Chairman Powell did a fine job threading the needle at his press conference following the FOMC announcement. He achieved this feat by signaling FLEXIBILITY in his press conference, “The Fed is prepared to adjust the pace of purchases if warranted by changes in the economic outlook.”

In response to a question during the press conference, Chair Powell responded:

“MR. POWELL: So on the first part of your question, which is why not stop purchasing now, I would just say this. We’ve learned that where—in dealing with balance sheet issues, we’ve learned that it’s best to take a careful sort of methodical approach to make adjustments.

Markets can be sensitive to it and we thought that this was a doubling of the speed. We’re, basically, two meetings away now from finishing the taper, and we thought that was the appropriate way to go so we announced it and that’s what will happen.”

This acknowledgement of “Markets” implies the “Powell Put” is still in service for the time being.

This is in sharp contrast to his December 2018 statement “So we thought carefully about this, on how to normalize policy, and came to the view that we would effectively have the balance sheet runoff on automatic pilot.” That statement created the worst December stock market performance since the Great Depression.

These were the two most important statements from the FOMC release:

1) With inflation having exceeded 2 percent for some time, the Committee expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment. (In the press conference he defined “maximum employment” as a discretionary measure that encompasses: Unemployment Rate, Labor Force Participation Rate, Job Openings, and Demographics).

2) In light of inflation developments and the further improvement in the labor market, the Committee decided to reduce the monthly pace of its net asset purchases by $20 billion for Treasury securities and $10 billion for agency mortgage-backed securities. Beginning in January, the Committee will increase its holdings of Treasury securities by at least $40 billion per month and of agency mortgage‑backed securities by at least $20 billion per month.

