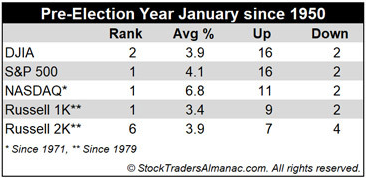

- Pre-Election Year Januarys Stellar – #1 S&P 500 and NASDAQ, #2 DJIA (Almanac Trader)

- New China Foreign Minister Seeks Better US Ties in Blinken Call (bloomberg)

- China’s Central Bank Pledges Support for Domestic Demand (bloomberg)

- ‘Somebody who doesn’t read lives one life, somebody who reads an unlimited number of lives.’ (Mark Cuban)

- China’s low profile tech bosses may become more visible and vocal (scmp)

- For U.S. Stocks, 2022 Is a Year With Almost No Record Highs (wsj)

- Some in China return to regular activity after COVID infections (yahoo)

- We’re in the second biggest home price correction of the post-WWII era—here’s the latest data (fortune)

- Soon-To-Be Grandfather Bill Gates Is Betting On AI, Gene Therapy And Other New Technologies To Solve Global Problems (forbers)

- Alibaba’s DingTalk records 600 million users, works to accelerate monetization (technode)

- Lula Is Back. What Does That Mean for Brazil? (cfr)

- Why the Price of Plastic Is Crashing After a Record Surge (bloomberg)

- The Best Cars We Drove in 2022 (roadandtrack)

- You Can Drop 20 Shots in 2 Weeks?! (SagutoGolf)

- Big Banks Predict Recession, Fed Pivot in 2023 (wsj)

- Xi Warns of Tough Covid Fight, Acknowledges Divisions in China (bloomberg)

- More social media regulation expected in 2023, members of Congress say (nypost)

- Buy Medtronic Stock. Shares of the Dividend Aristocrat Look Attractive. (yahoo)

- Shopify in advertising push to fill void left by Apple privacy crackdown (ft)

- Turkish stocks soar as local investors seek refuge from blistering inflation (ft)

- Paul Krugman Says Controlling Inflation By Inducing Recession Is Like ‘Stopping The Action On The Field Until Everyone Sits Down’ (benzinga)

Be in the know. 21 key reads for Monday…