- Chinese Stocks Could Rise Another 20%, Goldman Sachs Says. Here’s How. (barrons)

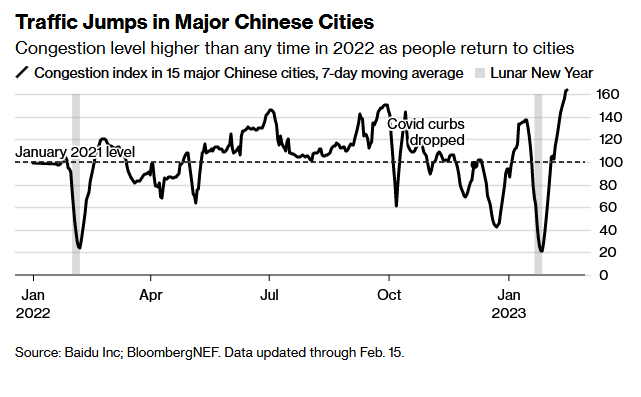

- China Leaders Pledge Stronger Growth as Recovery Takes Hold (bloomberg)

- China Sets New Rules for Overseas IPOs. (barrons)

- 9 Healthcare Stocks Where the Doubters Are on the Run (barrons)

- Companies Are Getting More Confident About Profits. What It Means for Stocks. (barrons)

- Pfizer Is Moving Beyond Covid. Why Its Stock Is a Buy. (barrons)

- Beware the Fed’s Favorite Inflation Metric Amid Raft of Market-Moving Data (barrons)

- What PayPal and 26 Other Companies Have Said About Layoffs This Year (barrons)

- Investors Stung by Treasuries Rout Brace for Next Blow From Fed (bloomberg)

- Morgan Stanley Says S&P 500 Could Drop 26% in Months (bloomberg)

- From CEOs to Coders, Employees Experiment With New AI Programs (wsj)

- Workers’ Pay Globally Hasn’t Kept Up With Inflation (wsj)

- Hotels, Booking Sites Say Americans Will Keep Traveling in 2023 (wsj)

- Going Private Again Is All the Rage Among Newly Public Companies (wsj)

- Walmart outlook disappoints Wall Street after strong holiday quarter (cnbc)

- ChatGPT recommends 5 books to become a smarter investor – including 2 tied to Warren Buffett (businessinsider)

- Chinese provinces give 30 days’ paid ‘marriage leave’ to boost birth rate (reuters)

- Alibaba shakes up its local consumer services business with a boost to navigation platform Amap as market competition intensifies (scmp)

- A neglected tool of central banks shows its worth (ft)

- Medtronic rises as solid topline points to recovery, analyst sees an encouraging Q4 setup (streetinsider)

Be in the know. 20 key reads for Tuesday…