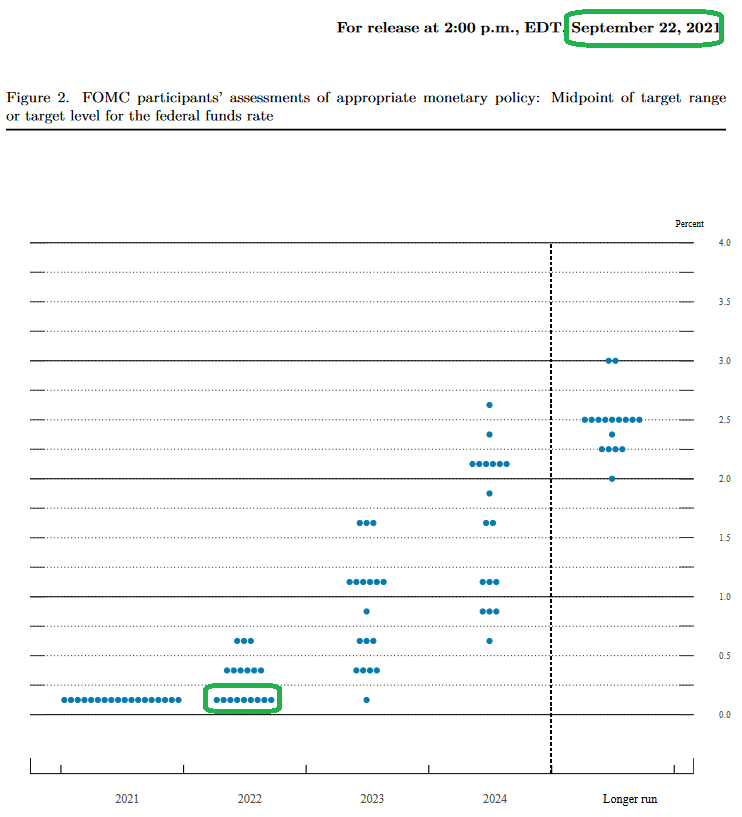

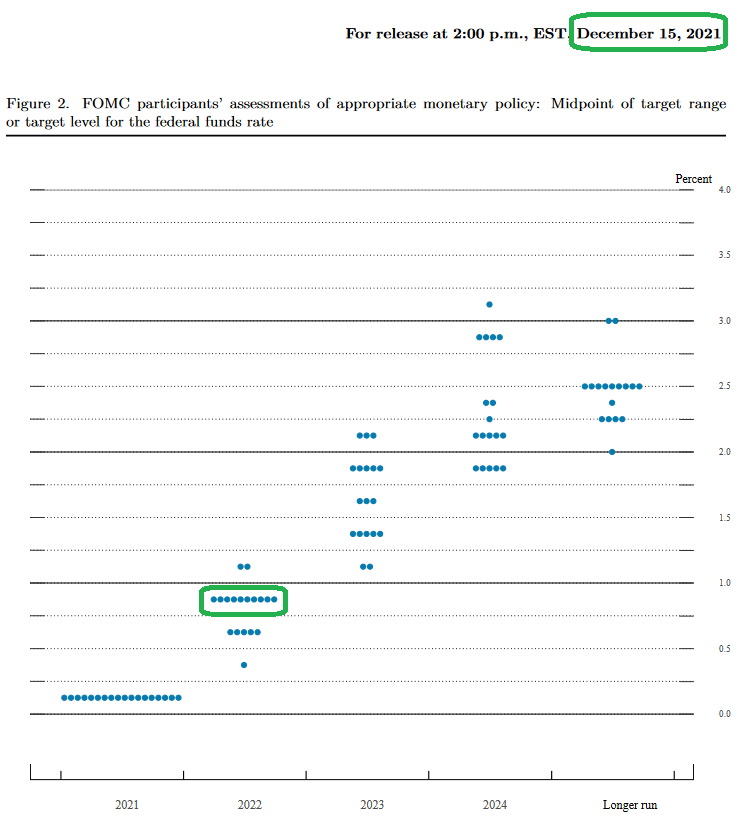

In theory, leaving short rates low (for now) and reducing longer dated Treasury purchases to ZERO by March SHOULD re-steepen the curve in coming months. However, we did see a BIG change in the dot plot from the September meeting. As you can see below, rate hike expectations among FOMC members jumped from 1 to 3 for 2022.

This is a BIG change. At this pace, they could easily invert the yield curve by 2023 – with a recession starting in 2024. The question will be demand from foreign buyers as the Fed steps out of the market. He referenced the foreign carry trade in response to the following question (related to the steepness of the curve):

QUESTION: I wanted to ask about the bond markets. When you see the 10-year at a 146 basis points, do you have any sort of concerns about an environment by which you might be hiking interest rates into—would you prefer the curve be a little bit steeper? What are you gleaning from the bond market actions over the last six weeks?

CHAIR POWELL: I think a lot of things go into, you know, the long rates, and the place I would start is just look at global sovereign yields around the world, look at JGBs, look at bunds, and they’re so much lower. You can get, you know, a much higher yield on U.S. Treasurys by buying USTs rather than bunds and you can hedge the currency risk back into yen, back into euros and still be way ahead. So, in a way, it’s not surprising that there’s a lot of demand for U.S. sovereigns in a world—you know, at a risk-free world where there’s so much—they’re yielding so much more than bunds or than JGBs. So that’s a big part of it.

