- Investors Shouldn’t Sweat the Defense Budget. Here’s Why. (Barron’s)

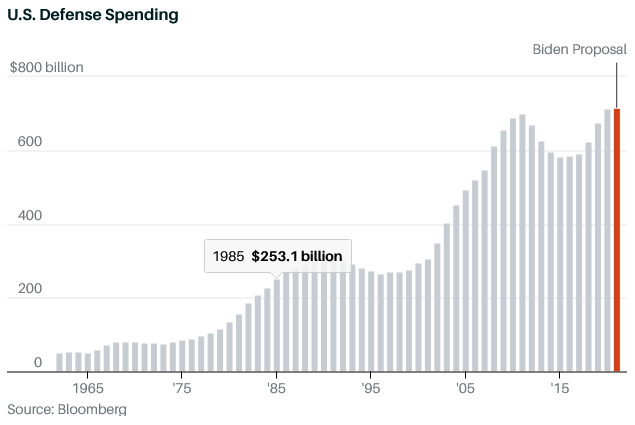

- Aerospace and Defense May Be the Best Offense for Q2: 5 Top Stocks to Buy Now (24/7wallst)

- U.S. PPI up 1% in March, with factory-level inflation rate registering 4.2% on a year-over-year basis (MarketWatch)

- Biotech Stocks Hit A Snag — Why Experts Say The Heyday Isn’t Over (IBD)

- Why It Might Be Time to Buy Brazil Stocks (Barron’s)

- Stocks Are Close to Bubble Territory Again—but Only by Some Measures (Barron’s)

- Safe haven plays still popular amid rotation into cyclical stocks, March fund flows show (MarketWatch)

- Stock-Market Investing Is Picking Up. Baby Boomers Might Be Behind It. (Barron’s)

- First-Time Investors Now Make Up 15% of Retail Market (Institutional Investor)

- How Equity Analysts Filled the Covid-19 ‘Information Void’ (Institutional Investor)

- New York City’s Wealthy Will Pay Nation’s Highest Tax Rates. How Will That Affect a Rebound? (Wall Street Journal)

- Dangerous Games. The Energy Report 04/09/2021 (Phil Flynn)

- Home Prices Soar in Frenzied U.S. Market Drained of Supply (Bloomberg)

- ‘Enjoy this ride’ — Wharton’s Jeremy Siegel says stock market could go up 30% before boom ends (CNBC)

- NIH recommends Lilly and Regeneron’s combination antibody treatments to people with mild and moderate COVID-19 (MarketWatch)

- General Electric (GE) PT Raised to $17 at UBS on Turnaround (Street Insider)

- 2 wild economic charts we’ll be watching closely: Morning Brief (Yahoo! Finance)

- Inflation might be the way out of the debt crisis (Financial Times)

Be in the know. 18 key reads for Friday…