- Ozempic Won’t Change the World or Your Flight. Here’s Why. (barrons)

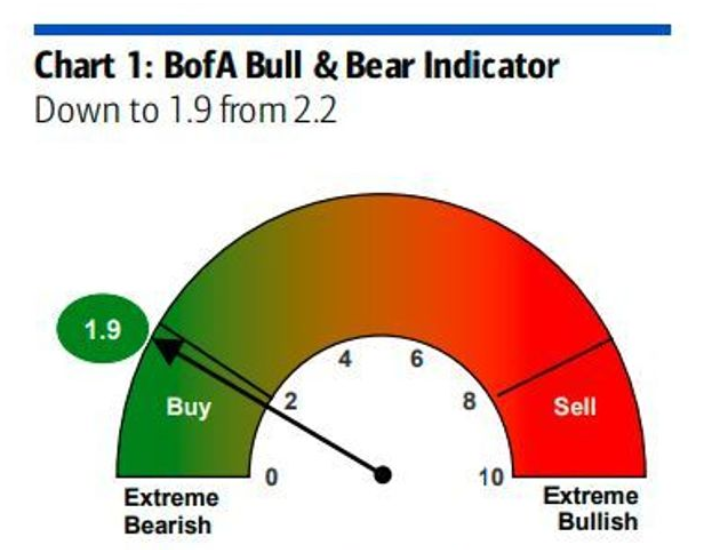

- BofA Sees Near-Term Stock Rally as Signal Flashes Contrarian Buy (bloomberg)

- Biden Wants to Boost Israel Aid. Defense Stocks Rise. (barrons)

- Surging Bond Yields Could Help to Keep the Fed on Hold (barrons)

- It’s Time to Take a Chance on the Stock Market’s Biggest Losers (barrons)

- The UAW Strike Is Quiet for Now. Union Chief Could Stir the Pot Today. (barrons)

- China’s economy is performing much better than markets think, says Shehzad Qazi (cnbc)

- 2-year treasury will be a signal for when investors will get relief: NFJ Investment’s John Mowrey (cnbc)

- Alibaba Kicks off 2023’s 11.11 With Record Investment by Merchants (alizila)

- Alibaba and Tencent lead US$342 million total investment this year in Zhipu AI (scmp)

- Ant Group buys land to expand HQ as shadow of China’s tech crackdown dissipates (scmp)

- Will The Policy Bazooka Be Unleashed As Lines in The Sand Are Crossed? (chinalastnight)

- EM Stocks Set For Worst Week Since August Amid Mideast Conflict (bloomberg)

- UAW and General Motors Inch Toward Tentative Deal, Union Negotiator Says (bloomberg)

- PC demand is back, says Acer CEO who sees robust growth in ‘foreseeable future’ (cnbc)

- Fed funds futures traders pull back on likelihood of Fed rate hike by December and January (marketwatch)

- China Liquidated The Most US Securities In Four Years To Prop Up Plunging Yuan (zerohedge)

- World’s Largest Chipmaker Sees ‘Bottom’ After Semiconductor Downturn (zerohedge)

- Amex calls out ‘strong’ spending and credit trends as earnings beat estimates (marketwatch)

- Charlie Munger Says This Investment is Getting ‘More Hype Than It Deserves’ — He’s Not A Fan, But It’s A Huge Part Of Berkshire Hathaway’s $350 Billion Portfolio (yahoo)

- Venezuelan sovereign bonds soar 90% as US allows the return of American investors (businessinsider)

- The decline in China’s US Treasury holdings isn’t as big as it seems (businessinsider)

Be in the know. 22 key reads for Friday…