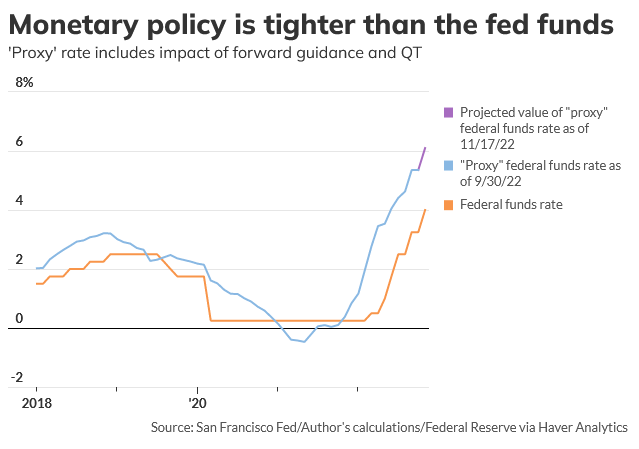

- What Bullard got wrong about a 7% fed funds rate (and why the terminal rate may be closer than you think) (marketwatch)

- China Growth Target Should Be at Least 5%, PBOC Adviser Says (bloomberg)

- JD Reports Higher Quarterly Sales, Defying China Downturn Fears (bloomberg)

- Boeing Is Taking Action to Fix Its Defense Business (barrons)

- A year after the Nasdaq peak, why stocks could rally from here. (marketwatch)

- How 18 semiconductor stocks shine when compared with Nvidia this earnings season (marketwatch)

- Zuckerberg Says This Will Be a Sales Driver Before His Big Bet on the Metaverse (barrons)

- Here’s another reason softer inflation may be a game-changer for stocks: the dollar may finally have peaked (marketwatch)

- He Thought His Home Might Sell for $30 Million. Fifteen Months Later, It’s ‘The Steal of the Century.’ (wsj)

- Wall Street Economists Split on Whether Fed Cuts Rates in 2023 (bloomberg)

- China’s Covid Cases Near Record High in Test for Looser Rules (bloomberg)

- Ray Dalio says none of China’s new leadership team appear to be ‘extremists’ (cnbc)

- An iPhone Factory Needs Workers. The Chinese Government Wants to Help. (nytimes)

- Masa-Son Steps Back From Running Softbank, Personally Owes Almost $5 Billion To Troubled Tech Giant (zerohedge)

- Macron says China’s ability to pressure Russia is ‘extremely useful’ (ft)

Be in the know. 15 key reads for Friday…