Following the Pandemic Crash and recovery, I gave Chairman Powell and Secretary Mnuchin a lot of credit for saving the world from a global depression by acting quickly and forcefully. As I take a look back, I think Mnuchin deserves all of the credit. Here’s why:

In December 2018, just after Powell was appointed as Fed Chair, he made the rookie mistake of saying Quantitative Tightening was on “Auto-Pilot” at the December 19, 2018 press conference. The stock market was already weak going into the conference, but his lack of market experience/savvy led him to believe a hawkish stance (at the exact wrong time) would make sense. He compounded a 7% pullback in the market into a 16.5% crash in just 4 days following his thoughtless comments.

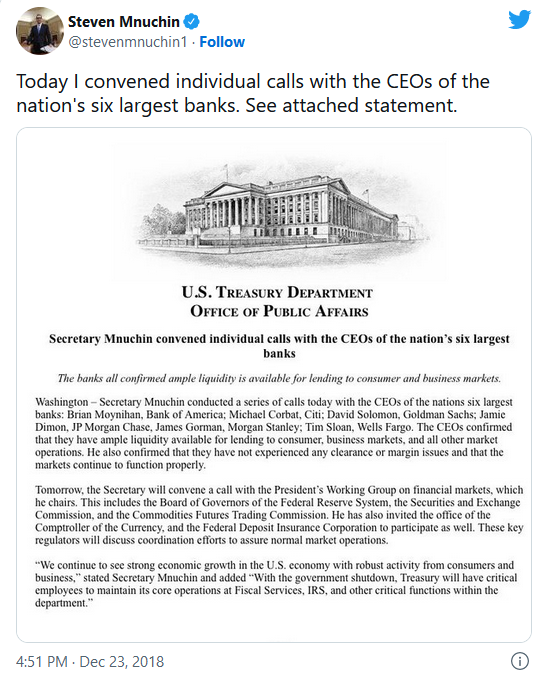

Steven Mnuchin had to call the CEO’s of the largest 6 banks and wrangle up ample liquidity to save a free-falling stock market on a Sunday (the day before Christmas Eve):

If Secretary Mnuchin had not done that, Powell’s amateurish comments could have completely crashed the stock market.

The following Friday, Jay Powell walked back his comments at a public event by saying the Fed would be flexible with all of its policy tools, including the balance sheet. The market rallied back to new highs in coming weeks:

Mnuchin saved the day in March of 2020 once again: The $2.2 trillion government rescue — which delivered cash to individuals, small businesses and giant companies succeeded because of the program’s chief architect, Treasury Secretary Steven Mnuchin. Secretary Mnuchin worked with Democrats and Republicans to devise and pass the landmark stimulus bill. Stress was building in the credit markets, the lifeblood of the modern financial system. Trading of commercial paper — a vital day-to-day financing source for major companies — was drying up. Investors were dumping municipal bonds, jeopardizing the ability of states and cities to borrow money and pay employees. Mnuchin also encouraged the Fed to backstop $1 trillion of commercial paper as well as some junk bonds. The Senate passed the $2.2T Cares act bill and the markets soared. (NY Times)

While Jay Powell learned his lesson of not being too rigid and tight from December 2018, he over played his hand in 2021 when he continued quantitative easing despite home prices soaring as much as 70% in 18 months. Powell runs the Fed like I play golf. He crushes his driver but has no feel around the greens. Unlike me, he seems to have no interest in practicing his short game until it’s too late and a colleague has to take over the steering wheel. Unfortunately, Mnuchin is no longer there to tell him what to do. Perhaps Janet Yellen can step in and help steer the ship once again. She was a solid Fed Chair.

Winston S. Churchill once said, “Generals are always prepared to fight the last war.” Unfortunately, this has been Jay Powell’s modus operandi. In 2021 he was too loose (despite the housing and inflation data signaling to pump the brakes a bit) due to his near death experience in December of 2018. He was fighting the last war and messed up again. Now, he’s doing the exact same thing at the exact wrong time. He realizes he was too loose last year and he is over-steering the economy into a ditch.