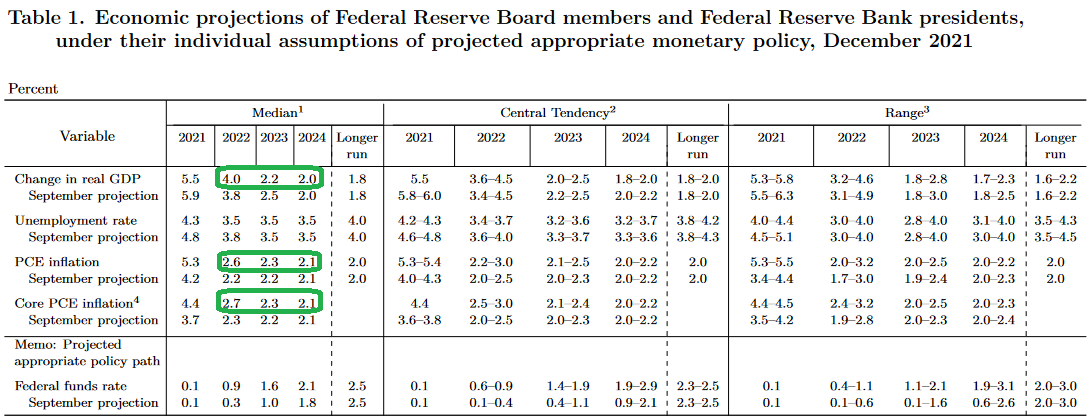

What is inconsistent is the idea that the Fed would continue to raise rates as aggressively as the dot plot implies – if they see inflation collapsing back to 2.3% by 2023. It goes to the old saying, “don’t listen to what people say, watch what they do.” Furthermore, why is the rush to remove accommodation so aggressive when they see GDP collapsing back to 2.2% in 2023?

So the market faced its fear today and it became a “sell the rumor, buy the news phenomenon.” The question now becomes, “is the first move the right move?” Will the yield curve continue to flatten as the Fed removes $80B a month in Treasury Bond purchases by March [i.e. will the manufactured demand for the long end of the curve (that is going away) be displaced by foreign demand]? If so, the move to tech this afternoon was correct. A flatter curve and slower growth environment would favor businesses with long duration earnings that can grow in a weak economic environment.

OR, will the yield curve start to re-steepen in coming months (red line above turns back UP – away from inversion) as the Fed exits as a buyer of the long end of the curve. If that is the case, you want to be in Small Cap, Cyclicals, Value and Re-Opening trades. We favor this outlook (re-steepening) and think the coming sessions will start to move in this direction.

OR, will the yield curve start to re-steepen in coming months (red line above turns back UP – away from inversion) as the Fed exits as a buyer of the long end of the curve. If that is the case, you want to be in Small Cap, Cyclicals, Value and Re-Opening trades. We favor this outlook (re-steepening) and think the coming sessions will start to move in this direction.

If foreign demand displaces the Fed purchases – as Chair Powell posited in the press conference – and 1.71% was the peak 10-year yield for this cycle (as was the case when they announced taper in December 2013), we will invert sooner than expected – assuming the dot plot is accurate. I think we may press above the recent peak in yields as the Fed steps out of the market, but we will see in coming months. If true, it would extend the cycle – as banks have more incentive to extend credit – with a steeper curve.

Of note, we are still waiting on the approval of Pfizer’s Paxlovid – which would recharge the re-opening stocks overnight.

Pfizer’s Paxlovid COVID-19 pill showed near 90% efficacy in preventing hospitalizations and deaths in high-risk patients, and recent lab data suggests the drug retains its effectiveness against the fast spreading Omicron variant of the coronavirus.

Pfizer Chief Scientific Officer Mikael Dolsten said in an interview yesterday that he expects authorization for use in high-risk individuals from the U.S. Food and Drug Administration and other regulatory agencies soon. He does not believe an FDA advisory panel meeting will be needed.

“We’re in very advanced regulatory dialogues with both Europe and the UK, and we have dialogues with most of the major regulatory agencies globally.”

Fox Business

On Monday, I was on Fox Business – The Claman Countdown – with Liz Claman. Thanks to Liz, Stu Oppenheim and Milanee Kapadia for having me on:

Watch Directly on Fox Business

I gave two longer term picks in this segment (at the beginning), and some end of year positioning at the end.

Cheddar

On Tuesday, I was on Cheddar News with Kristen Scholer. Thanks to Kristen, Ally Thompson and Joe Kohle for having me on:

Watch Directly on Cheddar in HD

Here were the show notes:

Meme Stocks and High Multiple Price/Sales Stocks are correcting for 2 reasons:

- MEME were overvalued to start with (AMC, GME). AMC traded up to 5x its 2019 valuation and the box office is still a fraction of what it was pre-pandemic. WallStreetBets crowd finally got the message when CEO Adam Arron sold most of his stock for $35M in the past month. Retail was left holding the bag as the stock has now fallen almost 70% off its June peak. Of note: Adam Aron is a great CEO who played a tough hand to perfection. He is the reason the company will survive – despite industry headwinds. That is a different conversation than valuation.

