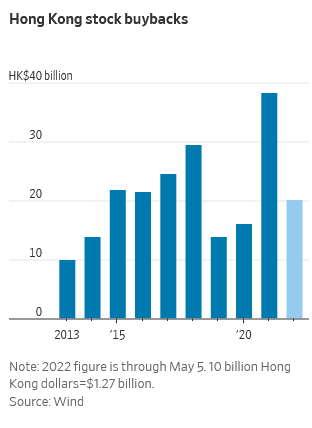

- Chinese Companies Boost Returns to Shareholders (wsj)

- Investors are too bearish about the US stock market (ft)

- Goldman’s Hatzius calls peak as firm trims core inflation forecast (marketwatch)

- Coronavirus: China’s central bank lends support as Shanghai eyes reopening after Covid-19 cases drop for 15th straight day (scmp)

- 4 Takeaways From the Milken Conference (barrons)

- Is the Big Tech crash already over? (ft)

- Officials of Relevant CSRC Department Answered Reporter Questions (csrc)

- 3 Signs Red-Hot Inflation Is Cooling Off (barrons)

- BioNTech Earnings Top Forecasts on Strong Sales of Covid-19 Vaccine (barrons)

- FedEx Has a Back Door Into E-Commerce. It’s Why One Analyst Likes the Stock. (barrons)

- Lockheed Plans to Double Production of Antitank Missiles Used in Ukraine (barrons)

- Travel Stocks Haven’t Recovered Yet. Where the Opportunities Are. (barrons)

- Beijing Residents Keep Faith With Government’s Zero-Covid Strategy (wsj)

- Steve Cohen’s Secret Weapon for the Mets: His Hedge Fund (wsj)

- Ukraine Fights for Besieged Mariupol as Russia Marks Key Date (wsj)

- China Remains an Outlier in a World of Surging Inflation (wsj)

- Has Shanghai Been Xinjianged? (nytimes)

- Buy these 6 stocks now as the tech sector begins its ‘bottoming process’ following the Federal Reserve’s double rate hike, says Wedbush analyst Dan Ives (businessinsider)

- ‘We are now living in a totally new era’ — Henry Kissinger (ft)

- CIA director says China ‘unsettled’ by Ukraine war (ft)

Be in the know. 20 key reads for Monday…