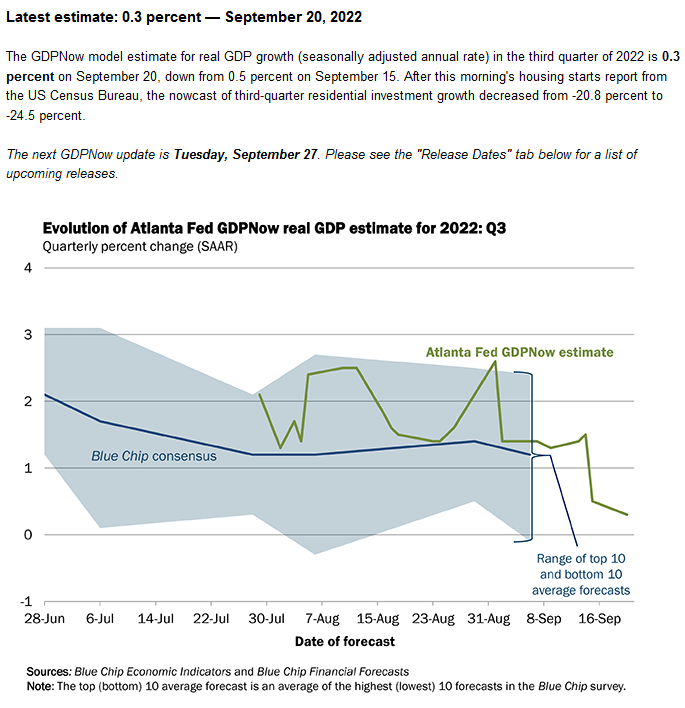

We have had 2 quarters of negative GDP growth so far this year (a technical recession). The tightening has already worked. He’s 50 yards out from the pin and rather than grabbing his lob wedge as sticking it next to the pin, he’s pulling out his driver and pounding it 200 yards past the hole. The time to use the driver was on the TEE (2021), not when you’re near the green and you’ve already destroyed demand. It looks like we will get a 3rd quarter of negative GDP for Q3. Atlanta GDPNow has been falling off a cliff and looks like it did before printing negative in Q2:

So if 2 quarters of negative GDP is no longer a recession, will 3 do the trick? My bet is it will finally be declared a recession somewhere around November 9 – even though it’s already happened. Once Biden wakes up and sees how many seats he has lost in the House and the recession is declared, they will move to replace Powell. I would anticipate there will not be much resistance on either side. That will be a catalyst for the markets.

Alternatively, if the markets don’t get bid in the next day or so, maybe Powell learns from his last two failures and walks back his statements on Friday. He is scheduled to speak on Friday afternoon in a virtual conference entitled “Fed Listens.” It would be nice if he took a class called “Fed Reads” and figured out when you read the data it points to deteriorating conditions that are not conducive to further tightening. Proper interpretation would warrant a “Mission Accomplished” speech after already pushing the economy into recession and understanding that inflation (unrelated to war and supply chain) is following the negative growth trajectory on a lagged basis. The proper play would be to say, “policy works on a lagged (6-9 month) basis and we have just implemented 3 EMERGENCY LEVEL rate hikes of 75bps each. We will now wait and see how the data comes in before making any further moves.”

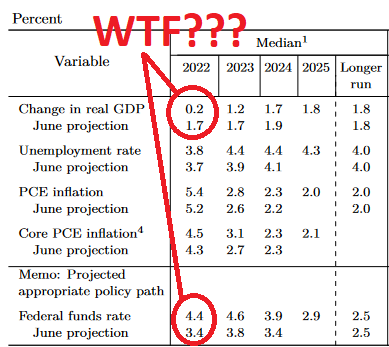

Instead of declaring victory and waiting for the data, he made a HUGE DOWNGRADE in economic outlook while at the same time made a HUGE UPGRADE in tightening expectations:

They will have to be walked back. The only question is whether they will require another crash to do so, or if they panic at the June lows and walk it back. The one thing about the Fed is they want to avert another economic crisis that will cost trillions to backstop. They simply don’t have the bullets left. Much better to let inflation run slightly above trend than push the economy into a deeper recession.

