- US Commerce Secretary’s China Trip Has a Chance of Success That Eluded Others (bloomberg)

- Alibaba launches AI model that can understand images and have more complex conversations (cnbc)

- Vanguard says value stocks haven’t been this cheap vs. growth since the COVID outbreak (marketwatch)

- China Regulator to Meet Global Investors to Shore Up Market (bloomberg)

- China Eases Home Purchase Rules in New Push to Boost Economy (bloomberg)

- U.S. central bank has earned the right to take its time with interest-rate decisions, Boston Fed’s Collins tells MarketWatch in Jackson Hole interview (marketwatch)

- How Jackson Hole Became an Economic Obsession (nytimes)

- China Deserves Long-Term Strategic Asset Allocations: Chen (bloomberg)

- Detrick: Favor small-caps and cyclicals, which do well with higher yields (cnbc)

- Exclusive: China plans to cut stamp duty on stocks by up to 50% to revive confidence-sources (reuters)

- China offers tax breaks to home buyers, finance ministry says (marketwatch)

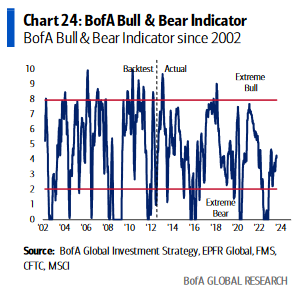

- Investor sentiment turns sour after a bad month for stocks – here’s why that’s a bullish sign. (businessinsider)

- If the UK stock market is cheap, why doesn’t it go up? (ft)

- China imports record amount of chipmaking equipment (ft)

- Powell’s pivotal speech Friday could see a marked shift from what he’s done in the past (cnbc)

Be in the know. 15 key reads for Friday…