- Bearish Sentiment on Stocks Is Best Thing Rally Has Going for It (bloomberg)

- Deposits at Small U.S. Banks Stabilized Last Week (barrons)

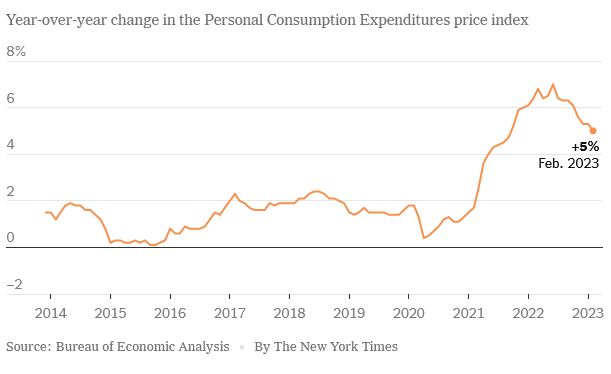

- The Fed’s Preferred Inflation Gauge Cooled Notably in February (nytimes)

- Rolls-Royce’s CEO Has a Turnaround Plan. The Stock Is Revving Up. (barrons)

- There’s a simple reason why it’s very likely that the stock market bottomed in October (businessinsider)

- China’s Consumers Extend Economic Rebound From Pandemic (wsj)

- Google cuts lavish employee perks — including ‘micro-kitchens’ in push to save (nypost)

- TikTok hires ex-Obama officials, ex-Disney exec in trying to avoid US ban (nypost)

- ‘Big Short’ hedge boss was ‘wrong to say sell’ as Nasdaq 100 enters bull market (nypost)

- How we know the super-rich are finally clamping down on spending (nypost)

- The Big Read. China truce with business — for now (ft)

- Flood of cash into US money market funds could add to banking strains (ft)

- Macau Gaming Revenue Jumps to Three-Year High on Tourism Boom (bloomberg)

- David Einhorn regrets selling his early Apple stake, predicts the Fed will pull back in fighting inflation, and reveals he’s betting on AI in a new interview. Here are the elite investor’s 8 best quotes. (businessinsider)

- Morningstar: Buy these 10 cheap stocks that will maintain higher-than-average dividends as a looming economic slowdown makes it even harder to find strong returns (businessinsider)

Be in the know. 15 key reads for Saturday…