Fed Forecasting Track Record

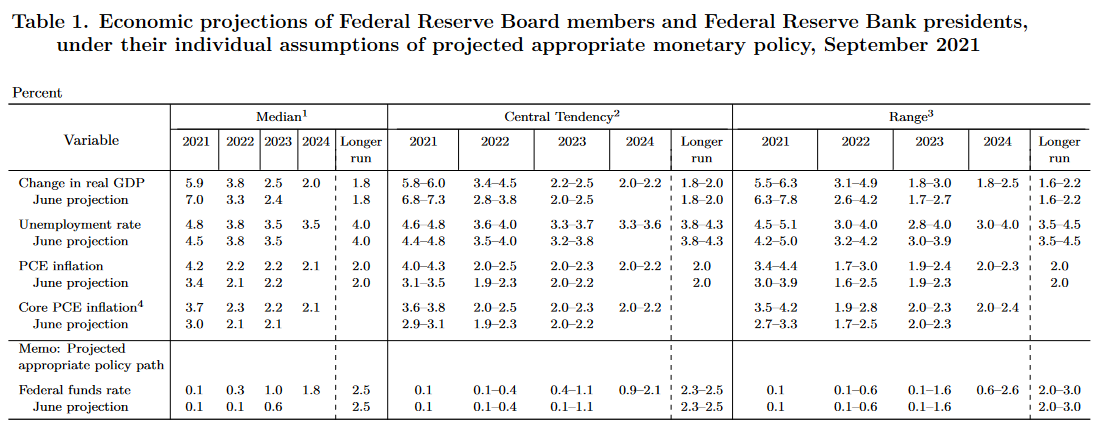

Just as the Fed underestimated their inflation outlook for 2022 (in 2021), they are now overestimating their inflation outlook for 2023 (in 2022). Let’s take a look at their history of (in)accuracy starting with September 2021 and working forward to today – September 2022:

In September 2021 the Fed thought GDP would be at 3.8% in 2022 and PCE Inflation would be at 2.2% (WHILE THEY CONTINUED TO EASE). WRONG. They thought .1% would be a good Fed Funds rate with PCE Inflation at 4.2%.

In December 2021 they TOOK THEIR ESTIMATES UP – expecting 4% GDP for 2022! The next 2 quarters were NEGATIVE GDP – with a 3rd on the way. PCE Inflation jumped to 5.3% but they thought .1% Fed Funds rate was sufficient.

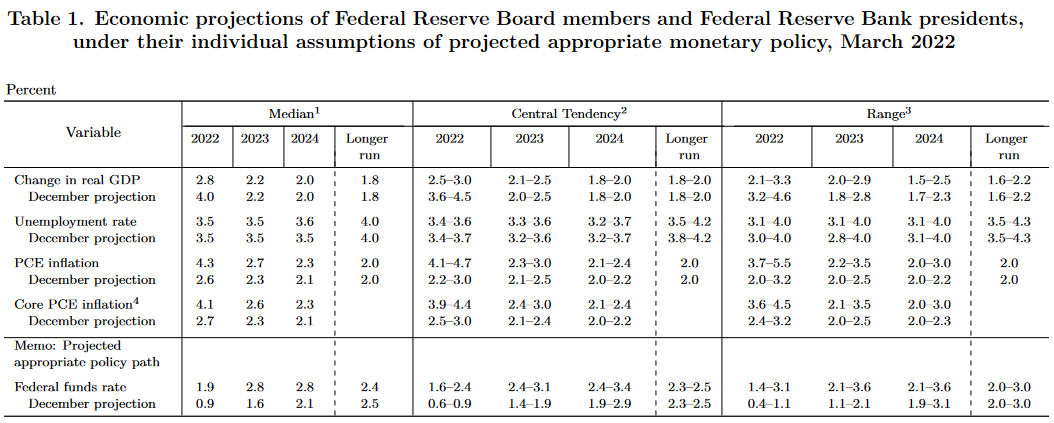

You can’t make this up, but in March, they CUT GDP estimates from 4% to 2.8% and decided it was time to start aggressive tightening into a slowing economy and catapulted their Fed Funds rate expectations to 1.9%.

