- Fund manager allocation to U.S. stocks in January collapses, BofA survey finds (reuters)

- Hedge-fund legend Seth Klarman pounced on Amazon and parent companies of Google and Facebook in the fourth quarter (marketwatch)

- Investors Pour Into Chinese Stock Funds (wsj)

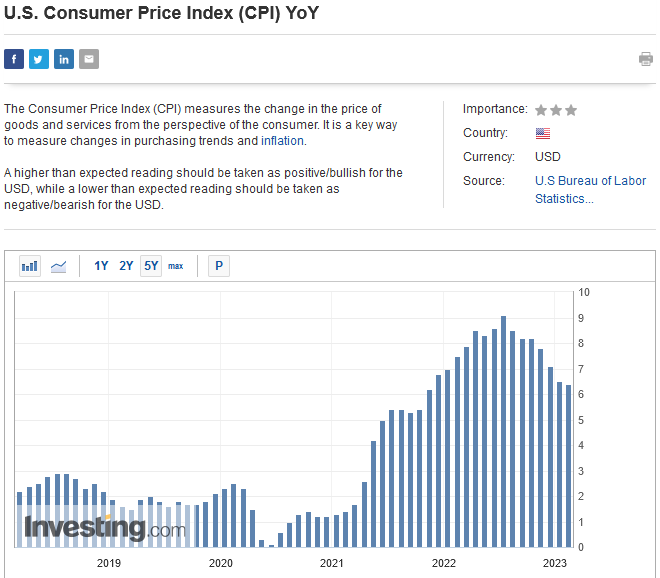

- Inflation Fell for the 7th Straight Month but Picture Is Mixed (barrons)

- The Big Read. Turning offices into condos: New York after the pandemic (ft)

- Coca-Cola sees signs of Powell’s ‘disinflationary process’ (Yahoo! Finance)

- Biotech Went Through Its IPO Boom. Now the Shakeout Is Underway (bloomberg)

- OJ’s Historic Price Squeeze Fades With Improving Supply Outlook (zerohedge)

- Biden Suddenly Orders Release Of Another 26 Million Barrels From Strategic Oil Reserve (zerohedge)

- BofA Survey Shows Investors Don’t Expect the Stock Rally to Last (bloomberg)

- 7 Stocks Generate An Astounding 25% Of The S&P 500’s Profit (investors)

- FT says Meta may lay off more staff soon; BofA praises ‘new efficiency mentality’ (streetinsider)

- George Soros loads up on Tesla and these other beaten-down stocks (marketwatch)

- Disney remains JPMorgan’s ‘favorite name’ for stocks in uncertain media industry (marketwatch)

- ‘A different animal’: The bear market is ‘over,’ but that doesn’t unleash bulls to send stocks on a 2023 tear, according to Wells Fargo (marketwatch)

- Fund managers and corporate executives have sharply reduced their recession expectations (marketwatch)

- ‘Unscripted’ Review: Sex, Lies and Viacom (wsj)

- Goldman’s CEO Says Business Leaders Are More Optimistic on Economy (bloomberg)

- Why Amazon, TikTok and YouTube are betting big on QVC-style livestream shopping (cnbc)

- Father of internet warns: Don’t rush investments into A.I. just because ChatGPT ‘is really cool’ (cnbc)

- Goldman Sachs CEO says odds of a ‘softer landing’ for U.S. economy have improved (cnbc)

- Vodafone rises after Liberty Global stake boosts M&A hopes (reuters)

- Fund managers rush into emerging stocks and cut cash – BofA survey (reuters)

- Amazon chief vows to ‘go big’ on physical stores (ft)

Be in the know. 24 key reads for Tuesday…