On Thursday, I joined Suart Varney on Fox Business to discuss Stock Market, Election, Seasonality, GXO Logistics, Paypal and more. Thanks to Christian Dagger, Preston Mizell and Stuart for having me on:

Watch in HD directly on Fox Business

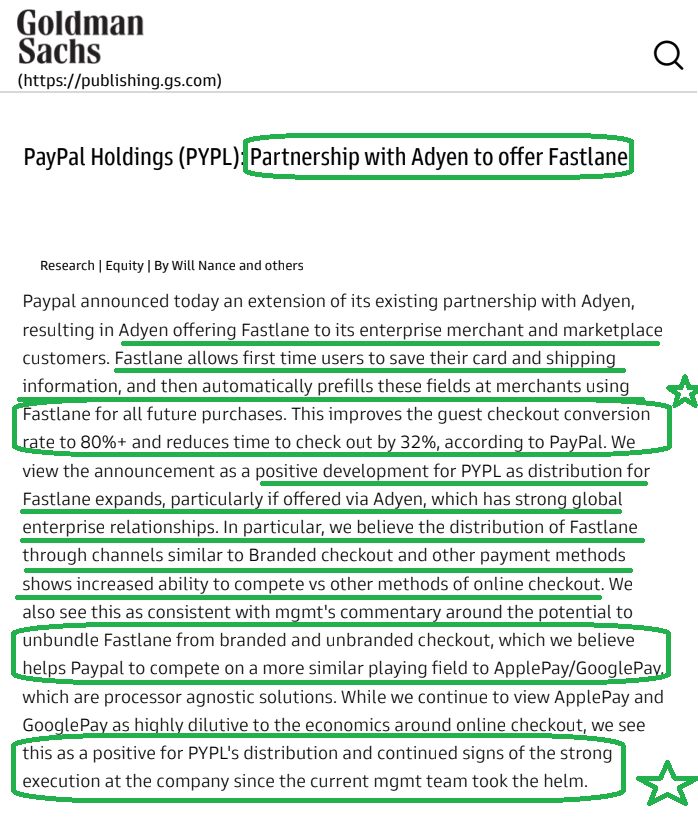

This announcement came out a couple of days after the above-mentioned interview – where I was talking about FastLane:

On Friday, I joined Charles Payne on Fox Business to discuss Stock Market, Seasonality, Tactical moves, Boeing, Cooper Standard and more. Thanks to Nicholas Palazzo and Charles for having me on:

You can find our original Cooper Standard thesis from May 2022 and most recent updates from last week here:

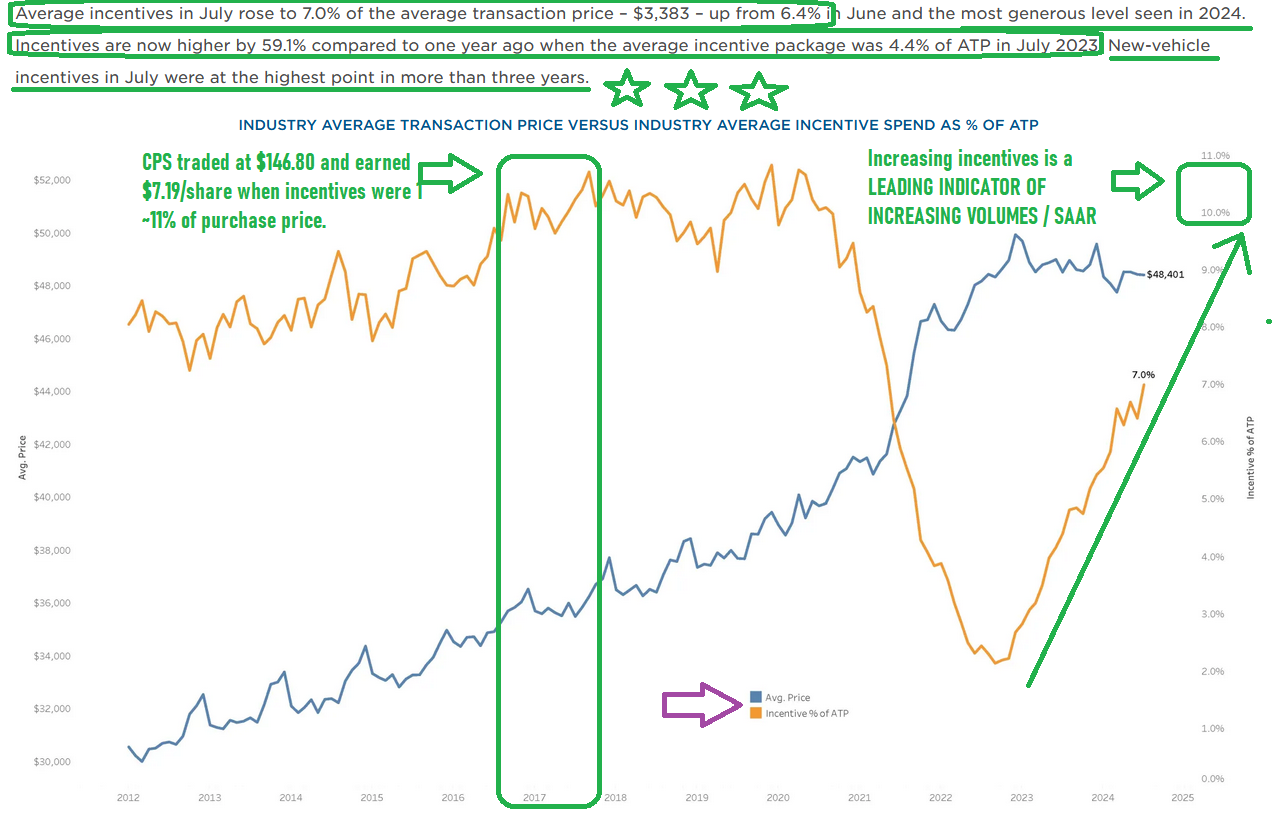

You will understand the significance of the chart below after your listen to my conversation with Charles Payne and read the article from last week (link above). As it relates to vehicle incentives, one of our loyal podcast|videocast viewers (h/t Stephen Frampton) sent us this updated chart from Cox Automotive (annotations by Tom Hayes):

Also on Friday, I joined Julie Hyman on Yahoo! Finance to discuss GXO Logistics, Natural Gas and Utilities. Thanks to Hayley Marks and Julie for having me on:

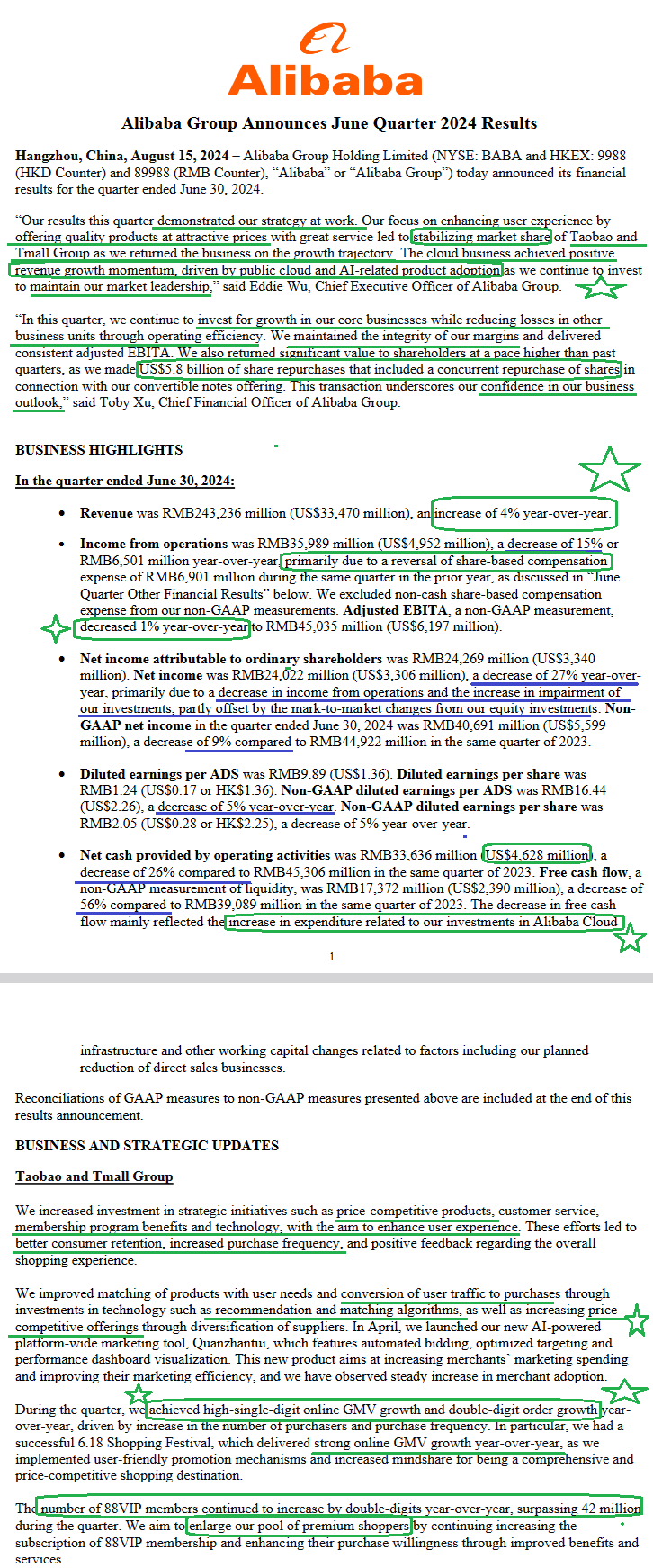

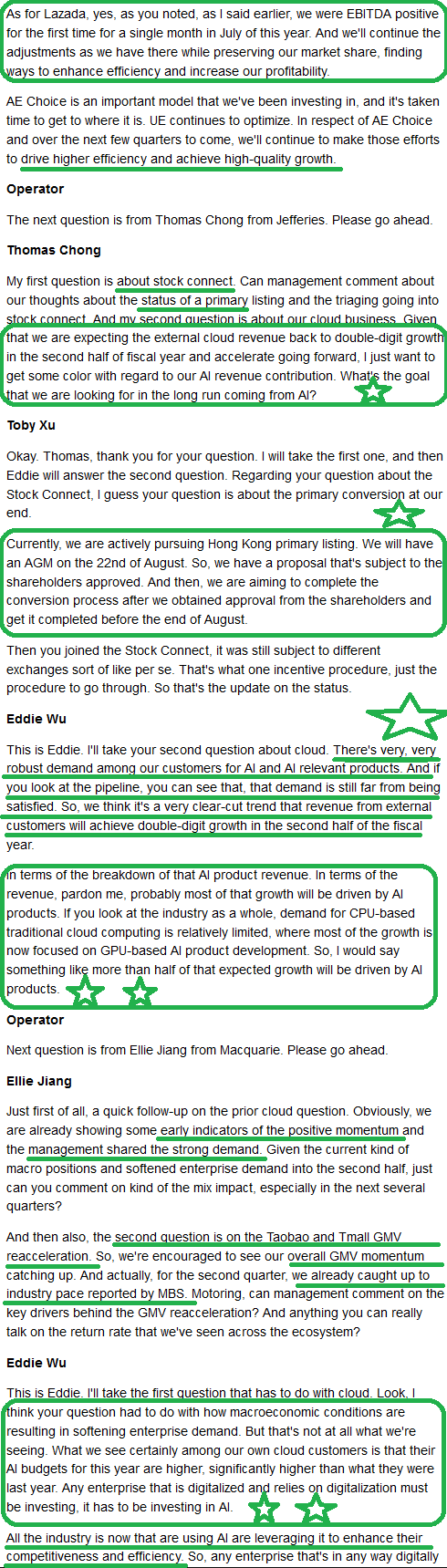

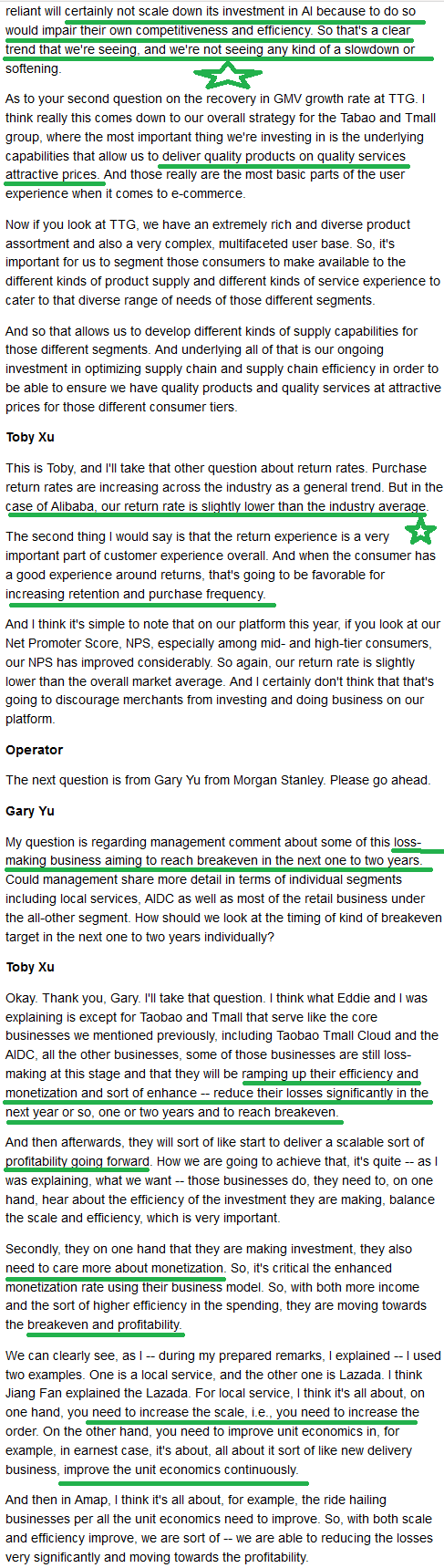

Alibaba Update

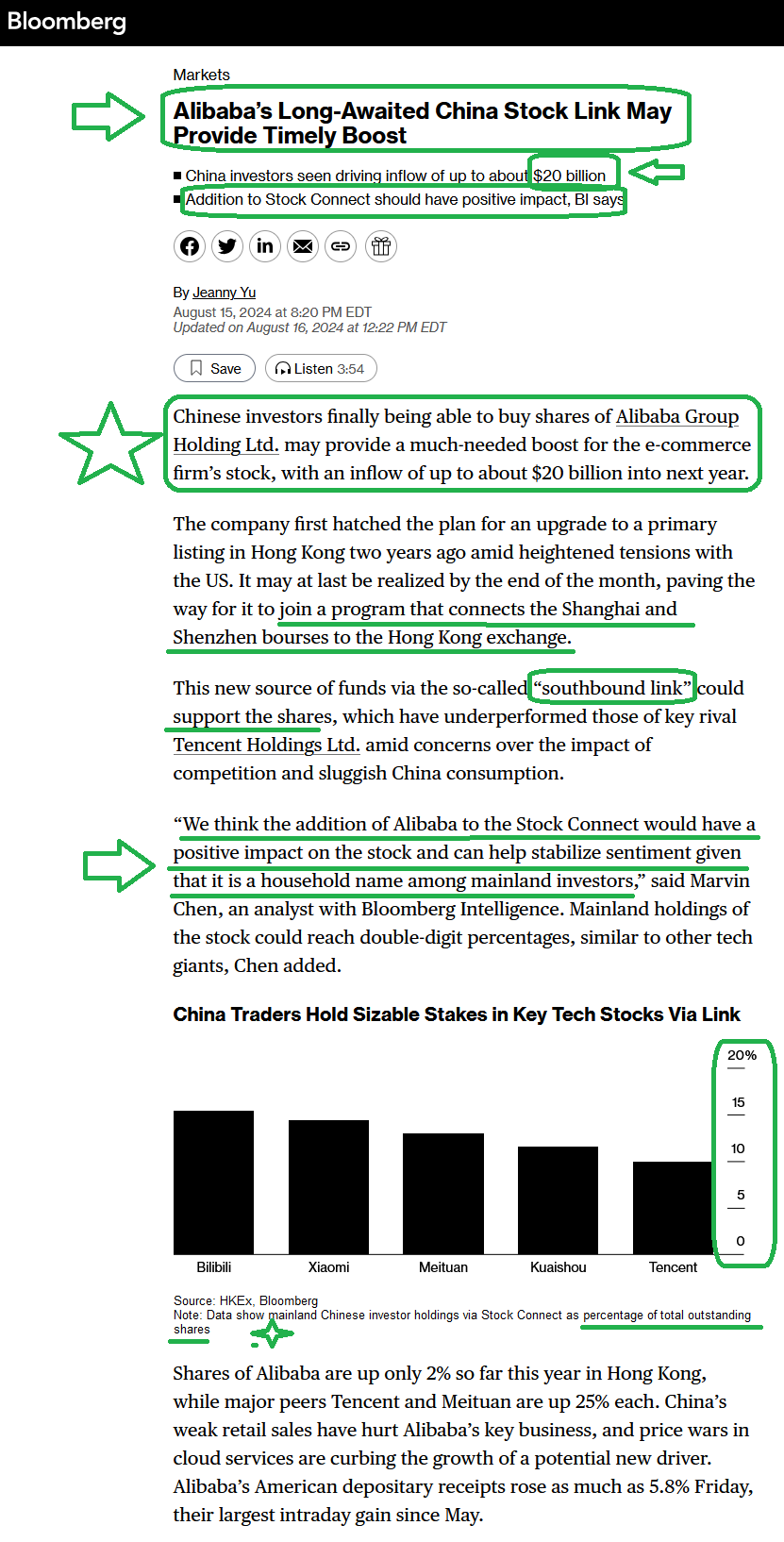

-As we’ve been anticipating for months, analysts are expecting ~$20B or more of new buyers for Alibaba stock as soon as early September:

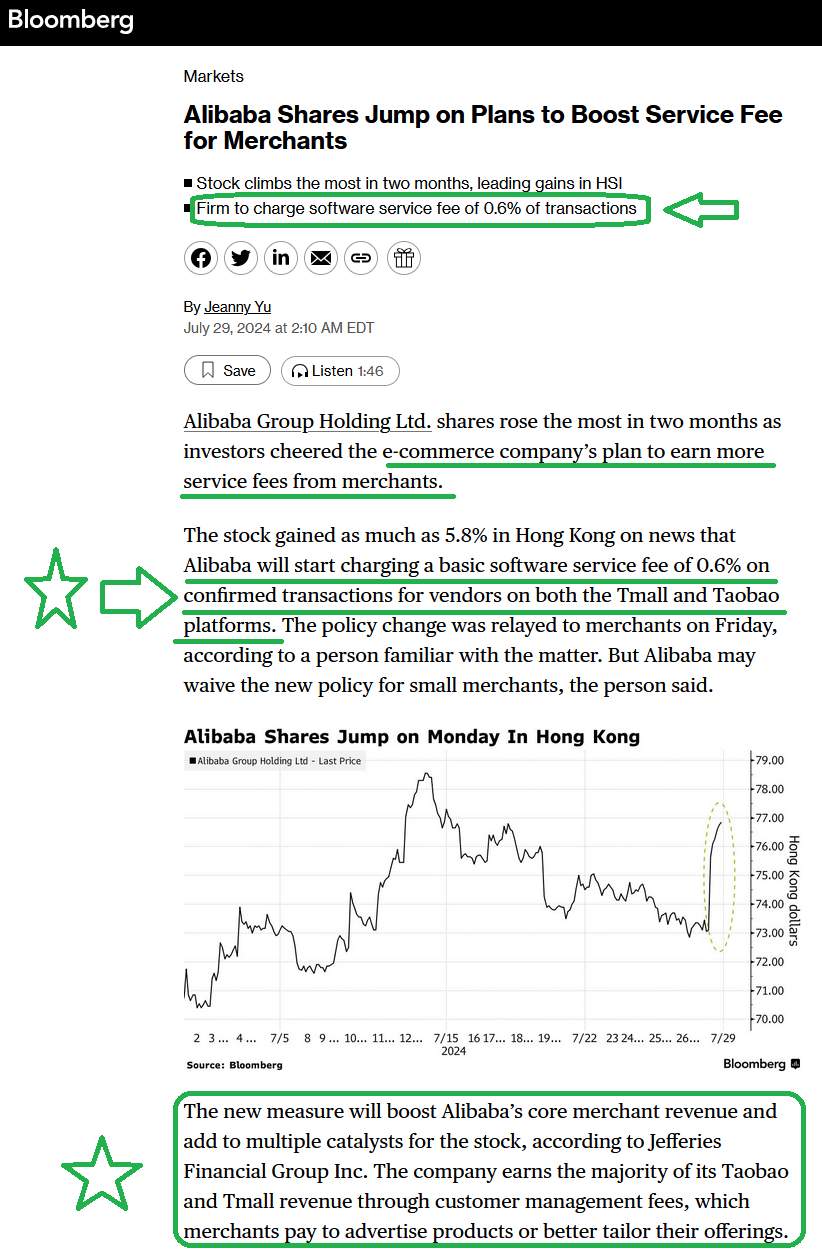

