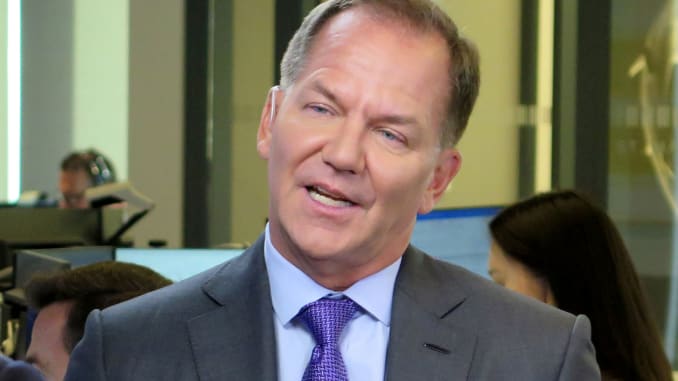

- Paul Tudor Jones says the Fed is done raising rates, stocks to finish the year higher from here (cnbc)

- Alibaba Vows Historic Investment in Taobao App, Content Creation (bloomberg)

- How billionaire Mike Bloomberg got fired and what came next (foxbusiness)

- “It may not take long for investors to turn back to Chinese stocks. While Chinese shoppers didn’t turn out as strongly as expected in the first few months after Beijing relaxed Covid-19 restrictions, strength in economic data had been building up to the recent strong showing—which bodes well for domestic retailers.” (wsj)

- Everyone Expects the Stock Market to Tumble. What if It Goes Up Instead? (barrons)

- Ford CEO Jim Farley Takes on Tesla (barrons)

- How Google Took Back the Narrative Around AI (barrons)

- Investors Are Nervous—and That Could Support Stocks (wsj)

- Investing Book That Flopped 32 Years Ago Now Sells for Thousands (wsj)

- Alibaba transfers autonomous driving team at DAMO Academy to logistics arm in latest restructuring move (scmp)

- ‘De-Americanize’: How China Is Remaking Its Chip Business (nytimes)

- Regional Banks May Emerge as a Winner in Debt Showdown, State Street Says (bloomberg)

- Fed Officials Signal Rate Caution on Credit and Price Pressures (bloomberg)

- CNBC ProPaul Tudor Jones says A.I. will spark the next ‘productivity boom’ (cnbc)

- These 11 regional bank stocks are deeply undervalued and should survive the intense pressures hitting the sector today, Morningstar says (businessinsider)

Be in the know. 15 key reads for Monday…