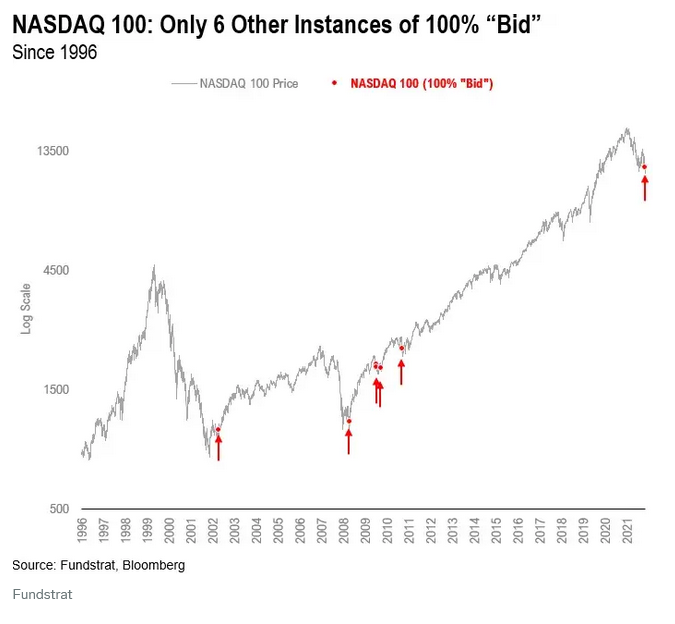

- There’s good reason to think that the 2-day surge in stocks this week wasn’t just another bear market rally, according to Fundstrat (businessinsider)

- Jobless claims rise more than expected as market starts to cool (foxbusiness)

- Biotech Hasn’t Been This Blazing Hot Since Early 2021 — Here Are The Top 5 (investors)

- China’s Xi Is Getting a Third Term. Investors Hope Something Gives. (barrons)

- China’s Most Important Political Meeting Is Coming. What Investors Need to Know. (barrons)

- Global economy will ‘crumble’ if Fed doesn’t stop hiking interest rates, billionaire investor Sternlicht says (marketwatch)

- Europe Has the Strength to Sail Through a Recession (barrons)

- K. Home-Builder Stocks May Be a Buying Opportunity as the Pound Tanks (barrons)

- Everything you want to know as OPEC+ agrees to cut oil production (businessinsider)

- Nobel laureate Paul Krugman warns the Fed risks going too far in fighting inflation – and predicts a return to rock-bottom interest rates (businessinsider)

- Wharton Professor Jeremy Siegel says he’s disturbed by the Fed’s groupthink as there are no members who have dissented with Powell’s hawkishness (businessinsider)

- Revolutionary Retreat. The Energy Report 10/06/2022 (Phil Flynn)

Be in the know. 12 key reads for Thursday…