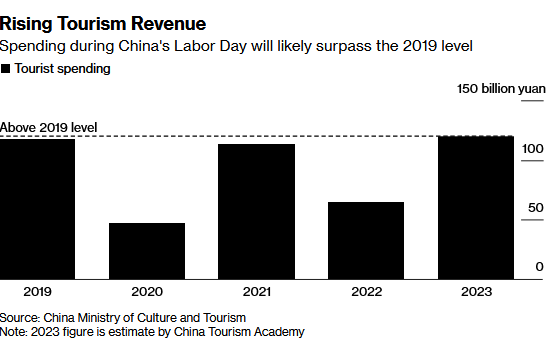

- China Celebrates Economic Recovery, Pledges More Help on Jobs (wsj)

- Hedge funds lose $18bn betting against tech stock rally (ft)

- The Fed Has No Good Options. The Risk of a Misstep Is Growing. (barrons)

- Big Tech Stocks Have Surged. Small Ones Haven’t. (barrons)

- Fed Blames Itself In Reviewing Silicon Valley Bank’s Collapse (barrons)

- How Activist Investors Target Companies in a Choppy Market (barrons)

- Why J&J’s Kenvue Spinoff Is Just What the IPO Doctor Ordered (barrons)

- JPMorgan, PNC Bidding for First Republic as Part of FDIC Takeover (wsj)

- Big Tech Earnings Spark Hope That Worst Is Over (wsj)

- Fed Emergency Loans Rise Again Amid Renewed Financial Stress (bloomberg)

- Billionaire Steve Cohen Has a Plan to Become the King of Queens (bloomberg)

- The MSCI China is trading at about 10.1 times forward earnings — 10% cheaper than averages going back two decades. The multiple is 34% lower versus the MSCI All-Country World index and 45% below the S&P 500’s valuation. (bloomberg)

- Elon Musk has called out the Fed more than 20 times for hiking interest rates too much. Here’s a roundup of his attacks on the central bank. (businessinsider)

- Intel tops Wall Street estimates, CEO says data-center business is improving (marketwatch)

- 2 Undervalued Stocks From the Morningstar Wide Moat Focus Index (morningstar)

Be in the know. 15 key reads for Saturday…