- Alibaba, Tencent Cast Wide Net for AI Upstarts (wsj)

- Fed policymakers see job market key to rate-cut decision (reuters)

- July home sales break a four-month losing streak as supply rises nearly 20% over last year (cnbc)

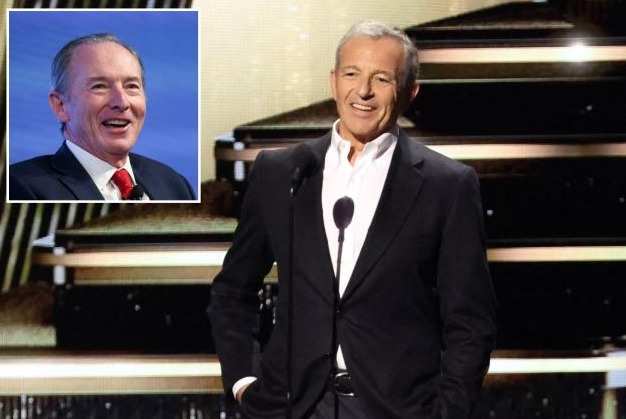

- Disney puts Morgan Stanley’s James Gorman in charge of finding Bob Iger’s successor (nypost)

- S. Added 818,000 Fewer Jobs Than Reported Earlier (nytimes)

- Fed Minutes Show a Cut ‘Likely’ to Come in September (nytimes)

- Summer spending boom showcases China’s service consumption potential (cn)

- The Fed is taking on risk they don’t have to take, says Wharton’s Jeremy Siegel (cnbc)

- The key to a soft landing is the Fed getting off data dependence, says Fundstrat’s Tom Lee (cnbc)

- com: No. of Overseas Payment Buyers Mount 30%+ YoY in 1H (aastocks)

- China names healthcare, education, tech as likely venues for more foreign investment (scmp)

- Major retail stores are cutting prices to entice customers as inflation soars (foxbusiness)

- Why China Is Battling Its Own Government Bond Market (barrons)

- Advance Auto Stock Skids. Earnings Miss Overshadows $1.5 Billion Sale of Worldpac. (barrons)

- Discount-Hungry Shoppers Propel Sales Gains for Target, T.J. Maxx (wsj)

- McDonald’s to Invest $1.30 Billion in U.K., Ireland Over Next 4 Years (wsj)

Be in the know. 16 key reads for Thursday…