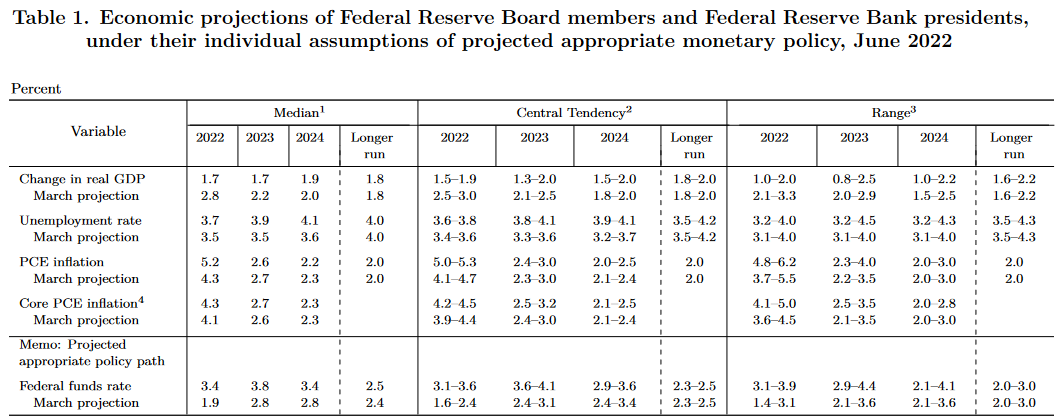

By June they figured they should collapse GDP estimates to 1.7% and increase the Fed Funds projection to 3.4%. They couldn’t figure out how to crash demand any more quickly than to step on the gas of a car headed toward a brick wall.

By June they figured they should collapse GDP estimates to 1.7% and increase the Fed Funds projection to 3.4%. They couldn’t figure out how to crash demand any more quickly than to step on the gas of a car headed toward a brick wall.

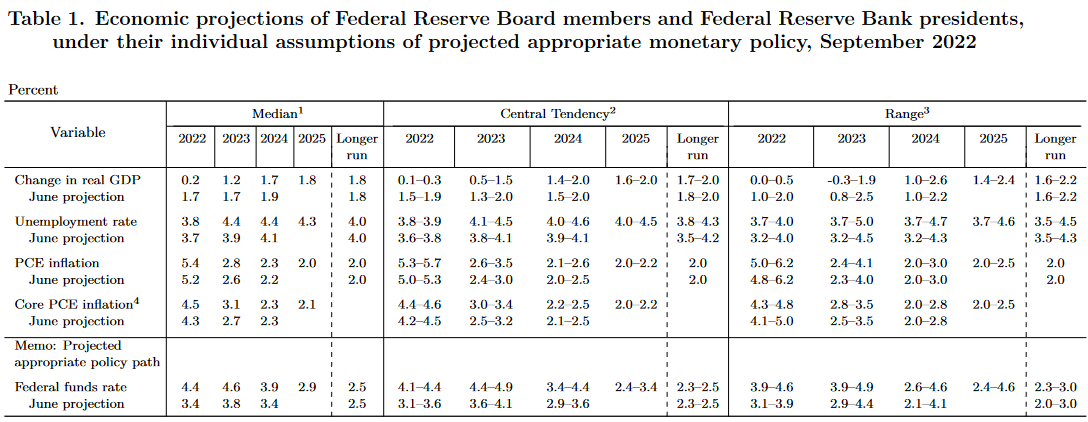

Finally, on Wednesday they decided, with GDP now near negative for the full year 2022 (took estimates to .2%) let’s see if we can completely destroy the economy by increasing Fed Funds Rate projection to 4.4% by the end of the year.

This is like teeing up your driver on the putting green. It makes absolutely no sense when you’re a couple of feet from the hole.

So LAST September, the Fed anticipated GDP would be 3.8% in 2022 and the Fed Funds Rate would be 1.9%. Instead we have negative GDP and projections of a 4.4% Fed Funds rate by year end.

