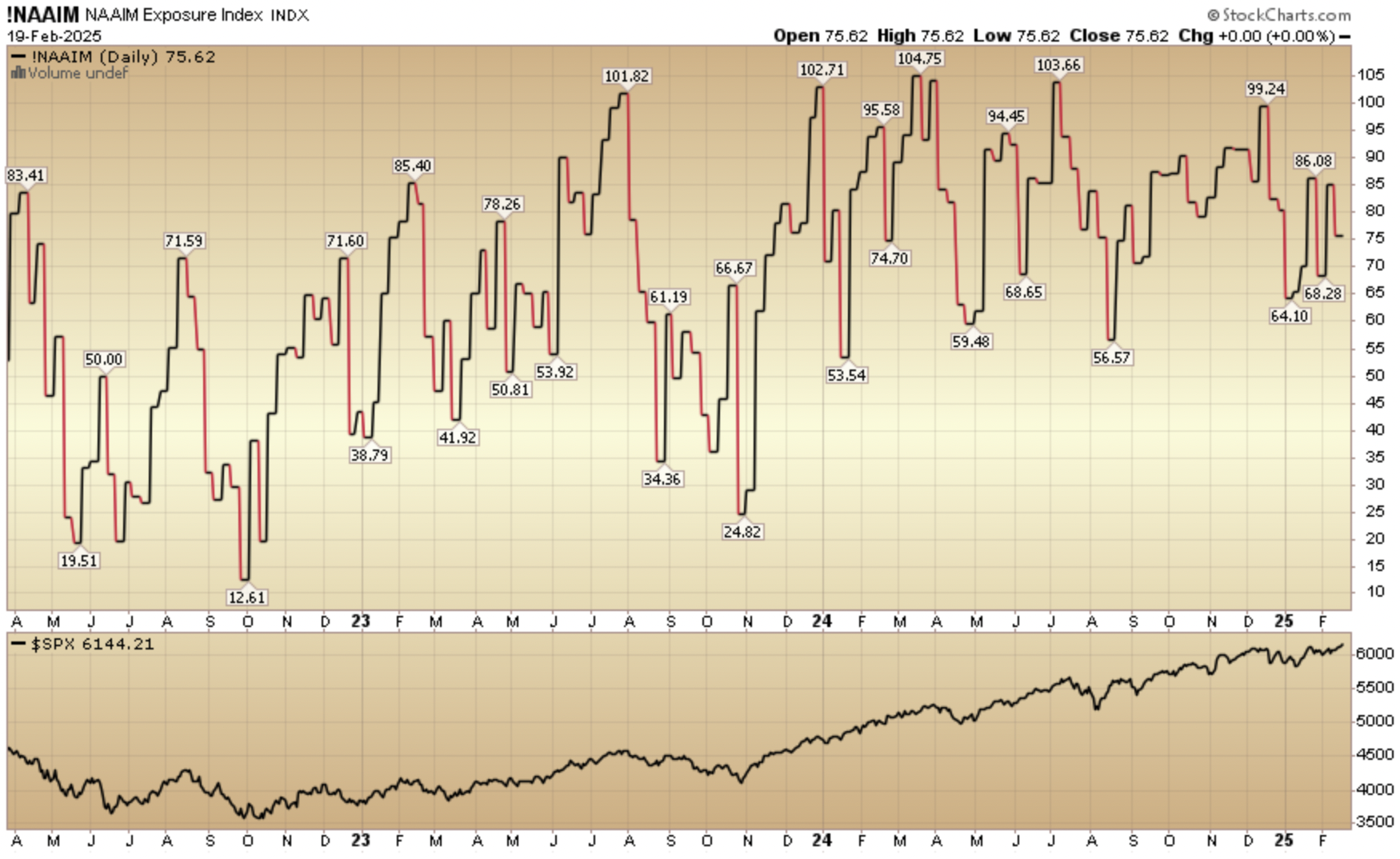

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked down to 75.62% this week from 84.91% equity exposure last week.

Our podcast|videocast will be out sometime on Thursday or Friday. We have a lot of great data to cover this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here

*Opinion, Not Advice. See Terms