- U.S. new-car sales seen rising more than 13% in September (marketwatch)

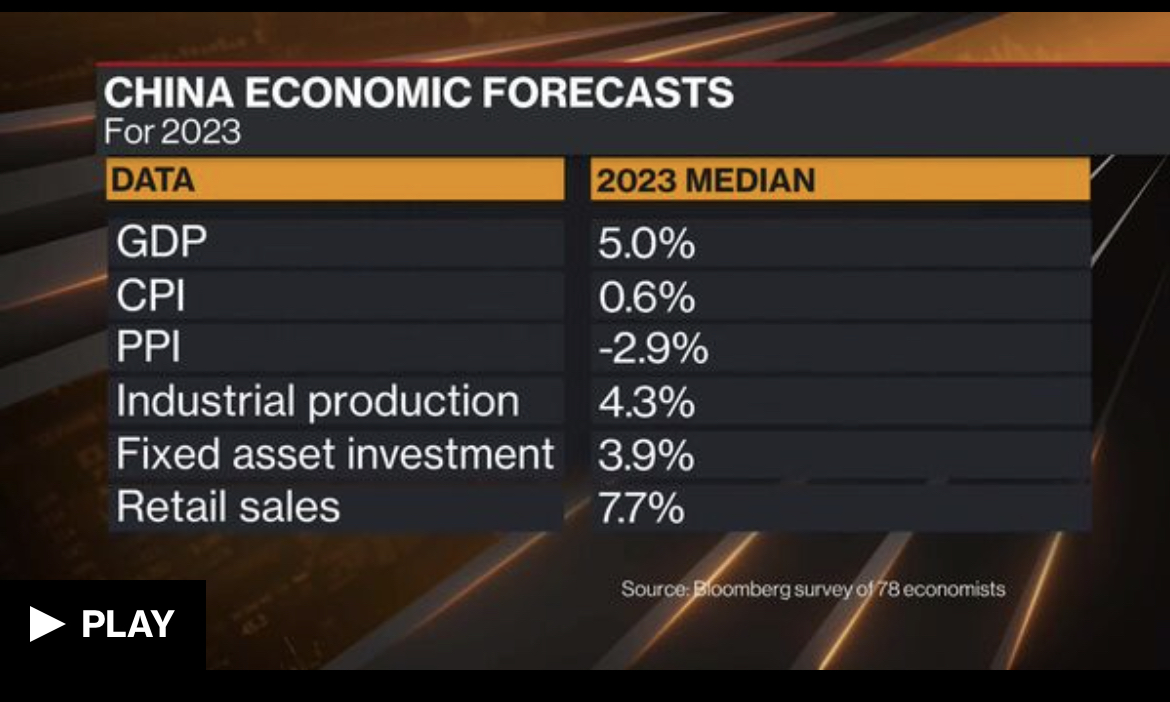

- China Industrial Profits Jump Sharply as Economy Stabilizes (bloomberg)

- If China Is So Weak, Why Are Commodities So Strong? (zerohedge)

- Here’s How Long a Government Shutdown Could Last (barrons)

- More UAW Strikes Could Be Coming. (barrons)

- Ford’s Factory Halt Is a Loss for Auto Workers and Consumers. Here’s Why. (barrons)

- The ‘Yield Curve’ Is Improving. These Types of Stocks Should Benefit. (barrons)

- JetBlue Issues Revenue Warning. It’s Not That Bad. (barrons)

- Fear on Wall Street? Shake it off, advise these strategists. (marketwatch)

- How Long Was the Longest Government Shutdown? It Depends Who You Ask. (barron’s)

- ‘We are in a bit of a vacuum that is scaring people,’ says Morgan Stanley portfolio manager of Treasury market selloff (marketwatch)

- U.S. economy grew 2.1% in the second-quarter, GDP shows (marketwatch)

- China Has Second Thoughts About Controlling Prices in Its Multi Trillion-Dollar Housing Market (wsj)

- What happens to the stock market if the government shuts down? The dollars and cents of it (usatoday)

- UAW’s Real Enemy Is Forced EV Conversion (zerohedge)

- Beaten down US solar sector may be primed for a rebound: Maguire (reuters)

- Alibaba’s Taobao and Tmall chief Dai steps away from roles at subsidiaries to focus on core e-commerce business: reports (scmp)

- China Names Lan Fo’an as Party Chief of Finance Ministry (bloomberg)

- The sentiment around Nike has gotten way too negative, says Oppenheimer’s Brian Nagel (cnbc)

- Detrick: Small cap stocks could lead a fourth quarter rally (cnbc)

- How Much Savings Do Americans Have Left, Anyway? (wsj)

- Who Is Detained Evergrande Founder Hui Ka Yan? His Rise and Fall Explained (bloomberg)

- US Consumer Spending Rose at Weakest Pace in a Year Last Quarter (bloomberg)

Be in the know. 23 key reads for Thursday…