- High Multiple (P/S) tech/momentum stocks, meme stocks, and crypto have been selling off ahead of the Fed announcement tomorrow. While it is widely expected they will accelerate the Taper from $15B/mo reduction to $30B/mo reduction the BIG issue is whether that will mean RATE HIKES start sooner as well. This will have a big impact on high multiple/meme/cryto.

Why? Right now the “cost to carry crazy is ZERO!” In every cycle, when capital is mispriced (cheap/low interest rates), it leads to MALINVESTMENT. In the late 90’s it was the dotcom boom that turned into a bust. In the mid-2000’s it was housing speculation. Today, it may be Meme/High P/S multiple/Crypto speculation.

With the exception of the last decade, over the past 100 years, buying a basket of stocks trading at 10x sales has inevitably led to massive losses. In the past decade, because rates have been at record lows and the recovery was slow, high multiple names were bid up as managers crowded into the few areas they could find growth in a 2% GDP environment.

Rate Hike Expecations: If you look at the Fed Dot Plot, they are expecting 2 rate hikes in 2022. If you look at Fed Fund Futures, we could see as many as 3 hikes.

This is CRITICALLY important because WHEN rates go up it makes the value of LONG-DURATION earnings assets (companies trading at high p/s multiples on the promise of earnings/cashflow far out in the future) GO DOWN.

Those companies that have CURRENT earnings become more valuable as investors demand earnings and cashflow TODAY when capital starts to cost them something.

You will also see the speculative assets come down when rates rise because the cost for paying for margin goes up – leading many to take down their leverage ratios.

We believe the stocks that have driven the market FAANG+NVDA+TSLA will start to underperform (or perform more inline with the S&P 500). Those stocks that have been left behind like Value, Small Cap, Cyclicals will start to outperform.

Despite Omicron, we expect the Fed to accelerate the taper tomorrow, HOWEVER, we also expect them to signal that rate hikes will NOT necessarily begin immediately after taper stops. They will look at the data (commodities have been weakening in recent months Grains, Metals, Energy, Hogs – but will not be felt by the consumer for another few months). The supply chain is improving as we are seeing ship count moderate at the LA ports.

Industrials is a sector we are focused on for 2022. The sector is expected to grow earnings at 36.2% relative to the S&P 500 which is expected to grow earnings at 8.7%.

The last shall be first! We think laggard companies like Boeing, Lockheed Martin, and even GE can start to outperform next year as the climate changes.

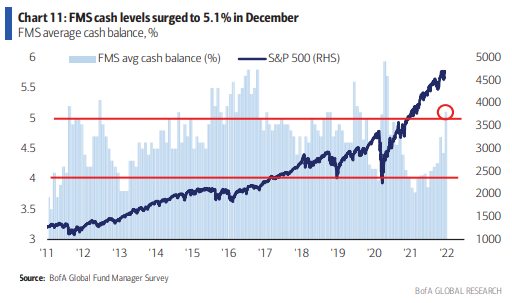

BofA Fund Manager Survey

On Tuesday, Bank of America published its monthly Fund Manager Survey. This month they interviewed 371 managers with $1.1T under management. We posted a summary here:

December Bank of America Global Fund Manager Survey Results (Summary)

The 3 key takeaway are as follows:

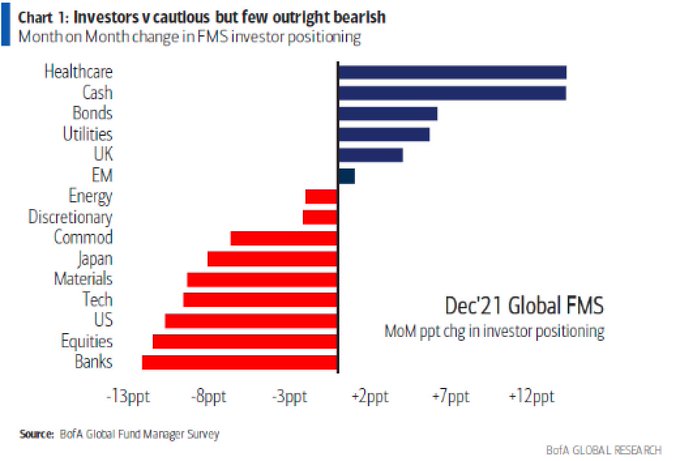

1) Managers RUSHED into cash in the past month and will now have to chase once again:

