- Jack Ma Engineered Alibaba’s Breakup From Overseas (wsj)

- This Week in China: Stock Market Starts to Believe in Recovery (bloomberg)

- Fed-Favored Inflation Gauge Rises by Less Than Forecast, Spending Moderates (bloomberg)

- BofA Says Investors Poured $508 Billion Into Cash This Quarter (bloomberg)

- 2023 has been bad for the bears. Here are 5 reasons why it’s going to get even worse. (marketwatch)

- Cornering Classic Cars (bloomberg)

- Mickey Drexler interview: Here’s what retailers could learn from Steve Jobs (nypost)

- Flight to Money Funds Is Adding to the Strains on Small Banks (bloomberg)

- How Moneyball Investing Ran Into a Data Squeeze Play (bloomberg)

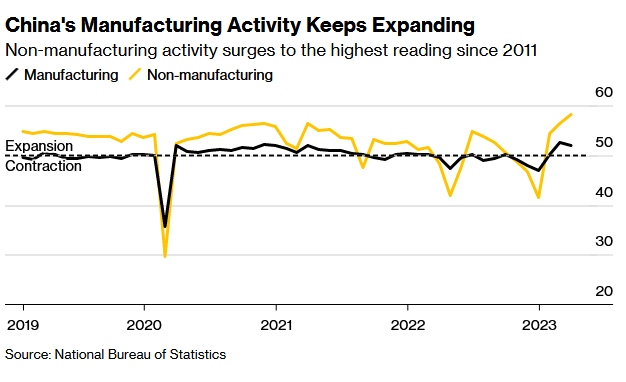

- China’s Strong PMIs Show Economic Recovery Gaining Traction (bloomberg)

- Cooper Standard Honored by General Motors as Supplier of the Year (cps)

- Michael Burry Says He Was ‘Wrong to Say Sell,’ Congratulates Dip Buyers (bloomberg)

- Small Banks Are Losing to Big Banks. Their Customers Are About to Feel It. (wsj)

- Dungeons & Dragons’ Epic Quest to Finally Make Money (bloomberg)

- China’s chip industry will be ‘reborn’ under U.S. sanctions, Huawei says, confirming breakthrough (cnbc)

- The dollar slipped this quarter after surging in 2022. Its struggles could be a sign of things to come. (businessinsider)

- Ford just upped the price of electric F-150 Lightning pickup – again (usatoday)

- Billionaire investor Bill Gross says the Fed easing up in fighting inflation could fuel a rally in government bonds (businessinsider)

- China Home Sales Continue to Rise in Latest Sign of Recovery (bloomberg)

- U.S. consumer spending retreats in February; inflation cools (reuters)

- Chinese companies rush for U.S. listings ahead of new rules (reuters)

- Rolls-Royce replaces finance director as new chief shakes up top team (ft)

Be in the know. 22 key reads for Friday…