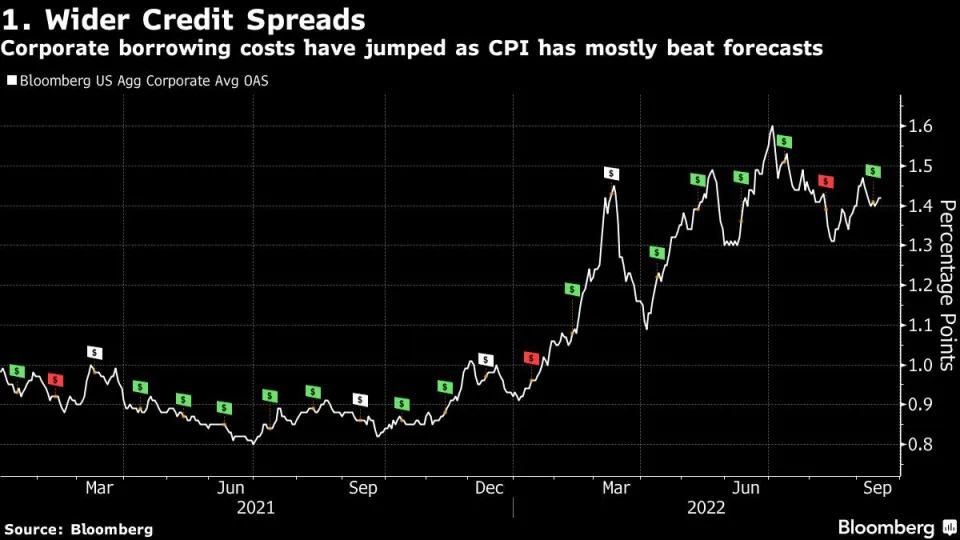

There are only two positives that can come from this level of incompetence: 1) They panic and walk it back quickly. 2) They panic and walk it back slowly. Time is running out as the credit markets are seizing up again:

Just as Powell fought the last war in 2021 being too loose in the midst of inflation (after his 2018 debacle of being too tight in a trade war). He is now making the same mistake for a 3rd time (tightening aggressively into a declining economy). There is a reason you only get 3 strikes in baseball and you’re out. Why the same doesn’t hold true for Fed Chairs – I guess we’ll find out soon enough (if he doesn’t pivot quickly).