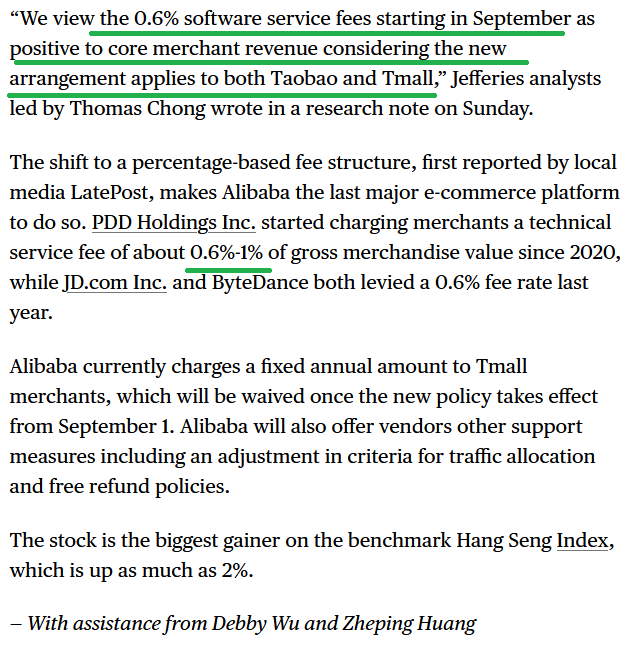

-Alibaba has finally decided to add a 0.6% “software service fee” to all transactions on Tmall and Taobao. To put this in perspective, revenues last year for Tmall and Taobao were ~$57B. 0.6% of $57B = $342M straight to the bottom line.

-Even the “sell side” analysts are turning “cautiously optimistic”:

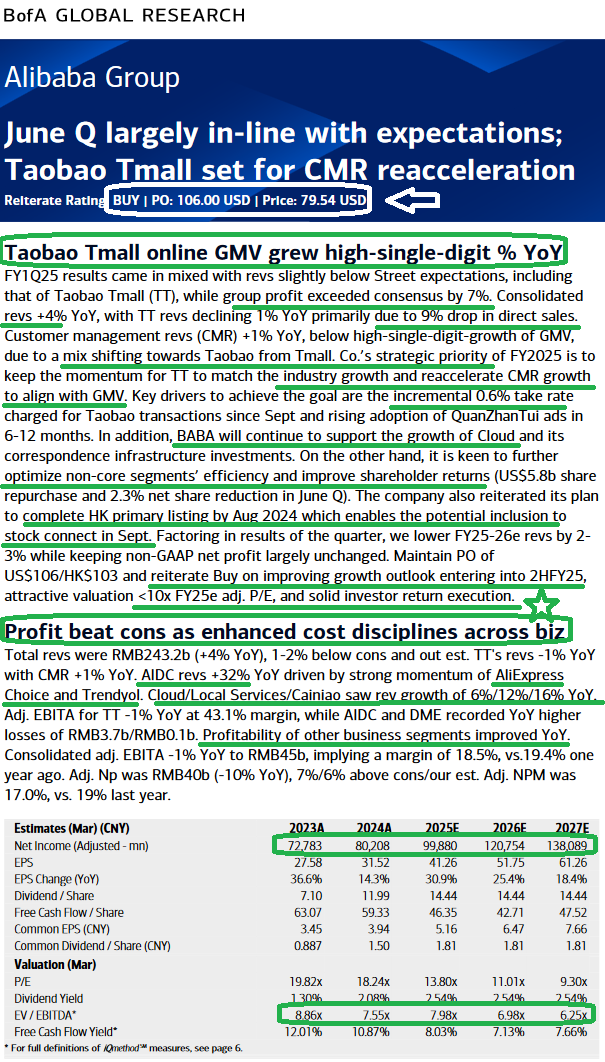

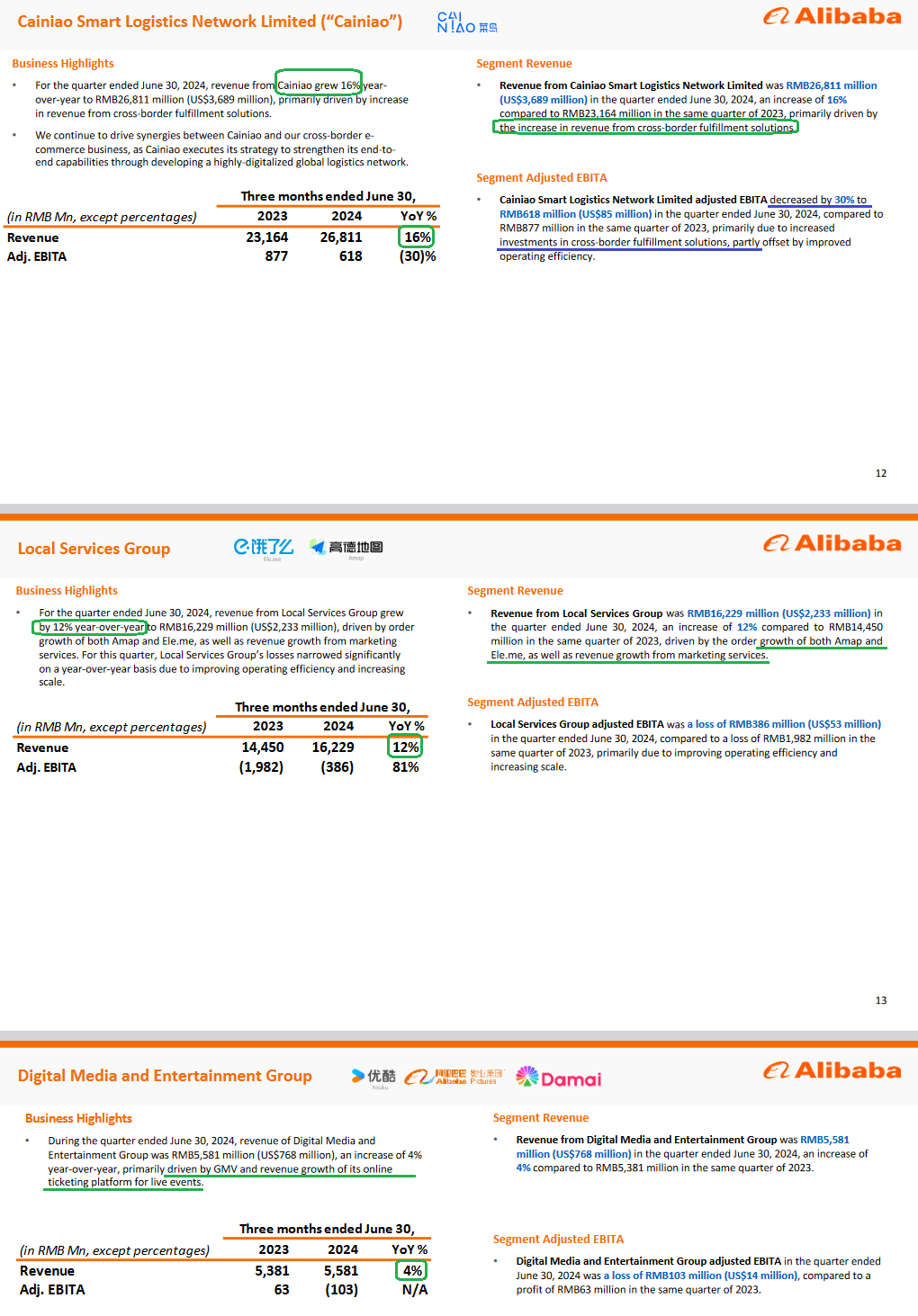

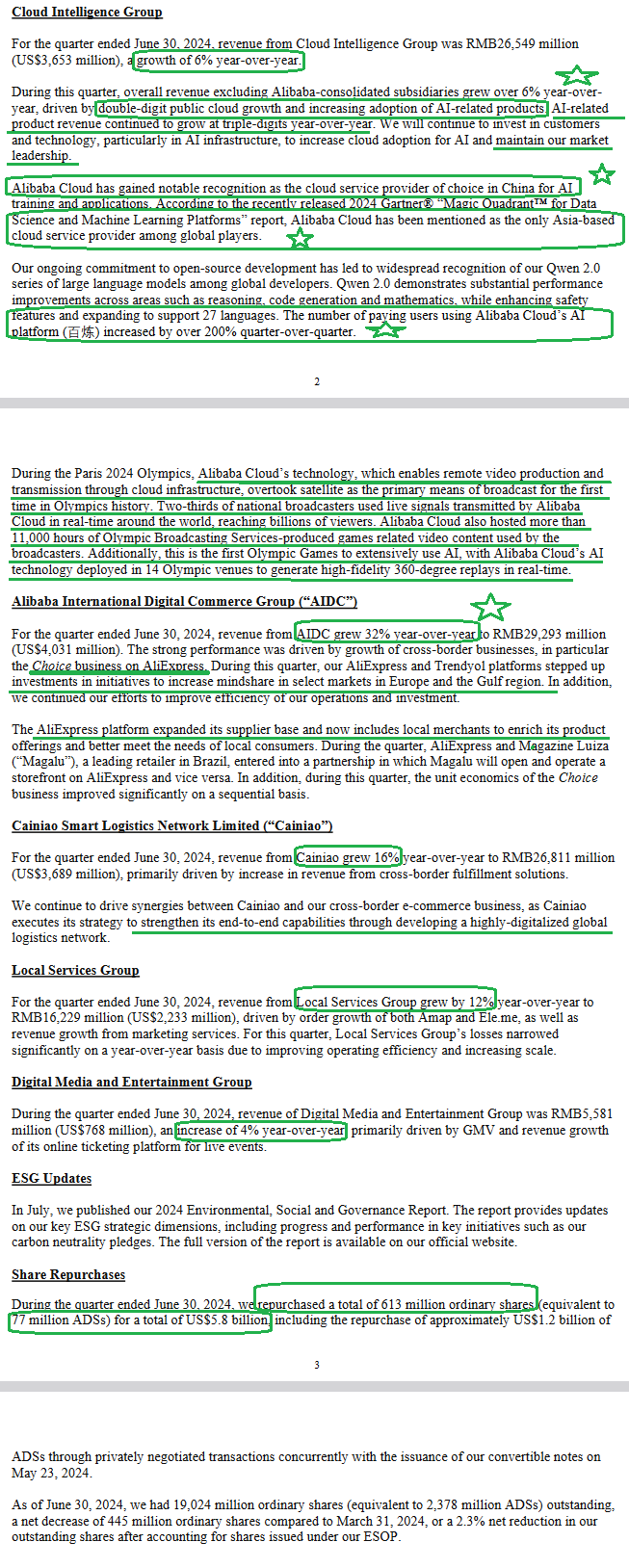

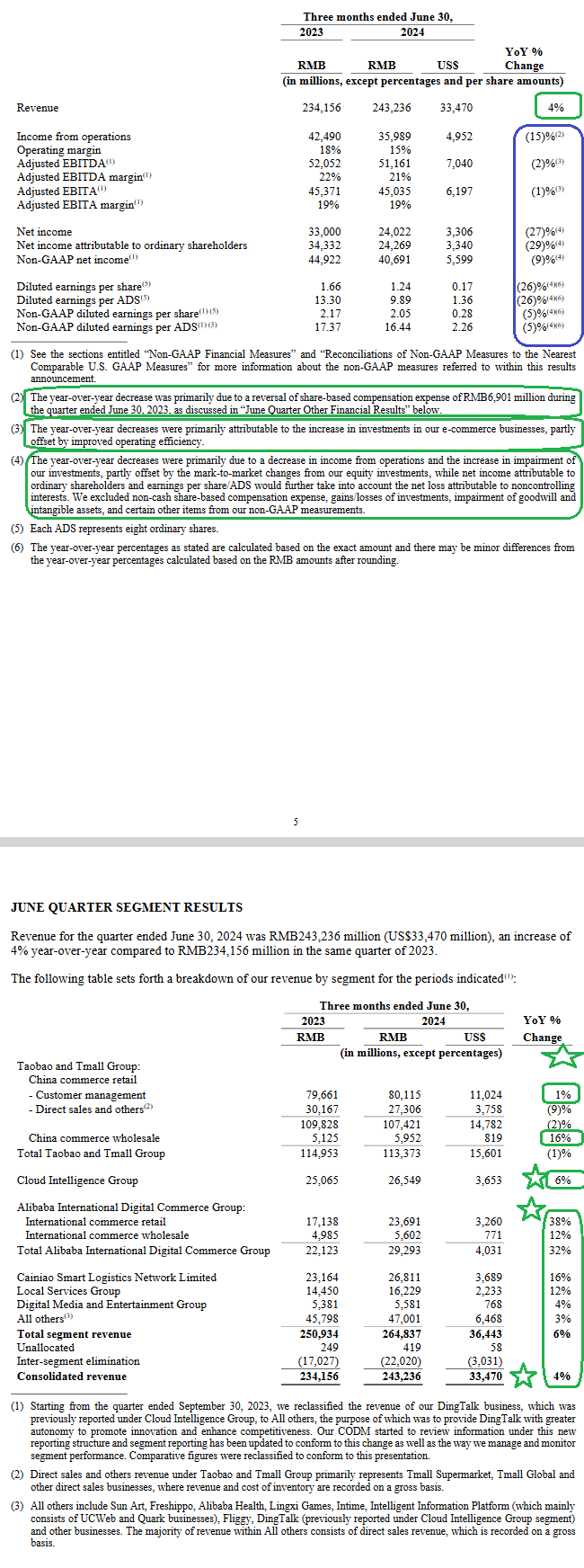

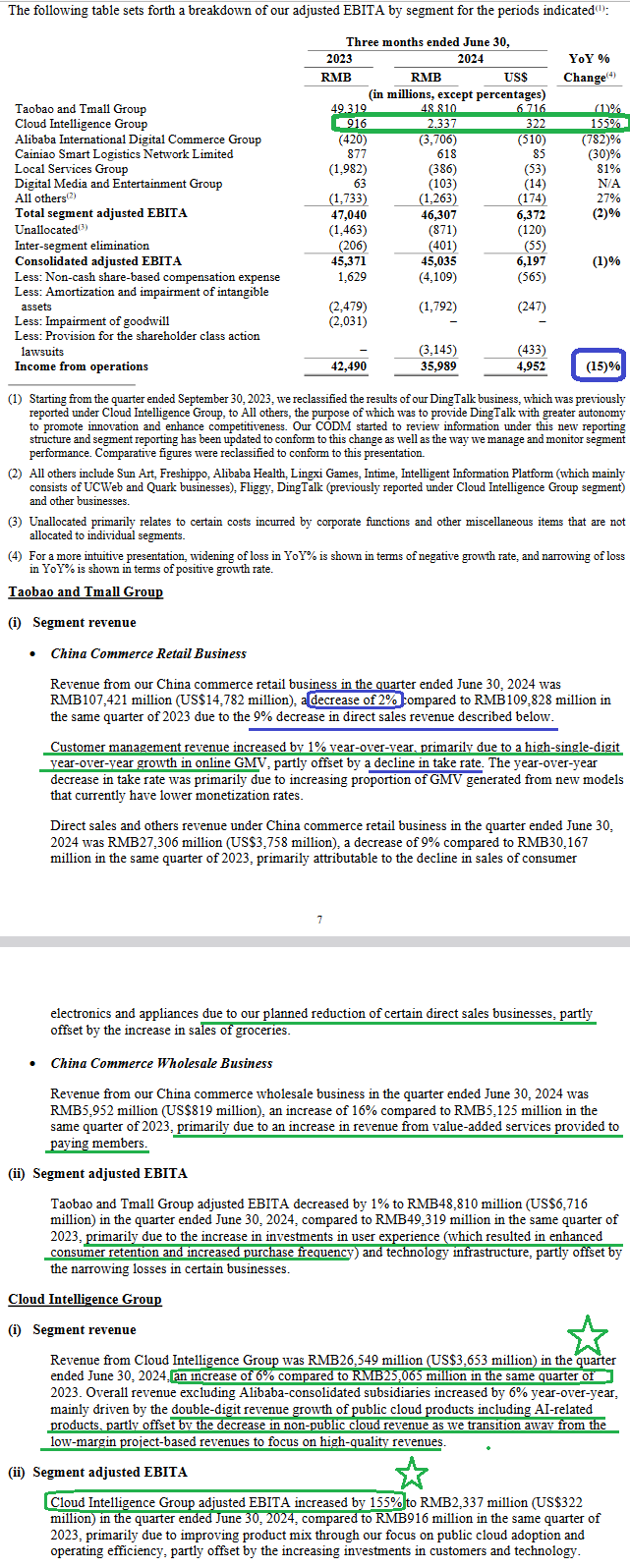

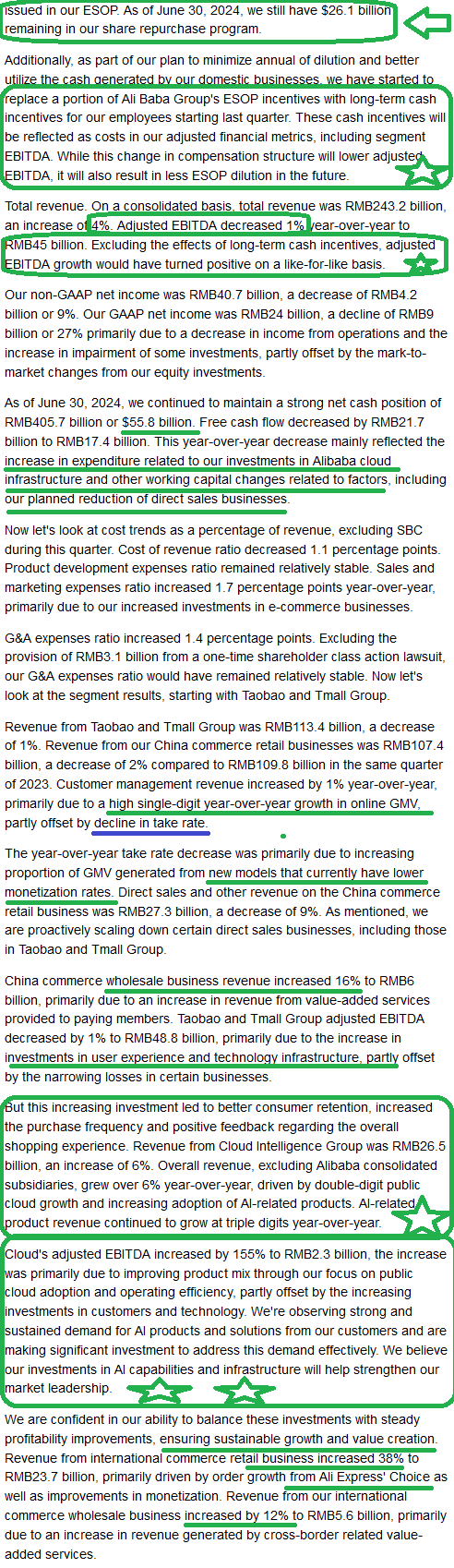

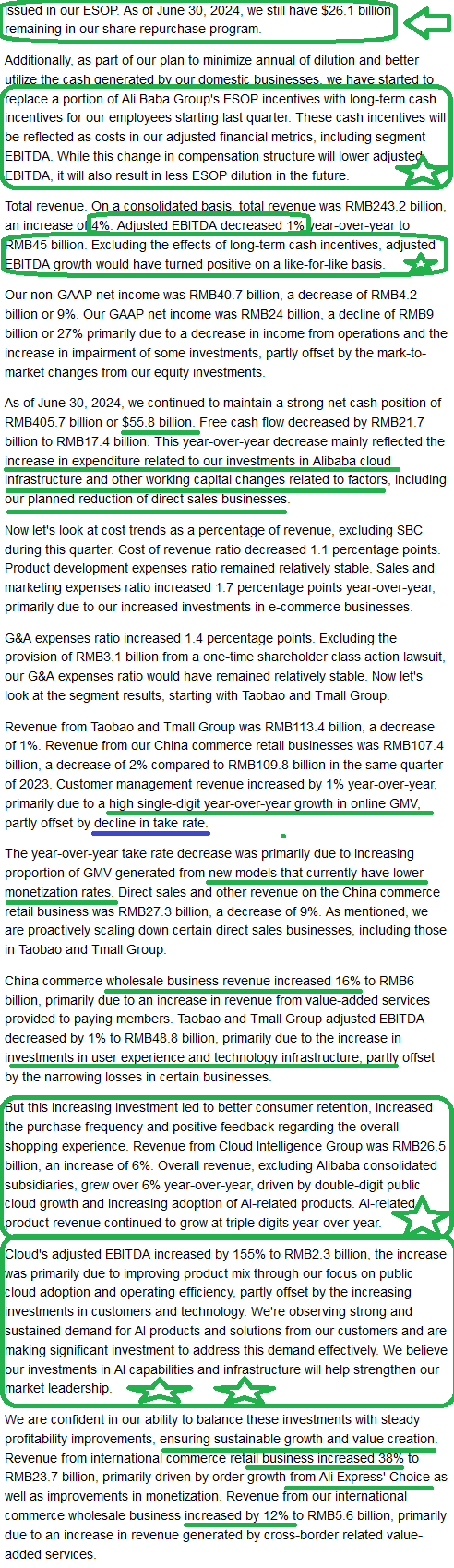

Last Thursday, Alibaba reported earnings. Here were the key points:

1) Overall Revenues grew by 4%.

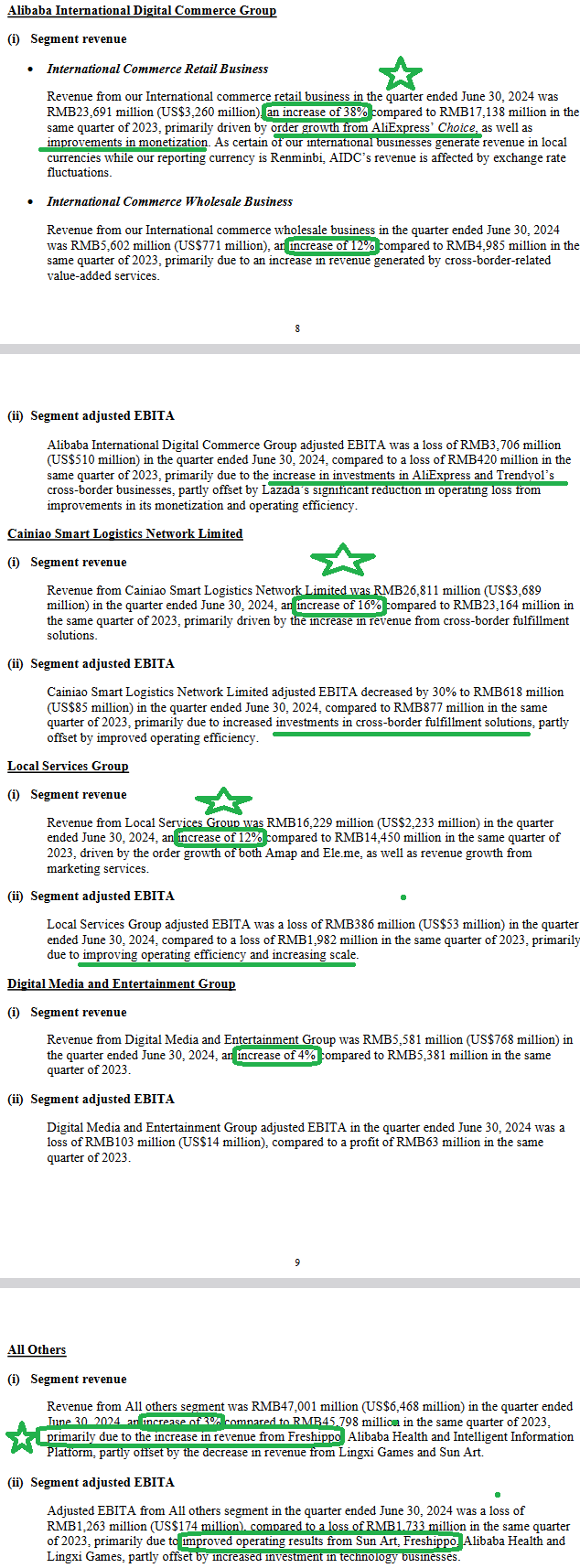

2) Cloud business grew 6%. “Revenue from Cloud Intelligence Group was RMB26.5 billion, an increase of 6%. Overall revenue, excluding Alibaba consolidated subsidiaries, grew over 6% year-over-year, driven by double-digit public cloud growth and increasing adoption of AI-related products. AI-related product revenue continued to grow at triple digits year-over-year.

Cloud’s adjusted EBITDA increased by 155% to RMB 2.3 billion, the increase was primarily due to improving product mix through our focus on public cloud adoption and operating efficiency, partly offset by the increasing investments in customers and technology. We’re observing strong and sustained demand for AI products and solutions from our customers and are making significant investment to address this demand effectively. We believe our investments in AI capabilities and infrastructure will help strengthen our market leadership.”

3) A.I. revenues grew triple-digits yoy.

4) Paying users of Alibaba Cloud’s AI platform increased by > 200% qoq.

5) Alibaba International Digital Commerce Group (“AIDC”) grew 32% yoy.

6) Cainiao Smart Logistics Network Limited (“Cainiao”) grew 16% yoy.

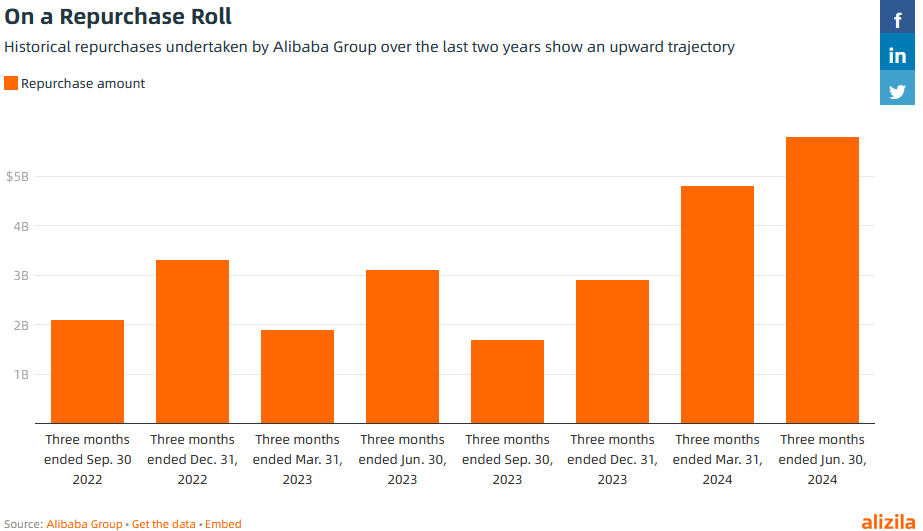

7) Repurchased $5.8B stock (net 2.3% reduction of outstanding shares after ESOP).

8) Cloud EBITDA was up 155% yoy.

9) Alibaba cut 6729 jobs this quarter.

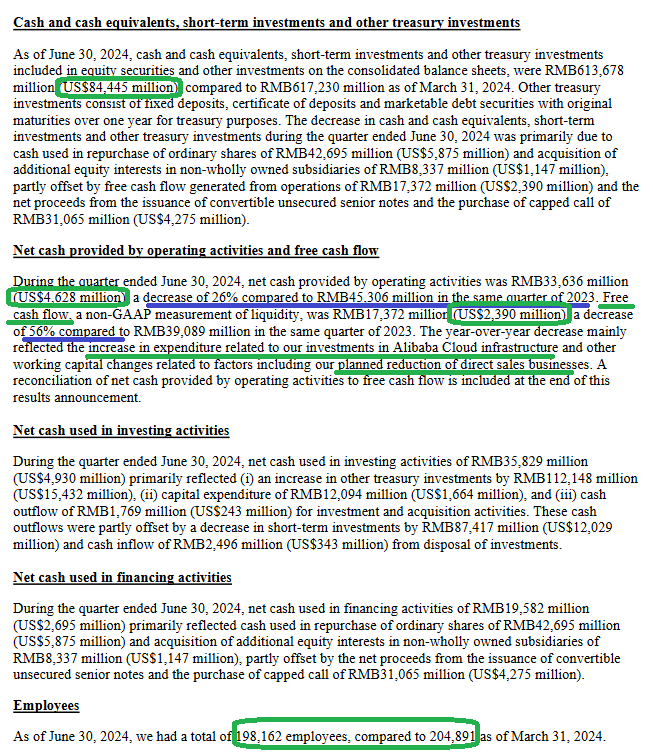

10) Generated $4.6B Cash From Operations, $2.3B Free Cash Flow. Down due largely to increase in expenditure related to investments in Alibaba Cloud infrastructure.

11) Internal and external data about e-commerce players’ market share dynamics indicates a positive trend in gradual market share stabilization.

12) As orders and GMV continue to grow, BABA is advancing monetization step-by-step. Through algorithm upgrades, they enhance the efficiency of merchants’ monetization while also improving the efficiency of traffic utilization and conversion of user traffic to purchases on the platform. BABA expects CMR growth to gradually align with GMV growth over the coming quarters.

13) Ed Wu – CEO: “We are confident that Alibaba’s overall revenue, excluding Alibaba consolidated subsidiaries, will return to double-digit growth in the second half of the fiscal year with gradual acceleration thereafter.“

14) Still $26.1B remaining on the share repurchase availability.

15) THIS IS A BIG DEAL AS ESOP dilution was OUT OF CONTROL until recently: “We have started to replace a portion of Ali Baba Group’s ESOP incentives with long-term cash incentives for our employees starting last quarter. These cash incentives will be reflected as costs in our adjusted financial metrics, including segment EBITDA. While this change in compensation structure will lower adjusted EBITDA, it will also result in less ESOP dilution in the future.”

16) For Alibaba Cloud, we are pursuing high-quality revenue and effectively execute our integrated cloud plus AI development strategy. We are confident that revenue from external customers will return to double-digit growth in the second half of the fiscal year with gradual acceleration thereafter.

17) Expecting double digit revenue growth in cloud 2H this year and accelerate moving forward. “Eddie. I’ll take your second question about cloud. There’s very, very robust demand among our customers for AI and AI relevant products. And if you look at the pipeline, you can see that, that demand is still far from being satisfied. So, we think it’s a very clear-cut trend that revenue from external customers will achieve double-digit growth in the second half of the fiscal year.”

“What we see certainly among our own cloud customers is that their AI budgets for this year are higher, significantly higher than what they were last year. Any enterprise that is digitalized and relies on digitalization must be investing, it has to be investing in AI.

All the industry is now that are using AI are leveraging it to enhance their competitiveness and efficiency. So, any enterprise that’s in any way digitally reliant will certainly not scale down its investment in AI because to do so would impair their own competitiveness and efficiency. So that’s a clear trend that we’re seeing, and we’re not seeing any kind of a slowdown or softening.”

18) Why the CFO sees Free Cash Flow decline as temporary:

“Your second question is about free cash flow. As I explained, there is quite a big significant drop of free cash flow. One of the reasons is the significant increase in expenditure on the AI infrastructure investments, if you like. So, I think — and the other reason, as I said, is because of the sort of — because of the working capital changes in relation to like some of the business scale jobs.

For these business scale jobs, many of them, if you like, a majority of them are from those planned scale down, if you like. As I was explaining why our direct sales business within Taobao and Tmall dropped quite significantly, the reason is we proactively scaled down some of these 1P business is in Taobao and Tmall. The reason is we believe in some of these business categories, 1P format probably is not a more efficient format. So that’s sort of practice.

But you will also have some of the businesses scale job was not because proactively did that. Some of it just like the overall market situation. For example, as I said, the revenue dropped from, for example, like Sanna, like Intime, all those businesses are in 1P. And the job of their scale actually impacts the working capital. I don’t know, probably I can give a little bit more color on. Because for doing 1P business, on one hand, you are buying inventory from vendor. On the other hand, you sell it. And does the vendor normally give you a credit term like in 60 days or 90 days.

If you can make your inventory turnover, i.e., sell inventory within a short period of time, shorter than the sort of credit term you’ve given, actually, you are generating cash flow, particularly if the size is going up, you are generating positive cash flow. So, on the contrary, if you’re reducing the scale, you are — it will have outflow on the working capital. But is that — is this a permanent impact? To me, I think that this is a relatively temporary impact. During the process of reducing scale, we will see this outflow. But when the business size became stable, we will no longer see these types of outflow.”

19) Why is the company doing so much CAPEX and when will it show a return on investment?

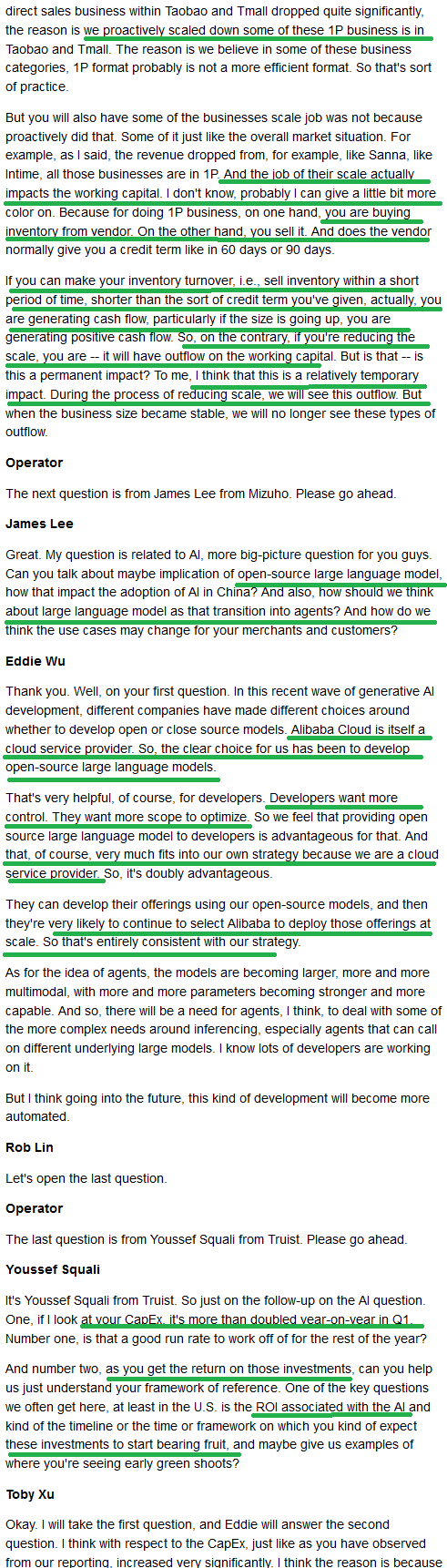

“Over the next several quarters, we expect to continue to be investing in AI CapEx at that kind of pace. And it’s simply because we see a lot of demand, a lot of unmet demand from many clients and you look at the pipeline those clients have, you know there’s going to be ongoing demand.

So, whether it’s for training or inference or API calls, what we see when we’re making these kind of CapEx investments, as soon as we get a server up, a server is instantly running at full capacity. There’s that kind of demand. So, we can expect to see a very high ROI over these next quarters because we’re building compute power to meet existing demand and that new compute power coming online is getting instantly taken up and running at full capacity on day one.”

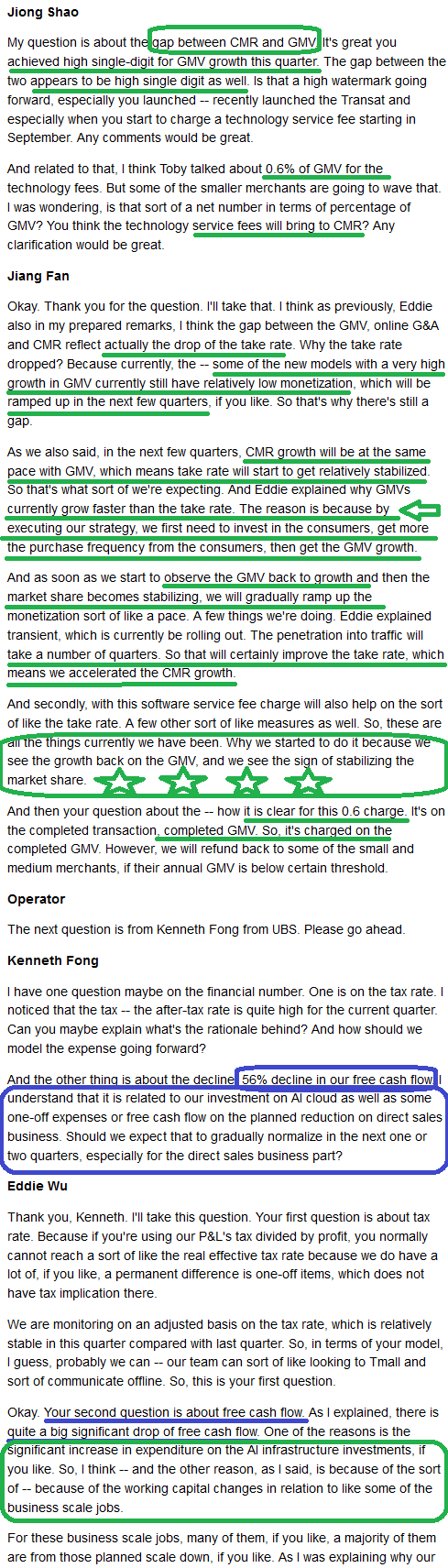

Here were the key highlights from the Earnings Call:

Now onto the shorter term view for the General Market:

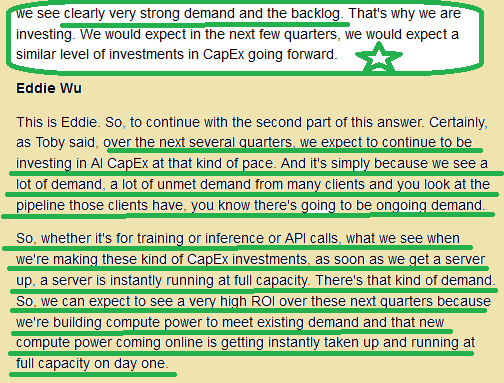

The CNN “Fear and Greed” moved up from 26 last week to 51 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

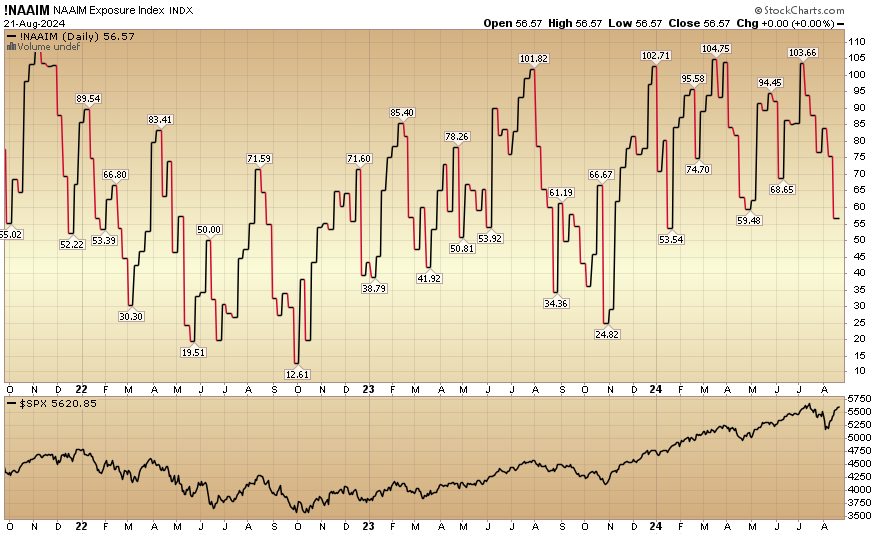

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 56.57% this week from 75.33% equity exposure last week.

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 56.57% this week from 75.33% equity exposure last week.

Our podcast|videocast will be out tonight. We’ll have a lot of great data to cover this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

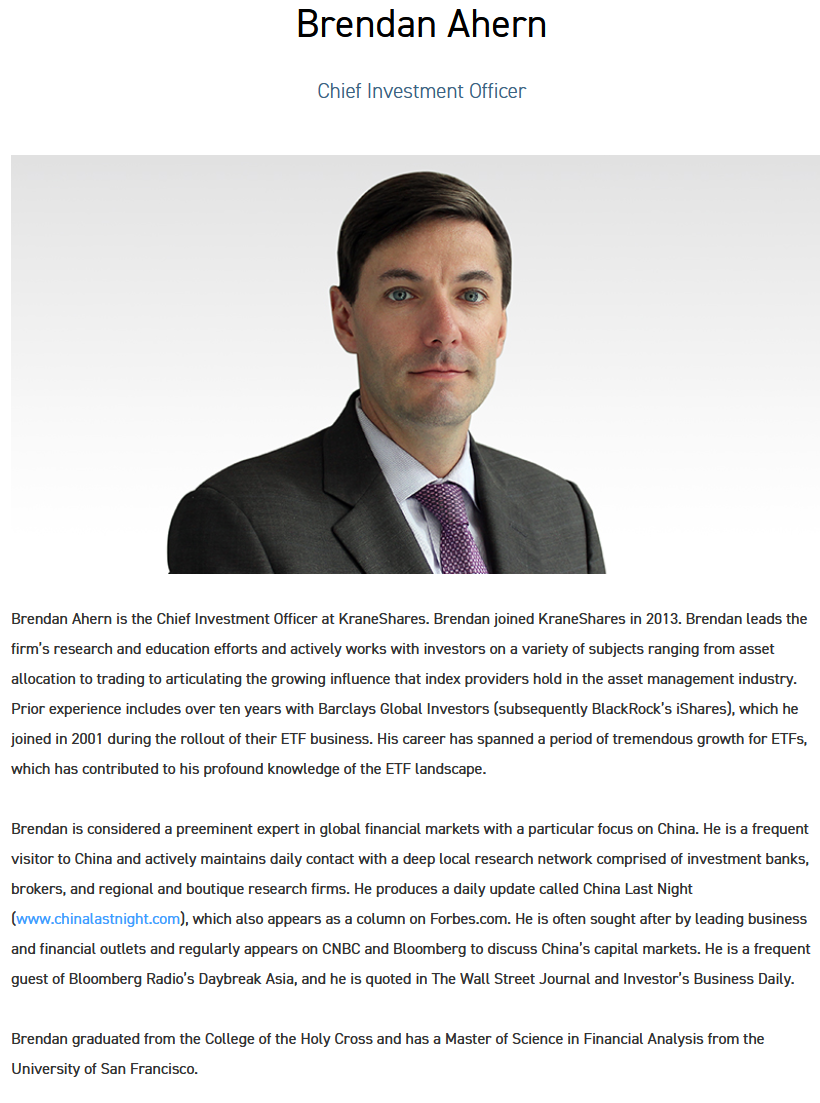

As a reminder, this week we are hosting a special guest on the podcast|videocast (HFTWTH episode 253) – Brendan Ahern (CIO of KraneShares) to give us his specialized expertise on the Chinese economy, markets, government policy, Alibaba and more. His KraneShares CSI China Internet ETF (KWEB) has ~$5B AUM.

Congratulations to all of the new clients that came in during our early Q1, Q2 and Q3 raises so far this year. We successfully closed out our Q3 raise for smaller ($1M-$5M) accounts in July.

Larger ($5-10M+) accounts can access “open enrollment” here.

*Opinion, Not Advice. See Terms

Not a solicitation.