From January 11-16, 2020 Bank of America conducted its monthly survey among 249 managers that manage ~$739B in AUM. The key takeaways were…

Equity Allocation:

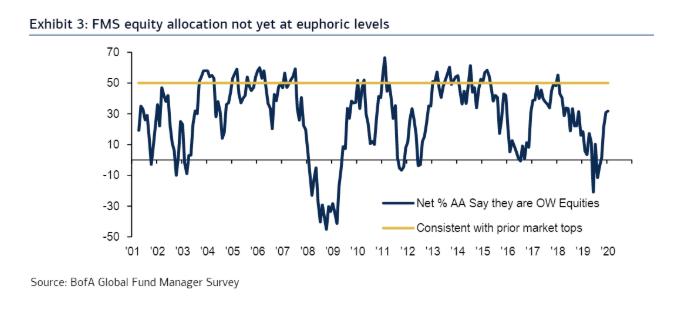

- Bullish, but not yet Euphoric.

- BofA chief investment strategist Michael Hartnett, “We stay irrationally bullish risk assets until peak positioning and peak liquidity incite a spike in global bond yields and ‘the big short’ opportunity.”

- 32% overweight. Up from 12% underweight in August (biggest increase since August 2011).

- Highest Equity allocation in 17 months.

- Remains below the net 50% overweight level consistent with prior market tops.

Yield Curve:

- A net 51% expect the 3mo./10yr U.S. Treasury yield curve to steepen over the next twelve months.

- This is down 11% from the recent high in November 2019.

Growth and Profits:

- Global corporate profit expectations jumped 14 percentage points from December to 27% of respondents now expecting corporate profits to improve over the next year.

- Half see global growth improving over the coming year. This is the highest rate since February 2018.

Inflation:

- 14 percentage point jump in consumer price increase expectations to a net 56%.

- Highest since November 2018.

U.S. Dollar:

- A net 53% think the U.S. dollar is overvalued.

- This is the second highest recording since 2002.

- Here’s what happened the last time:

Cash levels:

- Remained at 4.2% for the third consecutive month.

- Highest level since March 2012.

Commodities:

- Allocation to commodities rose 4% to a net 10% overweight.

- Highest level since March 2012.

Top 3 tail risks:

- 29% – 2020 U.S. presidential election

- 22% – trade war with China

- 20% – bond bubble popping