2) In addition to cash, they also moved into defensive positions ahead of the Fed Meeting:

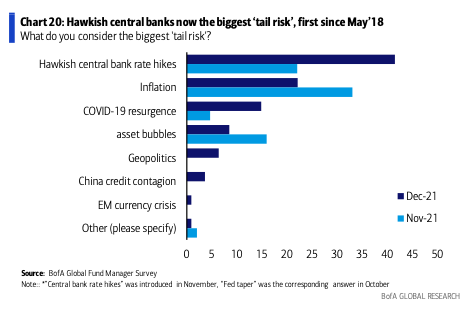

3) The biggest “tail risk” is hawkish central bank rate hikes. We saw signaling toward that end in today’s dot plot (posted above):

China

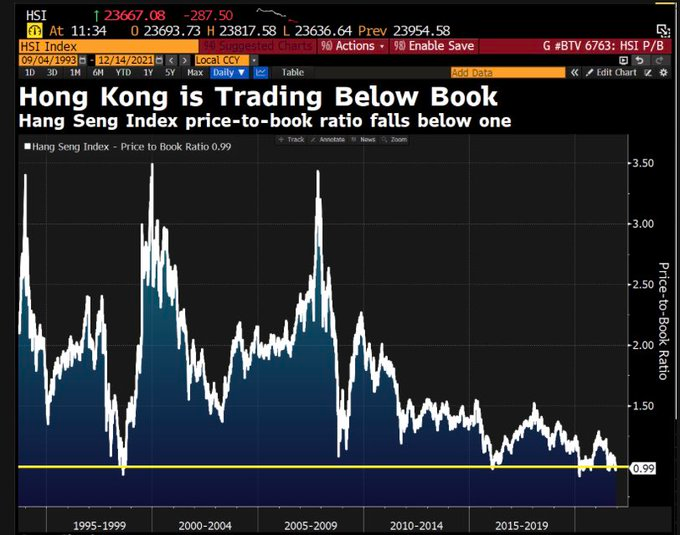

As we mentioned on last week’s podcast|videocast we have swapped out our US Alibaba (BABA) shares to Hong Kong (9988) shares. While likely unnecessary, it takes any de-listing risk off the table for us. In that context, we saw this chart posted by David Ingles of Bloomberg TV earlier this week:

As you can see in the charts above and below (match the trough years), it has paid handsomely to be a buyer of Hong Kong stocks when they traded below book value. This is what we are doing now:

This is also consistent with the Emerging Markets (China is ~35%):US ratio chart we have been showing in recent weeks to illustrate the extreme that we expect will begin reversion in 2022:

Now onto the shorter term view for the General Market:

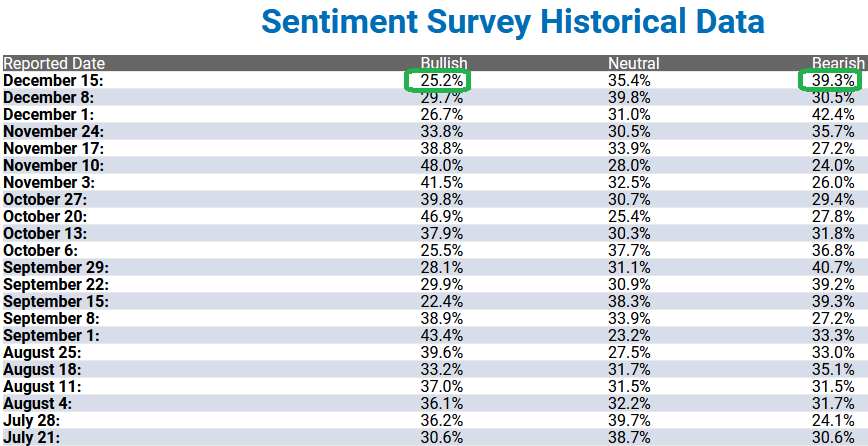

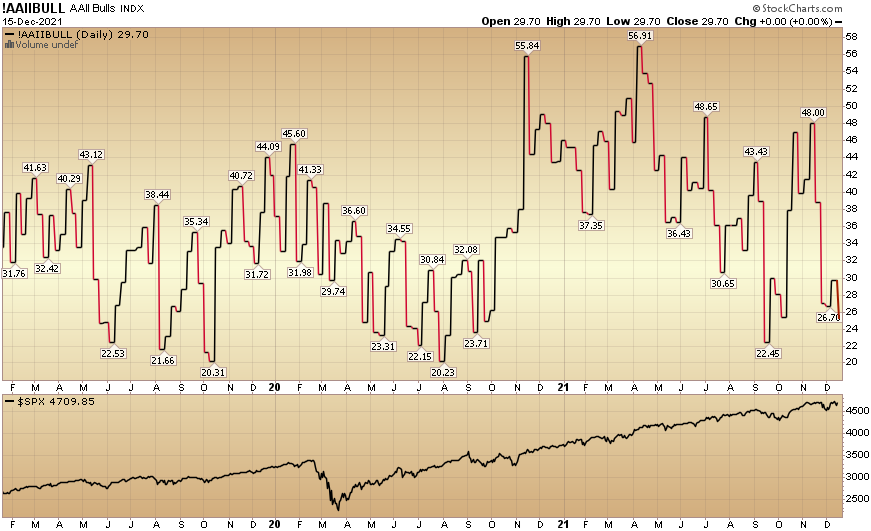

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) declined to 25.2% this week from 29.7% last week. Retail optimism has been largely flushed out.

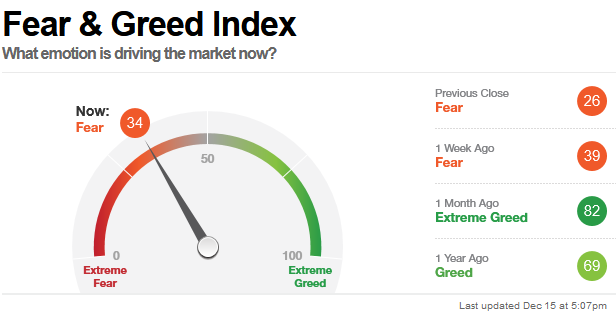

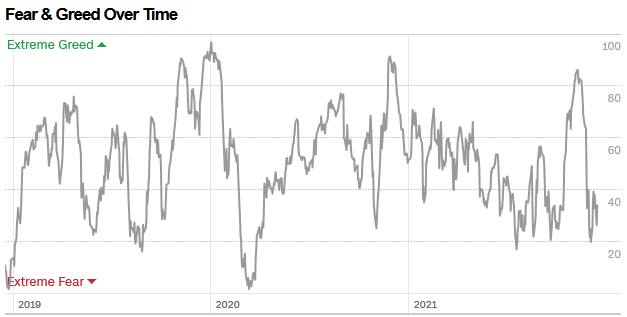

The CNN “Fear and Greed” Index ticked down from 39 last week to 34 this week. Fear is still present. You can learn how this indicator is calculated and how it works here: (Video Explanation)

The CNN “Fear and Greed” Index ticked down from 39 last week to 34 this week. Fear is still present. You can learn how this indicator is calculated and how it works here: (Video Explanation)

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 69.46% this week from 87.87% equity exposure last week. Managers will now have to chase into year-end.

Market participants were happy that the Market went up after the Fed announcement, but make no mistake – despite Powell’s now experienced hand at the press conference – it was a hawkish outcome (with embedded flexibility to assuage the market).

In that vein, our outlook for 2022 remains intact – high single digit to low double digit returns for the S&P 500 in 2022 – with much more volatility as participants sniff out liquidity withdrawal by 2H. We will continue to be focused on buying those areas of high quality – that are on sale – and trading at reasonable valuations. As we referenced at the end of our Cheddar interview above, “the last shall be first.”

The opportunities to make big money will be “under the surface” in 2022. As capital starts to have a cost, buying companies that generate earnings and cash flow TODAY will be rewarded.