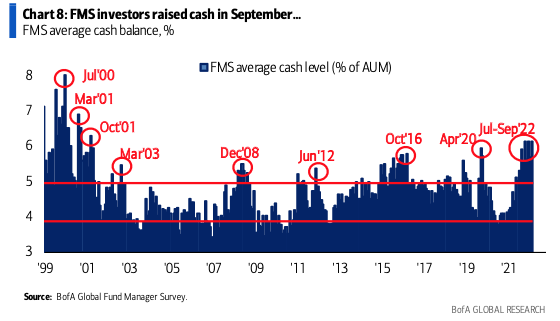

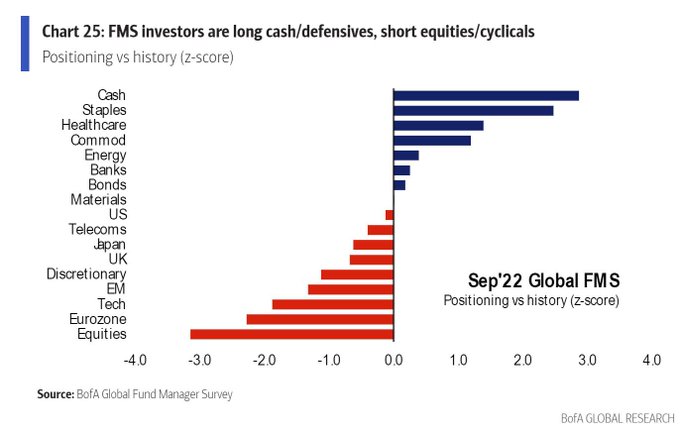

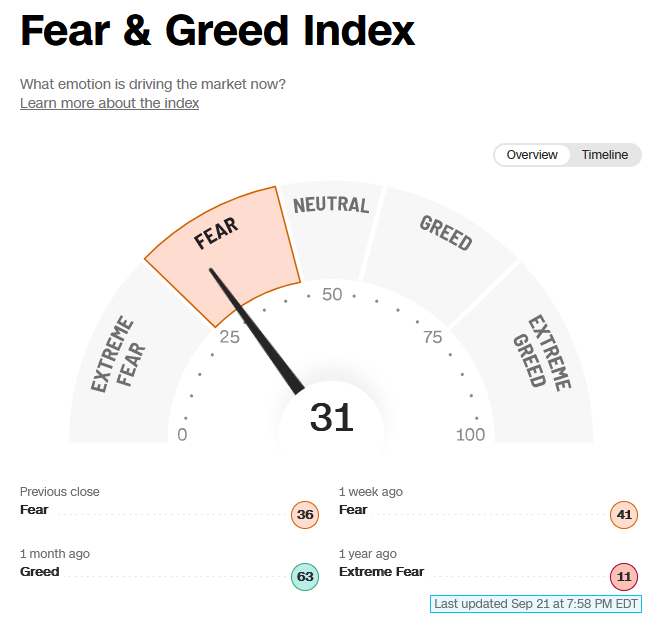

The good news is that market participants are positioned for the apocalypse (high cash balances and defensives) as we have covered in recent podcast|videocast(s). Any reversal in policy outlook would force panic buying into year end. We’ll likely know whether that is in the cards or not by Friday.

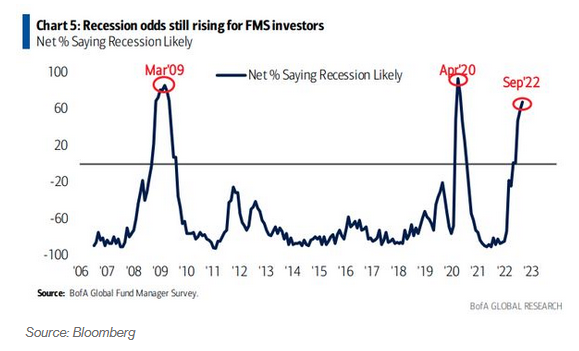

Keep in mind one thing though: Recession expectations are the highest since March 2009 and April 2020. The recession was already happening and the Stock Market bottom was already in. It’s possible this time will be the same, but we’re cutting it close:

Unfortunately, Powell seems like he will need a little more shock treatment again – like in December 2018 – before he wakes up and pivots. We’ll find out soon enough if he learned anything from his first two strikes and pivots before his hand is forced (or the decision is taken away from him):

Cheddar TV

On Friday I joined Hena Doba on Cheddar TV to discuss market outlook, positioning and history. Thanks to Hena, Ally Thompson, Elly Park, Lisa Farkas and Joe Kohle for having me on:

Watch in HD directly on Cheddar

We got more views on this interview than any other we have ever posted on LinkedIn. If you are interested in an in-depth look on positioning and upcoming catalysts, I encourage you to check it out.

CGTN Africa

On Tuesday I joined Hannah Viviers on CGTN Africa to discuss the Fed, Recession, Housing and Current Market Opportunities. Thanks to Hena, Samuel Kantai and Lucia Moki for having me on:

Watch in HD directly on CGTN Africa

Now onto the shorter term view for the General Market:

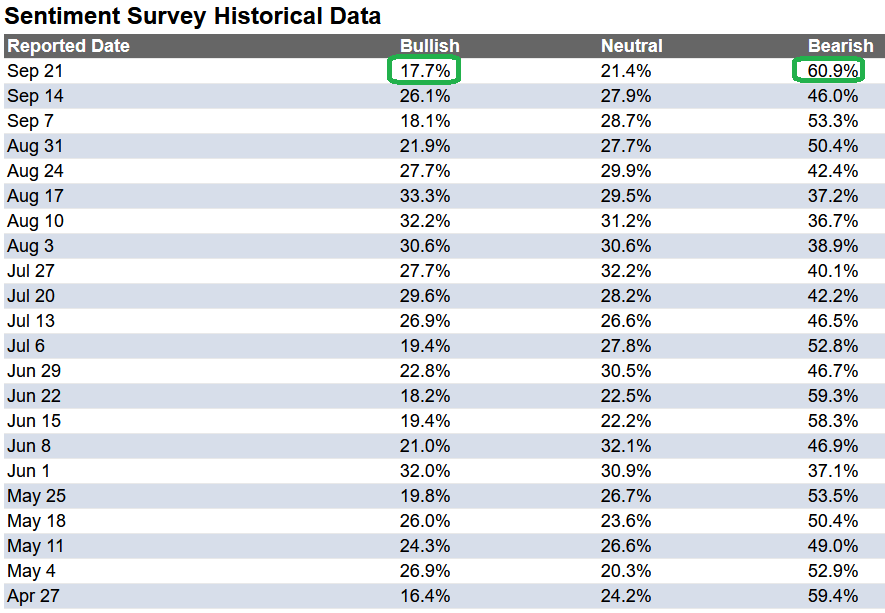

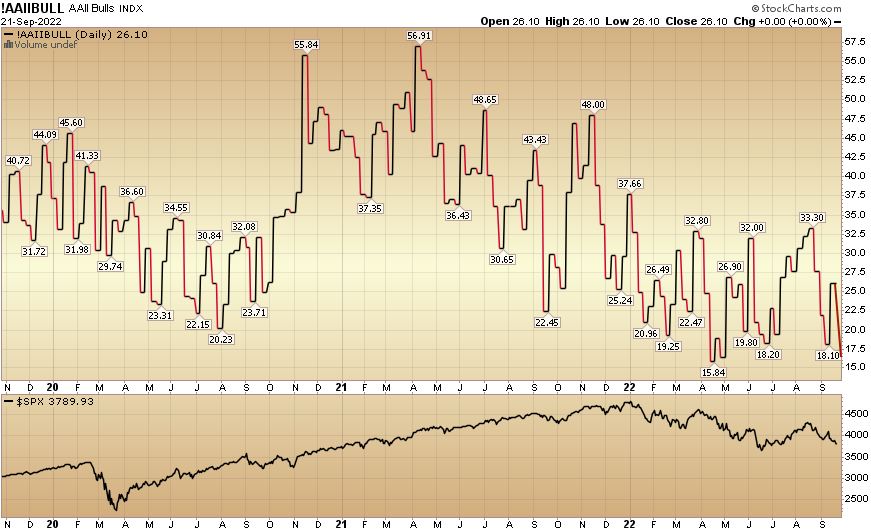

In this last week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) collapsed to 17.7% from 26.1% the previous week. Bearish Percent spiked to 60.9% from 46%. Retail Sentiment is now lower than it was at the pandemic lows (20.23) and the Great Financial Crisis lows of (18.92).

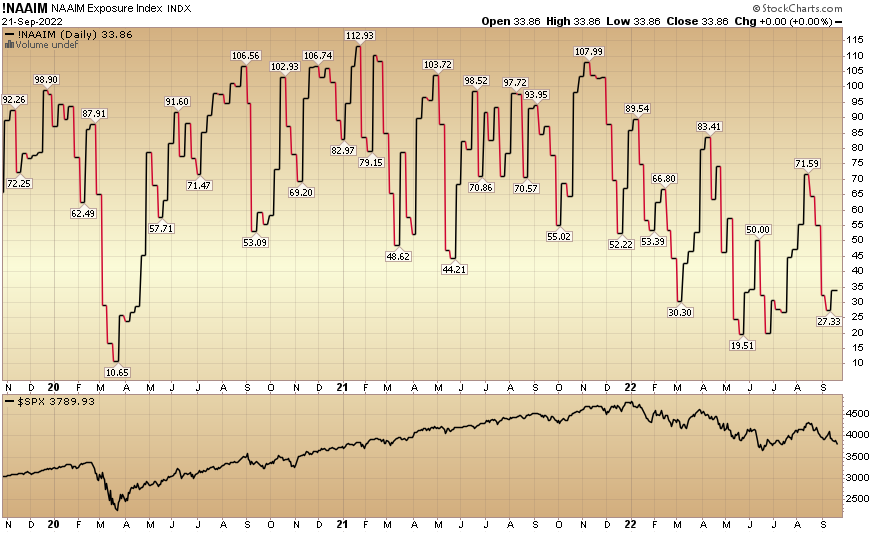

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked up to 33.86% this week from 27.33% equity exposure last week. Any good news and managers will be forced to chase up into year-end: